Gold Bugs Now A Joyous Mood

The world’s fiat bugs promised that money printing, debt, and government meddling were the solution to the debt crisis of 2008.

They did the same thing with the Corona crisis of 2019-2021, and now they are doing it again with the horrifying war crisis of 2022.

For gold bugs who are watching this madness, it’s a tragic comedy of errors that dwarfs the greatest Shakespeare plays.

(Click on image to enlarge)

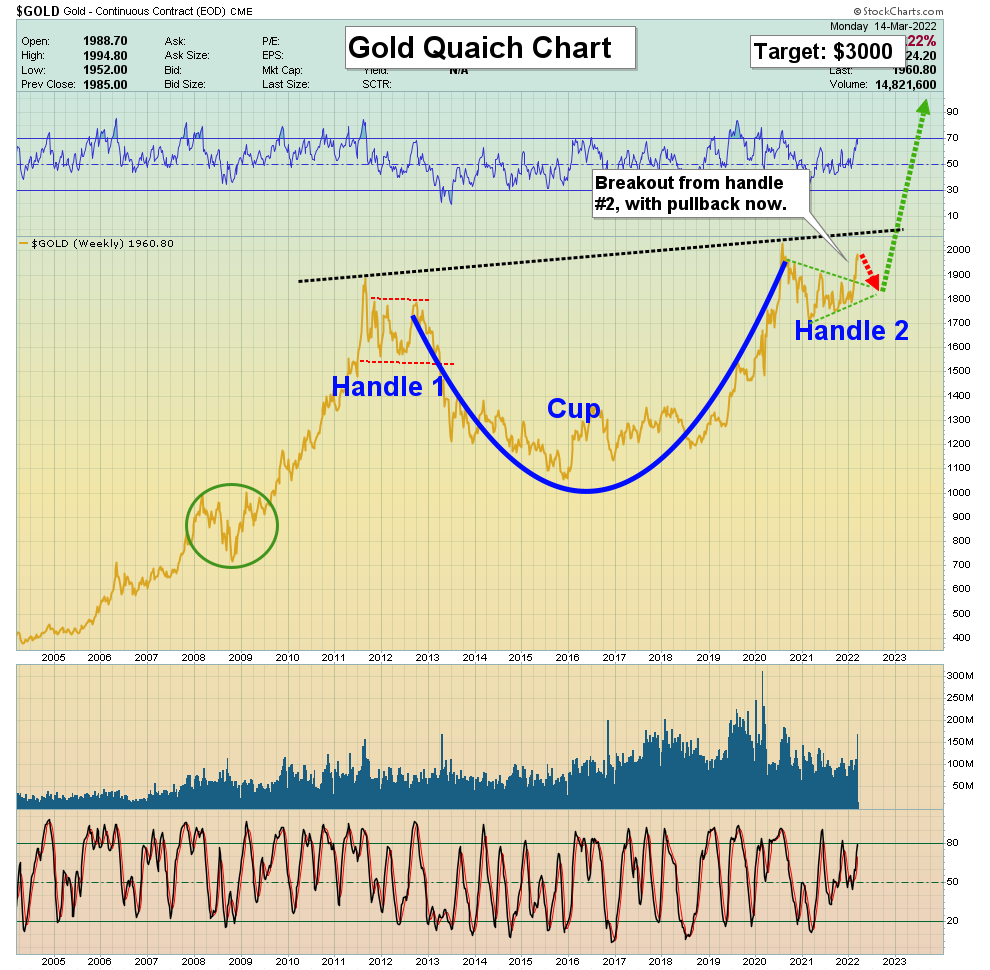

big picture chart for gold

The U.S. government ban on Russian oil, extreme sanctions, and the Ukraine war are three fear trade price drivers for gold that have reached their maximum effect… in the short term.

At the same time, Indian gold buying has dried up due to the rally and the new Corona wave in China has buyers going to the sidelines there. The bottom line:

Technically, a pullback to the small triangle apex at $1900-$1850 seems normal and the fundamentals are in perfect alignment with this scenario.

(Click on image to enlarge)

daily gold chart

While long-term investors can buy miners now, my focus is $1920, $1880, and $1835, the support zones defined by previous highs.

