Does Fed's Hawkish Posture Create A 'Buy The Dip' Moment?

The Fed's hawkish comments coming out of the FOMC meeting last week unsettled markets. The comments moved up the potential for the start of interest rate increases to 2023 and St. Louis Federal Reserve President, Jim Bullard indicated rate increases could begin in late 2022. These potential rate increase start dates are still pretty far out; however, it is a change from what the market was expecting.

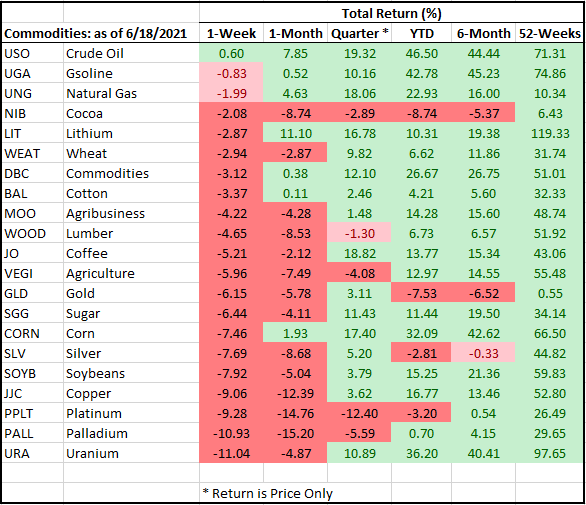

With the Fed indicating a sooner rate tightening, investors that took advantage of trades that would benefit from higher inflation got a surprise. For example, many commodities ended down on the week and some substantially. Platinum (PPLT) was down 9.28%, Uranium (URA) down 11.04%, Copper (JJC) down 9.06%, and many more finished in the red as seen in the below table.

Image

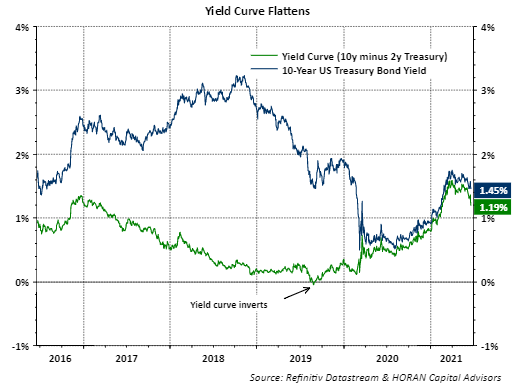

With a rate hike potentially occurring sooner, long-term interest rates fell as well. One variable that impacts longer-term interest rates is inflation expectations. If investors now believe the Fed will raise short-term rates in an effort to slow the rapidly growing economy, inflation may remain in check. As a result, longer-term interest rates declined (bond prices rose) with the 10-year U.S. Treasury yield ending the week at 1.45%, down from almost 1.60% earlier last week as seen with the blue line in the chart below. Also displayed on the below chart is the yield curve, i.e., the 10 year U.S. treasury yield minus the 2 year U.S. Treasury yield. This flattening of the yield curve is an indication the bond market anticipates a slower pace of economic pace. I have noted in prior posts, Seems All About The Fed At The Moment, one reason the Fed raises short-term rates is to get rates to a more normal level from which to react in an economic contraction; however, this can slow the economy too. If short rates move higher than long-term rates, i.e., the yield curve inverts, an economic recession can follow. A yield curve inversion occurred in 2019 and some might say, in spite of the Covid-19 pandemic, the economy was already headed for a recession. The Fed has a tricky balance trying to normalize interest rates without inverting the yield curve.

Image

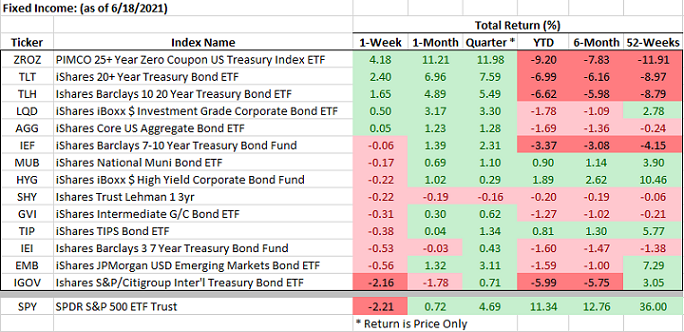

Some short-term interest rates actually rose last week, but long-term and zero-coupon bonds performed well as seen in the below table.

Image

As it relates to the equity market, the year has been good for equity investors. The S&P 500 Index is up 10.93% year to date, S&P MidCap 400 Index is up 13.24% and the S&P SmallCap 600 Index is up 18.92%. The unsettled equity market saw the S&P 500 Index decline only 1.91% last week. Of course, this is not a significant decline, but important technical levels have been reached. One important one is the S&P 500 Index has reached its 50-day moving average. As the below chart shows, this has been an important area where the market has developed support. In other words, buyers came in and bought the dip. One will not know if this occurs until a few more trading days are resolved.

Image

This potential buy the dip moment may be different than prior ones due to the change in tone from the Fed. Also, further equity market weakness is sometimes seen at this point in the calendar. As is sometimes said, patience is a virtue. At the moment, the underlying economy is strong and is likely to remain so into 2022. Company earnings should benefit from this economic growth and that should translate into respectable stock price appreciation. As I often write, the market does not move higher in a straight line. And just as I write this Sunday evening, Dow and S&P futures are down about .60%, i.e., 200 points on the Dow and 24 points on the S&P 500 Index.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more