Commodities Soar As Bonds, Stocks, & Bitcoin Rollercoaster Wildly

The big headlines today - with Europe still closed for Easter - were the surges in commodity markets...

WTI topped $109 - erases Biden SPR plan benefits...

(Click on image to enlarge)

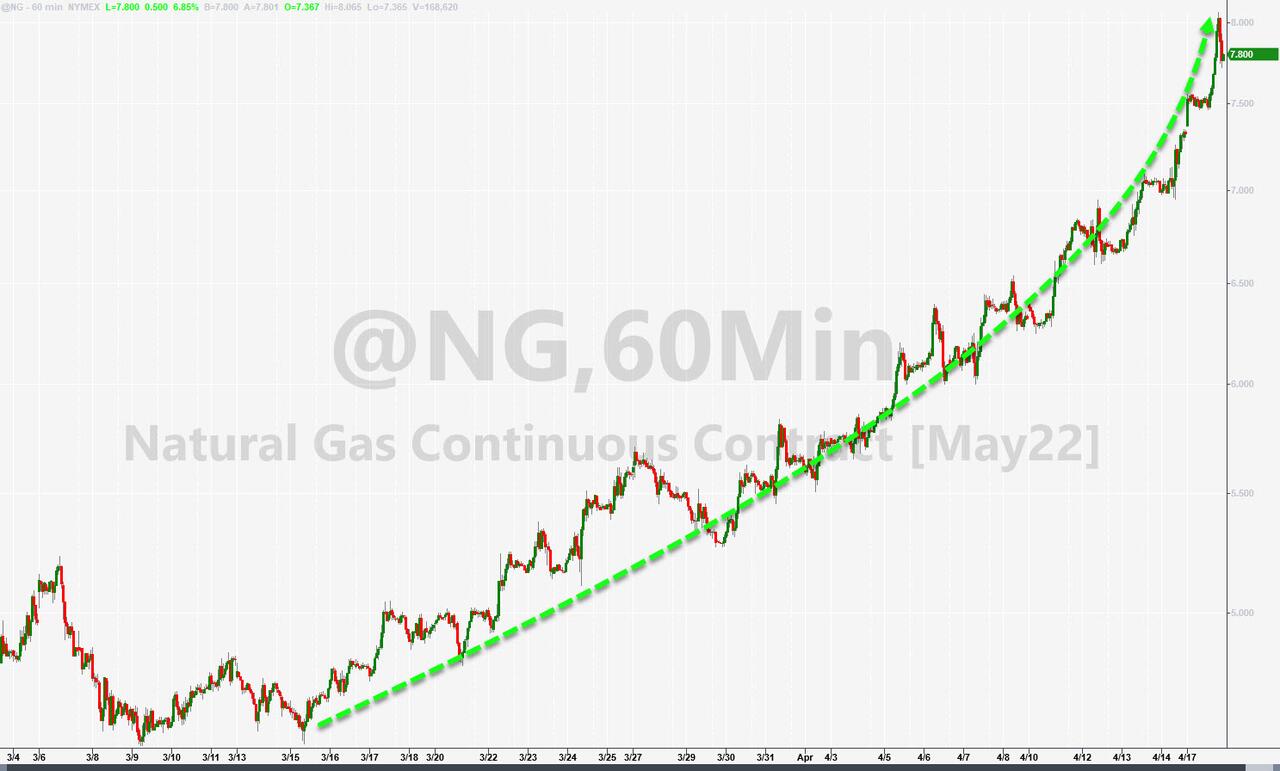

US NatGas surged above $8 for the first time since 2008

(Click on image to enlarge)

