Futures, Yields, Oil And Gold Slide As German Confidence Plummets To 2011 Lows, Euro Hits Parity

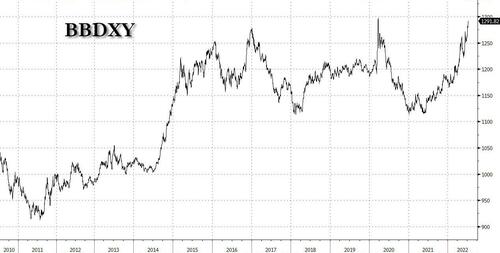

US index futures, global markets, Treasury yields, bitcoin and oil all fell on Tuesday as the dollar continued its relentless ascent to levels just shy of the March 2020 global crash record high...

... highlighting pervasive trader unease about the economic outlook as high inflation and a looming recession are set to unleash a catastrophic global recession coupled with a worldwide dollar shortage, now with the added boost of China’s renewed struggles with COVID.

S&P and Nasdaq 100 emini futures dropped about 0.5% each having slumped as much as 0.9% earlier, as traders brace for an ugly Q2 earnings season which may provide clues on how companies are weathering inflation and recession concerns.

The US 10-year Treasury yield falls to about 2.91% amid a broad-based flight to safety; bonds also rallied in Europe. German bonds surged, sending the benchmark 10-year yield to the lowest since May, after data showed investor confidence plunged to a 2011 low.

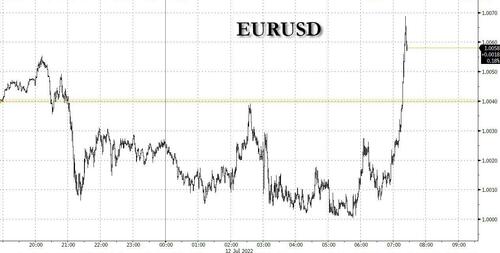

As shown above, the dollar rose just shy of record highs last seen at the height of the 2020 market panic over COVID and the yen strengthened, underlining investor caution. The euro meanwhile briefly touched parity (technically, it was 1.00003 but that's semantics for purists who have nothing better to do) hammered by the region’s energy crisis and acute recession fears.

Dollar strength will not only “affect this quarter’s earnings, but more likely it’s going to affect the revenue generation outlook for the next couple of quarters and that, I think, is a big problem,” Kimberly Forrest, founder and chief investment officer of Bokeh Capital Partners, said on Bloomberg Radio.

PepsiCo, one of the first major corporations to report, rose in premarket trading after lifting its revenue forecast. The soft-drinks maker said demand remained robust despite inflation, though it expected headwinds from the strong dollar. Bank stocks, meanwhile, were lower in premarket trading amid a broader slump in risk assets. Cryptocurrency stocks drop in premarket trading as Bitcoin (BITCOMP) drops below $20,000 in its fourth straight day of declines amid a stronger dollar. In corporate news, LoanDepot said it will cut about 2,000 additional staff by the end of the year. Here are the other notable premarket movers:

- Gap (GPS) shares fall 6.4% in premarket trading after the apparel retailer fired CEO Sonia Syngal and said it expects rising costs and deepening discounts to erase this quarter’s operating profit.

- American Express (AXP) shares are down 2.2% in premarket trading after Morgan Stanley cut the recommendation on the stock, as well as on Capital One (COF), to equal- weight from overweight as inflation takes a larger share of household disposable incomes.

- STORE Capital (STOR) shares fall 3.3% in premarket trading after Morgan Stanley downgrades it to underweight from equal-weight and cuts National Retail Properties (NNN) to equal-weight from overweight, saying that US triple net REITs could see a headwind from the rising cost of capital.

- Ginkgo Bioworks (DNA) shares are up 9% in premarket trading after exchange-traded funds managed by Cathie Wood’s Ark Investment Management bought 860,480 shares in the company.

Meanwhile, the latest Fed commentary highlighted both the central bank’s hawkishness and the risks that come with aggressive interest-rate hikes. Fed Bank of Atlanta President Raphael Bostic said the US economy can cope with higher interest rates and repeated his support for another jumbo move this month. Fed Bank of Kansas City President Esther George, who dissented last month against the central bank’s 75 basis-point rate increase, cautioned that rushing to tighten policy could backfire.

European bourses are also deep in the red. Euro Stoxx 50 falls 0.7% with the Stoxx Europe 600 sliding for a second day, though it pared the decline with utilities outperforming as EDF jumped after a report that the French government will pay a premium to take control of the electricity company. The DAX lags, dropping 0.8%. Banks, travel and autos are the worst performing sectors. German bonds surged, sending the benchmark 10-year yield to the lowest since May, after data showed investor confidence plunged to a level not seen since the sovereign debt crisis in 2011.

