Brace For Buyback Tsunami Following Record Flood Of Corporate Bond Issuance

While traders were focused on today's ECB meeting and the (spectacular) 30Y auction which initially pushed yields higher on supply concerns only to see them slide right back down after the huge buyside demand for ultra-long dated paper, the real action was in corporate bond land where the last few days have seen an unprecedented borrowing binge.

As Charlie McElligott wrote in his daily note, "after nearly $40B of deals Tuesday, there was another $28.2B across 19 issuers and 34 tranches yesterday, with the early look showing 14 deals in today’s pipeline already—just INCREDIBLE demand for Paper AND Duration."

This "supply firehose" also caught the attention of BofA credit strategist Hans Mikkelsen, who in a note titled aptly enough...

... wrote that US investment-grade issuance for the first two days of this week stands at $60.6bn across a record (for any two-day period) 39 deals; this compares to the previous two-day record was 36 deals immediately after Labor Day in 2019.

Indeed, while the post-Labor Day week is normally one of the busiest of the year in debt capital markets, the past three sessions have been among the most active ever.

While heavy supply over short periods can tend to weigh on credit spreads if investors start getting pickier, that has certainly not been the case this week, with Wednesday’s slate of sales seeing order books three times covered on average.

Some details on the supply deluge: the average new issue concession and break performance were in line with yesterday at an impressive +5bps and -2.9bps, respectively, meaning that bonds were promptly bid up upon breaking for trade as yield-starved accounts simply could not get enough. The spread on the Bloomberg U.S. Corporate Investment-Grade Bond Index hasn’t budged this week, sitting at just 88 basis points.

And while BofA expected the unprecedented issuance spree to fade on Thursday, Bloomberg notes that the "firehose" of supply showed no signs of slowing Thursday amid what bankers and borrowers say are ideal conditions for high-grade companies to tap the bond market for financing.

After a relatively slow August even by Wall Street standards, issuers are back in force. They’re taking advantage of pent-up investor demand for high-quality credits, and looking to lock in their funding needs for the year amid concern that the Federal Reserve will soon begin to pull back stimulus that’s helped push interest rates to near-record lows.

According to Bloomberg calculations, another 14 blue-chip companies were looking to sell bonds Thursday, after the abovementioned 39 firms priced more than $60 billion of debt over the previous two sessions.

“Companies want to issue and lock in this low financing now, and not take any chances on the Fed,” said Matt Brill, head of U.S. investment-grade credit at Invesco Ltd. “And buyers have not been scared at all. We have not seen spreads back up or any deals struggle to get done.”

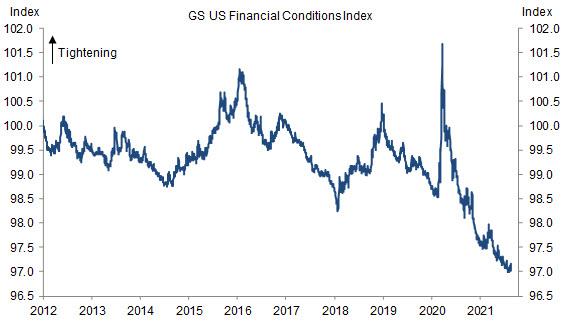

One reason for the debt issuance scramble is that companies are concerned conditions could worsen should Fed officials begin to tighten monetary policy in the coming months and are taking advantage of one of the most attractive funding environments on record with financial conditions the easiest they have ever been, according to Goldman.

Many are looking to lock in cheap funding costs and improve their balance sheets via refinancings while they still can, yet others are just hoping to load up on cash which they can then use to repurchase stock.

“Us investors are saying ‘Hey, keeping bringing more. We’re not getting enough bonds,’” Brill added, noting that the lack of supply over the last half of August meant a lot of dry powder was ready to pounce on new issues.

Much of the new supply this week has been focused on balance sheet management and lowering cost of debt, with relatively few M&A-focused transactions. As Bloomberg notes, several deals - including Walmart’s massive $7 billion sale Wednesday - are earmarked to fund tender offers, a sign that low rates are one of the main motivators.

