Futures Slide As Soaring Oil Nears $85

While cash bonds may be closed today for Columbus Day, which may or may not be a holiday - it's difficult to know anymore with SJW snowflakes opinions changing by the day - US equity futures are open and they are sliding as soaring oil prices add to worries over growing stagflation (Goldman and Morgan Stanley both slashed their GDP estimates over the weekend even as they both see rising inflation), fueling concern that a spreading energy crisis could hamper economic recovery (as a reminder, yesterday we had one, two, three posts on stagflation, showing just how freaked out Wall Street suddenly is).

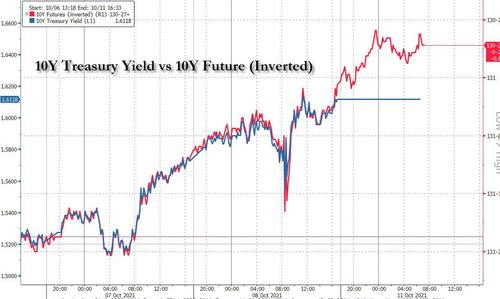

Rising raw material costs, labor shortages and other supply chain bottlenecks have raised concerns of elevated prices hammering corporate profits while rising rates are suggesting that a tidal wave of inflation is coming. And while cash bonds may be closed, one can easily extrapolate where they would be trading based on TSY futures which are currently trading at a 1.65% equivalent.

But while cash bonds may be closed, the big mover on Monday was oil, with WTI surging nearly 3% and touched a seven-year high as an energy crisis gripping the major economies showed no sign of easing. Meanwhile, Brent rose just shy of $85, rising to the highest since late 2018 when the Fed abruptly reversed tightening course. Over in China, coal futures reached a record as flooding shuttered mines.

The surge in oil lifted shares of Chevron Corp, Exxon Mobil Corp and APA Corp between 1.2% and 3% in premarket trading. At the same time, rising rates hit FAAMGs, with Apple, Microsoft and Amazon all falling between 0.6% and 0.8%. The surge above 1.6% for 10-year Treasury yields is intensifying debate among strategists over how to position investor portfolios amid anxiety over whether transitory inflation is transitioning into stagflation. Lucid Group rose 2.2% and Occidental Petroleum climbed 3.1%, leading gains in the U.S. premarket session. Here are some of the biggest movers and stocks to watch today:

- U.S.-listed Chinese tech stocks soar 2% to 5% in premarket trading, extending their recent rebound. Rally supported by Beijing slapping a smaller-than-expected fine on food delivery giant Meituan and last week’s news that U.S. President Joe Biden was planning to meet with Xi Jinping before the end of the year. Alibaba (BABA US +5%) leads gains, while JD.com (JD US) and Baidu (BIDU US) rise 2% apiece

- Watch U.S. energy stocks as oil surges past $80 a barrel as the global power crunch rattled a market in which OPEC+ has only been restoring output at a modest pace. Exxon Mobil (XOM US +1.1%), Chevron (CVX US +1%) and Occidental (OXY US +3.1%) among top risers in premarket trading.

- Robinhood (HOOD US) dropped 2%; the company was under pressure in U.S. premarket trading as a looming share sale by early investors and a toughening regulatory environment for cryptocurrencies are adding to the headwinds in the stock market for the darling of the U.S. retail trading mania.

- ChemoCentryx (CCXI US) up 2% in U.S. premarket trading, adding to Friday’s massive gains after the drug developer won U.S. approval for Tavneos as a treatment for a rare autoimmune disorder

- Cloudflare (NET US) slides 1.8% in U.S. premarket trading after Piper Sandler downgraded stock to neutral

- Akerna Corp. (KERN US) gained in Friday postmarket trading after Matthew Ryan Kane, a board member, bought $346,032 of shares, according to a filing with the U.S. Securities & Exchange Commission.

“We see rising risks to global growth and evidence of more persistent inflation, which makes us more cautious on the outlook for global markets overall,” Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International, wrote in a note to clients.

In Europe, the Stoxx 600 Index fell 0.2%, led by declines in travel and property firms. Miners and energy stocks were the two strongest-performing sectors in Europe on Monday on rising prices for iron ore and oil. The Stoxx 600 Basic Resources Index climbed as much as 2.4%, while the Energy Index gains as much as 1.5% to the highest since Feb. 24, 2020. European banking stocks also advanced on Monday, following four weeks of gains, and traded about 1.3% below pre-pandemic high. The sector has gained 36% ytd, is the best performer among 20 European sectors in 2021. Up 0.7% today, outperforming a slightly weaker broader Stoxx 600 Index and as investors tilt toward cyclical sectors.