Asian stocks fell to a new two-year low as China’s technology shares continued to face selling pressure amid regulatory jitters and a resurgence of COVID cases in the nation. The MSCI Asia Pacific Index slipped as much as 1.5%, dragged by tech and consumer discretionary shares. The Hang Seng Tech Index fell 11% from a June high to enter a technical correction as regulatory fines for the country’s tech giants continued to damp sentiment.

In China, investors are concerned more COVID lockdowns may lie ahead as Beijing continues with a strategy of mass testing and mobility curbs. Chinese benchmarks took a hit from renewed lockdown fears from a fresh virus outbreak in Shanghai. Japan and Taiwan were among the region’s worst performing markets on lingering concerns of a global economic slowdown. Market participants are hoping that key US inflation data due Wednesday and China’s GDP figures on Friday will provide clues on the global economy’s direction. Asia’s stock benchmark has slumped 20% this year amid worries about higher interest rates and the prospect of an economic downturn. Investor sentiment continued to weaken in Asia despite remaining positive in China, said Olivier d’Assier, the head of APAC applied research at Qontigo. “Within an inflationary background, hopes of continued high profit margins in developed markets can only be balanced with fears of a margin squeeze among the developing world’s supply chain.”

In FX, the Bloomberg Dollar Spot Index rose a second day as the greenback was steady or higher against all of its Group-of-10 peers apart from the yen amid rising recession concerns. The euro fell to a low of 1.00003 per dollar but struggled to go below parity. Options traders are still preparing for life below this psychological support level. The pound lagged all of its Group-of-10 peers. UK retailers reported another drop in sales, while economists see the risk of a UK recession in the next 12 months at almost 50-50. Australian and New Zealand fell gradually. Iron ore prices sank to a seven- month low, with the demand outlook dimming on fears China may again impose strict COVID-19 curbs that hurt construction activity.

In rates, Treasuries were underpinned following gains for bunds and gilts after German ZEW expectations gauge dropped to -53.8 vs -40.5 estimate. Treasury yields richer by up to 7.5bp across intermediates, flattening 2s10s spread by 1.4bp on the day to -10.3bp, deepest inversion since 2007; German 10s outperform Treasuries by ~5bp, gilts by ~7bp. German 10-year yields dropped to lowest since May, dragging Treasury yields lower. German curve bull-flattens, richening 12-14bps across the back end. Gilts bull-steepen, with short-dated yields dropping over 15bps. Peripheral spreads widen to Germany with 10y BTP/Bund widening ~3bps to 199bps. In bond auctions we get a $33BN reopening of 10-year notes at 1pm ET follows good demand for Monday’s 3-year new issue, which stopped 0.5bp through. WI 10-year yield around 2.92% is ~11bp richer than June result, which tailed by 1.2bp.

Crude futures decline. WTI falls ~2.5% to trade near $101.60. Base metals are mixed; LME tin falls 3.1% while LME aluminum gains 0.3%. Spot gold is little changed at $1,735/oz. Spot silver loses 1.1% near $19. Bitcoin drops over 3.5% to trade back below $20,000.

Looking at the day ahead now, and data releases include the US NFIB small business optimism index for June. Central bank speakers include BoE Governor Bailey, the Fed’s Barkin and the ECB’s Villeroy. Finally, earnings releases today include PepsiCo.

Market Snapshot

- S&P 500 futures down 0.6% to 3,835.50

- STOXX Europe 600 down 0.4% to 413.46

- MXAP down 1.3% to 154.65

- MXAPJ down 1.3% to 508.44

- Nikkei down 1.8% to 26,336.66

- Topix down 1.6% to 1,883.30

- Hang Seng Index down 1.3% to 20,844.74

- Shanghai Composite down 1.0% to 3,281.47

- Sensex down 0.6% to 54,067.35

- Australia S&P/ASX 200 little changed at 6,606.28

- Kospi down 1.0% to 2,317.76

- German 10Y yield little changed at 1.16%

- Euro down 0.3% to $1.0008

- Brent Futures down 2.1% to $104.83/bbl

- Gold spot up 0.2% to $1,736.88

- U.S. Dollar Index up 0.43% to 108.48

More By This Author:

Euro Tumbles To Dollar Parity For First Time Since 2002Costco CEO Warns "A Lot Of Consumers Are In Recession Right Now"

Corn Prices Soar As Heat Could Damage Yields

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more