Chasing Inflation: When You Wish Upon A Star

If Fed Chair Powell can’t see the reality for what it is, will more hawkish moves result in higher interest rate hikes?

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

However, before we dissect all of the details from Powell’s press conference, the FOMC officially announced the death of QE on Nov. 3. To explain, with the Fed reducing its bond purchases by $15 billion per month (effective immediately), QE should hit net-zero in June 2022.

The precious metals reacted, and mining stocks even managed to show strength. I discussed details of the implications of the upswing in the GDX in my video analysis today.

Moving back to the fundamental issues - the FOMC’s monetary policy statement read:

“In light of the substantial further progress the economy has made toward the Committee's goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities.

“Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage‑backed securities by at least $35 billion per month. Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month.

“The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.”

As a result, while taper clouds have hovered over the precious metals for months and helped upend their YTD performance, have we finally reached the fundamental ‘all-clear?’ Well, in a word, no.

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

For example, Powell said during his press conference that “the inflation that we’re seeing is really not due to a tight labor market. It’s due to bottlenecks and it’s due to shortages and it’s due to very strong demand meeting those…. We don’t see troubling increases in wages, and we don’t expect those to emerge.”

And as for “transitory:”

“Transitory is a word that has had different understandings,” said Powell. “Really for us, what transitory has meant is that if something is transitory it will not leave behind permanently – or very persistently higher – inflation. So that’s why we took a step back from transitory. We said ‘expected to be transitory.’”

For context, all inflation is transitory. And depending on one’s time horizon, 25 years can be considered transitory. Thus, while Powell’s explanation of his forecasting error is quite humorous, the taper is now in the rearview. However, now it’s time for the second act:

“We don’t think it’s time yet to raise interest rates,” said Powell. “Our decision today to begin tapering our asset purchases does not imply any direct signal regarding our interest rate policy. We continue to articulate a different and more stringent test for the economic conditions that would need to be met before raising the federal funds rate.”

However, to repeat what I wrote on Oct. 26:

Originally, the Fed forecasted that it wouldn’t have to taper its asset purchases until well into 2022. However, surging inflation pulled that forecast forward. Now, the Fed forecasts that it won’t have to raise interest rates until well into 2023. However, surging inflation will likely pull that forecast forward as well.

To explain, when asked about the FOMC “chasing inflation” and why investors have priced in rate hikes in 2022, Powell responded:

“What’s happened, and we’re very, very straightforward about it: inflation has come in higher than expected. Bottlenecks have been more persistent and more prevalent; we see that just like everybody else does. And we see that they’re now on track to persist well into next year. That was not expected. Not expected by us. Not expected by other macro forecasters.”

For context, I wrote on Apr. 30:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

More importantly, though, when a reporter pointed out that the pace of the current taper is strikingly faster than 2013, Powell responded:

“This is faster than what people had expected six months ago. It’s earlier and faster…. And that’s partly because we see inflation coming in higher.”

For context, I wrote on May 26:

For weeks, I’ve been warning that the U.S. Federal Reserve (Fed) is likely to reduce its bond-buying program much sooner than investors expect. And while investors are happy to ignore the warning signs, it was only two weeks ago that Clarida called April’s CPI print “one data point” and said that “the economy remains a long way from our goals.” As a result, the markets are a lot like the weather, and things can change rather quickly.

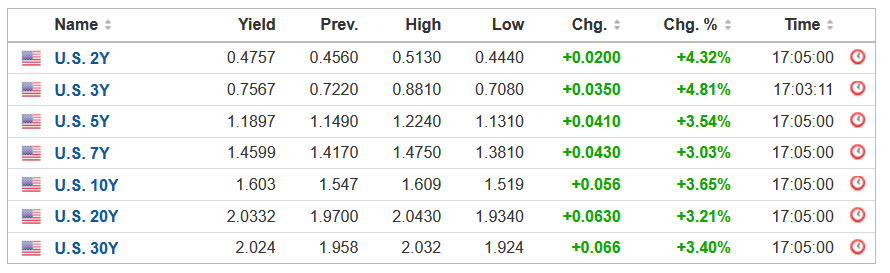

Thus, with “earlier and faster” likely to be repeated in the coming months, the fundamental outlook for the PMs is still quite treacherous. To explain, with U.S. Treausry yields rallying during Powell’s press conference, further momentum could elicit a re-enactment of the PMs’ drawdowns that we witnessed in early 2021.

