British Pound Forecast: GBP/USD Rally Erases Policy Error Losses

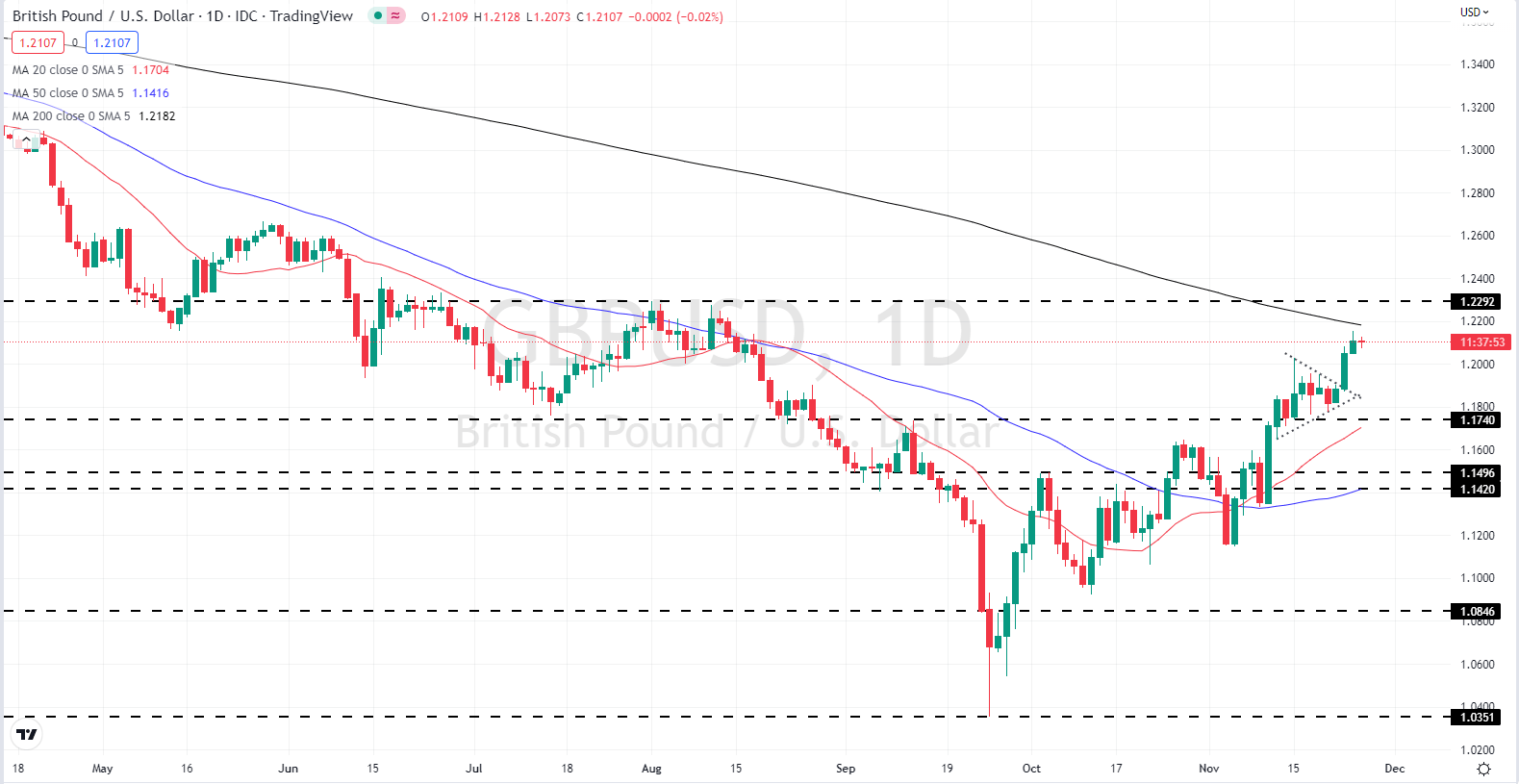

Sterling continues its multi-week rally, helped in part by a weaker US dollar, and cable has now erased all the losses bought about by the previous government’s tax-cutting policy errors. GBP/USD has rallied by nearly 18 big figures from its multi-decade low of 1.0350 and is back at levels last seen in mid-August.

