First 10Y Auction Of 2024 Prices To Tepid Demand, 4th Tail In A Row

One day after a stellar 3Y auction launched the coupon Treasury issuance for 2024, moments ago we got the sale of the first benchmark piece of paper for the new year, when some $37BN in a 9-Year 10-Month reopening were sold to the public in a generally strong auction.

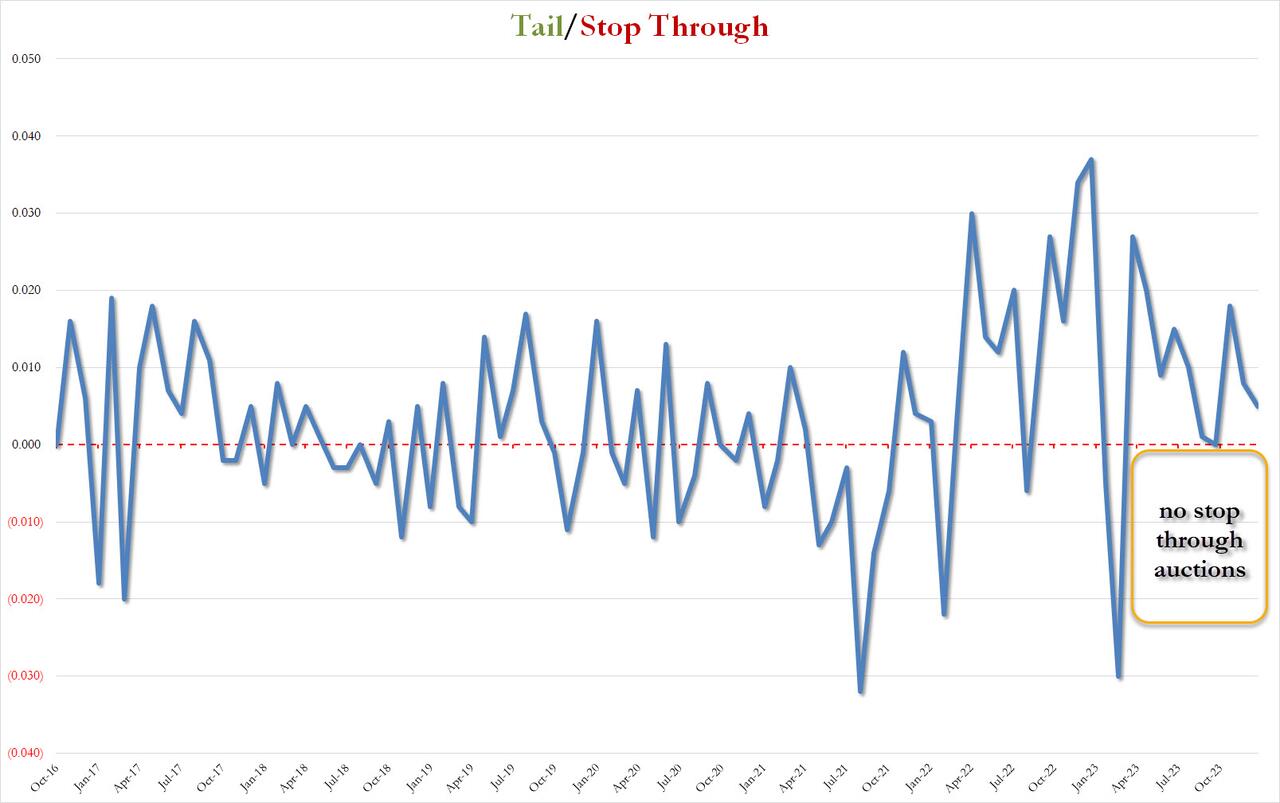

The auction priced at a high yield of 4.024%, which was a sharp drop from December's 4.2960 and was the lowest yield since the 3.999% August auction. More notably, the high yield tailed the When Issued 4.019 by 0.5bps. This was the 4th consecutive tailing 10Y auction, and the 11th non-stop through auction in a row (September was on the screws). More remarkably, there have been only 3 stop-through 10Y auction in the past 27 months!

