Foreigners Dump US Treasuries In August, China's Holdings Drop To Almost 4 Year Low

The Treasury’s latest TIC data report, published after the close and detailing August international capital flow activity, showed total foreign ownership of US Treasurys dropped by $13.8 billion From July's record $7.097 trillion to $7.083 trillion - the first month of selling since April - with Japan, China, UK, and Hong Kong, the biggest sellers.

(Click on image to enlarge)

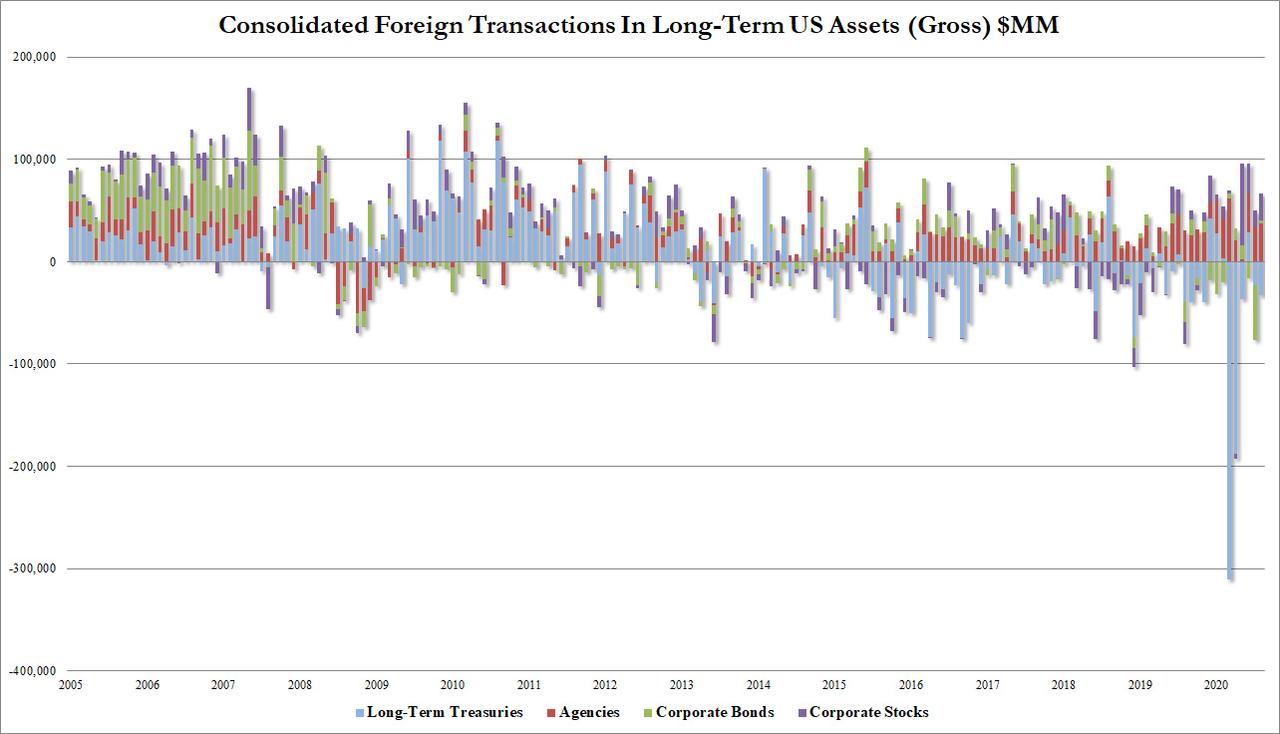

Before we get into the weeds, a big picture snapshot showed that in August, the most notable flows were as follows:

- Foreign selling of Long-Term treasuries: $33.1BN

- Foreign buying of Agency debt: $37.7BN

- Foreign buying of Corporate debt: $2.3BN

- Foreign buying of Equities: $26.6BN

As shown in the summary chart below, the $33.1BN TSY outflow was the biggest monthly selling of long-term Treasuries since the $36.7BN sold in May. The rest of the flows were generally in line historical trends.

(Click on image to enlarge)

