General Stock Market Commentary - Saturday, July 25

The Short-Term Trend

I think a new short-term downtrend may have started on Friday, July 24.

The ten-day call/put has turned decisively lower, along with the PMO above.

The SPX momentum indicator has also turned lower.

Not all the charts have turned lower, however. The SPX equal-weight is holding up, although its stochastic is in the range where it is likely to start showing some weakness soon.

The bullish percents are mixed. The NASDAQ is looking weak, while NYSE is doing alright.

Everyone knows that this is a tough market to trade right now. Tech stocks have run up too far while most other stocks have languished, and this has created two markets.

Also, we are just beginning a new earnings cycle while major stimulus is being debated on in DC. There is also the election that now takes center stage. Maybe this isn't the time to try and make any big bets on stocks going up or down.

The Longer-Term Outlook

The ECRI index started to level off a few weeks ago, just under its -5 level which distinguishes recession from expansion. This makes sense considering the three largest states have had to limit re-opening.

Still, looking on the bright side, this index hasn't turned lower, so let's assume that a very slight improvement in the economy may continue. I think this means that the stocks that have done well since the March lows will continue to benefit, although we know choppiness is assured.

The money supply is healthy and headed higher. This is a major plus for the economy and for stocks.

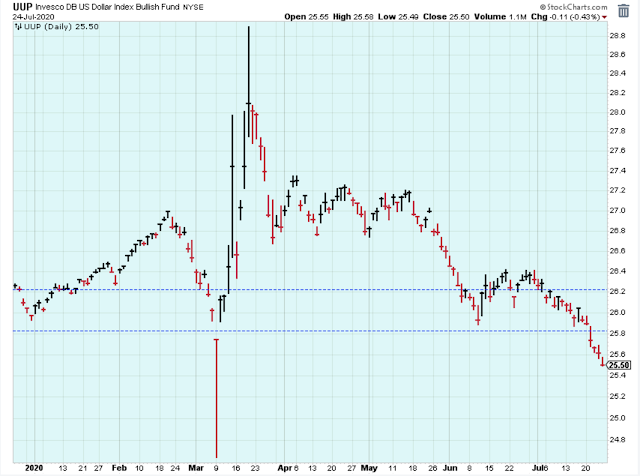

The US Dollar is weak. A weak dollar is inflationary and it discourages foreign investment in US stocks. Also, a weak dollar implies that short-term rates are too low, which helps gold prices. Higher short-term rates put downward pressure on price/earnings multiples, which hurts high-multiple tech stocks.

Looking back over this past week, we had weak technology stocks and strong gold miner stocks.

Outlook Summary

- The medium-term trend is uncertain and must be reviewed at a later time.

- The short-term trend is down as of July 24.

- The economy is in recession as of March 28.

- Contrarian Sentiment is uncertain and must be reviewed, as well.

- The medium-term trend for Treasury bonds is up as of January 25 (prices higher, yields lower).

Disclaimer: I am not a registered investment adviser. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more