Fed Hangs Tough

FOMC chair Powell disappointed equity markets this week with testimony reiterating his insistence that financial conditions must keep tightening (through higher for longer interest rates and ongoing balance sheet reduction “QT”) amid growing strife throughout the world economy.

Indeed, Powell unapologetically explained (and he’s correct) that higher unemployment, lower economic activity, and less financial speculation are needed to punch the inflationary impulse below 3 percent.

As US short-term rates have moved above 5 percent, longer-term Treasury bonds have rallied, causing their yields to fall. The US 10-year yield is at the same level today as last October when the overnight rate was still 3 percent. (Canadian yields have followed a similar pattern). The 2s/10s spread gapped to -108 basis points, the most inverted since 1981.

The ten-year minus 3-month yield spread hit -106bps. This is the most negative spread differential since the housing-led double-dip recession of 1980-81. The seven previous instances of this spread going negative since 1967 (red circles below, courtesy of JP Morgan and ISABELNET.com) signaled an incoming recession without any exceptions.

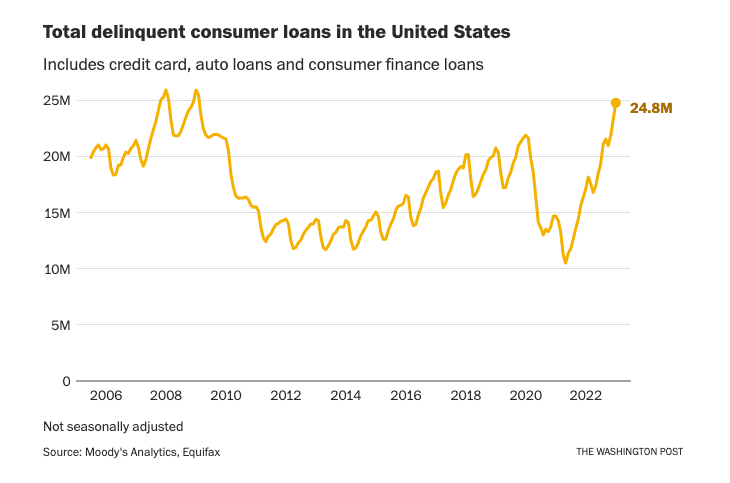

Even with lagging unemployment rates still near historic lows, households are behind on their debt payments by the most since 2008 (US data is shown below since 2005). The Fed projects that 2 million Americans will lose their jobs over the next year.

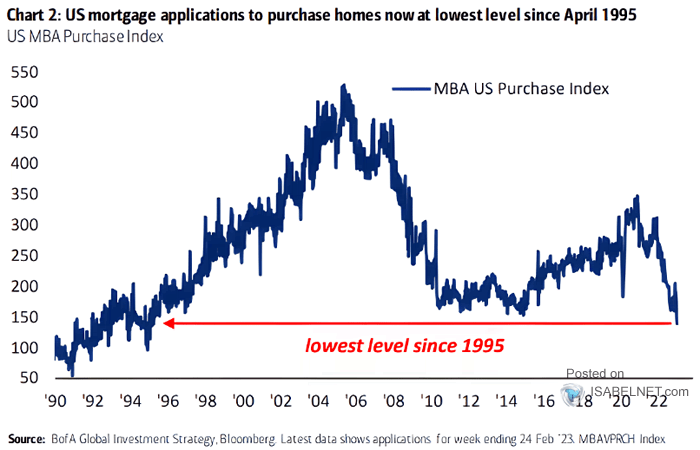

US mortgage applications have fallen to the lowest level in 28 years, lower than during the 2008 recession. Well beyond the tech sector, layoffs in the economically-significant construction industry are in a cyclical uptrend.

The Bank of Canada reiterated that its rates are on hold (but still doing quantitative tightening) as it watches even worse data unfolding in Canada’s housing sector amid record household debt.

No central banks are racing to the rescue soon — bravenewworld.

More By This Author:

Understanding Bond Yields And Mortgage RatesRate Of Change!

Stress Compounding At Higher Rates