Euro (EUR) Latest: EUR/USD Set For Further Gains After Fed Powell’s Dovish Nudge

US interest rate hikes are set to be pared back in the coming months after Fed chair Jerome Powell suggested that a 50bp hike is now likely at the December 14 FOMC meeting. The Fed has hiked interest rates six times this year with the last four hikes all a super-sized 75 basis points.

‘Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting’ Powell told the Brookings Institute yesterday.

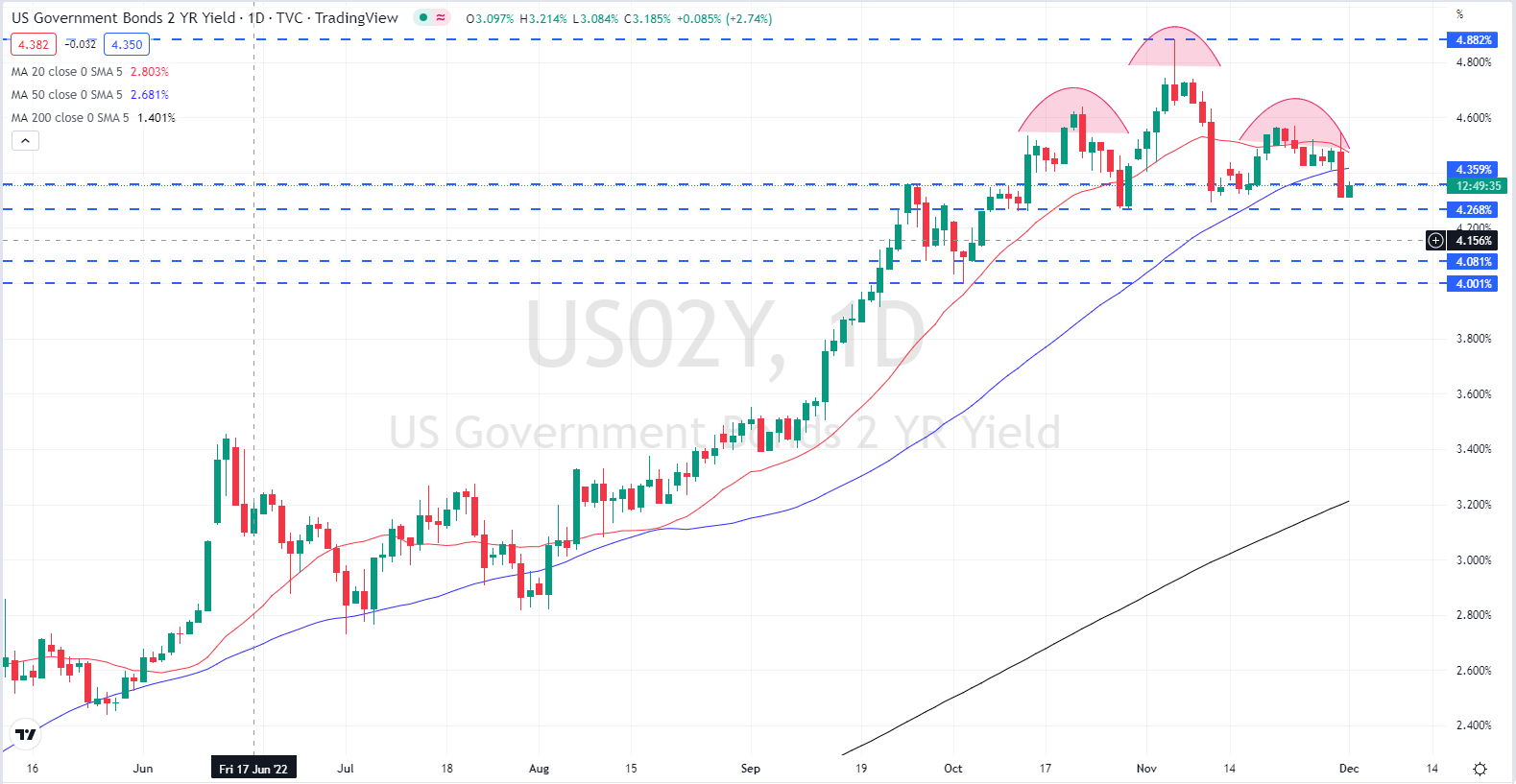

Chair Powell’s dovish tilt yesterday sent short-dated US Treasury yields tumbling with the 2-year losing over 20 basis points on the session. The technical outlook for the rate-sensitive 2-year UST remains bearish with a head and shoulders pattern clearly visible on the daily yield chart.

UST 2-Year Yield Chart

(Click on image to enlarge)

The latest look at the Fed’s preferred measure of inflation, core PCE, is released at 13:30 today and will give the market a closer look at current price pressures in the US. Inflation is expected to nudge one-tenth of a percent lower to 5% in October.

