Bond Market Gyrations: A Setup For A Major Crisis Ahead?

Image Source: Pixabay

Bond Market Volatility Could Lead to Severe Consequences

Investors shouldn’t ignore the bond market these days. The volatility happening currently could be a setup for something worse ahead of us…in fact, a crisis could be around the corner.

Before going into more detail, let’s look at what’s really happening…

You see, in mid-2023, it became clear that the Federal Reserve’s interest rate hiking cycle was coming to an end, and rate cuts could be ahead. In late 2023, the Fed even made it very clear that rate cuts were coming. The bond market started to position itself, and we saw yields on bonds drop a bit, too. All very normal behavior.

In September, the Fed made its first interest-rate cut. Then, it reduced rates again in November and December 2024. But the bonds market didn’t follow.

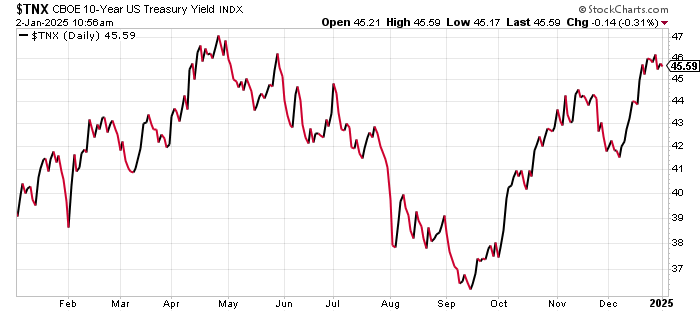

Take a look at the chart below; it plots the yields on the 10-Year U.S. Treasury.

Chart Courtesy of StockCharts.com

See something interesting?

As the Fed started to cut interest rates, the bond market panicked. Yields on 10-Year U.S. Treasury bonds have spiked roughly 100 basis points since, moving close to where they were in May 2024. In bond market terms, this is a massive move in the opposite direction.

Why Does the Bonds Market Matter?

Now, perhaps you’re wondering why this matters.

It’s important to understand this one basic thing: the interest rates that the Fed sets are primarily for banks. The bonds market decides what the rates will be on mortgages, business loans, car loans, etc.

Put simply, what the bonds market is doing right now essentially indicates that consumers and businesses aren’t really getting any break from interest rates. The fact that yields are going up suggests that interest rates could even go up. Their debt services payments that ballooned over the past few years could remain at the same level. This could be a big drag on consumption and, ultimately, the economy.

How Bonds Market Volatility Could Cause a Financial Crisis

But, it’s important to look at the bigger picture as well.

Know this: the bonds market is much bigger than the stock market, and it has the ability to impact other assets as well.

In financial markets, for example, yields going higher suggests that bond portfolios are actually losing value.

How high could the yields go until some financial institution, be it a pension fund, hedge fund, or whatever, says that their losses are too huge and they can’t remain in business?

This has the potential to send shockwaves throughout the financial markets.

Plus, it’s also important to realize that yields doing something unexpected could impact derivatives as well.

Major banks hold a lot of derivatives that are backed by interest rates. Assuming only a fraction of these derivatives goes “bad,” there could be dire consequences. In fact, it wouldn’t be wrong to say that a financial crisis could become a possibility.

Higher yields are also dangerous for the stock market, especially those companies that own a lot of debt. Problems in the bond market could impact their margins and stock prices.

Real estate is highly sensitive to what happens to yields as well. If yields remain sticky for a while, it’s hard to imagine real estate giving any kind of stellar performance. Certain segments of the real estate market, including commercial real estate, could find themselves in a painful situation.

Why Investors Shouldn’t Get Complacent as the Bonds Market Suffers

I could list quite a few more reasons why what’s happening in the bond market these days could lead to a dangerous outcome. But remember: the idea here is not to scare you. My goal is to keep my readers aware of the risks that are building up.

I am watching the bond market very closely. The move in yields that has happened on the back of the Federal Reserve just cutting rates tells me that there’s some sort of crisis in the making.

I know it takes time for things to show up on the surface, so patience is the key here.

I will end with this: the last time the yields on the U.S. 10-Year Treasury hit close to five percent in 2023, there was a great deal of noise about how many things could “break.” We are not too far away from that five-percent threshold on these U.S. bonds. Be very careful.

More By This Author:

Stock Market Crash: 1 Reason To Be Ready For It In 2025

Top Stocks Trouble? This Market Disparity Could Trigger A Major Headache

Gold Prices Outlook: The Lower It Goes, The Better It Gets?

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more