Avoid The Noid – Stock Market (And Sentiment Results)

Wikipedia, “The Noid was an advertising character for Domino’s Pizza created in the 1980s. Clad in a red, skin-tight, rabbit-eared body suit with a black N inscribed in a white circle on his chest, the Noid was a physical manifestation of all the challenges inherent in getting a pizza delivered in 30 minutes or less. Though persistent, his efforts were repeatedly thwarted.”

I chose this theme in the context of how we have positioned in recent weeks – relative to how the market has positioned in relation to the relentless headlines (The Noid/Noise) that have worked overtime to take people out of their stocks at the exact wrong time. In this analogy, the “Noid” is headline noise (wall of worry) while “getting a pizza delivered in 30 minutes of less” is getting the market indices to new highs.

In recent weeks’ notes and podcast|videocast(s) I have repeatedly stated:

(Click on image to enlarge)

So while everyone is screaming that a recession is coming, the two most important indicators have not confirmed their fears:

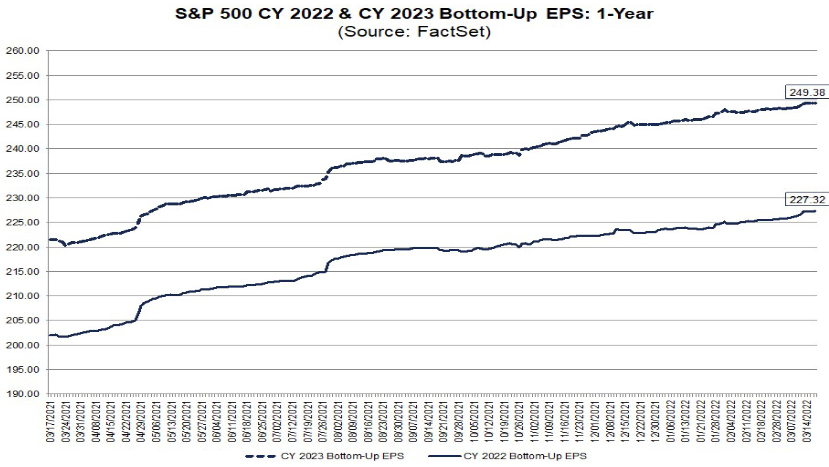

1. Earnings estimates continue to CLIMB:

(Click on image to enlarge)

2. The yield curve 2/10 spread has not inverted.If/when that changes, there is historically a 6-18 month lead to the market top. In many cases the inversion has been a BUY signal as the last 6-18 month move (after inversion) is the steepest:

(Click on image to enlarge)

Our base case is they re-steepen the curve with balance sheet roll-off before it actually inverts. If the facts change, we will change our mind – with plenty of time to spare. We don’t have to predict it, rather simply respond to the data.

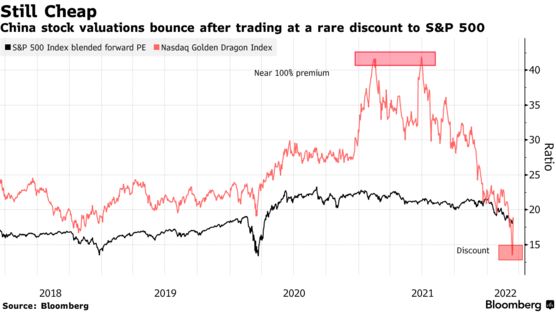

China

We’ll cover a lot more on China in this week’s podcast|videocast, but for those of you emailing to find out if you “missed it” because Alibaba BABA rallied ~65% off the lows in the last 8 days, know that it’s just the beginning. Over the next 12-24 months we believe there’s a ton of gas in the tank for China Tech that got “left for dead” and labeled “un-investable” by the majority of commentators/analysts in recent weeks.

A core part of our thesis has consistently been that the Hang Seng (home of big China Tech) has only traded at a discount to book value several times in history. Only AFTER this big move in recent days are we trading modestly above book value. We will consider the “froth” discussion when the index trades back up to 2-3x book. Here’s what happened next:

Now onto the shorter term view for the General Market:

