2025 Begins With Extreme Risk To The Us Economy And Markets

As we enter 2025, the US economic situation is showing signs of growing tension, with several dynamics converging to accentuate the fragility of the financial and consumer system.

Numerous graphs reveal a fundamental shift in the interest rate environment, coupled with an alarming deterioration in household finances.

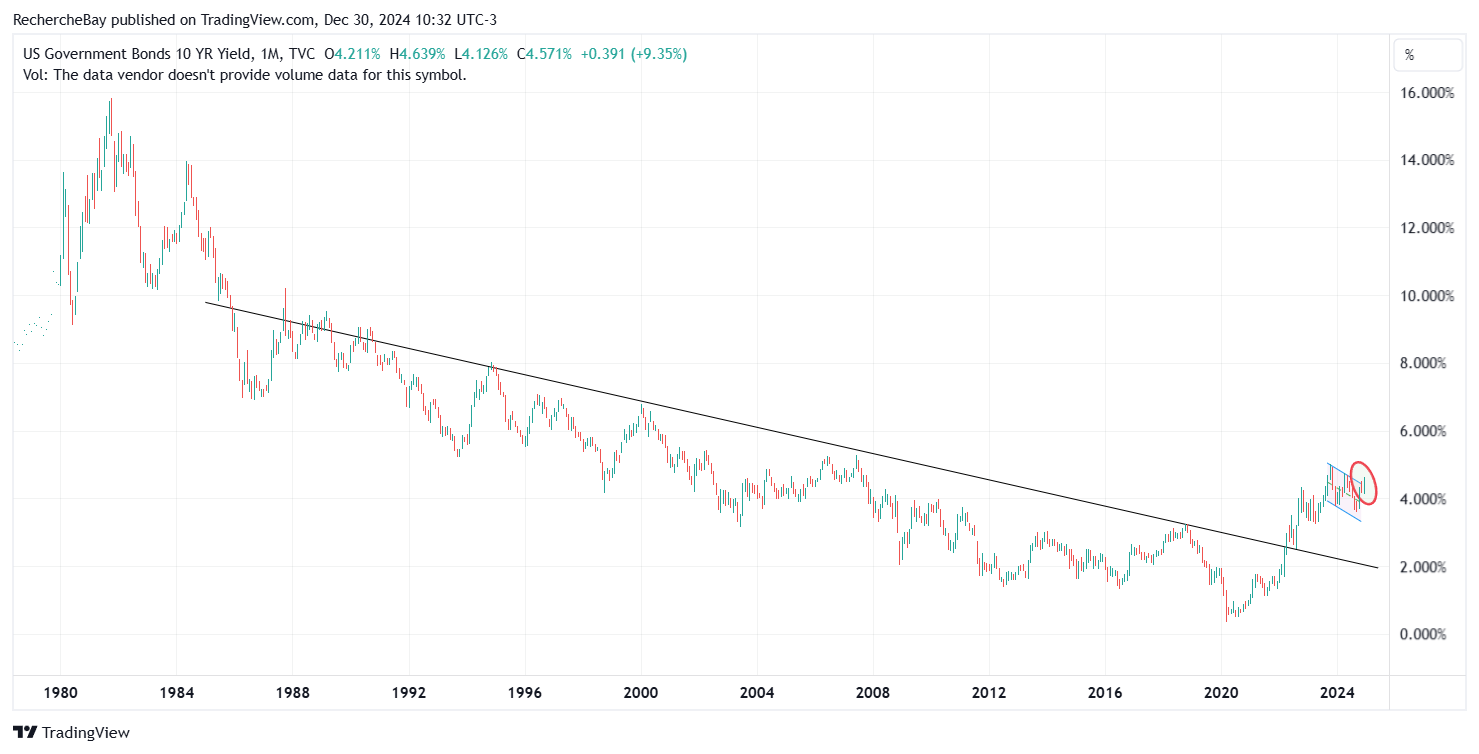

The first important graph is that of the US 10-year yield:

Since 2022, there has been a clear breakout of the historic downward trend in 10-year bond yields, marking a major turning point in financial market dynamics.

Since the 1980s, this trend, illustrated by the line drawn on the chart, has symbolized a paradigm of continuous reduction in the cost of debt, characterizing an era of steadily declining interest rates.

Today, the crossing of this threshold symbolizes a fundamental revaluation of the markets, driven by persistent inflationary expectations. Despite a slight correction, rates remain at high levels, squeezing both the real economy and household finances. In recent weeks, rates have crossed a bullish flag, signalling a likely progression to new highs over the coming year.

