Gold Correction After Trump's Election: Why 2024 Is Not 2016

Could Donald Trump's election put the brakes on gold's rise?

In 2016, the Republican candidate's victory in the US presidential election led to a €100 drop in the price of gold in euros, with the price falling from €1,180 to €1,080 in the four weeks following the election:

(Click on image to enlarge)

This decline was then completely erased at the beginning of 2017:

(Click on image to enlarge)

Today, an ounce of gold is quoted at more than two and a half times its 2016 price.

Gold would have to undergo a correction of €250 before we could consider a decline comparable to that of 2016:

(Click on image to enlarge)

This correction would bring the gold price back to the level it had reached in mid-September.

Gold's correction in dollar terms is more pronounced, as the election result benefits the greenback in the short term.

As in 2016, Trump's victory strengthened the dollar on expectations of rapid economic growth, tax cuts and interest rate rises, making US assets more attractive to investors.

The DXY index has surged since the results were made official:

(Click on image to enlarge)

The dollar is behaving exactly as it did in 2016: rising in anticipation in October and soaring until the end of the year.

(Click on image to enlarge)

Will the dollar resume its ascent by the end of the year?

If so, this move would pose a short-term threat to gold.

However, internal factors are currently supporting the gold price and could ultimately prevent a correction similar to that of 2016.

In the monthly bulletin reserved for GoldBroker clients, I highlight sustained investor demand in October: gold ETF outstandings soared last month. Even with rates and the dollar on the rise, gold's performance in October was historic.

Gold closed at its highest quarterly and monthly nominal level ever, up 4.15% in the last month alone:

(Click on image to enlarge)