Earlier in the session, Asian stocks jumped, buoyed by Hong Kong-listed technology shares including Meituan, which was consigned a lower-than-expected regulatory fine. The MSCI Asia Pacific Index climbed as much as 0.9%, driven by the consumer-discretionary and communication sectors. Alibaba and Meituan were the top contributors to the gauge, each surging about 8% in the first trading in Hong Kong after the food-delivery giant was handed a $533 million fine for violating anti-monopolistic practices. The result of the investigation into Meituan is “a relief and likely to provide closure to the share price overhang,” Citigroup analysts wrote in a note Friday, when the penalty was announced. Hong Kong’s stock gauge was among the top performing in the region. Japan’s benchmarks also climbed as the yen weakened to an almost three-year low against the dollar and new Prime Minister Fumio Kishida said he’s not considering changes to the country’s capital-gains tax at present. Improved sentiment in China is providing much-needed support to Asian equities, which declined for four straight weeks amid uncertainty circling global markets. Power shortages in China and India, supply-chain woes, inflation risks and rising bond yields are all on the radar as the earnings season kicks off. “We are still in a market that is very, very concerned about the growth outlook,” said Kyle Rodda, market analyst at IG Markets. These sort of rallies that appear almost inexplicable are “symptomatic of the market still trying to piece together all pieces of the puzzle,” he added.

Australia: The S&P/ASX 200 index fell 0.3% to close at 7,299.80, with most subgauges taking a hit. Miners advanced, posting gains for a third session, offsetting losses in healthcare and consumer discretionary stocks. Star Entertainment was the worst performer after a report saying the company had enabled suspected money laundering, organized crime and fraud at its Australian casinos for years. Fortescue surged after the company said it plans to build a green energy factory to rival China. In New Zealand, the S&P/NZX 50 index dropped 0.5% to 13,019.37.

In FX, the pound crept higher to touch an almost 2-week high versus the dollar and the Gilt curve shifted higher, led by the front-end, after the Bank of England’s Michael Saunders, one of the most hawkish members of the Monetary Policy Committee, suggested in remarks published Saturday that investors were right to bring forward bets on rate hikes. Hours earlier, Governor Andrew Bailey warned of a potentially “very damaging” period of inflation unless policy makers take action. Australia’s dollar led gains among G-10 currencies on the back of increases in oil, natural gas and iron ore prices and as Sydney emerges from a 15- week lockdown on Monday. Iron ore futures extended gains as improved rebar margins at Chinese steel mills buoyed demand prospects. The yen dropped against the dollar, with analysts forecasting more weakness ahead as the nation’s yield differentials widen.

As noted above, treasury futures slumped in U.S. trading Monday, with the cash market closed for Columbus Day; they implied a yield of 1.65% on the 10Y. 10-year note futures price is down 8+/32, a price change equivalent to a yield increase of about 3bp. Benchmark 10-year yield ended Friday at 1.615%, its highest closing level since June, as investors focused on the inflationary aspects in mixed September employment data. China's10-year government bond futures declined to a three-month low while the yuan advanced as the central bank’s latest liquidity draining weakened expectations of fresh monetary policy easing. Futures contracts on 10-year notes fall 0.4% to 99.14, the lowest level since July 12. It dropped 0.4% on Friday. 10-year sovereign bond yields rose 5bps, the biggest gains in two months, to 2.96%.

Looking ahead, upcoming reports on third-quarter company profits which start this week are seen as the next potential pressure point in a market already under siege from slowing global growth, sticky inflation and tighter monetary policies. Global earnings revisions are sliding - an omen for U.S. stocks that have taken their cue from rising earnings estimates all year.

“The coming earnings’ season in the U.S. will be heavily scrutinized for pricing power, margins and clues on the shortage situation, as well as wage pressures,” according to Geraldine Sundstrom, a portfolio manager at Pacific Investment Management Co. in London. “Already a number of large multinationals have issued warnings about production cuts and downgraded their Q3 outlook due to supply chain and labor shortages.”

Market Snapshot

- S&P 500 futures down 0.3% to 4,371.25

- STOXX Europe 600 down 0.2% to 456.41

- German 10Y yield up 1.5 bps to -0.135%

- Euro little changed at $1.1568

- MXAP up 0.8% to 196.45

- MXAPJ up 0.7% to 642.13

- Nikkei up 1.6% to 28,498.20

- Topix up 1.8% to 1,996.58

- Hang Seng Index up 2.0% to 25,325.09

- Shanghai Composite little changed at 3,591.71

- Sensex up 0.5% to 60,358.30

- Australia S&P/ASX 200 down 0.3% to 7,299.79

- Kospi down 0.1% to 2,956.30

- Brent Futures up 1.9% to $83.98/bbl

- Gold spot down 0.1% to $1,755.02

- U.S. Dollar Index up 0.11% to 94.17

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more