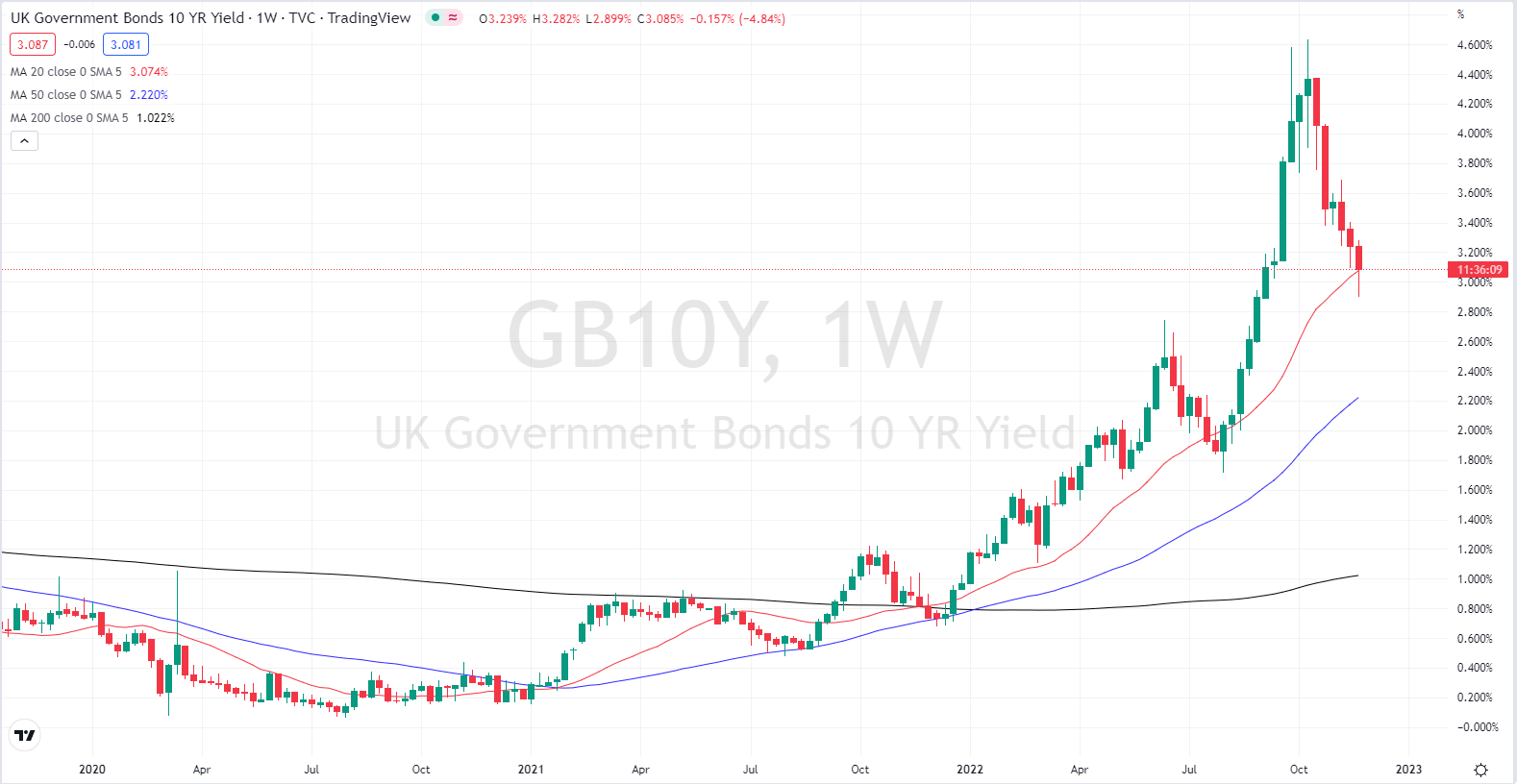

It is not just Sterling that has expunged ex-UK PM Liz Truss’s errors with the gilt market also rallying hard – yields falling – since the beginning of October, lowering the government’s borrowing costs sharply.

UK 10-Year Gilt Yields – Weekly Chart

(Click on image to enlarge)