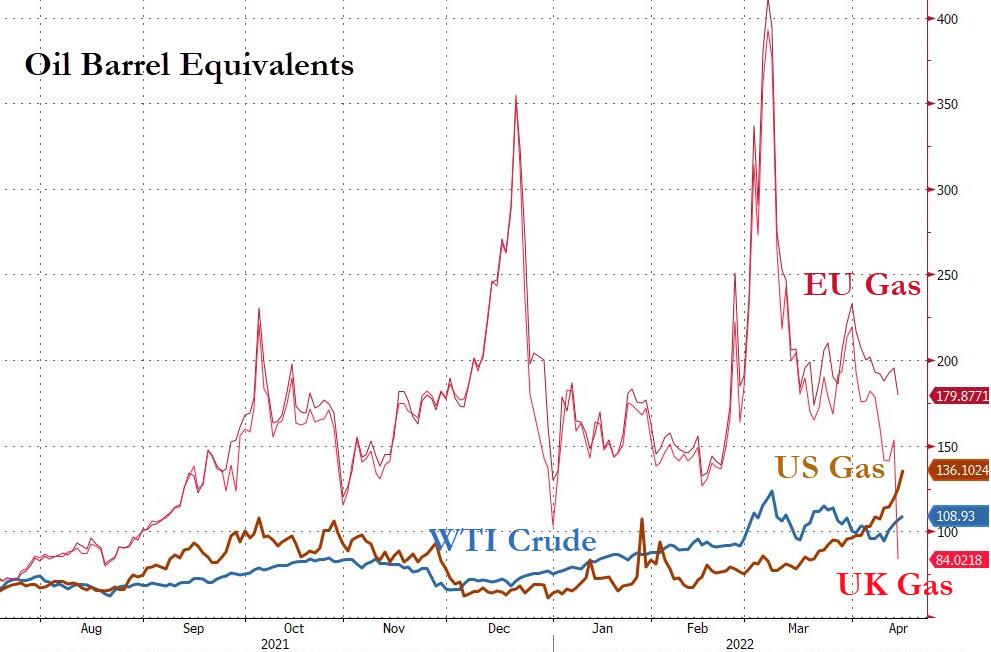

That's equivalent to $136 per barrel of oil...

(Click on image to enlarge)

And Corn topped $8 for the first time since 2012...

(Click on image to enlarge)

Other markets were wild rollercoasters with stocks dumping overnight, soaring at the cash open, dumping as Europe closed (it was already closed but the algos weren't told), then pumping back to the highs of the day, before puking it all back again. Small Caps were the worst performers but the swings in Nasdaq were the most aggressive...

(Click on image to enlarge)

The retracement of the massive short-squeeze of the 2nd half of March continues...

(Click on image to enlarge)

Source: Bloomberg

The 2008 analog continues to hold...

(Click on image to enlarge)

Source: Bloomberg

Morgan Stanley's Mike Wilson has an interested 'signature' on his BBG Bio...

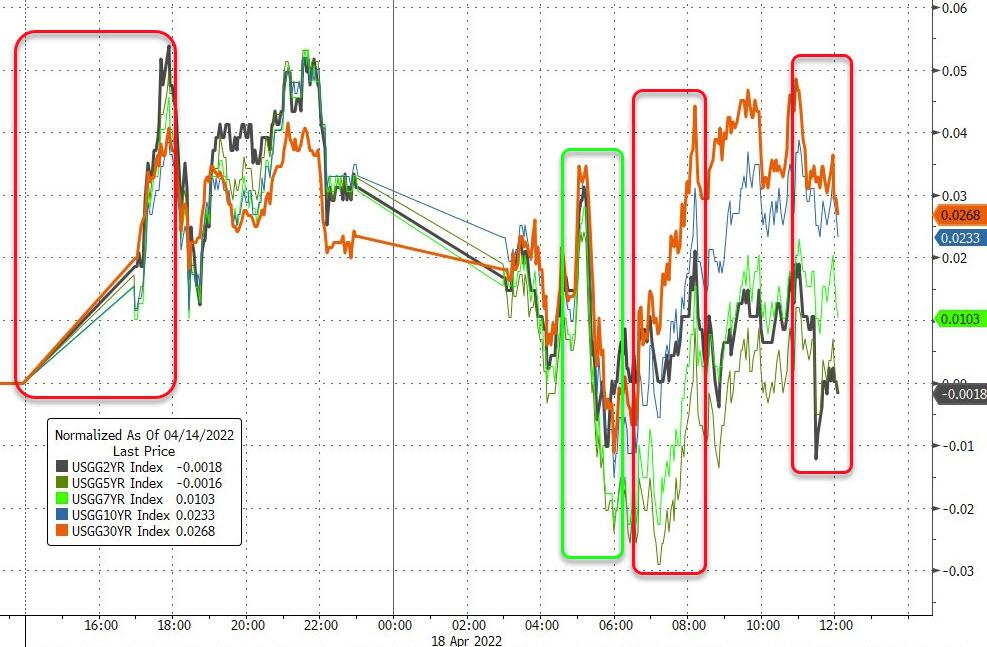

Bonds followed a similar path with an overnight bid was rejected and yields pushed higher during the US day session. The longer-end underperformed while the belly ended the least changed on the day...

(Click on image to enlarge)

Source: Bloomberg

The yield curve continued to steepen with 2s10s back up to +40bps and 7s10s now uninverting...

Source: Bloomberg

The dollar continued higher today...

(Click on image to enlarge)

Source: Bloomberg

Gold futures surged back up above $2000 overnight and then puked it all back to close lower on the day...

(Click on image to enlarge)

Bitcoin was even more chaotic with a big dump to almost $38500 before someone went panic-bid and lifted the cryptocurrency back up to $41,000...

(Click on image to enlarge)

Source: Bloomberg

Finally, President Biden has a problem as the resurgence in crude prices (and implicitly wholesale gasoline prices) mean that gas prices at the pump are turning back up and are on course to erase all of the albeit tiny price drop prompted by the Biden SPR Release plan...

(Click on image to enlarge)

Source: Bloomberg

Will we see record-er lows in Biden's approval ratings after this?

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more