China’s Nuclear Option To Sell US Treasurys

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy. America could follow the path taken by Venezuela or Zimbabwe.

How serious is this threat?

The Independent Institute wrote (replete with a graphic purportedly showing a “nuclear bomb”) about it:

What would happen if the Chinese government were to weaponize its holdings of U.S. Treasury bonds by suddenly selling off all of them?

That’s an option that has been suggested by Hu Xijin, the editor of the government-controlled Global Times.

Dumping its U.S. national debt holdings is considered to be China’s “nuclear option” for retaliating against the U.S. government in the trade war…

The Financial Time headline says it all: “China dumps US Treasuries at fastest pace in two years”. The body of the article uses that word “weaponize” (British spelling).

Bloomberg warns that “Trade Feud Has Treasury Investors Eyeing China’s Holdings at Fed”. At least their article does not reiterate “weaponized”.

CNBC adds a new element, that is killing America, China would be destroying itself too. The article uses the word “weapon”, as well as calling it the “nuclear option.”

Capital Outflows

Ambrose Evans-Pritchard at the Telegraph is one of the few voices looking at the “accelerating pace of capital outflows from China”. He provides lots of good analysis that we would say is common sense, except it is presently uncommon (yes, yes, we know that common, here, refers to base logic not ubiquity). Capital outflows are due to foreign investors fearing the impact to Chinese corporate profitability from Trump’s tariffs, and Chinese corporations raising US dollars to avert potential defaults.

All around the world, businesses borrow US dollars. They must somehow earn dollar revenue to service this debt. A trade war reduces the volume of trade, and can crush the profitability of the trade that survives. Therefore it makes dollar debtors more desperate for dollars.

To Evans-Pritchard’s list, we would add one more driver. From many informal conversations, we have had, we see a picture of high net individuals seeking to move capital out of the yuan. This outflow, by the way, risks rupturing Hong Kong’s currency peg, managed by its currency board (one of the darling ideas of monetary central planning).

Today, we want to cover the point that China can’t sell Treasurys, because it would hurt itself. China would suffer some pretty severe powder burns if it were to fire this weapon. And next week, we will prove our main point: although China might affect the price of USD against whatever other currency it might buy, it cannot affect the interest rate.

Self-Inflicted Wounds

Selling of the USD is simply China taking the other side of the trade, of those who are selling yuan to buy dollars. China does not want the yuan to collapse, so when there is heavy selling pressure it steps up as the buyer. Which means selling its dollar reserves. The price of the yuan is under China’s control, so long as its dollar reserves hold out. If it runs out of dollars, then that is when the world will discover what the market value of the yuan really is. Its dollar holdings are a precious reserve that it needs to marshal carefully, not squander.

Lest the above be taken as vindication for Trump’s tariffs “at least they’re hurting China more than America,” let us be clear. We are damning the whole regime of irredeemable currency, with the dollar as the world’s reserve currency. To do so with maximum impact, we must describe the mechanics of the system accurately.

The Addicts’ Need for Dollar Injections

Every country in the world (except a few pariahs) needs a steady flow of newly-created dollars. They must have dollar revenues to service their debts. And, like everyone else, they are trapped by the feature, not bug, irredeemable currency. Debt cannot be extinguished, only serviced. Someone must borrow more—many someones—to keep the scheme going.

We see here, in this discussion of Chinese capital outflows, a little bit of the meaning of the reserve currency. It does not mean: oil is priced in dollars (though oil is priced in dollars). It does not mean that transactions are settled in dollars (though they are settled in dollars). It means that a great deal of borrowing is done in dollars.

The growing group of Chinese manufacturers that are getting caught in the trade war’s net still must service their debts. If they cannot, then they are in default and their lenders will seize their assets. And, it should be noted, the lenders want the monthly cash flow, not the defunct manufacturers’ assets because they themselves borrowed in order to lend. They must service their debts, or else face their own liquidations.