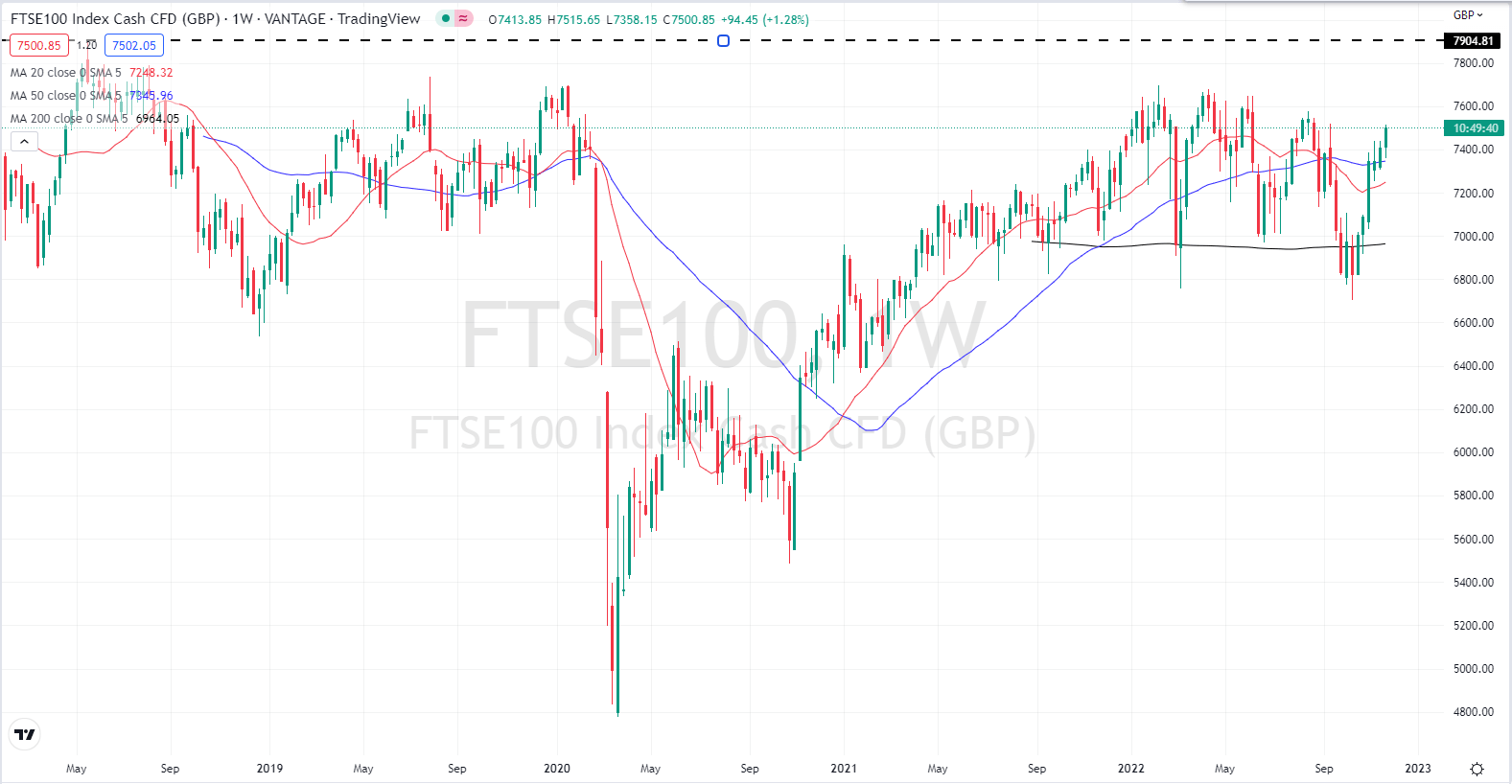

The UK FTSE 100 has also been in a buoyant mood over the last few weeks and is close to 800 hundred points higher than its mid-October nadir.

FTSE 100 - Weekly Chart

(Click on image to enlarge)

The week ahead has little in the way of market-moving economic data releases or events, leaving cable looking at the US dollar. The US economic docket has a handful of high-importance releases, including core PCE and NFPs, so the cable may come back under the greenback’s influence again, in the short-term at least.

For all market-moving data releases and economic events see the DailyFX Calendar.

Cable’s move higher this week has seen it make a textbook break higher from a bullish pennant pattern, leaving GBP/USD very close to the longer-dated, 200-day moving average. If cable can make a confirmed break above this important technical indicator, then GBP/USD may well continue to push higher in the weeks ahead.

GBP/USD Daily Price Chart

(Click on image to enlarge)

All Charts via TradingView

Retail Traders Increase their Weekly Net-Short Positions.

Retail trader data show 38.05% of traders are net-long with the ratio of traders short to long at 1.63 to 1. The number of traders net-long is 6.23% higher than yesterday and 4.99% lower from last week, while the number of traders net-short is 2.68% higher than yesterday and 19.55% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the British Pound – bullish or bearish?

More By This Author:

USD/JPY Collapsing Towards A Fresh Three-Month LowEuro (EUR) Latest: EUR/USD Treads Water Ahead Of FOMC And US Data Releases

Gold Price Latest – FOMC Minutes And Data Key To Short-Term Price Action

Disclosure: See the full disclosure for DailyFX here.