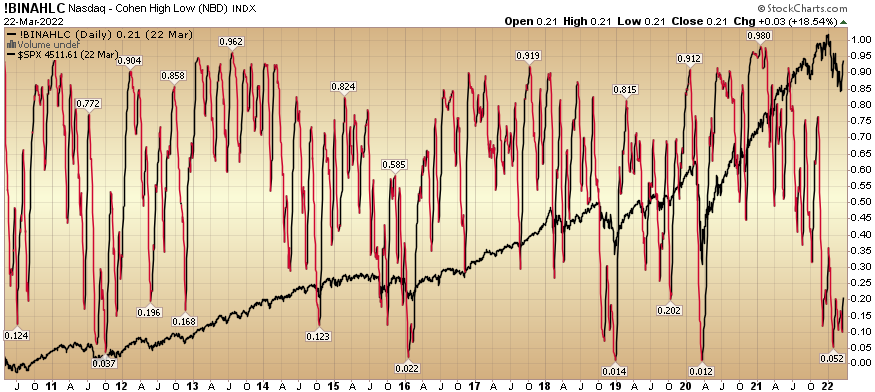

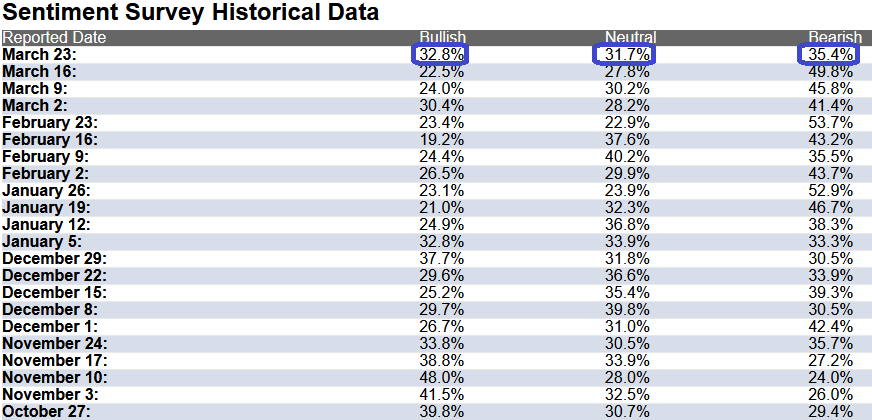

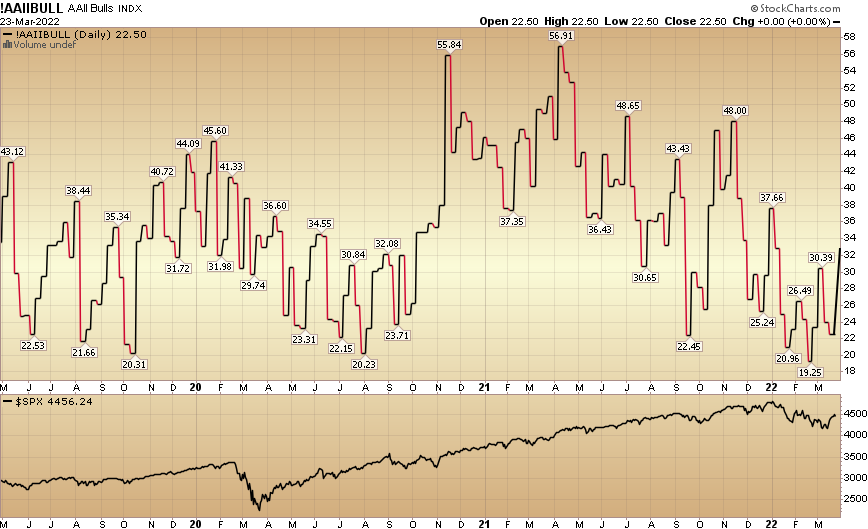

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 32.8% this week from 22.5% last week. Bearish Percent fell to 35.4% from 49.8%. After last week’s historic rally, Retail trader/investor sentiment has thawed back to neutral levels. Opinion follows trend…

(Click on image to enlarge)

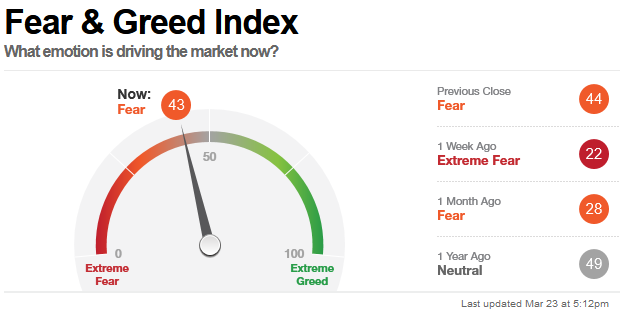

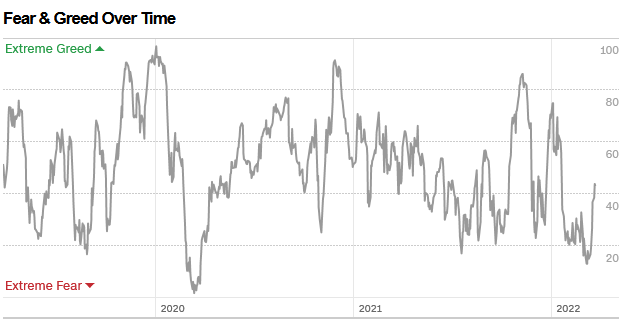

The CNN “Fear and Greed” Index rose from 22 last week to 43 this week. Despite the monster rally off the lows in the past week, fear is still in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

