A Toxic Brew For Pension Funds

Image Source: Pixabay

This week, I spoke with Ben Hunt, co-founder, and CIO of Epsilon Theory, a newsletter, and website that examines the markets through the lenses of game theory and history.

In this Global Macro Update, we discuss why the UK bond market might be a threat to the global financial system… why the global repricing of interest rates is hitting the world like a wrecking ball… the two ingredients that, combined, have created a toxic brew for long-term institutional investors... what happens when pension funds get margin calls… and much more.

The video of my full conversation with Ben Hunt is below.

Read on for a summary…

Global Repricing of Interest Rates

Retiring in comfort is part of the American Dream. Some workers—today mostly public-sector employees—are promised defined benefits upon retirement. Those defined benefits are managed by asset managers and are known as pension funds.

According to Federal Reserve Board data from 2021, there are $45.8 trillion in US retirement assets, and approximately $32 trillion of those are held in pension funds.

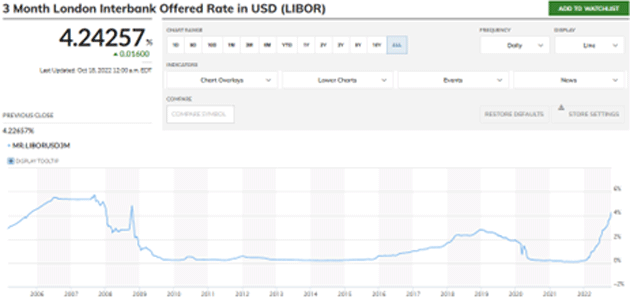

Naturally, pension funds are long-term investors. But with interest rates artificially kept near zero for over a decade, many pension funds have adopted quick-fix strategies from Wall Street... and now—with rising rates—the chickens are coming home to roost.

(Click on image to enlarge)

Source: MarketWatch

So, what will be the consequences of those bad decisions? Will US pension funds ultimately suffer as much as the UK’s? Watch Ben and me talk about these and many more questions.

But first, our market recap...

A Quick Look at the Markets This Past Week…

Gold was down .55% to $1,633.

The average 30-year mortgage rate rose from .29% to 6.94%.

Yields on 10-year Treasuries increased from 5.4% to 4.23%.

The S&P 500 increased 2.3% to 3,666.

Bitcoin was down .72% at $19,046.

Oil remained relatively flat at $85.71/barrel for WTI.

And now...

Video Length: 00:31:18

More By This Author:

The “Procter & Gamble Of The UK” Is Now On My WatchlistMortgage Rates Headed To Below 5%

Currency Crescendo

Disclaimer:The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One ...

more