Gold First A Swoon & Next The Moon

It’s been a frustrating couple of days for many gold bugs who are not properly positioned to handle the 2021-2025 war cycle.

(Click on image to enlarge)

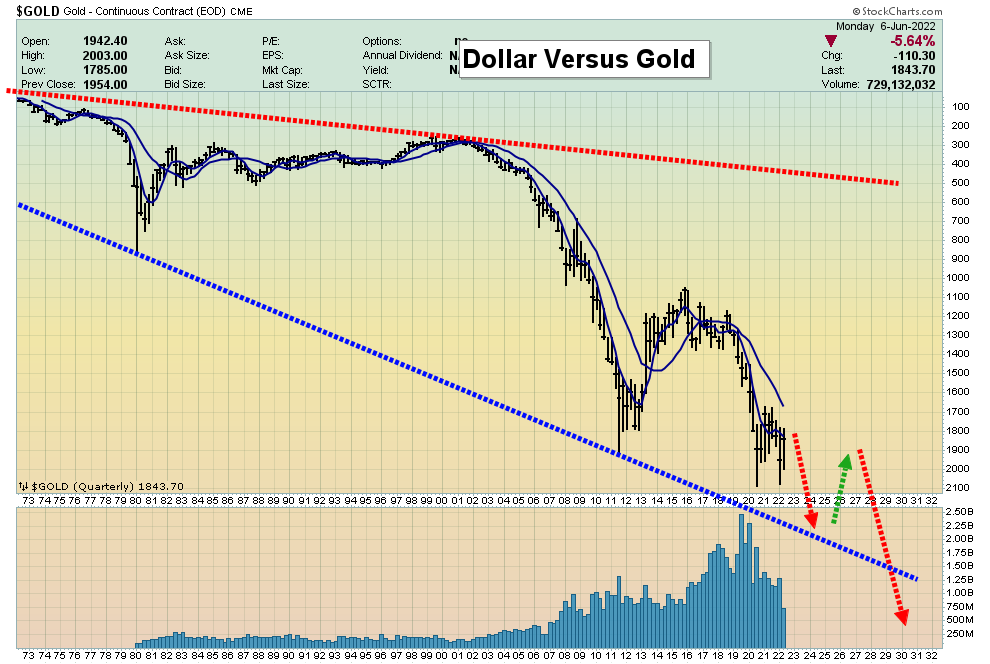

“fiat frustration” chart

Gold bugs have two days of frustration, while fiat bug frustration appears to be… infinite.

(Click on image to enlarge)

long-term XAU chart

While gold rises against all fiat over time, most miners show minimal overall progress over the past 40 years.

Clearly, a buy-and-hold approach is superb for gold, but for the miners, and for silver, a more tactical approach is required.

America is in month 18 of a 60month war cycle and as time passes, odds are high that the situation for most citizens will become much worse, and perhaps dire.

(Click on image to enlarge)

horrifying US interest rates chart

A huge base pattern is in play and it likely launches bond market yields on a two-decade run to all-time highs. I don’t expect rates to peak until around the year 2042.

(Click on image to enlarge)

TBF chart

Before the central banks became more aggressive about managing “transitory” war cycle inflation, gold rallied strongly against fiat.

As the banks get more serious, gold tends to churn and swoon while rates and bear bond funds like TBF rise. If inflation keeps rising, gold catches a bid again.

A big one!

In the meantime, TBF and similar bear bond market plays are an essential holding for most serious gold bugs.

(Click on image to enlarge)

GSG diversified commodities fund chart

In the short-term, some profits should be booked, but it’s very early in what looks poised to become a multi-decade inflation cycle.

A diversified commodity fund is also an essential holding in any serious gold bug’s portfolio.

(Click on image to enlarge)

FXI Chinese stock market chart

War, inflation, and empire transition are world’s biggest investment themes.

