Financial Markets To Federal Reserve: Is That All You’ve Got?

So the Fed, as expected, cuts interest rates again. And – also again – Fed Chair Powell implies that he’s done cutting for a while. The financial markets – also once again – react like junkies contemplating their final hit.

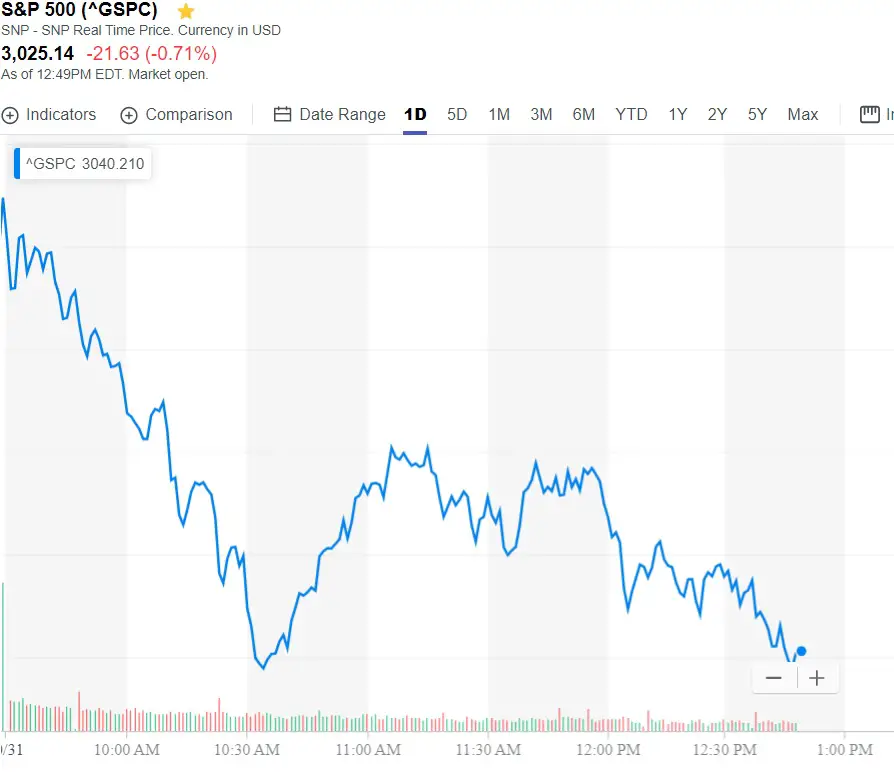

Stocks are falling…

(Click on image to enlarge)

…and Treasury yields are plunging, which is to say Treasury bond prices are rising as everyone goes “risk off”:

(Click on image to enlarge)

Which brings us back to the perennial question of how bad the withdrawal has to get before the Fed caves. This is monotonous, but also a nice, tradable pattern, one that seems obvious to everyone but the main players.

Consider the delusions now driving monetary policy:

• Fed governors appear to think they can stop cutting interest rates if they want, when in fact they can’t, ever. Rates must continue falling to make the debts taken on at past higher rates manageable. Put another way, in a financial system this overleveraged, there can be no “neutral” interest rate. Every rate is catastrophically high in the face of a mountain of bad debt and has, therefore, to be replaced by ever-lower rates to delay the eventual/inevitable deflationary Depression.

• Wall Street traders seem to think that easy money is a good thing for asset prices no matter how bubbly the assets’ valuation. This explains the near-universal bullishness among money managers, as evidenced by their willingness to be long at current prices. Their delusion is not so much wrong as one-sided. At cyclical extremes (like now), what easy money produces is volatility. So yes, asset prices can rise during the manic phase of the process, but they plunge commensurately when the market’s mood shifts and hot money stampedes for the exits. That day is coming.

• Trump appears to believe that bullying the Fed into negative interest rates “like the rest of the world” will produce an outcome different from the stagnation/chaos of those other countries. But it won’t because interest rates are price signaling mechanisms that, via the “cost of capital,” tell entrepreneurs and businesses how and where to invest. Move rates below zero and borrowing itself becomes a cash flow positive endeavor, making productive investment beside the point. This explains the ongoing leveraged buyout of US public companies via share repurchases, as executives choose to make their money the easy way.

Viewed from a slightly different angle, by the time rates turn negative, all the available projects with positive returns on capital will have been financed (since money was available all the way down; if a project wasn’t financed when credit cost 2% or 1%, then by definition that project wasn’t worth much). So by the advent of negative rates, all that’s left to finance are bad projects that are only viable if the financing itself is profitable. That’s why Japan and Europe are stagnant despite all the free money.

• The Democrats, last but definitely not least since they might be in charge shortly, think massive new entitlement programs are feasible in an already hyper-leveraged economy. This is a big subject with a lot of moral angles, but here it’s enough to say that we’re broke, so big new entitlements will be swept away in the coming national bankruptcy, in any event, making their implementation wasted effort.

Target-rich environment

The nice thing about mass financial delusion is that it offers a target rich environment for the non-delusional. So let’s make some lemonade by sketching out a trading strategy for the next round of official mistakes.

Month 1: While the Fed tries to ignore the junky markets writhing on the floor, short US stocks, with an emphasis on wildly-overvalued Big Tech. With remaining funds own “risk-off” staples like bonds, cash and gold.

Month 2: As the realization begins to dawn that an equities bear market might break the global financial system, consensus shifts to not whether the Fed will cut again, but when. Ease out of your stock shorts and long bonds. Keep your gold. Because you should always keep your gold.

Month 3: When everyone has concluded that the next Fed meeting will see another, possibly big, cut along with at resumption of QE, shift back to “risk-on”. Dump your remaining bonds and stock shorts, and go long the stocks that made you all those short profits.

Month 4: Leave the party. Convert the past few months’ trading profits into real assets like farmland, energy stocks, a rental house, and gold – always more gold. Then sit back and watch the delusions crumble.