'Dimon' - Hands Lift Stocks; Bonds, Bitcoin, & Dollar Dumped

As says JPMorgan's CEO Jamie Dimon, so goes the stock market... at least for today... During JPM's Investor Day (not exactly a time for dour outlooks), investors hear optimistic tones in the following sentence from Dimon...

“Strong economy, big storm clouds,” the JPMorgan Chase & Co. chief executive officer said at the firm’s investor day Monday.

“I’m calling it storm clouds because they’re storm clouds. They may dissipate.”

Dimon added that a recession is possible, but it would be unlike past downturns because of the unique blend of economic conditions acting on the economy.

As a reminder, Dimon’s comments follow remarks from Goldman CEO David Solomon last week, saying that there is a chance or recession amid “extremely punitive” inflation, though he’s not overly concerned about the risk of such a downturn.

JPM rallied 6% today, its best day since Nov 2020...

(Click on image to enlarge)

Of course not... when have ever really heard a CEO of a major bank say he expects a recession and the credit-crushing pain that goes with it... especially when bank stocks have been clubbed like a baby seal...

(Click on image to enlarge)

Source: Bloomberg

And that was enough for stocks to enter liftoff mode. After Friday afternoon's pre-opex meltup, futures extended gains overnight and Dimon's comments were just what the doctor ordered as an excuse to buy some more, lifting The Dow up over 2% at its highs. Late in the day some selling appeared but that was quickly bid. Small Caps were the laggards but even they managed a 1% gain on the day...

(Click on image to enlarge)

The S&P appeared to double-top (at last week's support) on this bounce and was unable to recover the key 4,000 level...

(Click on image to enlarge)

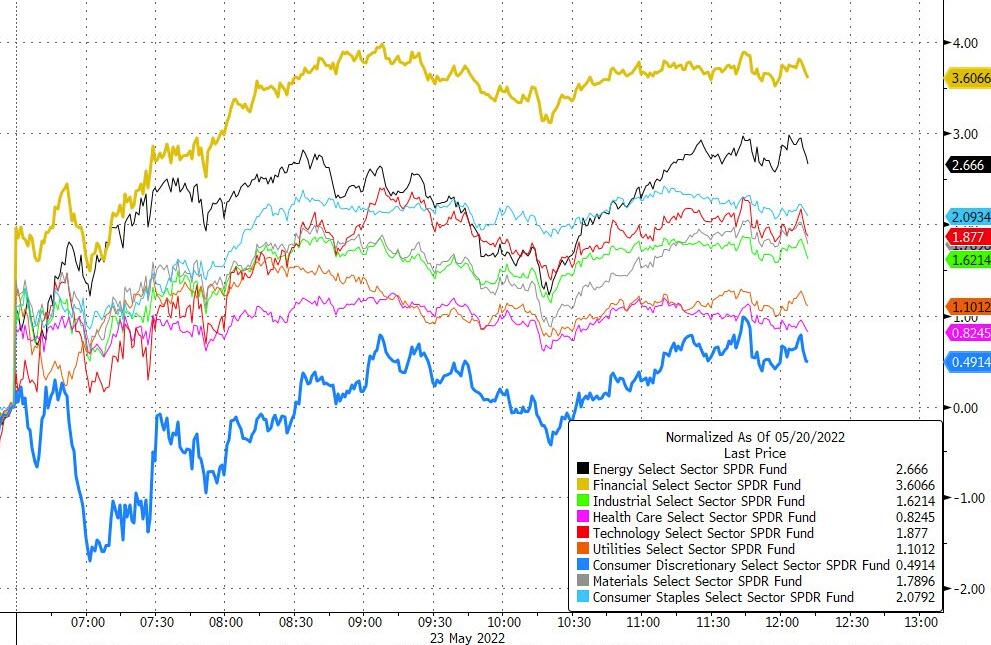

Banks were the day's best performers but Discretionary stocks lagged (an odd combination given Dimon's optimism as the driver - is consumer strong or weak?)...