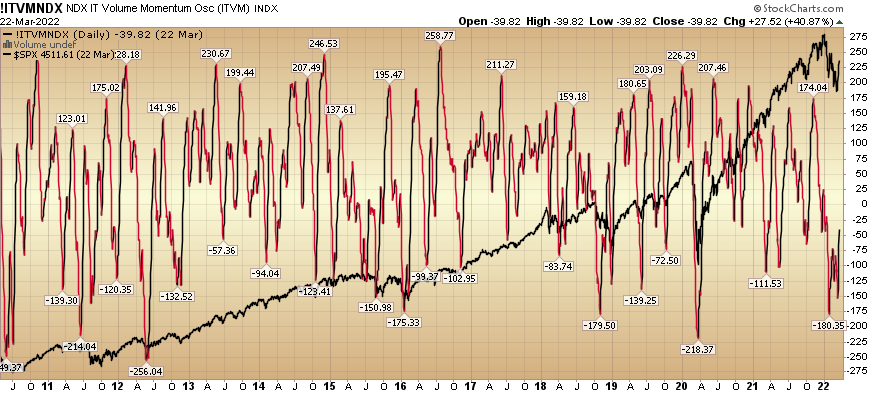

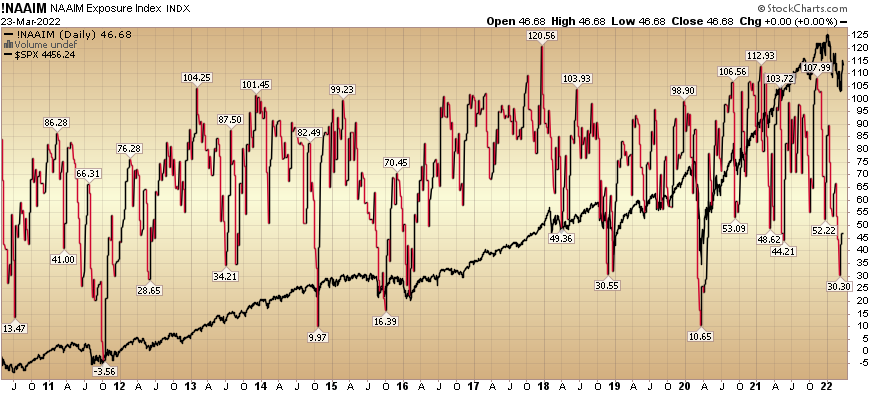

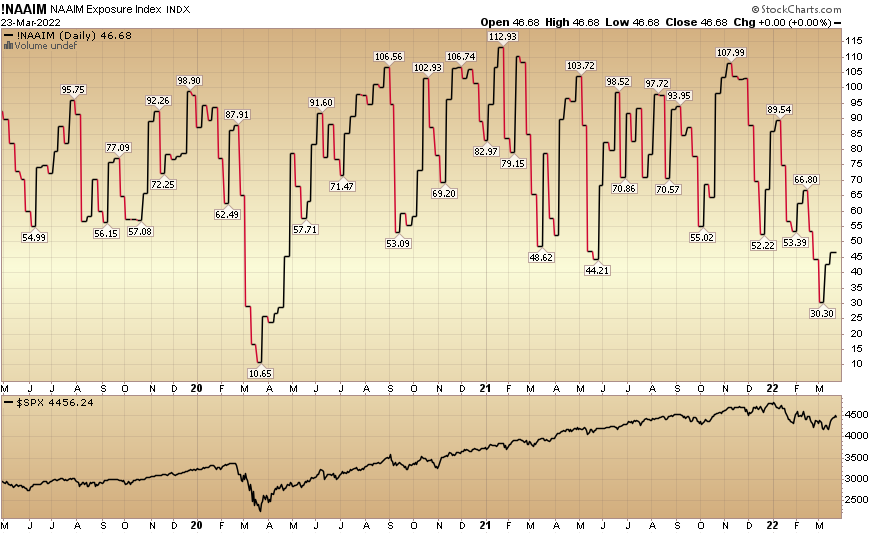

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 46.68% this week from 42.50% equity exposure last week. Managers still have among their lowest exposures to equities since the 2020 pandemic lows. Managers will have to chase further strength in the coming weeks.

(Click on image to enlarge)

Our podcast podcast|videocast will be out tonight or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.