For all market-moving economic releases and events, see the DailyFX Calendar

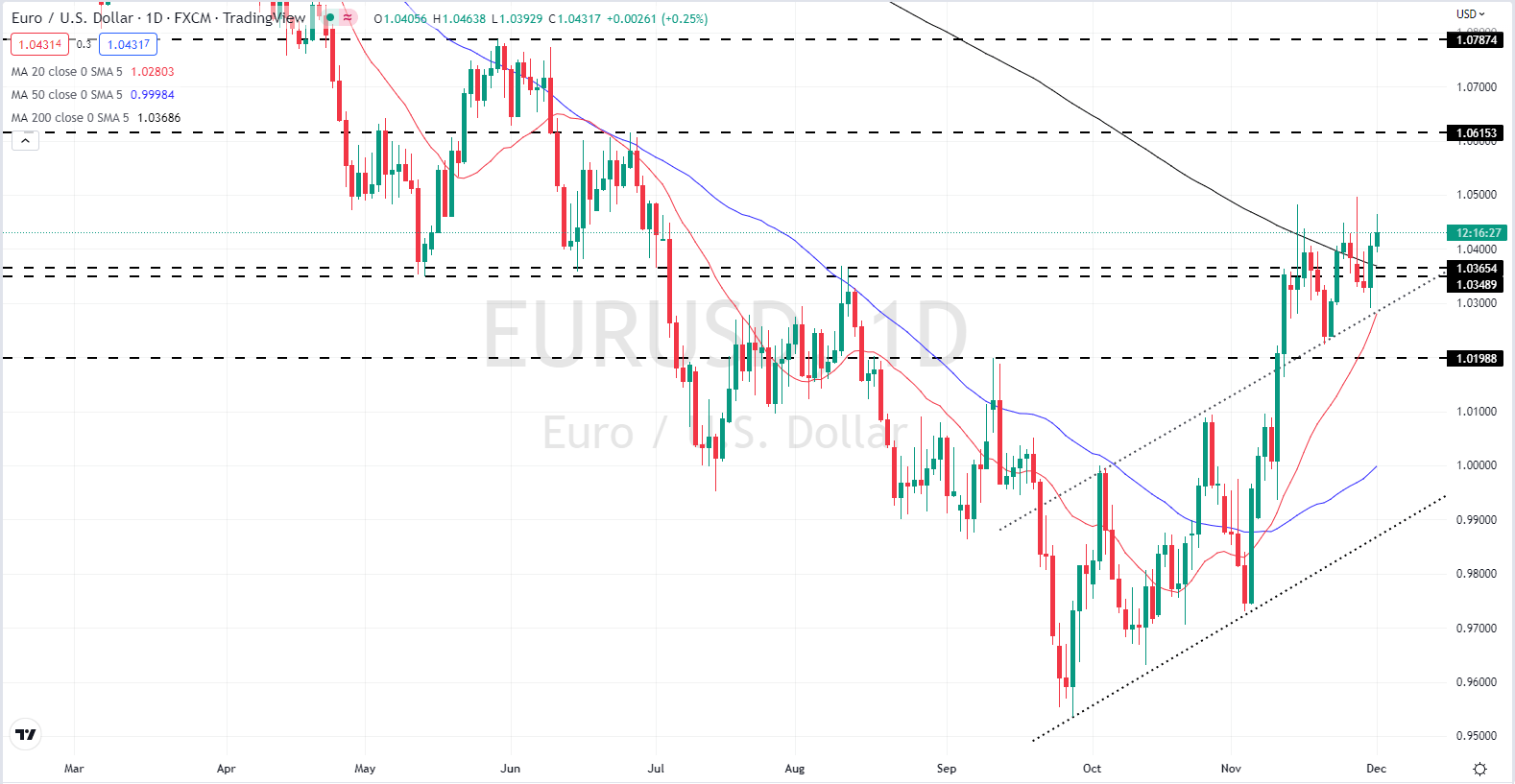

The recent push higher in the Euro vs the US Dollar has been given another boost by chair Powell and the pair now trades back above 1.0400, nearly 9 big figures higher than its multi-year low print on September 28. The November high at 1.0497 is the next target for the pair, ahead of a prior level of horizontal resistance around 1.0615. Support is seen at 1.0370 ahead of 1.0350.

EUR/USD Daily Price Chart

(Click on image to enlarge)

Charts via TradingView

Retail trader data show 43.33% of traders are net-long with the ratio of traders short to long at 1.31 to 1. The number of traders net-long is 13.00% lower than yesterday and 1.40% higher from last week, while the number of traders net-short is 1.24% lower than yesterday and 4.93% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?

More By This Author:

Gold Price (XAU/USD) Edgy As Short-Dated US Yields Rise Ahead Of Fed SpeechUS Dollar (DXY) Outlook – Fed Chair Powell, US Inflation Data And NFPs All Near

British Pound Latest – GBP/USD Treads Water As US Data Deluge Nears

Disclosure: See the full disclosure for DailyFX here.