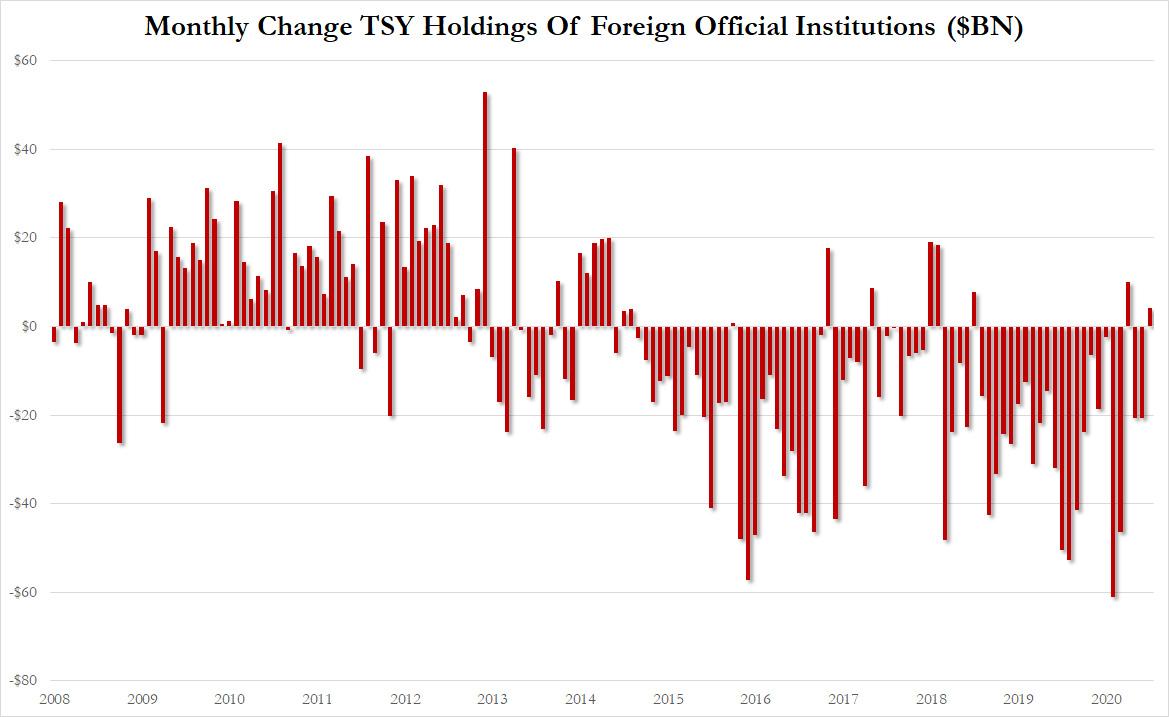

Taking a closer look at Treasuries reveals that while private and other non-official holders sold $37.2BN, or the most since May's $46.7BN, foreign official institutions such as central banks, reserve managers, and so on, actually bought US paper to the tune of $4.2BN, which is notable for an investor group that has bought US Treasurys in just 6 months since Jan 2017.

(Click on image to enlarge)

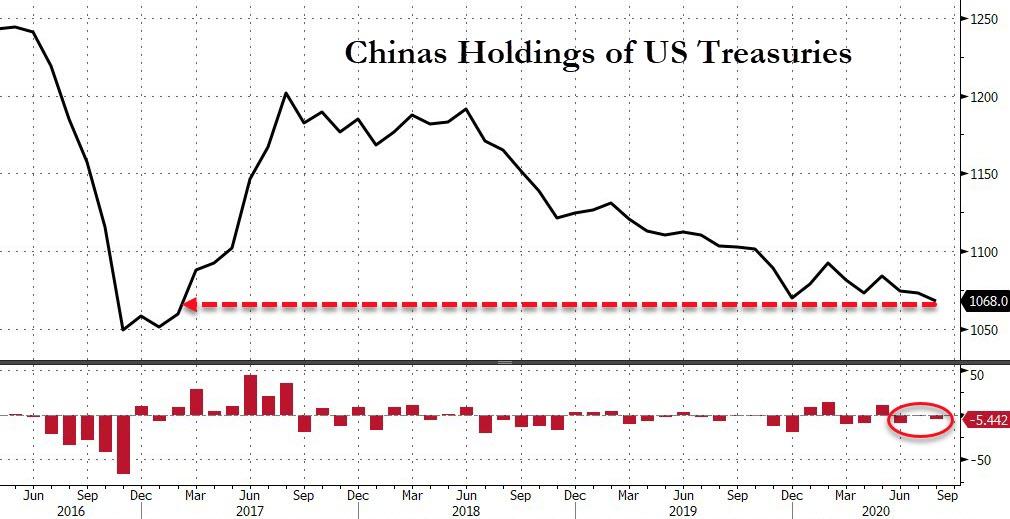

Drilling further down, we find that China sold another $5.4BN (or merely remarked lower as a result of the higher rates in August), bringing its total to $1.068 trillion, the lowest since March 2017.

(Click on image to enlarge)

A similar trend was observed in the Treasury holdings of the largest US foreign creditor Japan, which surpassed China as the biggest offshore holders of US paper in mid-2019, whose holdings of US paper also dropped from last month's record of $1.293 trillion by $14.6BN, the biggest drop since Sept 2019.

(Click on image to enlarge)

That said, not everyone was selling, and among the more notable buyers, we have Ireland (adding $4.5BN), Luxembourg (adding $4.1BN), and Saudi Arabia, which grew its TSY holdings by $5.4BN.

(Click on image to enlarge)

Yet while once upon a time analysts would look at such selling by foreigners with caution, now that the Fed is buying every newly issued US government bond, the reality is that the US no longer needs foreign creditors: after all it has an activist Fed which monetized the deficit and buys ever dollar in debt issued by the Treasury.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Given the direction our Fed is pushing, those not betting on the dollar are making a smart move. Perhaps the folks at the fed should pay attention to that.