Bonds Gave Us A Key Stock Market Signal The Same Week Musk Met With His Business Masters

Image Source: Pixabay

The US trading exchanges are closed today, December 26, as a result of the fact that Christmas fell this year on Sunday. Yes, that means the stock market casino is closed, although the Robinhood app is taking bets today on the Bitcoin price for those completely addicted to gambling in the markets.

Investing and trading does not have to be gambling, but that is what millions of people have made for themselves.

It worked for them until it didn’t and, so, this year was the first year of a slow-motion bear market, that has been slowly grinding the masses down.

People were told by social media ads and Youtube gurus like Cathie Wood that all they had to do to get rich is buy “new tech” and believe. The crypto coin symbolized this promise and so did those laser eyes, but it was all a lie.

And reality came this year.

Making money is about controlling risk – AKA money management – and aligning yourself with market trends and adapting to them when they change.

It’s not about predicting the future, but people think in terms of picks and predictions so that is how any market commentator has to talk if they want anyone to listen to them.

Anyone who wants to make money in the markets and has gotten into trading starting in 2020 NEEDS to read Stan Weinstein’s book Secrets to Profiting in Bull and Bear Markets.

Until they read that book they can expect to continue to have the same results they have had in the past two years.

In other words, they have no chance without the book.

All they need to do is buy the book to get started.

They don’t need to spend $1,000 on some course or trading service.

they just need to buy the book.

I’ll have more to say about next year and the markets in a few days, but right now I just want to point out to you what the bond markets have done this month.

Intermarket analysis is key to understanding market trends. Various markets impact one another and have relationships with each other.

This bear market was preceded by a top in the bond market in 2021. Bonds began a bear market before the S&P 500 did.

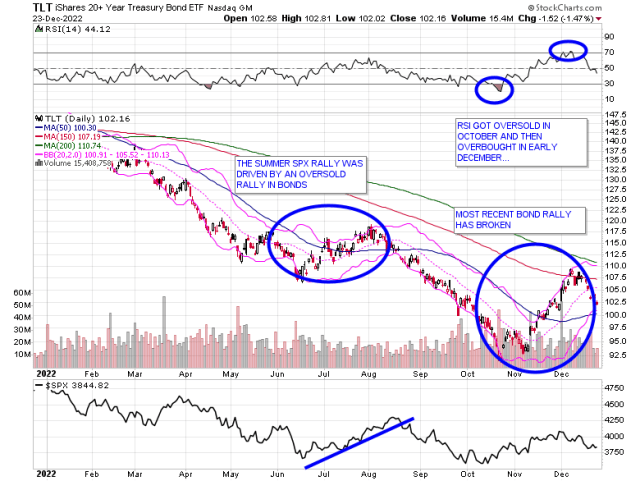

Bonds are still in a bear market, but we saw two bond bear market rallies this year.

The first one, in the summer, helped spur buying in the stock market, but when that bond rally peaked, at the end of July, the stock market turned down a few weeks later.

Now we have seen a rally in both stocks and bonds since October, but the bond market got extremely overbought two weeks ago and the bond market rally has already broken down, as you can see from the TLT ETF.

As you can see, the TLT Treasury bond ETF, rallied into its 150-day moving average and became overbought in terms of its RSI. The rally stalled out and TLT has since rolled over.

Other bonds ETFs, such as LQD and JNK, have similar charts.

I was hopeful coming into December that the stock market would trend up to sideways into the end of the year, and likely into the next Fed meeting in February, but also said that if the bond rally broke down I would abandon that notion.

That is what I am doing because that is what happened.

That doesn’t mean I think the market is going to go straight down now, but I just don’t see the upside here isn’t worth betting on.

That’s like flipping coins now.

We’re in a bear market and it has not ended.

Bear markets end when there is panic selling and the masses have given up.

Incredibly, there has been no panic selling his year and the masses continue to average down.

Yes, millions of Robinhood traders have been wiped out, but when it comes to tens of millions of individual “regular” investors they continue to deposit money in their IRAs, 401k’s, and investment accounts and average down with the conviction that the market always comes back.

The bear market will end when they give up.

Bonds gave a sell signal on the stock market this month that simply tells me to stand back from this rally now.

If anything, take money off the table.