(Click on image to enlarge)

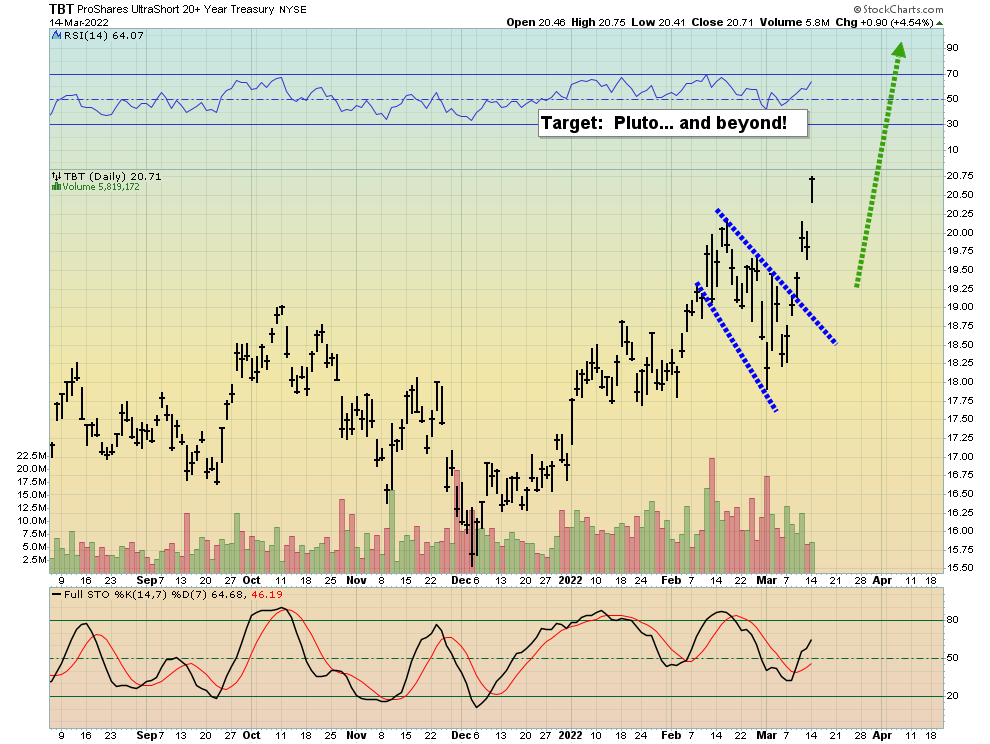

a leveraged bear play on interest rates

While commodities (including oil) take a breather, the pressure on rates is intensifying. Investors who are long gold (and related items) and short bonds are poised to outperform everyone else.

(Click on image to enlarge)

long-term interest rate chart

I’m projecting not just the couple of hikes that the Fed bandies about, but a rise above the highs of 1981!

To understand why that can happen, please see below.