(Click on image to enlarge)

Source: Bloomberg

Standout stocks today were the Monkeypox vaccine-makers, most specifically GeoVax Labs (GOVX) which is up 300% in the last 3 days...

(Click on image to enlarge)

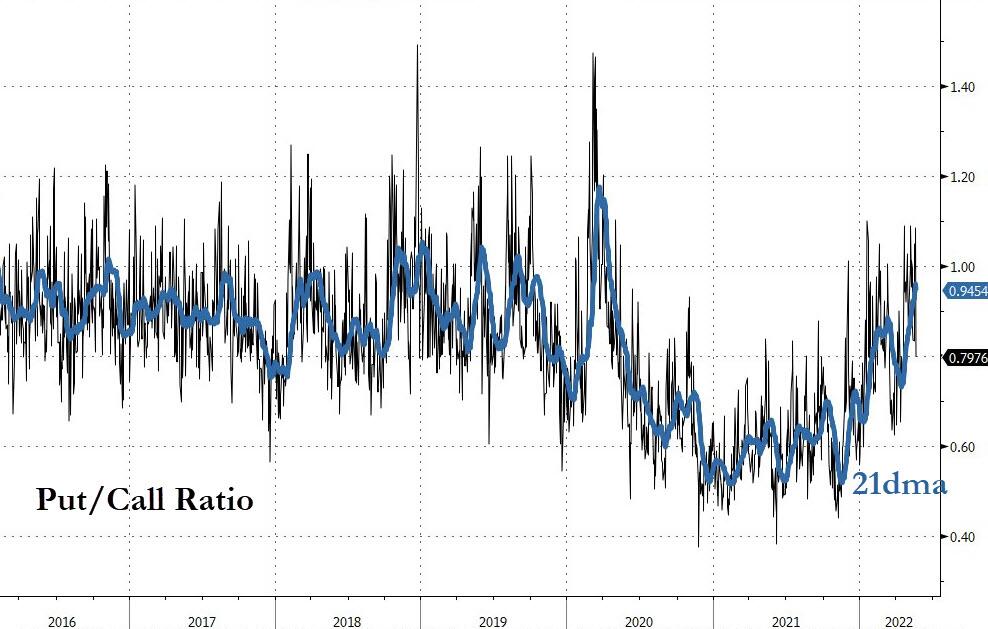

Put/Call ratios are on the rise again, back near their COVID crisis peaks...

(Click on image to enlarge)

