China Sees Massive Demand For USD Bond Issuance, Priced In Line With USTs For First Time

Image Source: Unsplash

As the ceasefire in the US-China trade war starts to fray at the edges (most notably in commodity export controls and tit-for-tat responses), it appears that China is having no issues whatsoever competing with the US for the world's capital.

China’s return to the dollar bond market generated enough demand to cover the deal almost 30 times over, with a $118.1 billion order book.

“It was so popular,” said Serena Zhou, senior China economist at Mizuho Securities, adding that some investors complained they weren’t allocated enough bonds.

“Although it priced on par, it will still be free money.”

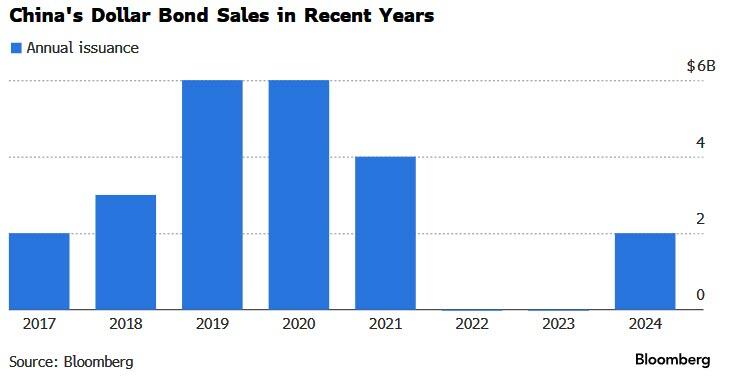

China last issued dollar bonds in 2024, when it sold $2bn of debt in Saudi Arabia.

“Markets are flush with liquidity and geopolitical tensions have eased,” said David Yim, head of capital markets, Greater China and North Asia, at Standard Chartered, which was one of the bookrunners for the deal.

Most notably, The FT reports that bankers on the deal said was the first time Beijing’s borrowing costs had matched Washington’s at issuance (while we do note that Chinese dollar-denominated bonds have previously traded at a negative spread to US equivalents in the secondary market).

China’s finance ministry issued $4bn of dollar bonds in Hong Kong, with the $2bn 3-year bond paying a coupon of 3.625 per cent, on par with US Treasury equivalents, and priced to yield 3.646 per cent, compared with 3.628 per cent for 3-year Treasuries.

The $2bn 5-year bond has a coupon 0.02 percentage points above equivalent Treasuries, with a yield of 3.787 per cent, compared with 3.745 per cent for US equivalents.

Issuance was split evenly between the two bonds.

The negligible spreads over Treasuries on the new bonds were an improvement even over China’s tight prints last year, when its three- and five-year notes were priced to yield just one and three basis points over similar-maturity Treasuries.

Bloomberg reports that more than half of the bonds were placed with investors in Asia, while European accounts got a quarter.

Investors in the Middle East and North Africa were allocated 16%.

The sale comes amid a steady rebound in dollar-note sales by Chinese firms, after the country’s unprecedented property crisis and the Federal Reserve’s interest-rate hikes triggered an issuance slump.

There’s been about $90 billion of publicly-announced sales in 2025, heading toward a three-year high, according to data compiled by Bloomberg.

More By This Author:

UBS Liquidates Funds, Faces $500 Million Exposure To First Brands FracasChina Introduces New Exports Controls On Antimony, Tungsten And Silver

U.S. Household Debt Hits Record $18.6 Trillion As Student Loan Defaults Explode

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more