Blowout 2Y Auction Sees Record Foreign Buyers, Yields Slide

Ahead of next week's FOMC meeting, when consensus expects no surprises from Powell ahead of a September rate cut, the same can not be said for today's first-of-the-week coupon auction, when demand for $69BN in 2Y notes (with 5Y and 7Y auctions on deck) was off the charts.

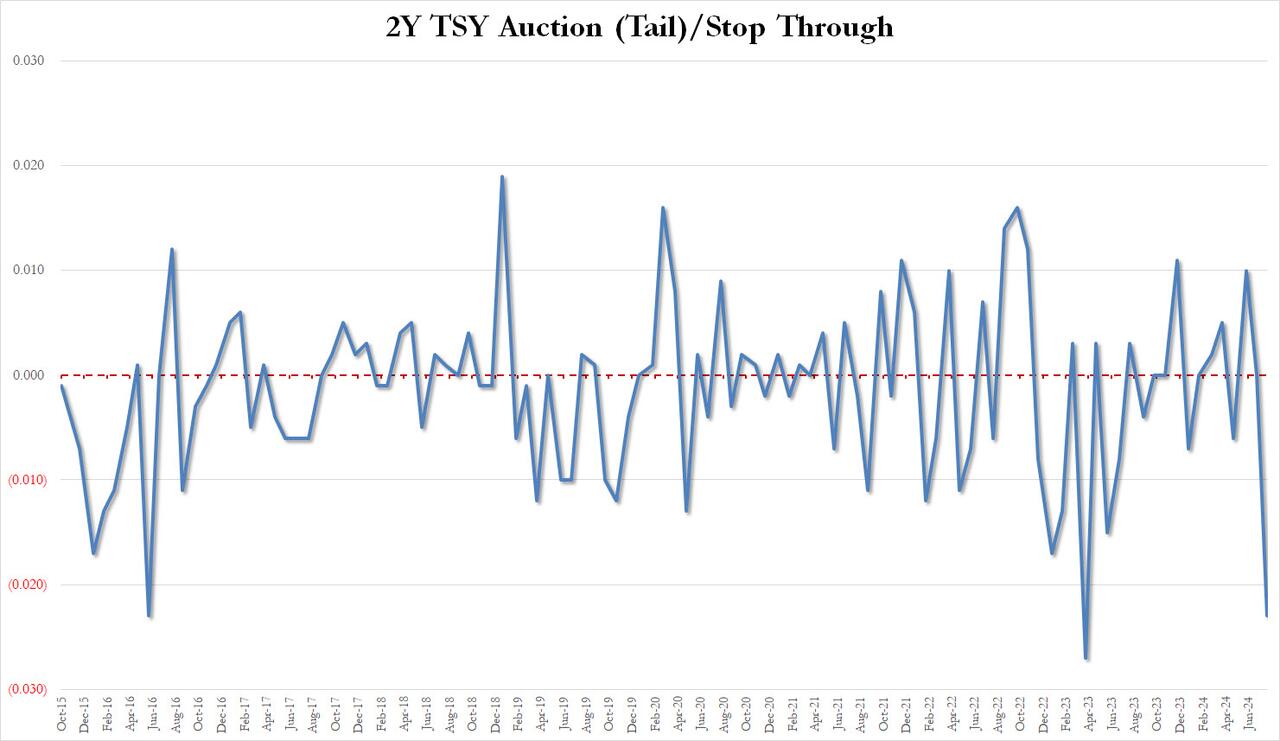

Starting at the top, the high yield printed at 4.434%, down 27.2bps from 4.706% last month, the lowest since January, and stopped through the 4.457% When Issued by a whopping 2.3bps, the second highest stop through on record (only March 2023 was higher)!

(Click on image to enlarge)