Source: Bloomberg

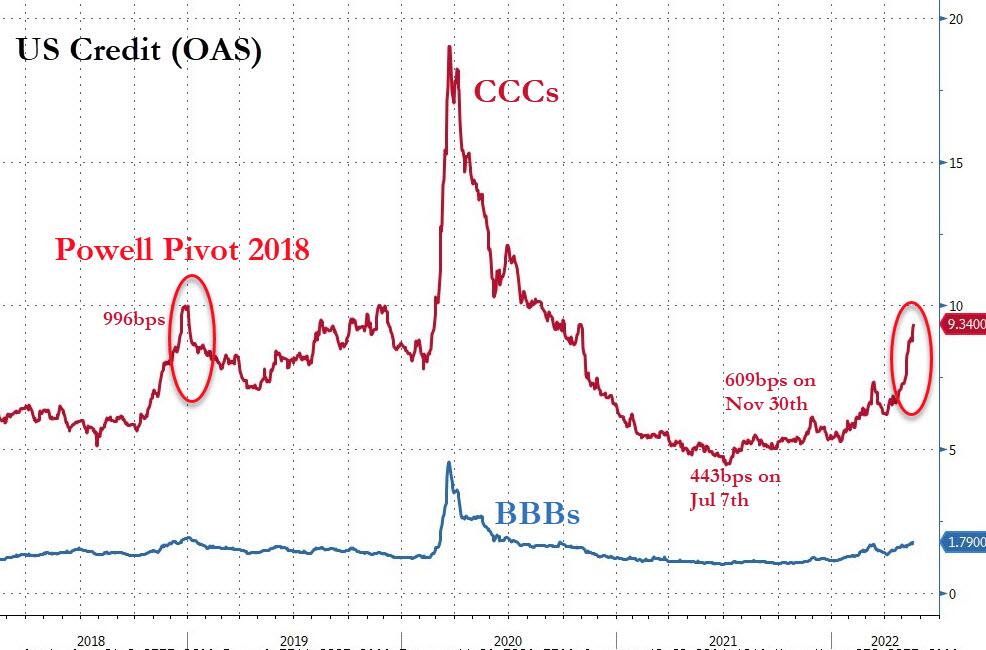

As we noted earlier, credit markets are starting to show signs of stress with 'triple-hooks' at their widest since Powell flip-flopped in 2018...

(Click on image to enlarge)

Source: Bloomberg

Bonds were battered as stocks jumped with yields up 8bps across the curve (with the short-end outperforming, up around 5bps)...

(Click on image to enlarge)

Source: Bloomberg

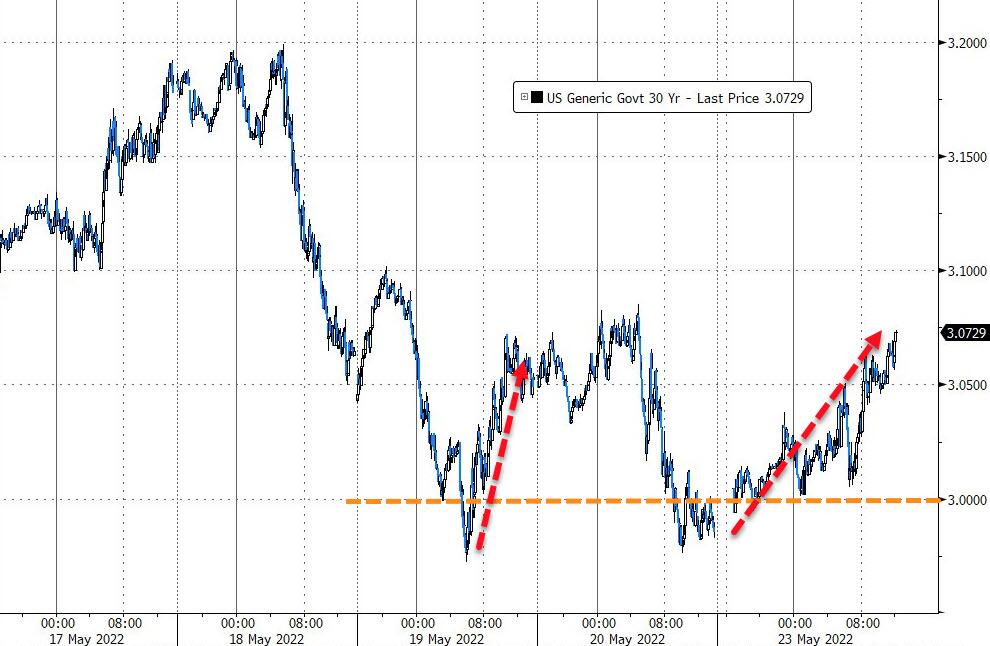

10Y Yields remain below 3.00% but 30Y bounced off it today...

(Click on image to enlarge)

Source: Bloomberg

The dollar continued its recent slide, now back at one-month lows...

(Click on image to enlarge)

Source: Bloomberg

Bitcoin rallied over the weekend to erase Friday's plunge... only to fall back below $30k this afternoon...

