Another Fed Rate Hike Keeps Policy Modestly Tight

Yesterday’s ¼-point rate hike by the Federal Reserve was expected, although there’s debate about whether another round of policy tightening is wise in the wake of recent bank turmoil following the collapse of Silicon Valley Bank (SVB).

Fed Chair Jerome Powell partly rationalized the hike by saying that SVB’s implosion was an “outlier” while the banking system overall remains “sound.” At a press conference following Wednesday’s rate increase announcement he told reporters: “This was a bank that was an outlier,” advising that the combination of a high percentage of uninsured depositors (accounts above $250,000) and mismanaging the bank’s duration risk felled SVB. “These are not weaknesses that are there at all broadly through the banking system.”

Perhaps, although regional bank stocks fell yesterday, which suggests that investors are still evaluating what to make of Fed policy that’s still pushing rate hikes at a time of higher risk for the financial sector.

A new set of economic projections published by the Fed yesterday – the so-called dot plot — point to interest rates peaking at 5.1% this year, which implies one more rate hike.

Fed funds futures, however, are currently estimating a mixed outlook for the next FOMC meeting on May 3. The implied probabilities for the rate outlook are more or less a tossup between putting rate hikes on pause vs. another ¼-point increase.

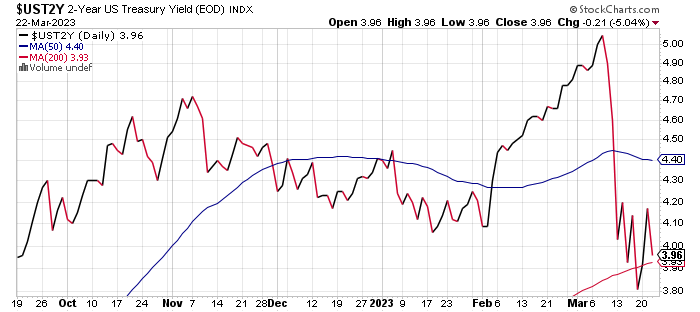

The policy-sensitive 2-year Treasury yield eased yesterday, suggesting that the bond market isn’t convinced that another rate hike is likely.

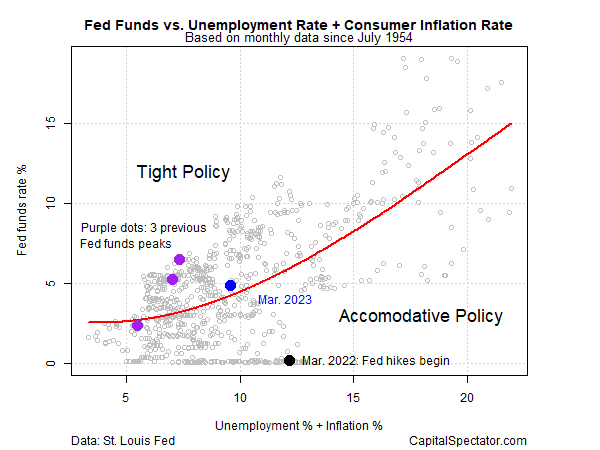

Meanwhile, a simple model of using unemployment and consumer price inflation suggests that Fed policy remains mildly tight after yesterday’s ¼-point hike. (Note: the chart below carries forward the February unemployment and inflation data as estimates for March.)

Even without additional rate hikes, Powell advised that the bank turmoil of late will create new headwinds for the economy. In effect, the SVB-related blowback is a defacto rate hike, he suggested, explaining:

Financial conditions seem to have tightened, and probably by more than the traditional indexes say. … The question for us though is how significant will that be — what will be the extent of it, and what will be the duration of it. We’ll be looking to see how serious is this and does it look like it’s going to be sustained. And if it is, it could easily have a significant macroeconomic effect, and we would factor that into our policy decisions.

“The bottom line is: Credit conditions are going to tighten, and the Fed is acknowledging that,” says Diane Swonk, chief economist at KPMG. The Fed “would like a slow cooling. They just don’t want a deep freeze. And this increases the chances that the economy falls through the ice.”

More By This Author:

Risk Of Wider Bank Crisis Appears To Be EasingTech And Communications Services Lead Equity Sectors In 2023

Bonds Extend Rally Amid Fears Of Bank Crisis

Disclosure: None.