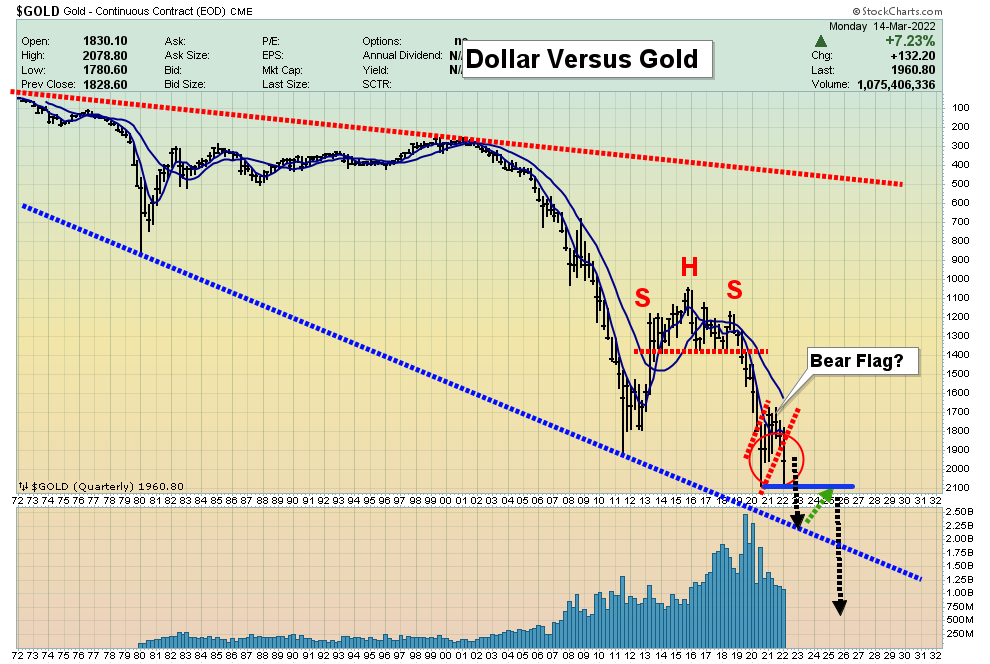

Whether digital or physical, the citizens of China, India, and Russia are going to be focused on the yuan more than the dollar. That’s because petrodollar has been replaced with the macabre “sanctionsdollar”.

Unfortunately, there are no benefits to American citizens from sanctions; Main Street prices are skyrocketing. Most republicans and democrats are united in warmongering against anyone who doesn’t join them in ruthlessly punishing Russian citizens for simply being alive.

Russian banks are already moving to offer their eager depositors new yuan savings accounts that feature a juicy 8% interest rate.

The yuan is likely to become a de facto currency of Russia in the coming years…. along with gold!

Ukraine has enormous armed forces, but in time the Russian forces will almost certainly overwhelm them.

(Click on image to enlarge)

Debt-oriented US government meddling in Ukraine is making a bad situation worse, and of course, that’s why this already-horrific dollar versus gold chart could become an “obliteration” chart.

(Click on image to enlarge)

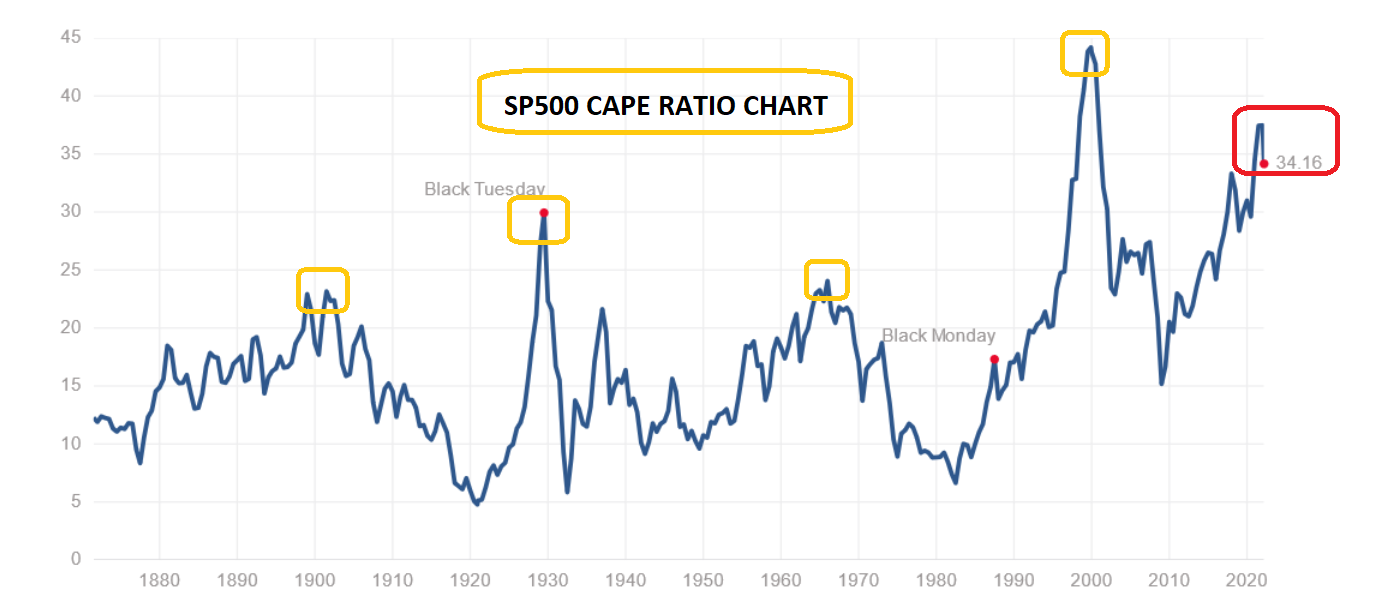

S&P500 CAPE ratio chart

When investors look at the big picture charts for rates, the stock market, gold, commodities, the dollar, and debt, it’s clear that the American empire now resembles a tin can full of meddling stormtroopers at best, and a hydrogen balloon in a blast furnace at worst.

