Gold Bond Seal

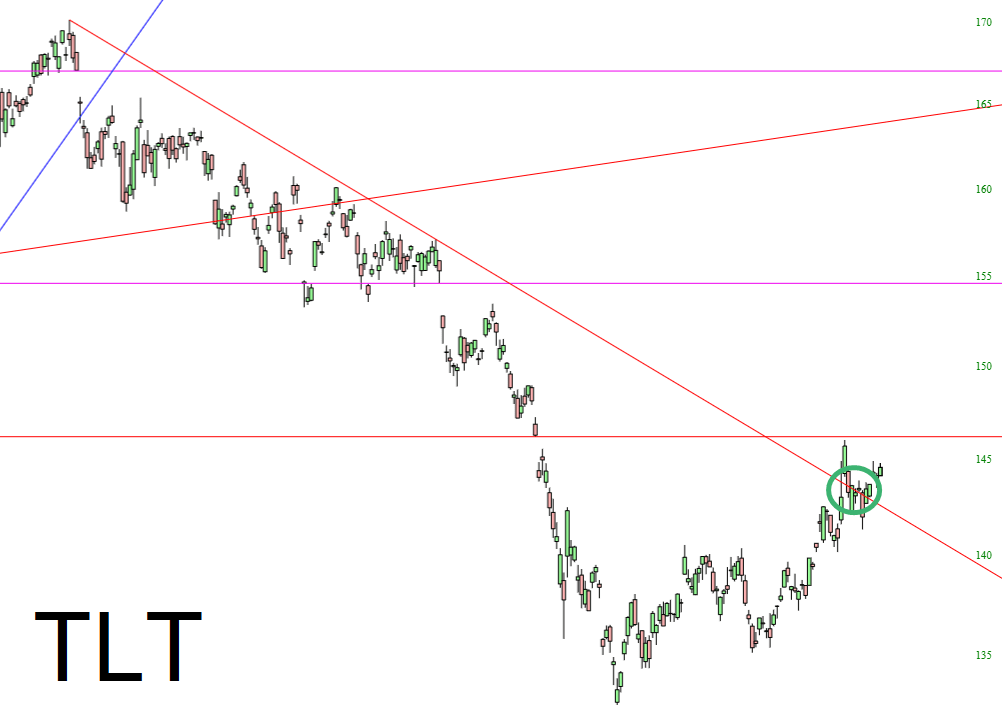

The bond market is going to be an important driver in equity prices for the rest of the year, and I would gently assert that they are looking bullishly poised (which, if true, would mean declining interest rates). Here we see TLT finally pushing above its downtrend, having successfully conquered it.

