Envy The Dead: Investing In Irrational Markets

Living in a world that doesn't make sense is no pleasure trip, and investing in an artificially inflated expansion cycle can be exasperating. What to do, what to do? For me, I've reclaimed sanity by shutting out noise, feelings, and my humanity: just buy what's down because supply and demand don't control the markets anymore.

It's a sad state of affairs, but when you've got a government that openly tells people to buy stocks, taking a short position isn't just fighting the Fed; it's fighting every central bank in the industrialized world, as they're all suppressing risk-free assets now. "There is no alternative" has become "Shut up and buy," and who am I to argue with that?

(Click on image to enlarge)

Courtesy: Yahoo Finance

I've actually come to envy investors of generations past: times when market forces were relatively organic and retirees could actually live off of bond yields, Social Security, and pension plans. By the time I'm 65, all three of those will be zero or negative.

Since peaking in 2011, precious metals have been in a bear market but they're now recovering nicely. My current mindset is that buying gold and/or silver today would be much like buying the stock market in late 2009. Bitcoin appears to be in a similar situation, though admittedly it doesn't have the lengthy history that precious metals have. Post-Libra, though, I can envision a time when cryptocurrency attains greater mainstream acceptance than all precious metals combined.

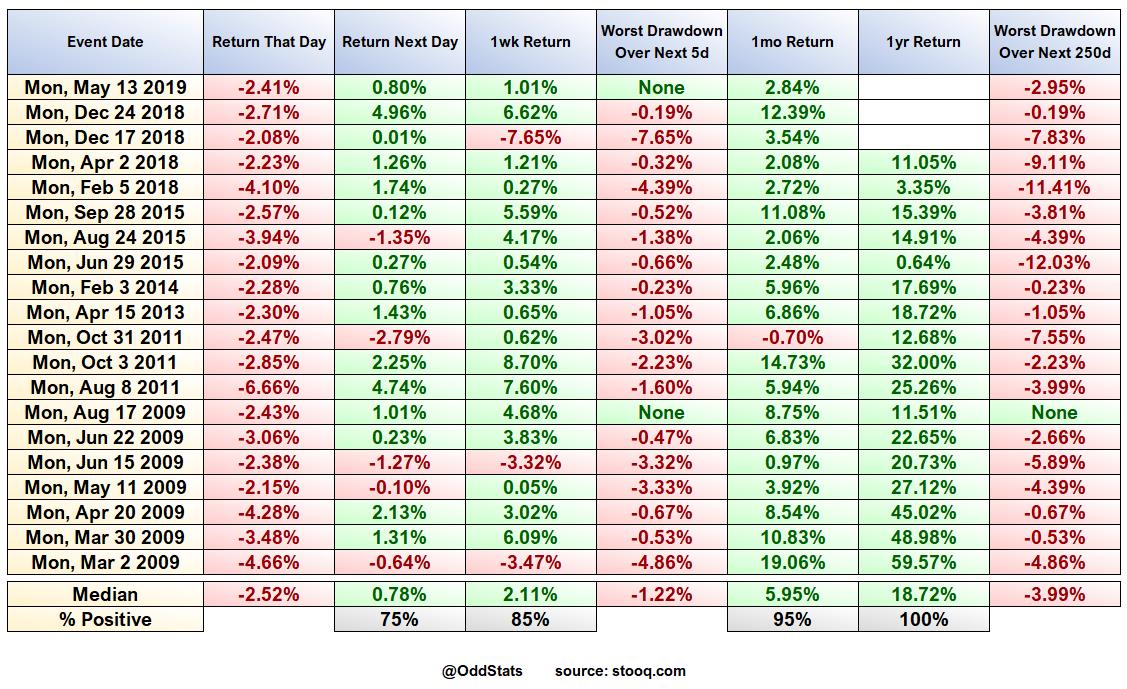

As far as stocks are concerned, you can still probably buy the dip without regard for the future. What choice do you have?

(Click on image to enlarge)

Courtesy: @OddStats, stooq.com

As long as the President wants a cheap dollar, everything that's measured against the dollar will continue to increase in relative value. Sure, we just saw the stock market's worst week and worst day of 2019, but we can't all buy the dips if no dips are orchestrated, can we?

Our best bet is to enjoy the randomness, relish the chaos, and seek out opportunities wherever they lie. And, do less thinking - it won't help us now.

Disclosure: David Moadel is not a licensed or registered investment advisor, and has no position in any securities listed herein.

I like your philosophy! :)