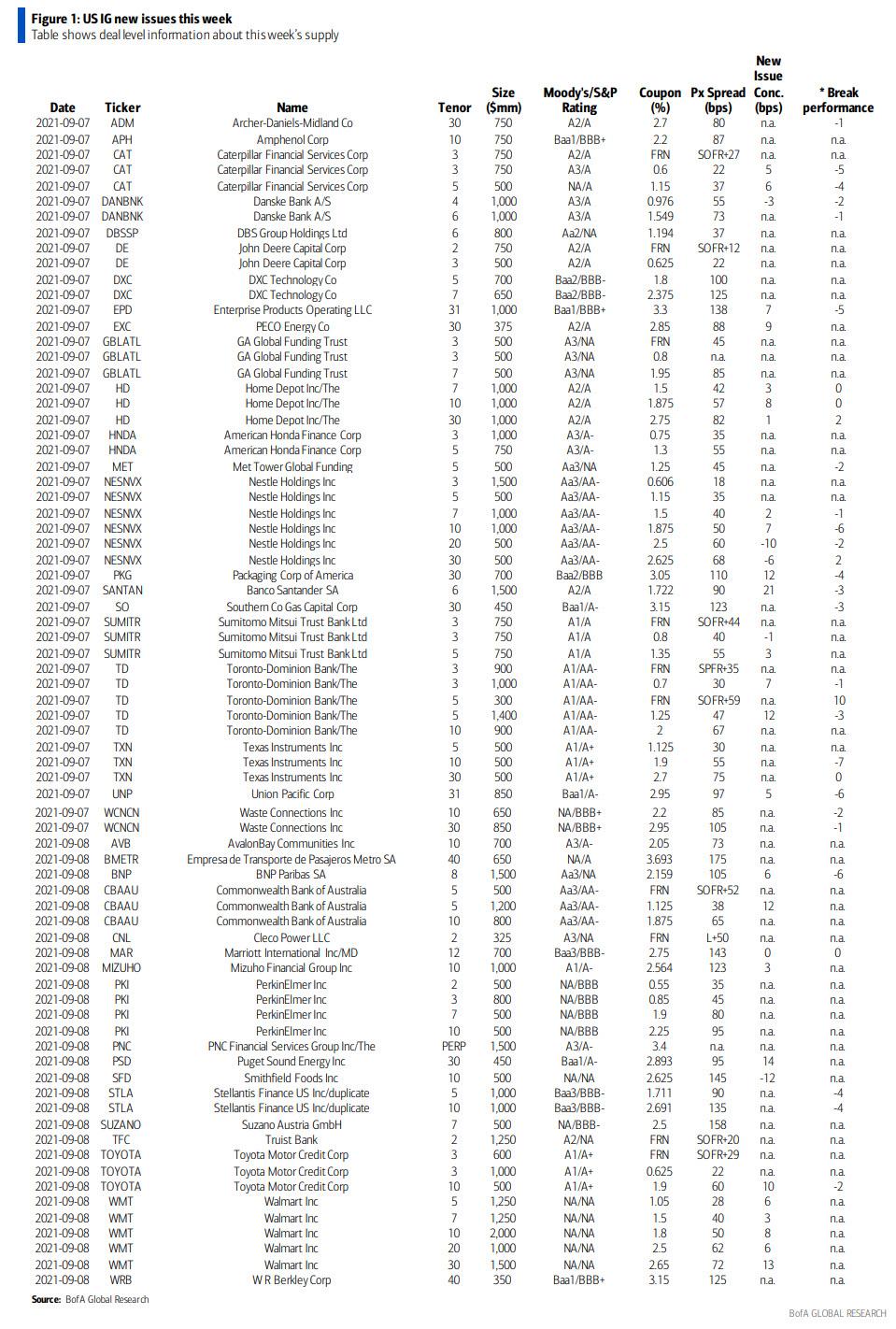

A quick look at the issuers who have just sold bonds shows a "who is who" of some of the world's most highly rated credits including Nestle, Walmart, Toyota, PECO Energy and many more. The table below is courtesy of BofA:

(Click on image to enlarge)

The deluge continues today with at least 14 lender meetings are deck in the leveraged loan market. Some more observations into today's borrowing frenzy from Bloomberg:

- An “abnormally low” spot spread differential between Libor and SOFR may be obstructing the adoption of replacement rates in the loan market, according to the Loan Syndications and Trading Association

- Walmart’s new investment-grade bonds rallied in secondary markets Thursday, a day after the debt offering received as much as $25 billion in demand

- Janus Henderson is launching two actively managed fixed-income ETFs that integrate sustainable investing criteria

- ABC Carpet & Home, the more than a century-old New York luxury home goods retailer, filed for bankruptcy late Wednesday after the pandemic and a delayed renovation upended its business.

The calendar is just as busy in Europe, where there are seven issuers selling at least 3.27 billion euros-equivalent of bonds on Thursday.

- U.K. specialist insurer Just Group Plc is on track to cut its interest costs by replacing a bond issued in only 2019, extending a run of similar transactions as companies take advantage of the collapse in yields

- Nearly 80% of European credit investors would be willing to pay a premium for a sustainability-linked bond where the key performance indicators used are “material” to the issuer

- Risk premiums and yields near record lows have pushed money managers with a mandate to buy European high-grade debt into buying lower-rated bonds.

One final note: while much of tens of billions in proceeds will be used to refi existing debt, we expect a good portion to stay as "general corporate purposes", i.e., used as dry powder to repurchase stocks. Which means brace for a tidal wave of buybacks in the coming days.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more