Not only is the dollar on the liability side of every major balance sheet in the world. It is also on the asset side. Including most especially the People’s Bank of China (PBoC). Like other central banks, it issues the local currency as its liability. And it holds dollars as its asset. That is, it borrows in its local currency to fund its portfolio of dollar assets. This is why we say that the other currencies are all dollar-derivatives.

Inside its local currency, the same mechanics of irredeemable currency are in effect. Debts cannot be extinguished, so there must be a steady flow of new borrowing sufficient for even the marginal debtor to service its debts. It is counter to this absolute requirement, for the PBoC to buy yuan and sell dollars. For a central bank to buy its own currency and sell assets, is to affect a monetary contraction. That is anathema to any irredeemable currency scheme.

Out of Frying Pan, Into Fire

At this point, someone might say that China need not sell dollars and buy yuan. It could trade its dollars for another currency. Aside from the question of whether another currency could support the enormous flows that China would create, and the fact that the other currencies are all dollar derivatives, there is a problem. The game for any central bank is to earn a profit on the spread between its liabilities and its assets. Let us explain.

The Fed is in the relatively simple position of borrowing short to lend long, with both liabilities and assets in the same currency. The Fed relies on the interest rate differential between its borrowings in the overnight market and its long-term assets. This is normally positive (though there is now an inversion).

To this duration mismatch, other central banks add currency mismatch. They care both about the interest rate differential and the exchange rate. Ideally, for them, their local currency would decline. Everyone loves a falling liability, indeed this is the point of inflationism. However, they must temper their desire. Their domestic corporations borrow in dollars. A falling local currency—in which they earn their revenues—feels to them like a rising dollar. They service their debts in dollars, which means they eat up more and more of their revenues to service the debt.

The next biggest currency, after the US dollar, is the euro. The euro now has the obvious problem of negative interest rates. So China would be borrowing at a positive interest rate, to buy assets with a negative interest rate. That is, it would pay to finance a portfolio that it would pay to hold. One need not be an economist of the Austrian School, to understand that this is not sustainable.

Summary

In part I, we have enumerated quite a list of challenges to the so-called “nuclear option”:

- Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves

- If it doesn’t buy another currency, it merely tightens monetary conditions in China

- If it does, it will drive up the price of whatever it buys, but crash it when it sells later

- It is still supporting the dollar, as the euro is (like the yuan) a dollar-derivative

- It would lose money by holding the position, due to the interest rate in the euro

- It incurs severe exchange-rate risk (the euro is in a downtrend against the dollar)

- And the debt of Spain, Italy, and others is headed for a train-wreck

Part I is the setup. All countries are trapped in this mad system of irredeemable currencies with the dollar as the world’s reserve. It cannot be changed, other than by moving to the gold standard.

In Part II, we will show that China (or anyone including the mythological bond vigilante, unicorn, and dragon) cannot affect the dollar interest rate.

Supply and Demand Fundamentals

The price of gold nine bucks. Brace for it… the price of silver fell more in proportion, 37 cents. We now have a new high on the gold-silver ratio.

For many years, some in the silver community wrote that silver was being consumed. That it was coming out of hoards and into industrial production, never to return. They meant it as a scarcity argument for a higher price. But if it is true, it is an argument that silver is being demonetized. Perhaps it is due to the Great Moderations of the central banks, or at least that is what the Fed’s apologists would say. Perhaps Or it could be that digital forms of gold, and products like the Aurum (a Monetary Metals lessee), remove the reasons for a second monetary metal to exist. No doubt the crypto bugs would say that bitcoin is replacing the monetary metals, and silver will go out the door first.

We don’t agree.

We will look at the data, and see the growing scarcity of silver that correlates to its shrinking price. But here, we want to make a different point. One which the crypto bugs would do well to seek to understand (and the Fed apologists understand, which is why they fight all the harder for irredeemable money).

It is not only the right of every human being to take his money home, withdraw it from the system, and refuse to extend credit. Not only is this a moral right, but it serves an important economic function also. It provides a break on credit expansion, and a floor under the interest rate. A floor that the Swiss franc, euro, and yen are sorely lacking. The dollar lacks it too, though we have seen only decades of falling rates, not negative rates yet.