(Click on image to enlarge)

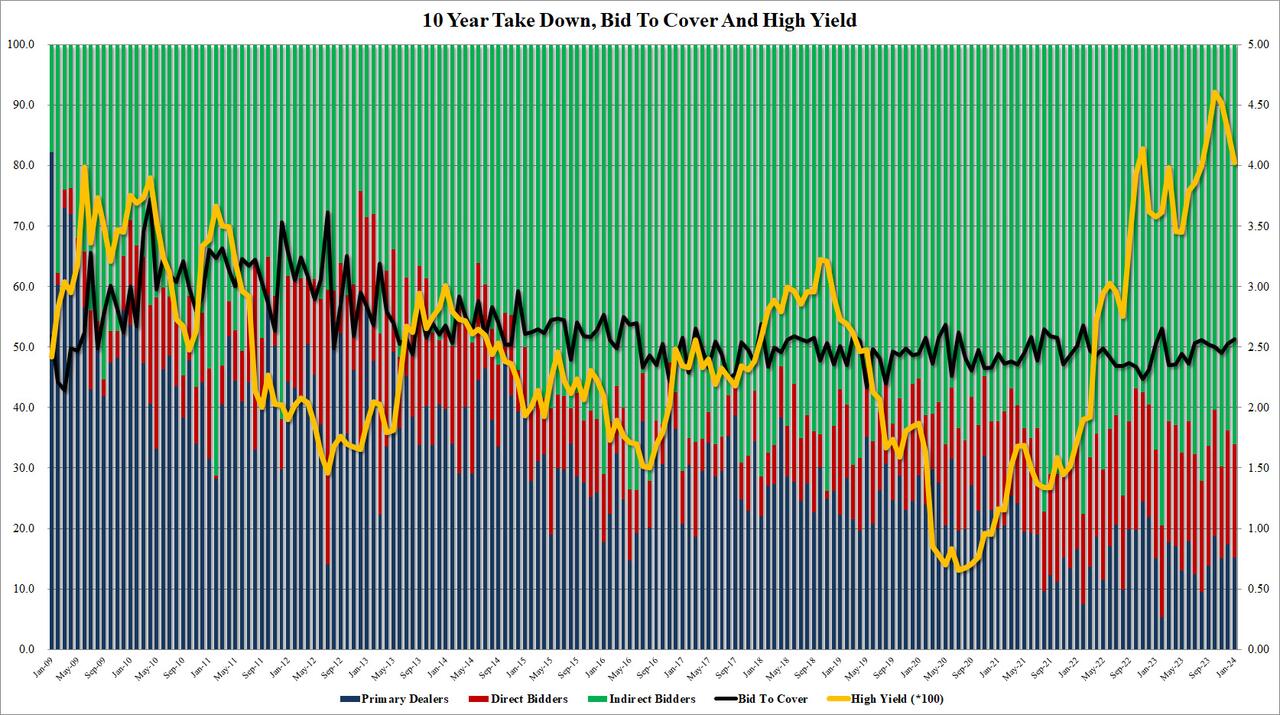

The bid to cover was better, rising to 2.56 from 2.53, and the highest since Feb 2023 (the 6-auction average was 2.49).

The internals were average, with Indirects awarded 66.1%, up from 63.8% but below the recent average of 66.7%. And with Directs taking down 18.7%, also in line with the recent average of 18.8%, Dealers were left holding on to 15.1%, just inches above the 6-auction average of 14.5%.

(Click on image to enlarge)

Overall, this was a mediocre auction which could have been worse, but also could have been better if it weren't for the now chronic inability of the benchmark paper to sell without tailing, suggesting there is a far deeper and concerning demand problem for US paper.

More By This Author:

Analysts See "Uranium's Third Bull Market" Through 2024Bear Market: Used Car Market Gives More Breathing Room For Fed

Bitcoin & Big-Tech Burst Higher Amid Bloodbath In Boeing & Black Gold

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more