(Click on image to enlarge)

Source: Bloomberg

Gold rebounded (after a spike at the futures open yesterday)

(Click on image to enlarge)

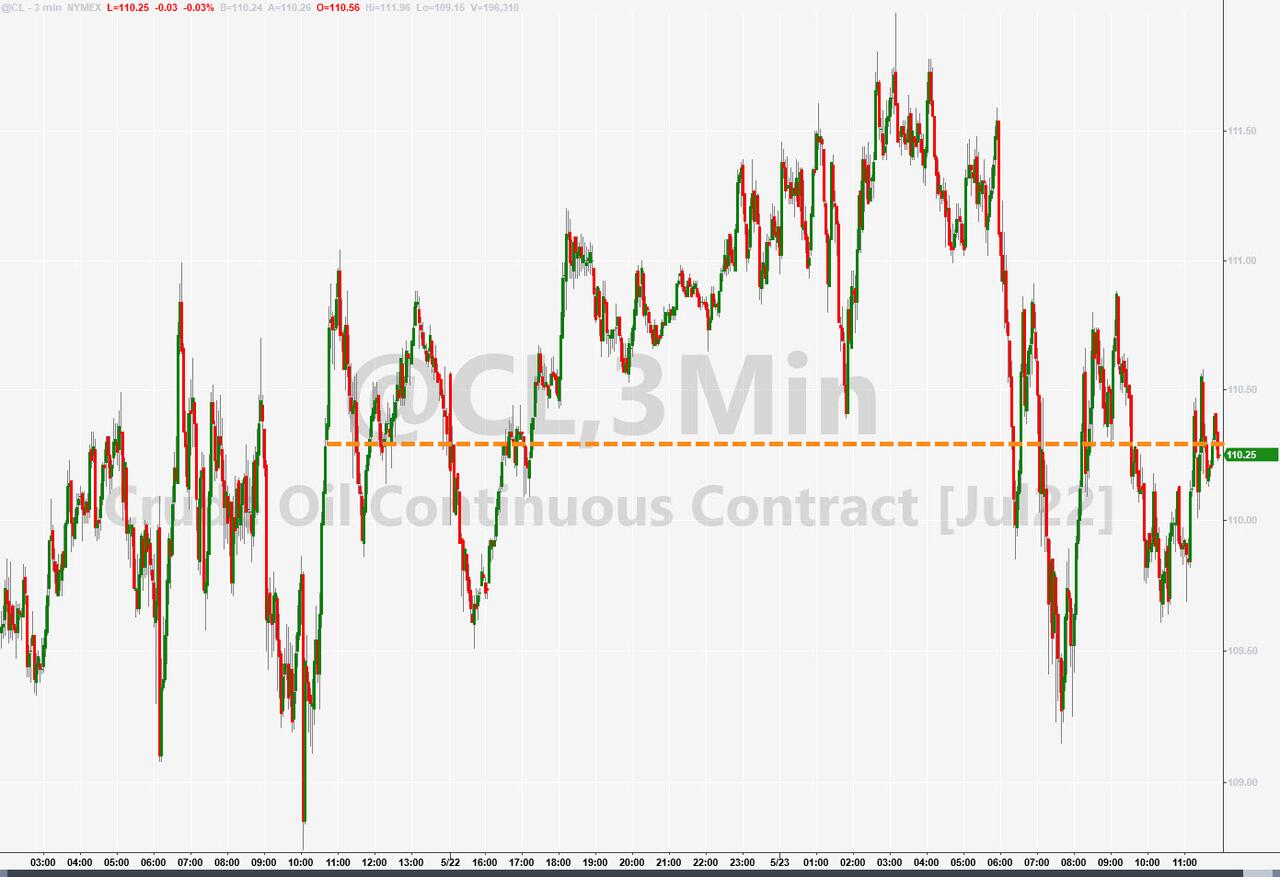

Oil prices chopped around ending unusually unchanged for once...

(Click on image to enlarge)

NatGas exploded higher (up 9%), back near multi-decade highs on EU buying plans ahead of winter and domestic heat warnings (driving utility demand)

(Click on image to enlarge)

Finally, we note that options flow today was not buying the Dimon dip...

(Click on image to enlarge)

Can it hold?

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more