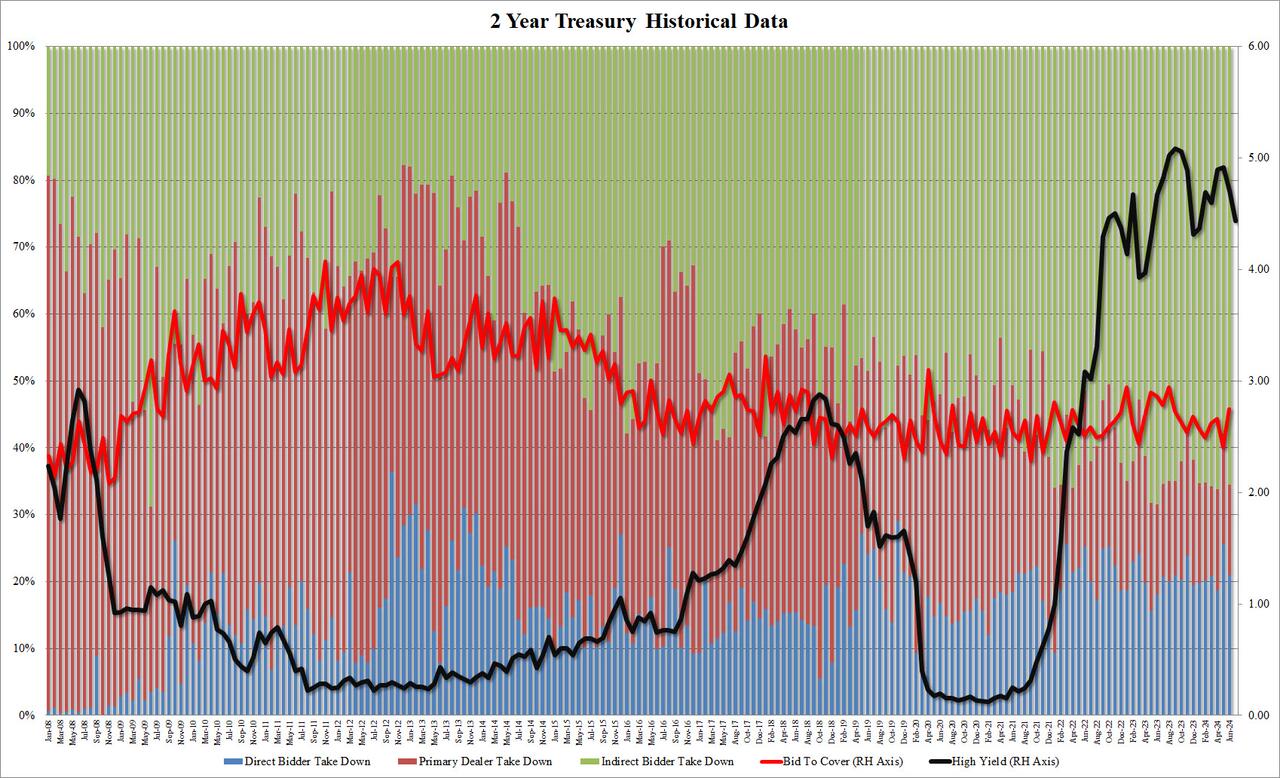

The Bid to Cover was 2.814, above last month's 2.751 and the highest since Aug 23 (and obviously above the six-auction average of 2.58).