Please see below:

Source: Investing.com

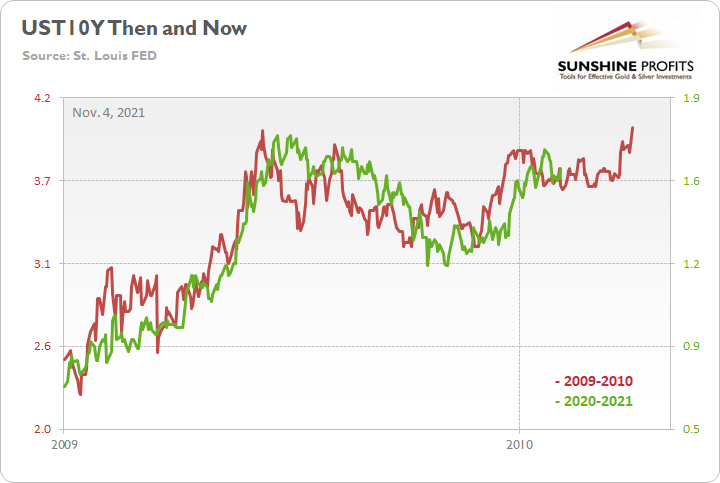

On top of that, while the U.S. 10-Year Treasury yield has consolidated in recent weeks, the benchmark is still following its 2009-2010 analog.

To explain, the red line above tracks the U.S. 10-Year Treasury yield’s rally off of the bottom in 2009-2010, while the green line above tracks the U.S. 10-Year Treasury yield’s current move. If you analyze the fits and starts, you can see that excessive optimism often gives way to excessive pessimism. However, after the dust settled in 2009, the U.S. 10-Year Treasury yield continued its uptrend and ultimately made a new high.

For context, the yield fell off a cliff in April 2010, before another sharp rally ensued in October 2010 (which recouped most of the losses). However, the important point is that the second cliff arrived roughly four months after the U.S. 10-Year Treasury yield recorded its second bottom. As a result, with the pace of the current economic recovery tracking well ahead of 2009, it will likely take a Black Swan event to keep the U.S. 10-Year Treasury yield from following a similar script.

Finally, while I haven’t mentioned the Fed’s daily reverse repurchase agreements (repos) in some time, the liquidity drain will now be augmented by an official taper. For context, the Fed’s reverse repos haven’t hit a new daily high since Sep. 30. However, the daily average has made a new all-time high – increasing from $642 billion in June, to $848 billion in July, to $1.053 trillion in August, to $1.211 trillion in September, and now, to $1.426 trillion in October.

Please see below:

To explain, a reverse repo occurs when an institution offloads cash to the Fed in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the Fed at an alarming rate.

And while I’ve been warning for months that the activity is the fundamental equivalent of a taper – due to a lower supply of U.S. dollars in the system (which is bullish for the USD Index) – the psychological effect is not the same. However, with an official taper now in place, the combination is fundamentally bullish for the U.S. dollar.

The bottom line? While the USD Index endured a ‘sell the news’ event on Nov. 3, the greenback’s fundamentals are stronger now than at any other point in 2021. And with Powell’s lack of foresight poised to elicit more hawkish shifts over the medium term, the dollar basket’s uptrend should remain in place for the foreseeable future. Furthermore, with U.S. Treasury yields likely to resume their uptrends as well, more downside should confront the PMs over the next few months.

In conclusion, the PMs were mixed on Nov. 3, as mining stocks ignored gold’s plight and rode the S&P 500 higher. However, stock market strength can only uplift the miners for so long and the GDXJ ETF will likely succumb to the technical and fundamental realities over the medium term. As a result, the bearish thesis remains intact and lower lows should materialize in the coming months.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more