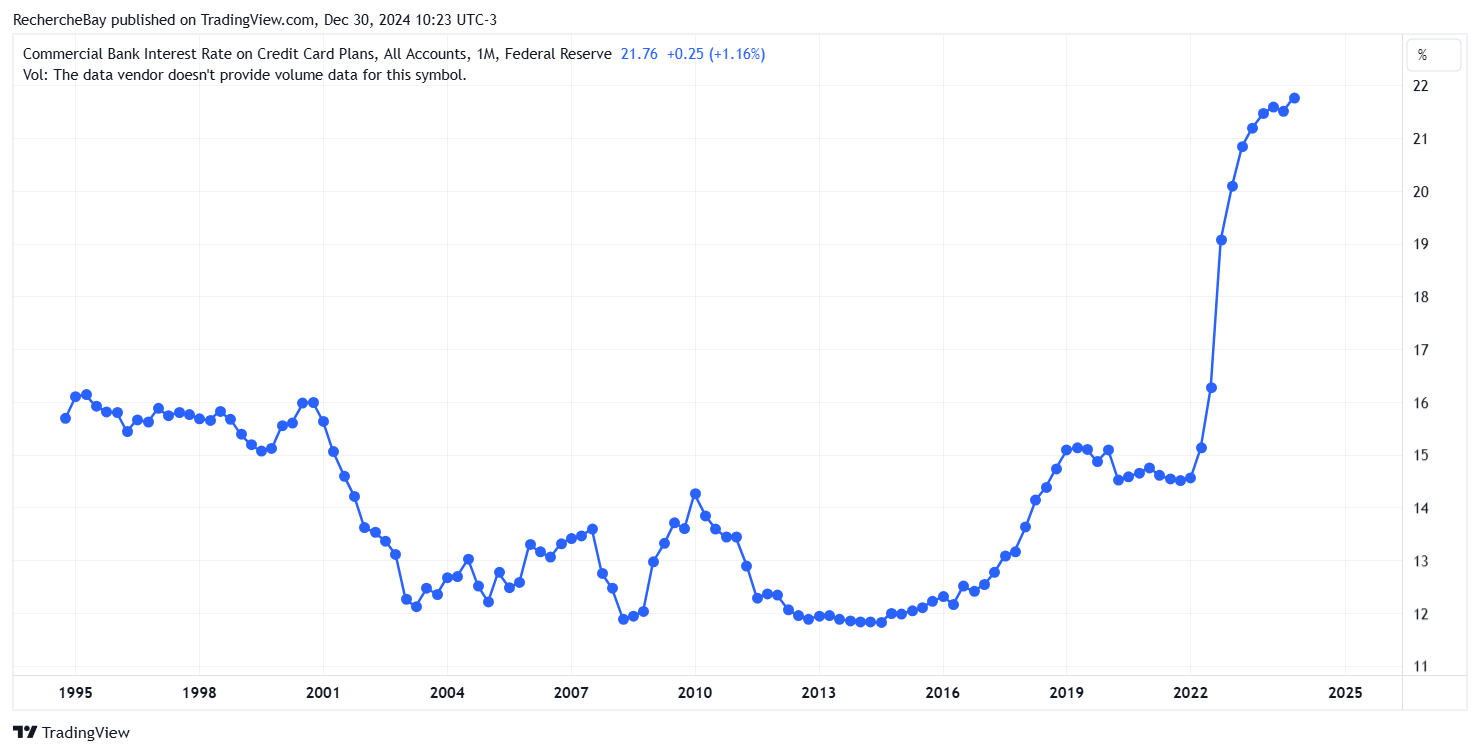

American consumers, already under pressure, are faced with skyrocketing interest rates on revolving credit, reaching a record 21.76%.

Never before have Americans paid so much on their revolving credit. Rates have been above 20% for more than two years now:

This exorbitant cost of debt is a direct braking force on their purchasing power.

The fact that interest rates of 20% have not curbed consumption in the United States is testimony to the abundance of available liquidity, a consequence of the massive injections of funds following the Covid crisis. However, this period of abundant liquidity for the American consumer is now over.