In bear markets, the thing to do is to use rallies to get out of losing positions and weak sectors, build cash reserves to buy for the time that there is real panic, and focus buying during the bear market only on those things that are outperforming the S&P 500.

Gold and silver did that this year and are in a position to do that even more in 2023.

Do not think in terms of predictions, but trends.

When it comes to trends there are two-time frames – short-term (hourly or daily) and weekly.

The long-term 150 and 200-day moving averages help you identify the long-term trend.

You then use the short-term trends to take positions within that long-term trend.

That’s how smart trading and investing work.

It isn’t about averaging down into garbage and falling into oblivion.

Does not crypto demonstrate how futile doing that becomes?

Warren Buffett sold just about all stocks he owned in October of 1969 and bought back several years later after a bear market.

That is how he became a billionaire, but he then marketed himself by talking about buying and holding forever as that is what the masses like to hear. Talking like that is how he got them to worship him as a financial celebrity and buy Berkshire Hathaway stock.

Study what people Buffett really did to win and ignore the propaganda.

No one will succeed in these markets by watching Cathie Wood videos or by endlessly scrolling through Twitter.

You need to become a true student of the market to be a winner.

Young people need to listen to Paul Newman and not social media people.

Video Length: 00:02:39

Less than 10% of people beat the performance of the S&P 500 in a meaningful way, but few people are students of the markets.

Now the stock market could go up this week.

In August, it continued higher even after that bond market rally ended, but the bonds warned that the rally would end.

This rally that began in October is not the start of a new bull market, but just another bear market rally, and that is what is important to know about it; so that’s why I don’t care if the stock market goes up this week. In fact, I don’t really care which direction it goes in this week, as I don’t think this week is going to really matter for it one way or the other.

And yes, Warren Buffett and Munger have been proven to be absolutely correct in what they said about Bitcoin earlier this year and their prediction on where it is ultimately going probably is too.

Video Length: 00:04:46

The funny thing about Buffett and Munger is that these guys are billionaires, but according to broke basement-dwelling millennials who bought worthless crypto coins these guys didn’t know what they were talking about. But the “HODLR’s” made the mistake of believing in crypto gurus, who are the worst of the worst. They just wanted to believe that crypto could be a lottery ticket for them and so they did, and so they wiped themselves out.

Some will learn from that mistake and move forward. The first step they need to take is to admit to themselves that they didn’t know what they were doing, so they let themselves be fooled, and then they can step forward by making the decision to learn to win.

So, if that is where you are – the decision you have is simple:

You can either start with the Stan Weinstein book and take the game seriously or look for another guru to replace the one that tricked you with their hype in hopes that they will give you a winner – but if you do that you’ll almost certainly end up with the same results all over again at the end of next year as you did this year.

But, this is the fork in the road millions are at now.

And those that still believe in crypto are keeping themselves in a totally hopeless position.

FTX was just the tip of the iceberg.

Remember, back in August Forbes reported that “Half of All Bitcoin Trades Are Fake.”

SBF isn’t just one bad apple in an otherwise healthy barrel.

The entire crypto market itself is essentially a fraud because the Bitcoin price itself is nothing but manipulation.

It isn’t real.

And Binance is one of the biggest investors in Elon Musk’s Twitter takeover.

They put $500 million into it with what is seen as an expectation “to organically engage with Musk and Twitter down the line about ways to collaborate or help in certain areas.”

Elon visited with some of his other major Twitter investors when he went to the world cup game in Qatar some of whom are already among the largest shareholders of Tesla.

In the 1980s and 1990s, millions of stock market investors looked up to Warren Buffett.

Now many of their children worship figures like Elon Musk instead and stay glued to their screens 24/7.

He told them to buy Dogecoin.

Billy Markus and Jackson Palmer were the two men who created the Dogecoin cryptocurrency.

They did it as a joke, but Elon used Twitter to pump it, making it into a financial millstone for millions.

Charlie Munger was right about the true nature of Bitcoin.

More By This Author:

Pivotal Week Lining Up For Gold, Silver, Commodities and the US Dollar Index – Mike SwansonRay Dalio Projects 20% Decline In Stock Market (Is He Right About Bear Market End Point?)

What If The Federal Reserve Rate Hikes Don’t Stop Inflation?