Savvy investors buy equity in the rising empire and sell equity in the fading one. Selling overvalued US stock markets and buying more fairly valued Chinese stock markets is another solid big-picture play. Here and now.

Ownership of TBF, GSG, FXI, and/or related items and component stocks (in addition to gold, silver, and the miners) puts any serious gold bug in a position to smile while most US investors could soon find themselves in a financial gulag... with a very small exit door!

(Click on image to enlarge)

The XME ETF is another great way to help gold and silver bugs smile all the way through the war, inflation, and empire transition cycles.

Here, I compare it to the Dow, and XME performed solidly since the Dow has crumbled. The main holdings are a mix of senior gold miners and base metal stocks.

Tactics? For the XME trading positions I bought into the $50 area lows, I’m a seller at $59 and $64, to lock in fast 20%-30% gains.

Excited gold bugs who also bought may want to apply similar tactics, to continue to profit from the “triple cycle” action of war, inflation, and empire transition.

(Click on image to enlarge)

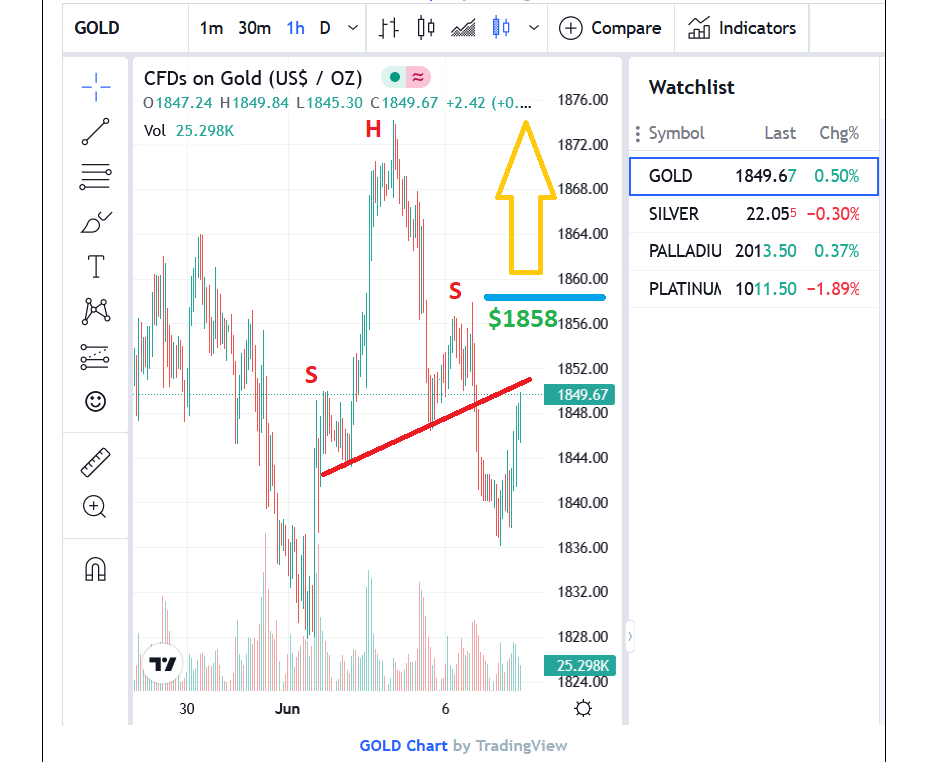

Gold had the early June swoon I projected. Is the swoon about to morph into a mining stocks trip to the moon?

A close over $1858 would destroy the H&S top pattern and gold is surging this morning as the Dow falls again. GDXJ is already into my first 20% target zone from the lows near gold at $1800. What next?

(Click on image to enlarge)

GDXJ chart

Investors who were too nervous to buy at gold $1800 could still buy now, either with small size or with a stoploss at $38 or $38.50.Sell orders can be placed at $44 and $50.Two days of frustration and swoon are over, and another glorious time for gold… is set to unfold!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Get Jacked With Gold!” report. I cover key ...

more