Whatever you may think of this theory, there is no way to stop people from hoarding the monetary metals. Governments can try force, but they are more successful in pushing the metals underground than in stealing very much of them.

Crypto does not satisfy the demand for taking metal home. And we mean, literally, home. To put in one’s cabinet or under the floorboards. Or bury in the backyard. The essential feature being: personal possession.

Cryptocurrency was designed without any awareness of this need. Digital gold does not address it either. It is a need served only by physical metal.

And for many people, gold is too expensive. The amount they can take home is either too small (think of a 1-gram bar of gold vs. 3 1-ounce silver coins). Or the bid-ask spread on such tiny gold units is too large. For these folks, silver fills a need that gold (or anything else) does not.

These folks work for wages.

Silver is the most hoardable metal, i.e. marketable in the small (gold is the most marketable in the large).

Will the wage earners give up this need, and cease hoarding silver? Maybe. But it will take more than a bit of a drop in the silver price to make us think it’s happening. Today is yet another opportunity to say: “look at spreads, not prices.”

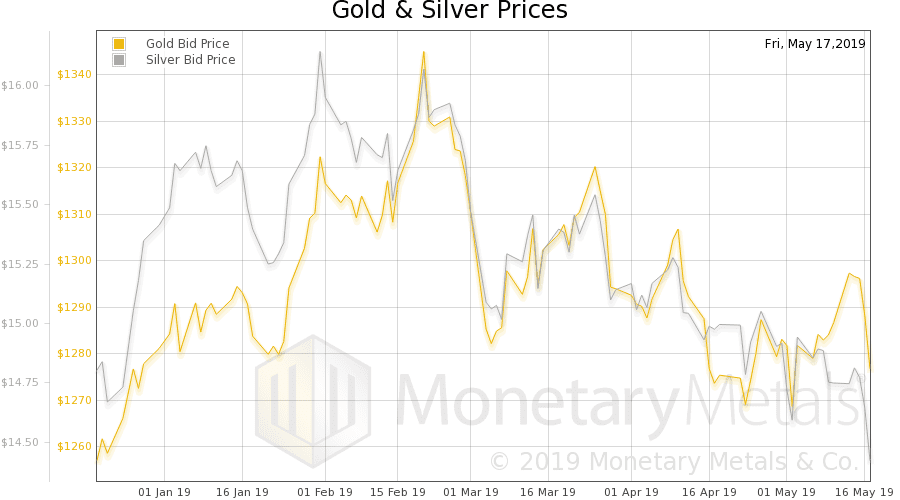

Anyways, let’s look at the supply and demand picture of gold. But, first, here is the chart of the prices of gold and silver.

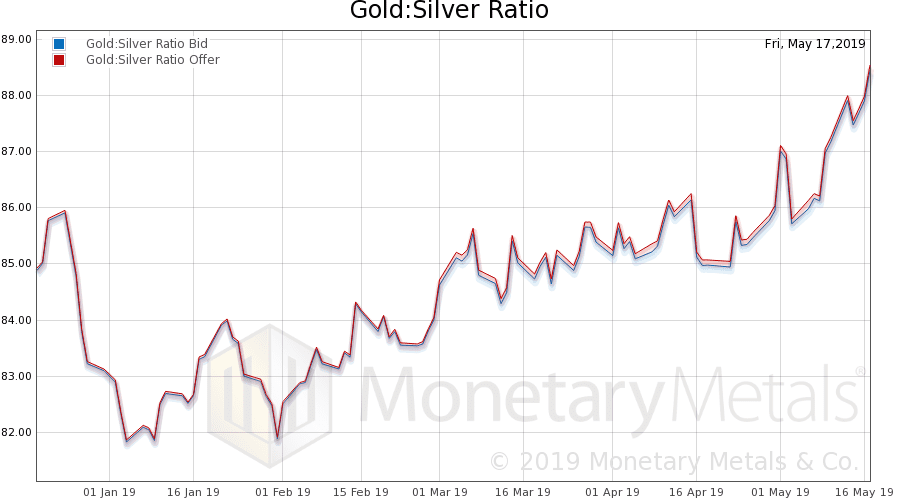

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose, to a new high over 88.