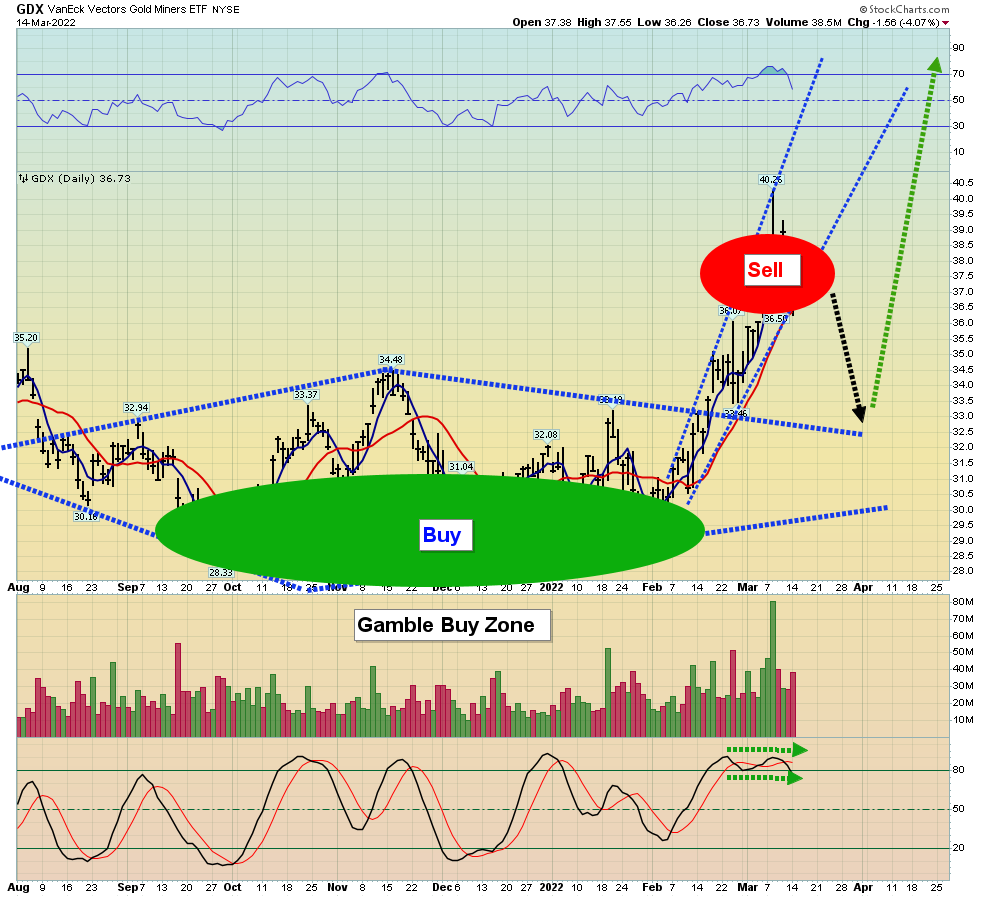

(Click on image to enlarge)

GDX tactics chart

Rather than anything technical on the GDX chart itself, I am most focused on the gold prices of $1920, $1880, and $1835 for fresh mining stock purchases. Investors are in a very positive mood on this pullback, and so they should be!

I’ll ask gold bugs to think now about how positive the mood will become as gold rises from my buy zones to fresh all-time highs!

My big picture newsletter is $199/year. It’s an essential aid in the incredibly ominous 2021-2025 war cycle.I got an overwhelming response to my ...

more

1920$ is gold price not miners price my friend

Oh man 🤣 I lost a bundle, bought the top, my fault 🤦🏽♂️