Central Banks Are Waking Up

Central Banks are slowly waking up to the fact that they cannot fix structural economic issues. In fact, evidence from the great monetary experiment of the last decade, indicates that they probably enhance them. The real economic problem is growing income inequality. Real economic growth is dependent on middle class consumption, and absent real wage growth, this consumption becomes ever more dependent on debt financing. While aggregated debt metrics for the U.S. consumer don’t seem to be overly-inflated, when you consider the burgeoning federal debt load issued for bloated entitlement spending, and the leverage of lower income families, a different picture emerges. By artificially lowering interest rates, Central Banks across the world enable governments to subsidize the structural problem of income inequality that they have failed to correct.

Central Banks cannot increase real growth over the long-run. Easy-money has benefited corporate buybacks, enabled the leveraged purchase of assets, and produced a wealth effect. However, it has not increased productivity, and has increased income inequality.

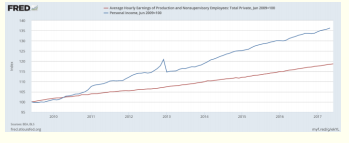

Figure 1- Since 2009, Personal Income which includes rental income, proprietor income, and wages has increased much more than wages for production and non-supervisory employees. Easy money drives income inequality.

Prior to the last recession, many economists believed that lower rates incentivize business investment. This never came to fruition, and thus never matriculated into the real economy. Businesses wait for robust revenue growth to invest in both capital and their workforce. Unfortunately, revenue growth is dependent on middle class wage growth, a cohort whose marginal propensity to consume is much higher than that of the upper class. Central Banks are starting to realize that future economic growth is reliant much more on fiscal initiatives than the Fed Funds rate.

Figure 2 - Low rates spur domestic investment, right? Nope.

If you are wondering why the Federal Reserve is intent on rising rates in the face of subdued GDP growth and low inflation, it is because they realize the sterility of monetary policy in the face of low productivity, subdued wage growth, and low inflation. Policy normalization, meanwhile, provides them with the dry powder they need to perform their true function—to be the lender of last resort in times of crisis. If raising rates into weakness doesn’t make sense, it’s because you think that the Federal Reserve, in this environment, matters. It doesn’t.

ASSET VALUES WILL CONTINUE TO BE DRIVEN BY CENTRAL BANKS

The rate by which global Central Banks normalize their policy will continue to drive asset values. The Fed has articulated its plan, to gradually raise short-term rates and to start limiting balance sheet reinvestment. There is no reason, absent an exogenous shock, that they will deviate from this roadmap. Meanwhile, Mario Draghi hinted that the ECB may start discussions on tapering their QE program. The announcement drove the ten-year bund up 35 bps in one week. The ten-year treasury followed increasing from 2.12% This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. It contains opinions of the author which are subject to change without notice.

Forward looking statements, estimates, and other information contained herein are based upon proprietary and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. to 2.39%. A continued policy pivot by Draghi will likely result in a European taper-tantrum, much like what the U.S. experienced in 2013, and U.S. rates will not be insulated. The Bank of Japan, on the other hand, is digging its heels in and offering to buy all ten-year JGB’s at 11 bps. This interest rate peg should hold up in the near-term, but history has shown that market manipulation ends poorly. I suspect that eventually they will be forced to pivot policy in the face of capital outflows and a drawdown of international reserves. Still, this is not a 2017 event.

Positioning in the fixed income markets, and the resolve of Central Banks, will determine the path of asset prices over the next year. In the U.S., market participants are still skeptical of Fed rate guidance. Adherence to their guidance should push rates higher as investors demand higher term premiums. There is more skepticism regarding ECB policy, and investors are taking the Bank of Japan at their word— expecting QE forever to continue. We expect higher interest rates in the second half of the year. The severity of the spike will likely depend on monetary policy overseas. A BoJ policy pivot would be the most adverse scenario for fixed income (and equity) investors.

Our baseline expectation is that markets will have to digest continued monetary normalization in both the U.S. and Europe, and Japan will continue their current path. As a result, we are expecting higher rates and weakness in gold. Yen weakness should continue and support global equity prices as the carry trade persists.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more

Good read, looking forward to more.