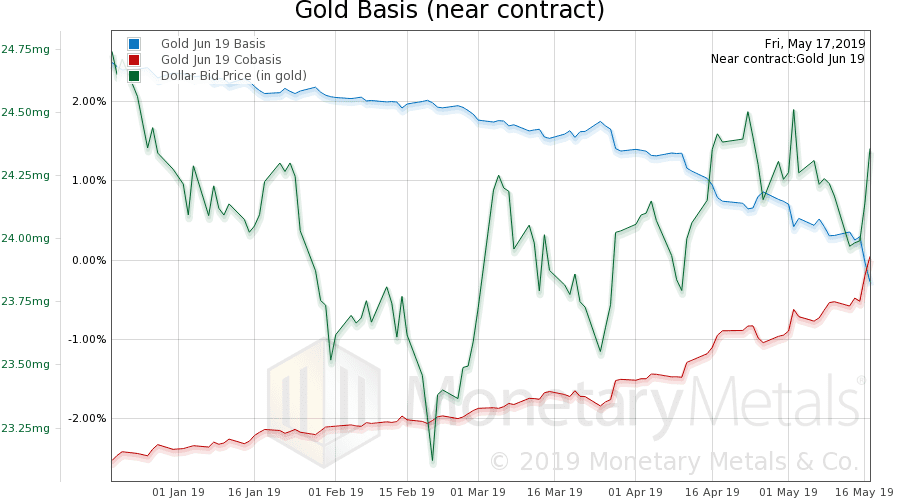

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The scarcity (i.e. cobasis) rises with the rise in the dollar (i.e. inverse of the price of gold in dollars). This is the soon-to-expire June contract. However, this time the gold basis continuous, shows the same trend, if less dramatically.

The Monetary Metals Gold Fundamental Price barely moved, ending the week at $1,370.

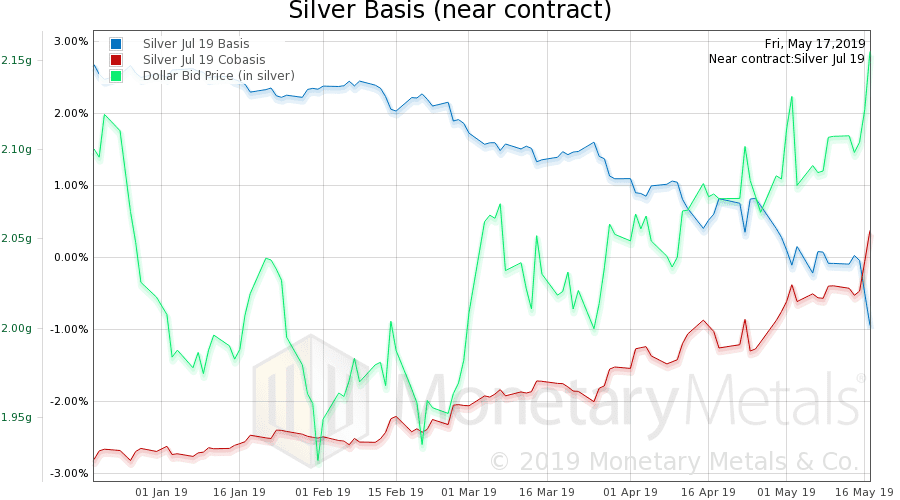

Now let’s look at silver.

The same trend occurs in silver, though this contract is a bit farther out. Note the backwardation, a month and a half from First Notice Day.

The scarcity of silver (i.e. cobasis) increased, but not a lot. Especially not in light of the drop in price.

The Monetary Metals Silver Fundamental Price was down another quarter, to $15.34.