Bankrupt Hertz Warns Buyers They'll Need A Miracle To Avoid Total Loss As Bonds Value Equity At Negative $2 Billion

Two days after Hertz' own lawyer, White & Case's Tom Lauria warned that the trading price of Hertz shares was "disconnected from fundamentals" just as bankruptcy court approved the company's plan to sell up to $1 billion in stock, the company has issued an 8-K in which it cut the offering price in half - now seeking to raise up to $500 million perhaps as a result of the drop in HTZ stock this morning - with a bevy of risk factors laying out the terms of the deal that Jefferies will pursue in its quest to sell hundreds of millions of HTZ shares to retail investors, including using the word "worthless" to describe its stock no less than five times.

On June 15, 2020, Hertz Global Holdings, Inc. (the “Company” or “we”) entered into an open market sale agreementSM (the “Agreement”) with Jefferies LLC (the “Agent”) under which the Company may offer and sell, from time to time at its sole discretion, shares of its common stock, par value $0.01 per share (the “Common Stock”), having an aggregate offering price of up to $500.0 million through the Agent as its sales agent and/or principal (the “ATM Program”).

The Agent may sell the Common Stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) of the Securities Act of 1933, as amended, including without limitation block transactions, sales made by means of ordinary brokers’ transactions on the New York Stock Exchange or sales made into any other existing trading market of the Common Stock, or in negotiated transactions with the consent of the Company. The Agent will use commercially reasonable efforts to sell the Common Stock from time to time, based upon instructions from the Company (including any price, time or size limits or other customary parameters or conditions the Company may impose). The Company will pay the Agent a commission of up to 3.0% of the gross sales proceeds of any Common Stock sold through the Agent under the Agreement, and also has provided the Agent with customary indemnification rights.

We already knew that; we also knew that in order to minimize the risk of lawsuits from buyers of stock who end up with a big, fat nothing - who will sue nonetheless - the company would have to make it clear that nothing short of a miracle will be needed for buyers to avoid a total loss, let alone make a profit. And sure enough in a risk factor geared exclusively to Robin Hood traders, "We are in the process of Chapter 11 reorganization cases under the Bankruptcy Code, which may cause our common stock to decrease in value, or may render our common stock worthless" the company warns that "any trading in our common stock during the pendency of our Chapter 11 Cases is highly speculative and poses substantial risks to purchasers of our common stock."

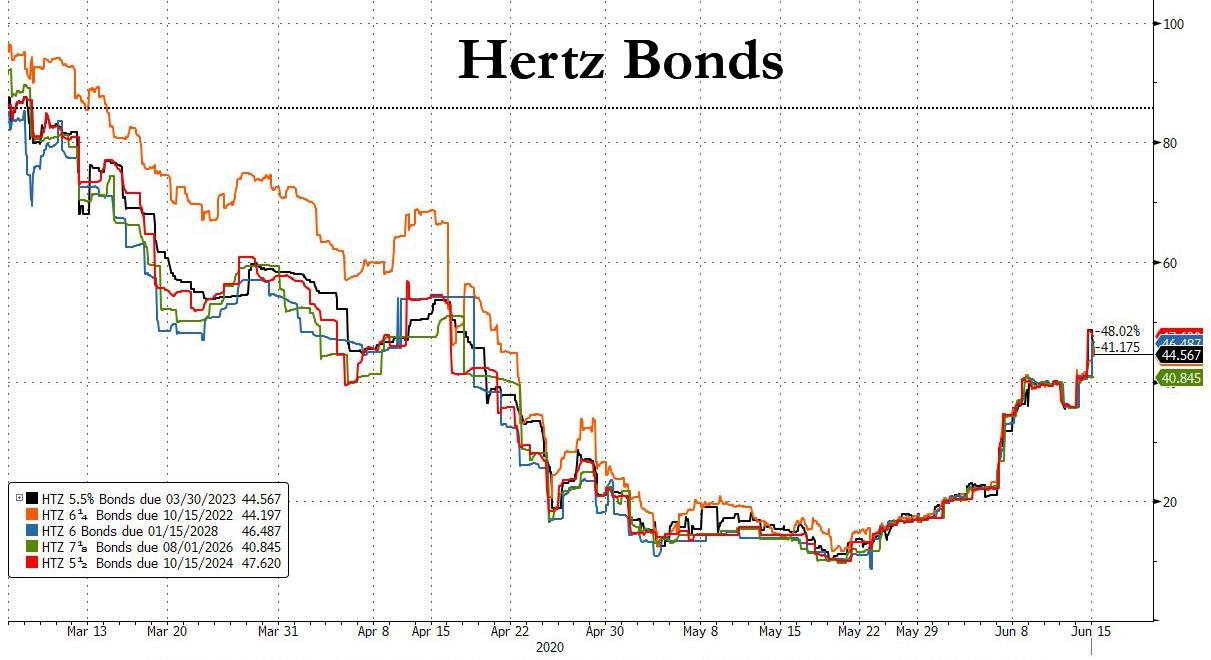

In case that wasn't enough, Hertz also said that "although we cannot predict how our common stock will be treated under a plan, we expect that common stockholders would not receive a recovery through any plan unless the holders of more senior claims and interests, such as secured and unsecured indebtedness (which is currently trading at a significant discount), are paid in full, which would require a significant and rapid and currently unanticipated improvement in business conditions to pre-COVID-19 or close to pre-COVID-19 levels" something which the company's bondholders clearly do not expect as of this moment. In fact, after surging in the past weeks, HTZ bonds dipped modestly this morning, with prices on the company's roughly $4 billion in unsecured bonds - which are all trading below 50 cents on the dollar - suggesting the equity "value" is worth negative $2 billion.

Finally, Hertz also made it clear that it expects "our stockholders’ equity to decrease as we use cash on hand to support our operations in bankruptcy. Consequently, there is a significant risk that the holders of our common stock will receive no recovery under the Chapter 11 Cases and that our common stock will be worthless."

While retail buyers of HTZ stock are facing a virtually certain total loss, the big winners from the Jefferies led offering are, well, Jefferies which will collect a 3% commission, the lawyer who will make $200K on the deal, and of course the company's creditors whose recoveries will be boosted by whatever amount Jefferies manages to sell.

Despite the repeat warnings, HTZ stock was last seen trading at $2.50, largely unchanged from Friday's close after sliding as much as 25% in pre-market trading, even as Jefferies is likely already dumping millions of share At The Money as of this morning.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

And people are still buying!