20Y Auction Sees Solid Demand Despite Jarring Treasury Volatility

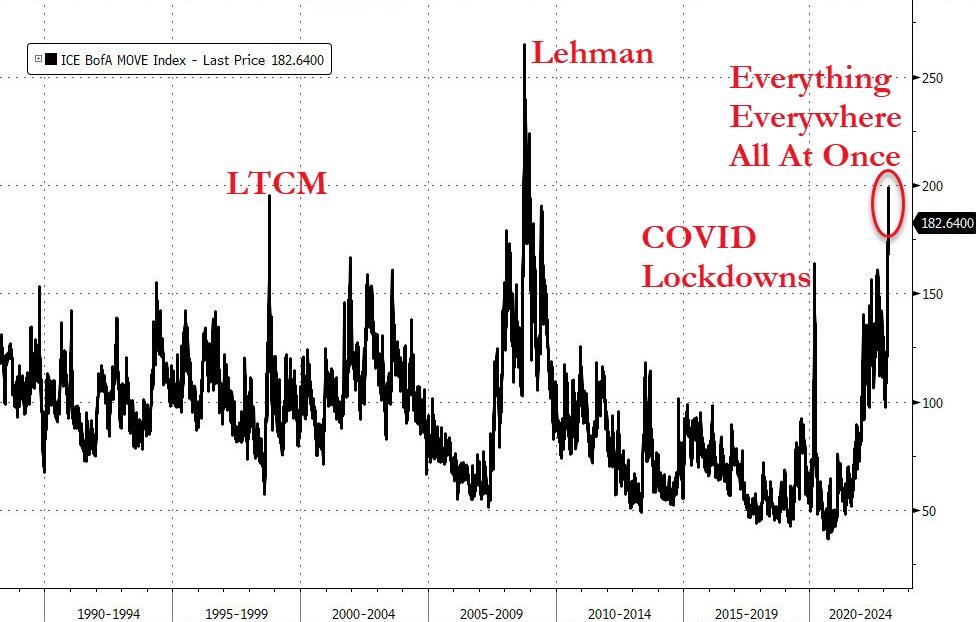

With bond volatility in the past weeks surpassing the covid crisis highs...

(Click on image to enlarge)

... some were concerned that today's 20Y auction could be a disaster because in a time when 2Y Notes swing in daily 6-sigma moves, what can one say about stability of paper that actually has lots of duration... and a very illiquid market like the 20Y.

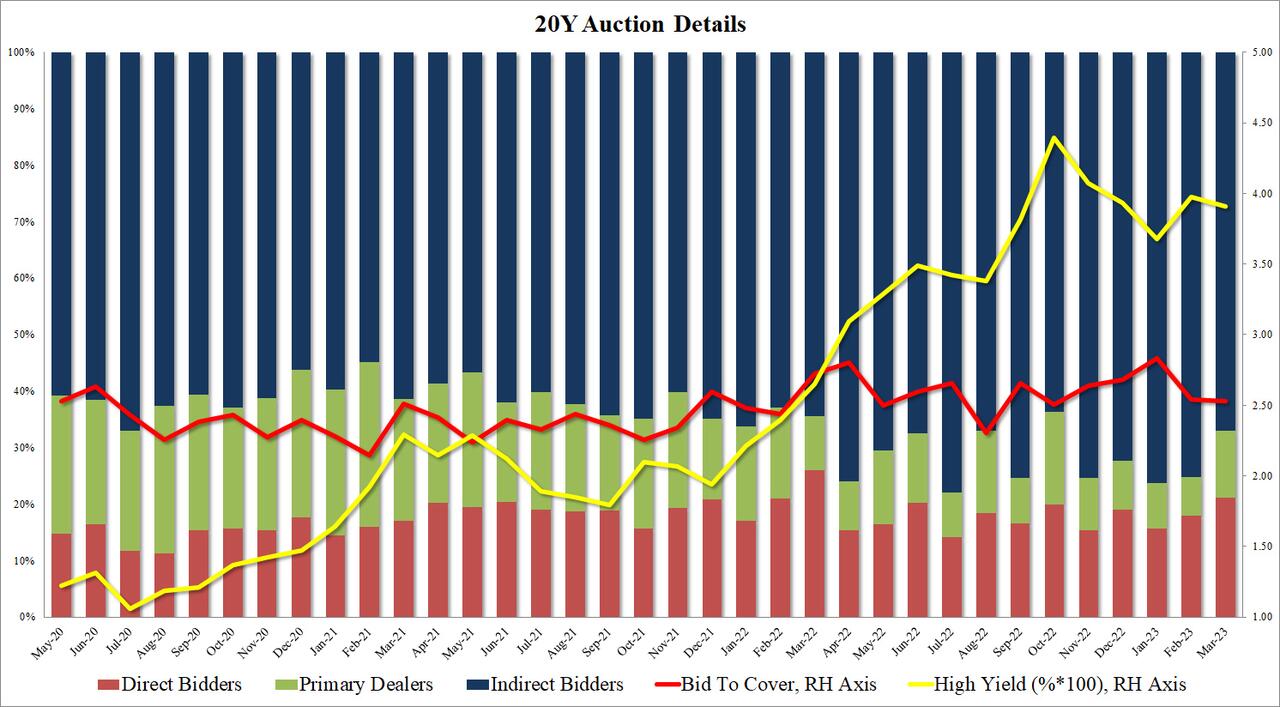

Well, in retrospect it could have been much worse: moments ago the Treasury sold $12 billion in a 20Y paper (in the form of a 19-year 11-month reopening), which saw solid buy side demand.

The high yield of 3.909% tailed the When Issued 3.906% by just 0.3bps (following last month's 0.2bps tail) which while the biggest tail since October, was hardly indicative of a steep drop off in demand.

The bid to cover of 2.53 was virtually unchanged from last month's 2.54 and was shy of the recent average of 2.64.

The internals were mediocre with Indirects awarded 67.03%, down from 75.3% last month and below the 73.0% six-auction average (it was the lowest since October). And with Directs awarded 21.1%, or the highest since March 2022, Dealers were left holding 11.9%, the most since October.

Overall, this was an ok auction, one which was far from the buyside demand of the previous four but also one which could have been far uglier in light of the shock and awe currently shaking the yield curve every day.

(Click on image to enlarge)

More By This Author:

Record $304 Billion In Weekly FHLB Debt Issuance Hints At Staggering Size Of US Bank RunBiden In Touch With Buffett On Bank Crisis

UBS Seeks Government Backstop As It Rushes To Finalize Credit Suisse Takeover Deal As Soon As Tonight

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more