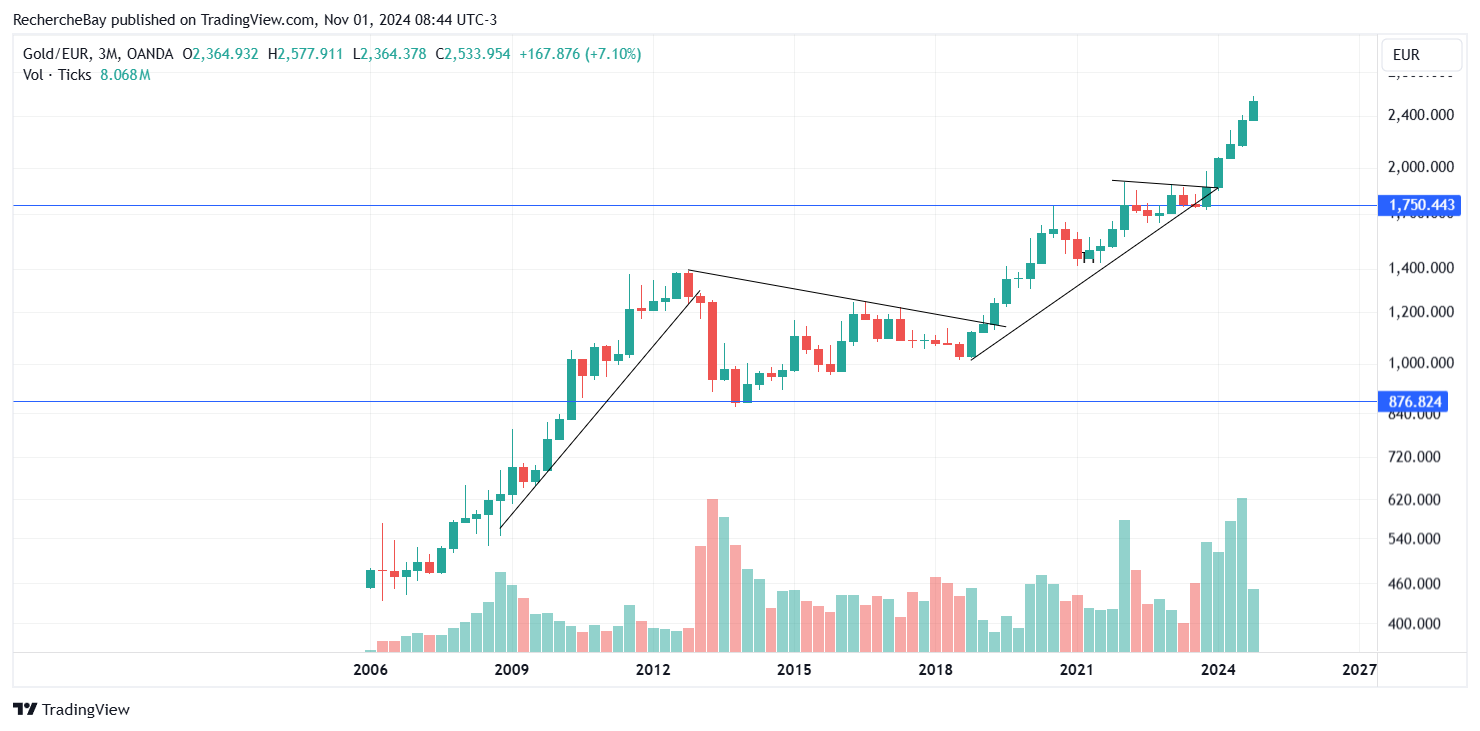

Monthly and quarterly records for gold in euros are even more spectacular:

(Click on image to enlarge)

Gold has gained over €850 in just 12 months!

Gold's take-off a year ago was anticipated thanks to the chart analysis detailed in my October 27, 2023 bulletin.

A year ago, I wrote: “gold, for its part, has just drawn a very fine all-encompassing candle in weekly variation, bouncing off its 200-day moving average. It's a bullish sign that will put even more pressure on COMEX participants defending the $2,000 threshold: these short sellers will have to scramble to avoid gold returning to its uptrend channel.”

(Click on image to enlarge)