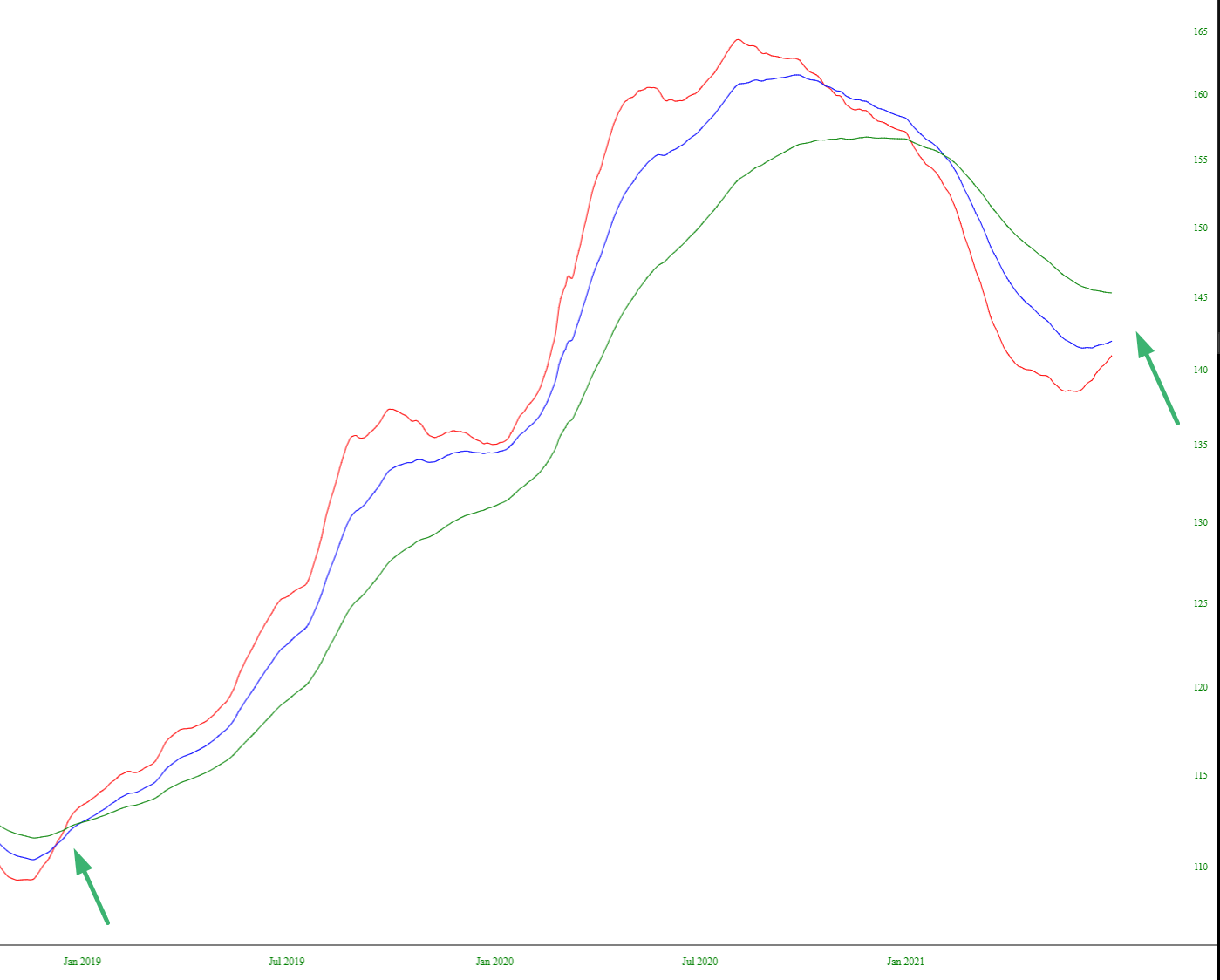

Viewing the trio of exponential moving averages (50/100/200), we see that these have not been bullishly configured for over two years. We could, however, be getting closer to a crossover.

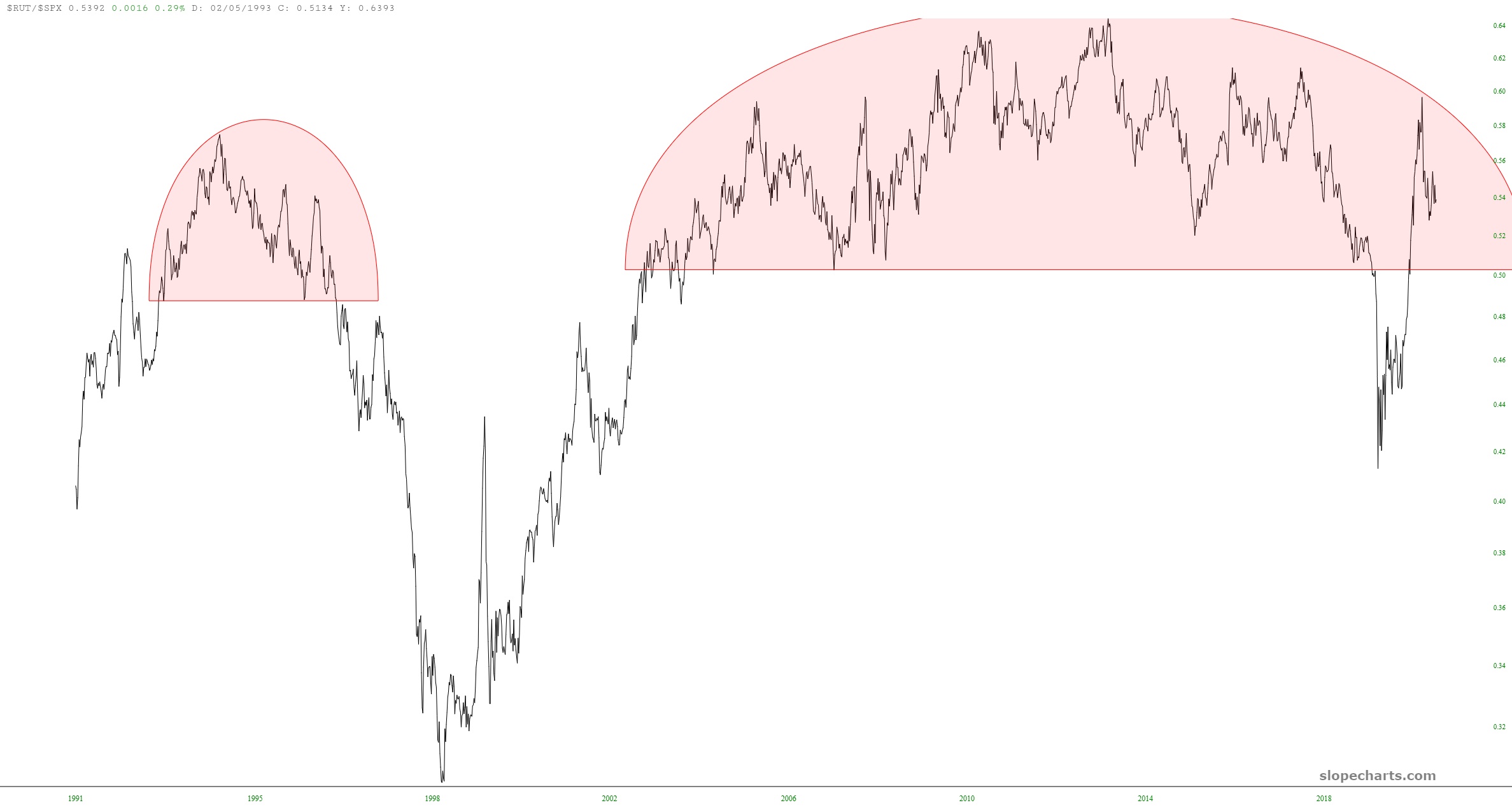

This would all line up nicely with the notion that small caps (RUT) would seriously underperform the big caps (SPX) for years to come since a weak interest rate environment would tend to be bad for the Russell 2000.

(Click on image to enlarge)

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more