Fed Pivot Watch - Thursday, Nov. 17

Speculation that the Federal Reserve is close to pausing its rate hikes took a hit this week after a Fed official downplayed the odds in a TV interview on Wednesday.

“Pausing is off the table right now,” says San Francisco Fed President Mary Daly tells CNBC yesterday (Nov. 16). “It’s not even part of the discussion. Right now, the discussion is rightly around slowing the pace and… focusing our attention really on what is the level of interest rates that will end up being sufficiently restrictive.”

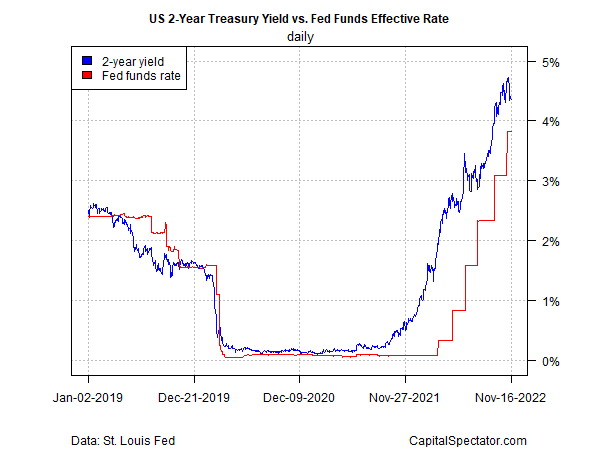

The equities market is getting ahead of itself in seeing a pause in rate hikes, much less a reversal, for the immediate future, says the chief client officer at Aspiriant, a wealth manager. “The market is just trying to grasp for news and it’s prone to overcompensate for the news, whether it’s good news or bad news,” advises Sandi Bragar. “We’re just at that point in the cycle where we think there’s still the high likelihood for potential downward trajectory of stocks as we head into 2023.”The Fed funds futures market this morning is pricing in high expectations of a slower pace of rate hikes going forward. A 50-basis-points increase is assigned a roughly 85% probability for the next FOMC meeting on Dec. 14, according to CME data. If correct, it will mark the first softer increase after a string of 75-basis-points increases this year. Looking into early 2023, another rate hike, perhaps just 25 basis points, is also considered possible at the February meeting, according to futures. The case for a pause or pivot also looks premature based on comparing the effective Fed funds rates with the 2-year Treasury yield, which is widely seen as the most policy-sensitive maturity. History suggests that the 2-year rate is a relatively reliable proxy for Fed funds expectations. That’s certainly been true in the current rate-hiking cycle. Notably, the 2-year rate began rising well ahead of the first rate hike in March.

An early market signal that Fed rate hikes are close to a pause will arrive when the 2-year rate is roughly equivalent to the effective Fed funds rate. When the 2-year rate falls decisively below Fed funds that will be a strong signal that the central bank is close to cutting rates at some point in the near future. But as the chart above suggests, a pause – much less a cut – is nowhere on the immediate horizon, based on the 2-year rate trading well above Fed funds.

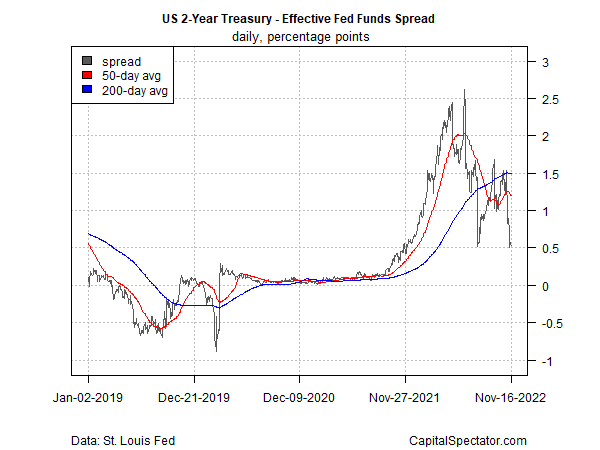

Looking at the 2-year/Fed funds spread provides a more granular profile of how these two rates are evolving and on that front, it’s reasonable to say that the rate-hiking regime has peaked. That alone doesn’t mean that a pause or pivot is imminent, but it provides a framework for concluding that the tide has turned.

There’s been a clear decline in the 2-year/Fed funds spread in recent months. Although this rate difference has been volatile, a downside bias is conspicuous. If the current spread – roughly 50 basis points – falls below this level, which has acted as a floor of late, it may signal that a pause is near.

More By This Author:

US Economic Growth Expected To Continue In Q4

Torturing The Data: Mid-Term Elections Implications

Real Estate Ex-US Led Ongoing Rebound In Markets Last Week

Disclosures: None.