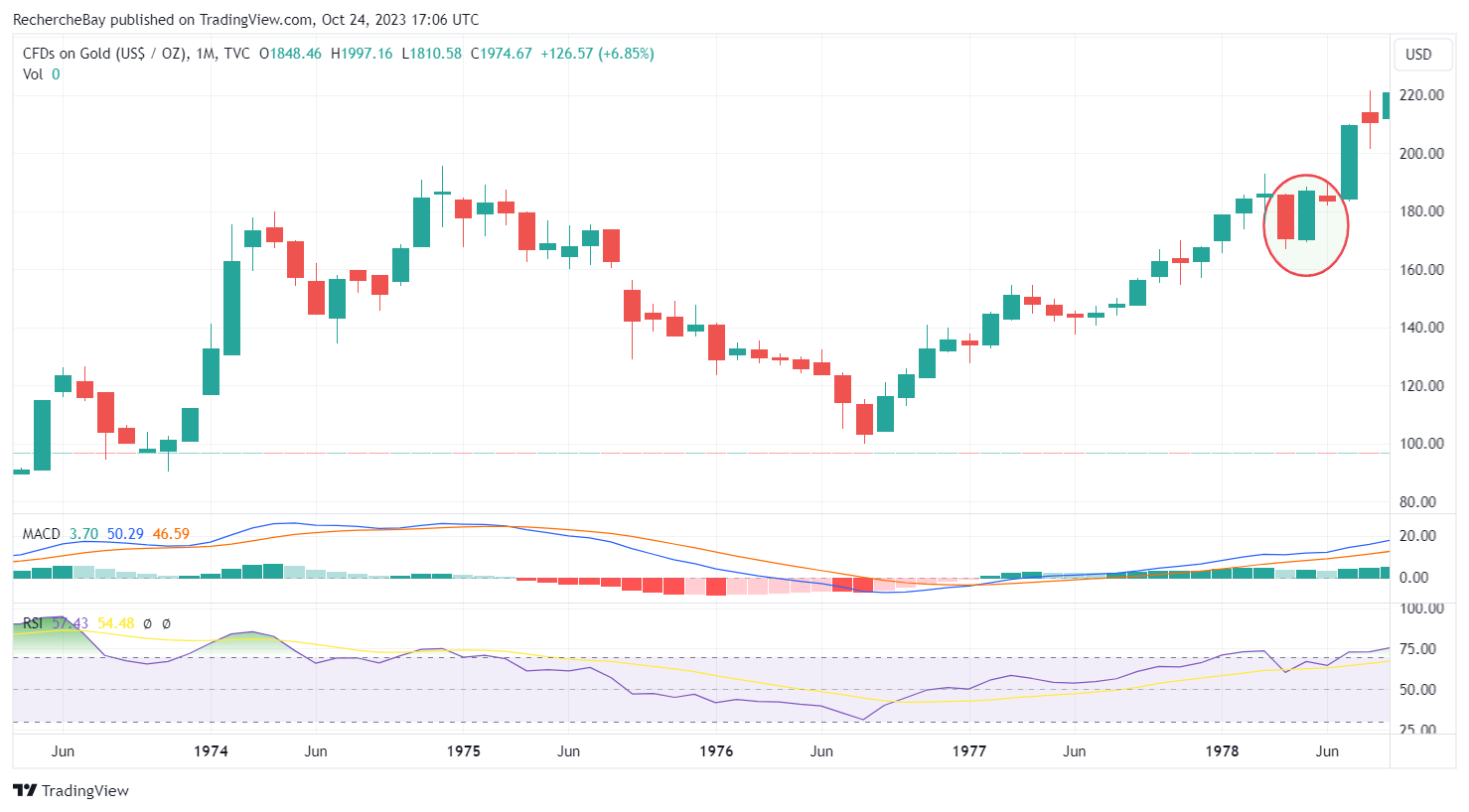

In monthly variation, we're seeing a large, all-encompassing candlestick. This type of monthly bullish signal is very rare for gold:

(Click on image to enlarge)

The last time such an all-encompassing candlestick appeared was in May 1978, just before gold's great takeoff, following the break of the third top at $180, and after four long years of consolidation between 1974 and 1978:

(Click on image to enlarge)

One year later, we can consider that this encompassing candlestick was indeed a bullish signal, just like the one in 1978 :

(Click on image to enlarge)

These ETF purchases are supporting the gold price, but the economic fundamentals are also very different from those of 2016.

US public debt now stands at $35 trillion, with $10 trillion to be refinanced over the next 12 months, an amount that has doubled in just four years. The deficit has reached $2 trillion, while interest on the debt now amounts to $1 trillion - three times more than ten years ago and twice as much as three years ago. These repayments absorb 20% of revenues, or $3 billion a day.

The rate hike seen immediately after Trump's victory:

(Click on image to enlarge)

In 2016, 10-year yields had also reacted strongly to Trump's victory before stabilizing at around 2.2%:

(Click on image to enlarge)

Today, these same rates now exceed 4.5%, and debt servicing is much heavier, with a significant proportion of debt to be refinanced in the coming months.

The graph of the 10-year bond rating is even breaking through a “failing wedge” in a strongly bearish configuration:

(Click on image to enlarge)

In 2016, this rating collapsed, but its value was 40% higher than today...

(Click on image to enlarge)

A correction of this magnitude would have far-reaching repercussions for the equity market, especially small caps. The euphoria that followed Trump's victory in this segment was mainly fueled by the promise of tax cuts. However, the threat of an uncontrolled rise in interest rates weighs even more heavily on these companies, which are often heavily indebted and face an increasingly difficult refinancing wall to overcome.

No, the situation is not identical to that of 2016!

Trump is back in power in a completely different context.

More By This Author:

Gold On A Parabolic RiseGold On It’s Way To New Heights

Silver Vs U.S. Stock Indexes Says "Silver Is Cheap"

Disclosure: GoldBroker.com, all rights reserved.