Choppy Behavior, Wobbly Market

This short-term uptrend is extended and overbought short-term, but I don't see many signs that selling is ready to pick up.

However, I am sticking with my system and taking partial profits while the PMO is at the top of the range so that I have cash available to be deployed for the next time the PMO is at the bottom of the range.

I am suffering from a bit of FOMO because the market keeps advancing while I have been selling, but this is a good system and I am sticking with it.

I don't really have too much to say about the market this week, so I'm just throwing in some charts of interest.

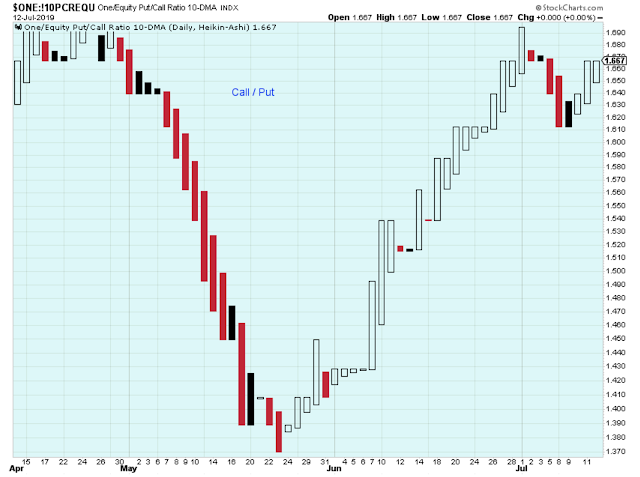

Last week I thought that the Call/Put ratio was starting to signal that the next short-term downtrend was starting, but it turned back up this week along with the market. Still, this choppy behavior is probably a sign that the market is a bit wobbly.

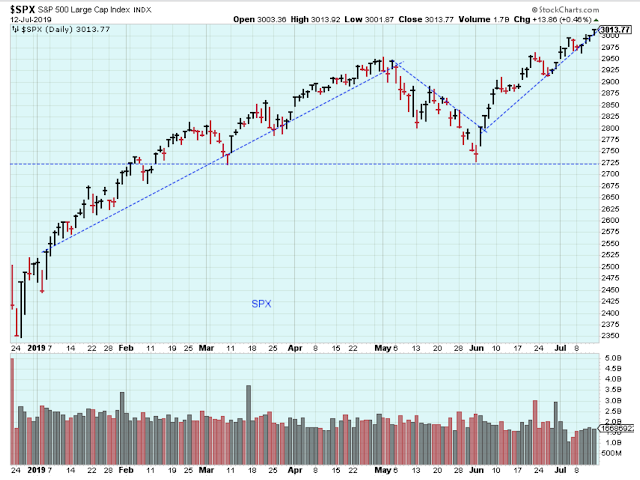

However, there isn't much in the run from June 1 to today that looks wobbly in this chart shown below.

In this morning's column by Mike Burk (link below).

"The all time highs for the blue chip indices were not confirmed by the secondaries.The Russell 2000 (R2K) is 8.8% off its all time high and was down for the week." - Mike Burk

But does it matter? People are making money being in the strong stocks.

Burk also mentions this morning that seasonality starts to turn quite negative in the coming week, however, this is offset by the money supply which has been soaring higher.

Biotech is not the place to be invested this year.

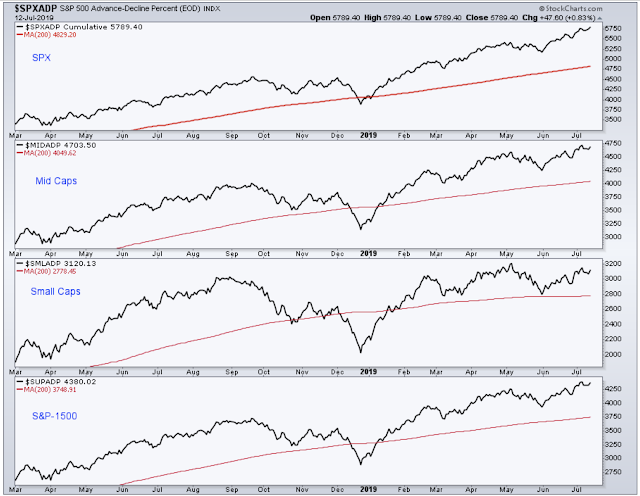

A chart published this morning by Arthur Hill.Lot's of strength showing here except maybe the small caps which are below the May highs. Arthur doesn't like the advance/decline lines of the major indexes because they include so many marginal stocks and special investment vehicles.

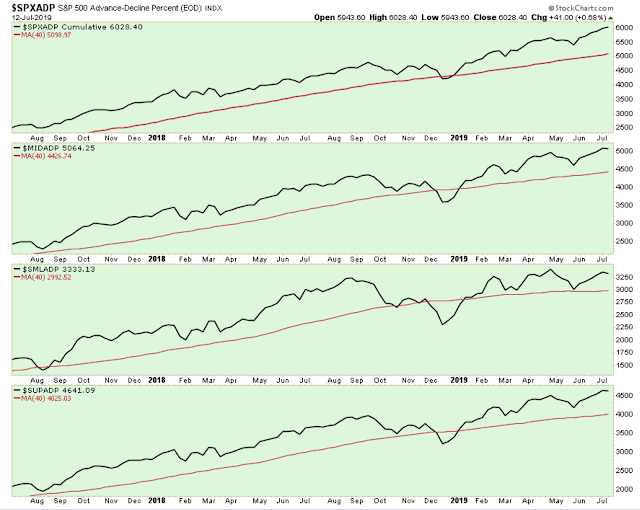

Here is a look at the same chart but as a weekly.

