Dollar & Bond Yields Tumble After 'More Or Less Benign' Payrolls Print

Rate-hike expectations have slipped lower following this morning's disappointing payrolls print. Sept remains around a 20% chance of a rate-hike, but the rest of the year has seen higher terminal rates dragged notably lower...

(Click on image to enlarge)

The short-end of the TSY yield curve has tumbled...

(Click on image to enlarge)

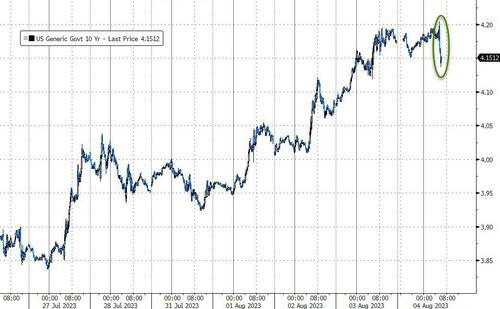

And while the longer-end is also seeing yields slide, the chart below offers context on the week's move...

(Click on image to enlarge)

As we warned, this could escalate very quickly here...

The dollar is fading on the dovish shift...

(Click on image to enlarge)

And that is sparking a bid under gold...

(Click on image to enlarge)

Academy Securities' Peter Tchir offers a kneejerk reaction to the 'more or less benign' report...

After Wednesday’s much stronger than expected ADP jobs report (324k) helped spark selling in treasuries, today’s report should take some pressure off the Fed and rates.

The headline number “missed” with “only” 187k jobs created, just a tad lower than expectation of 200k.

What struck me as most interesting, is they revised down prior reports by 49k. That follows last month’s downward revisions of 110k. When looking at the headline number and revisions, it is clear, at least in the Bureau of Labor Statistics data, the labor market has cooled.

JOLTS also had the fewest job openings in over 2 years – going back to April 2021. The openings are still high by historical standards but declining steadily (I’m in the camp that they are overstated due to how companies use various web services to “hire” or at least encourage resumes to be sent in). The QUIT rate has settled in around 2.4, which is barely above what it averaged in 2018 and 2019, prior to COVID.

The Household survey came in slightly better than the Establishment survey generating 268k jobs, just enough to nudge the employment rate down to 3.5%. That might catch the Fed’s eye, but I don’t think it will prompt them into action. The number of people working part time because they cannot find full time employment continues to trickle higher. Not a big deal, but interesting to watch.

Could the Fed be scared by average earnings? The monthly data was up 0.4% (again, and just above expectations of 0.3%) helping keep the annual rate at 4.4%. Sure, wages remain high and my news-stream is filled with employment and wage news, but will that continue if the labor market “normalizes”? The Fed cannot like this number, but on its own, I don’t think it is enough to make the Fed act.

Again, I think the Fed is TRULY DATA DEPENDENT, which means they will take into account a lot of data, over a period of time, and are no longer looking for any excuse to hike.

Bottom Line

I think the move in rates is overdone and we will see yields creep lower, which should support stocks, though I’m still skewed towards the “laggards” over the Magnificent Seven.

Look for rate vol to renew its march lower now that we’ve made it through NFP. I do think curves continue on their path of less inversion, though 2s vs 10s getting back to 72 has been a big move.

I suspect the price action of the past few days has renewed short interest in rates, credit and equities and that could be the catalyst to renewing the grind higher (for stocks, especially the laggards and equal weighted indices) and tighter for credit spreads. Fighting the trend and consensus in August is fraught with difficulty!

And on one final note, the downgrade of the U.S. government by Fitch led not only to several quotations from Academy, including in the NY Times and FT, but brought back memories as the very first time I was on Bloomberg TV, was Friday August 5th, 2011, the day that S&P downgraded the U.S. It turned what was more of a “screen test” with Pimm Fox into a much more lively segment!

Looking forward to an interesting August!

More By This Author:

Fisker Posts Just $825,000 In Revenue For Q2, Slashes Production Guidance AgainOil Prices Hold At April Highs After OPEC+ Panel Report

Futures Rally Fizzles As Apple Slides, Payrolls Loom

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more