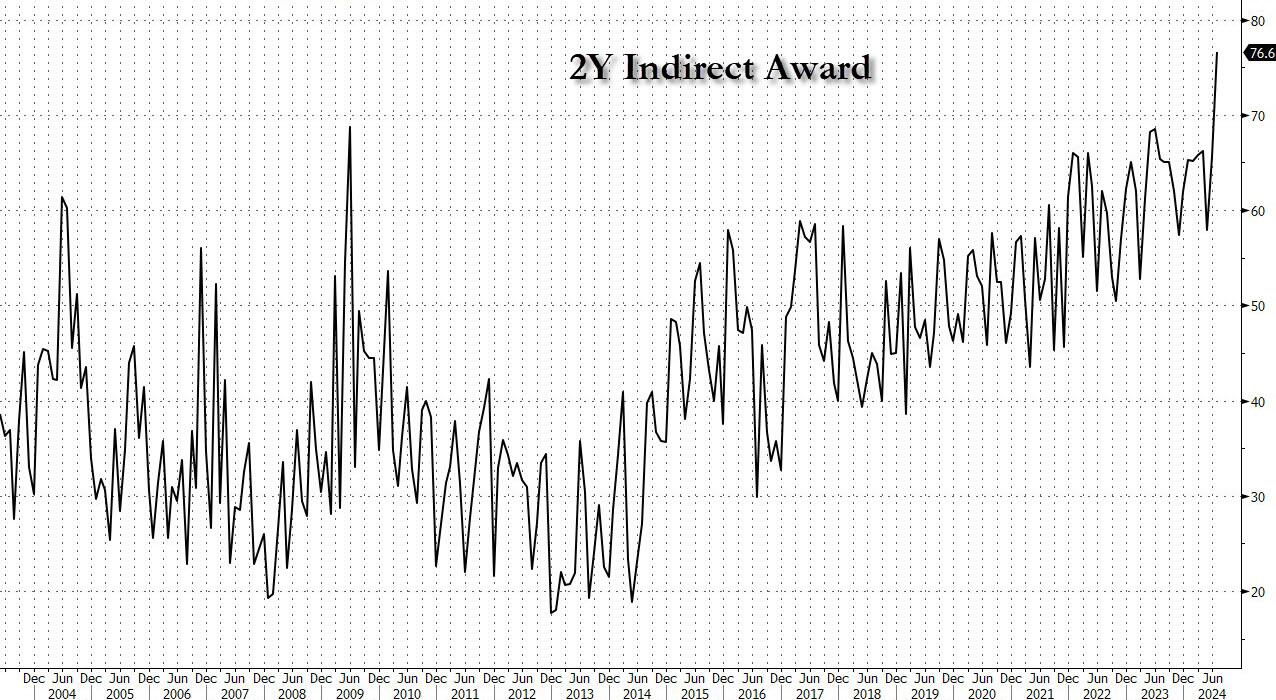

However, the internals were truly spectacular, with Indirects taking down an unprecedented 76.6%, up from 65.6% in June and the highest on record!

(Click on image to enlarge)

And with Directs awarded 14.4%, the lowest since Jan 22, Dealers were left holding just 9.0% of the auction, the lowest on record.

(Click on image to enlarge)

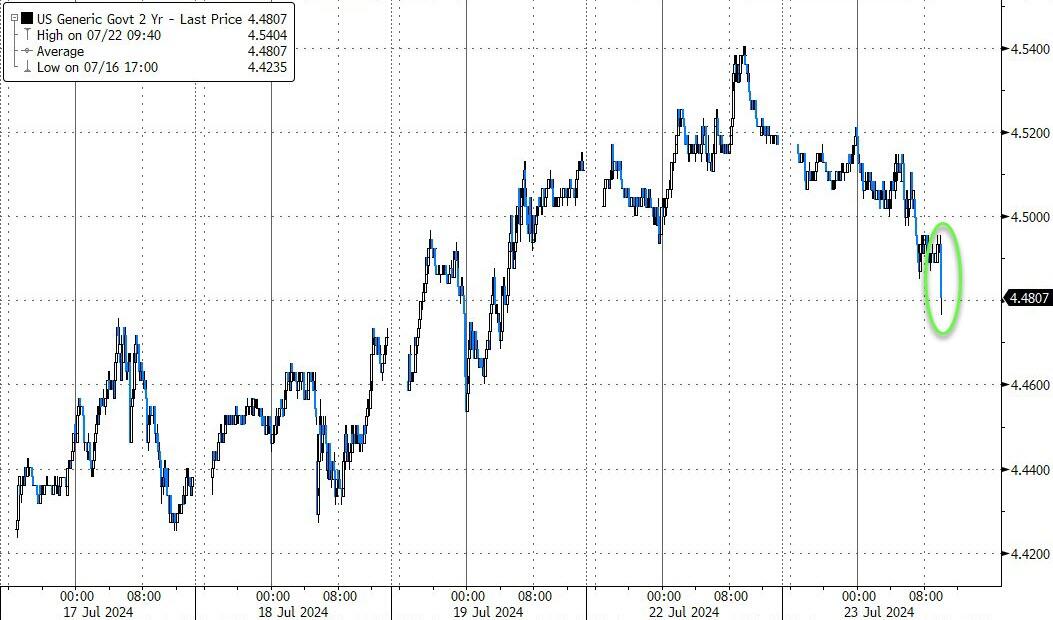

Bottom line: the market, and especially foreign official entities, are piling into the short end ahead of next week's FOMC decision in record amount, almost as if someone knows that contrary to expectations for no rate cut, Jerome Powell may actually surprise everyone next week. There were no surprises, however, in terms of the market reaction: yields tumbled after the stellar auction, with 10Y yields also tumbling to session lows.

(Click on image to enlarge)

More By This Author:

US Existing Home Sales Puked (Again) In July"Continued Deterioration": Goldman Sees "Surplus Market" In Copper, Pushing Prices Lower In "Short-Term"

Bitcoin & The Buck Bounce As Biden, Big-Tech, Bonds, & Black Gold Break Down

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more