There were a number of Twitter comments this week about how we stress too much about the next major downturn in the market. These comments caught my attention because they are so true of me. I'm always looking for signs that the next crash is right around the corner even though it so rarely is.

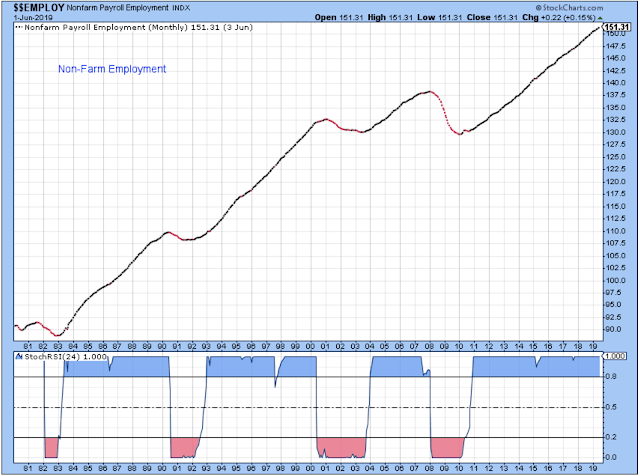

When we look back on this bull market we will probably remember it for the amazingly slow but extremely consistent rise in employment. Maybe it is this chart that will tell us when we really need to get worried about a crash in stock prices.

One thing interesting in this chart is the 1987-1988 period. Employment never dipped and so you would have been better off holding stocks than selling if you had missed the early signs of a problem in the market. The same thing happened with the 2015-2016 sell-off.Of course, in both cases, it was the Federal Reserve who came to the market's rescue, but I am not that it matters.

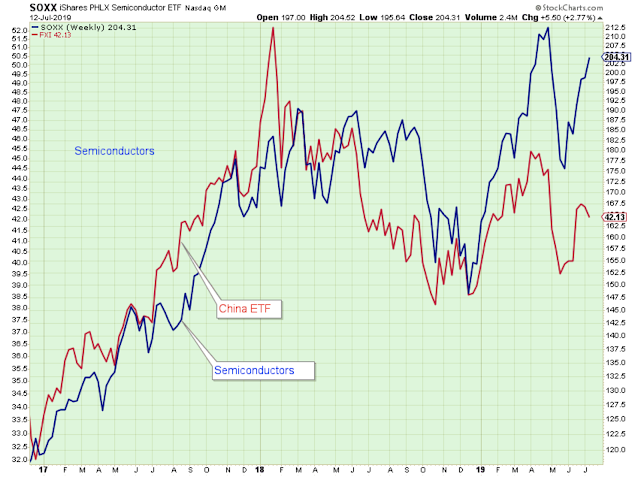

A few weeks ago everyone was talking about this important correlation. The Chinese market looks weak and has turned lower.

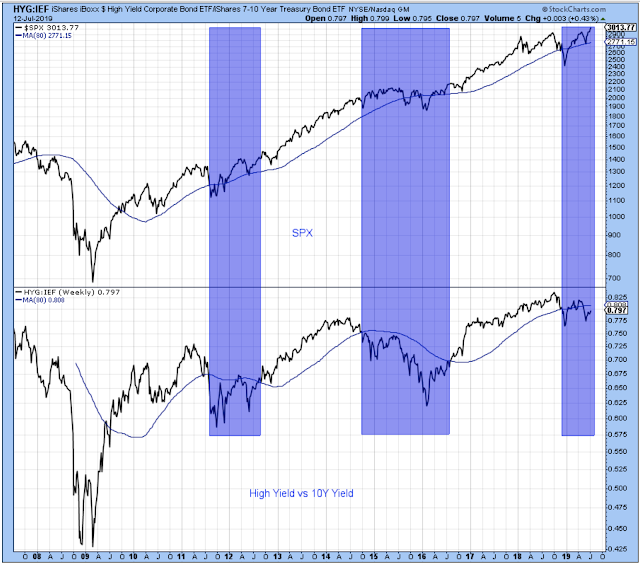

Here is a chart that shows that stocks do better when the high yield ETF is outperforming the 10 year Treasury ETF.Like I said, I am always looking for the worm in the apple.

Outlook Summary

The long-term outlook is cautious as of May-18.

The medium-term trend is up as of June 7. My apologies for missing this uptrend in June.

The short-term trend is up as of June 8. On watch for the next downtrend.

The medium-term trend for bond prices is up as of November 16 (prices higher yields lower). On watch for the next downstrend.

Investing Themes:

Treasuries, Cash

Top-Rated Stocks in Uptrends.

Strategy During a Bull Market:

- Buy large-cap stocks and ETFs at the lows of the medium or short-term market trends.

- Buy small-cap growth stocks on breaks to new highs in the early stages of market trends.

- Reduce buying when the market trend is at the top of the range.

- Take partial profits when the market uptrend starts to struggle at the highs.

- The cardinal rule is never invest based on personal politics. The stock market can do well regardless of which political party is in control.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more