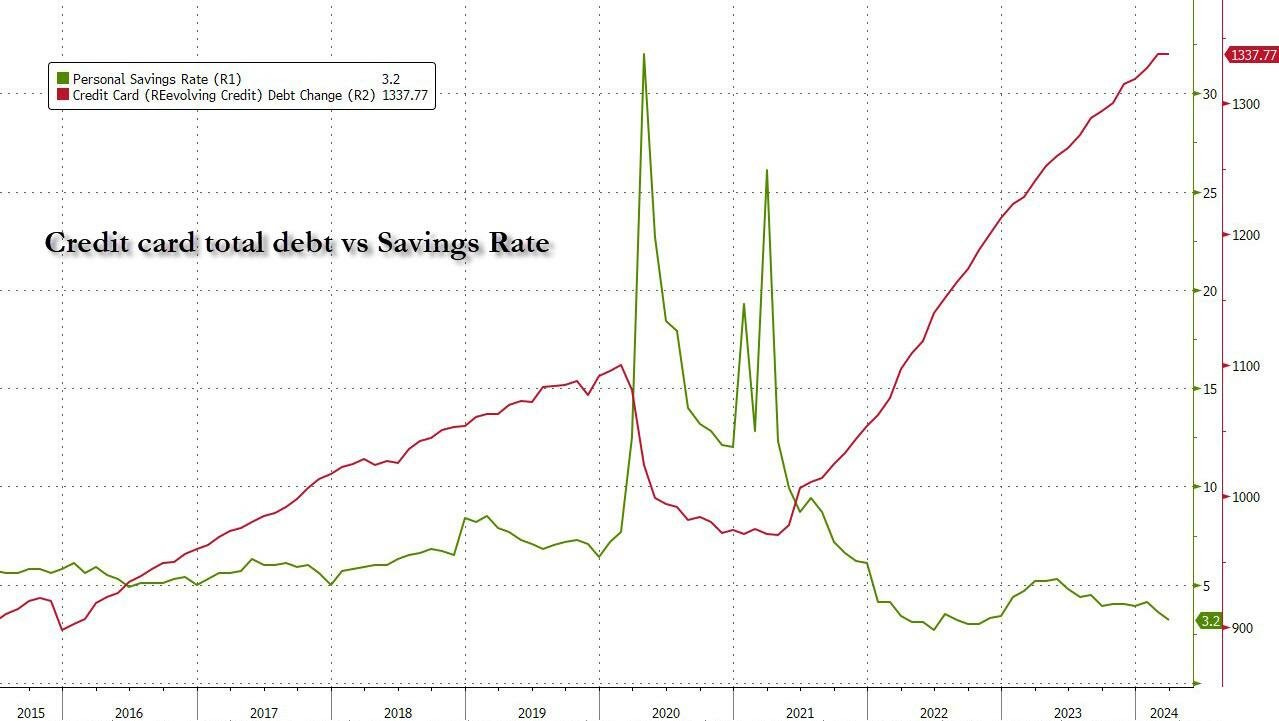

Consumers are now directly dependent on credit against a backdrop of drastically declining savings rates, which have stagnated at 3.2%. This means that households are using credit on a massive scale to compensate for an inability to maintain consumption from disposable income.

This situation can only exacerbate the accumulation of debt. Total credit card debt has reached $1.337 trillion, a historic level that exceeds even those observed during periods of economic crisis.

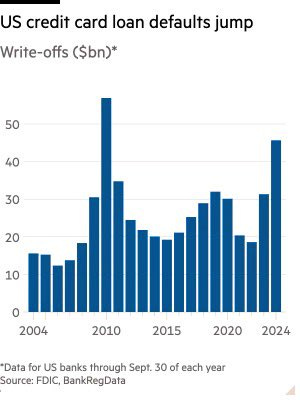

The spiral is clear: a growing reliance on debt to maintain a lifestyle, combined with record borrowing costs, leads to an increase in defaults.

The jump in write-offs on credit card loans, peaking at nearly $50 billion in 2024, is a leading indicator of the stresses to come in the financial sector:

This risk to consumer spending comes at the worst possible time. At the start of this year, the US economy is showing tangible signs of entering recession.

The Chicago PMI continued to fall, reaching 36.9 in December 2024, compared with 40.2 in November, below market forecasts of 42.5.

These data indicate a contraction in economic activity for the 13th consecutive month, recording its steepest decline since May:

The combination of these factors points to an imminent liquidity crisis in household consumption, the cornerstone of the US economy. Banks, exposed to these non-performing debts, could tighten their lending conditions, further exacerbating the economic slowdown.

At the same time, pressure on interest rates remains strong, restricting the Fed's room for manoeuvre, despite growing calls for easing.

This risk of economic contraction comes at a time when markets are reaching historically high levels.

The S&P 500 closed 2024 with impressive gains, after another record year in 2023.

The US stock market doubled in two years and tripled in five!

However, the last leg of the rise was achieved with very little volume, and market breadth is now at a dangerously low level...

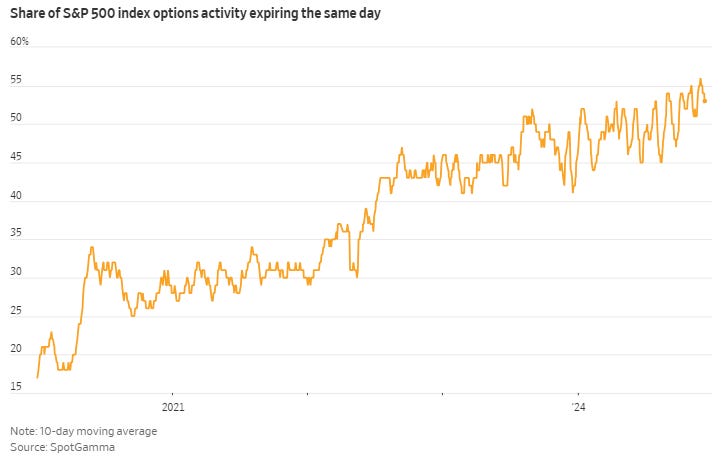

Bets on the future rise of indices are now focused on the very short term.

The year 2024 ended with a bang for the options market.

The most sought-after options are very short-dated, with record volume for 0DTEs (options expiring on the same day) at the end of the year.

Daily calls on the S&P 500 are at record buying levels, and there are now a majority of same-day expiring options on the S&P 500 options market:

Never before have bets on future share prices been made over such short timeframes.

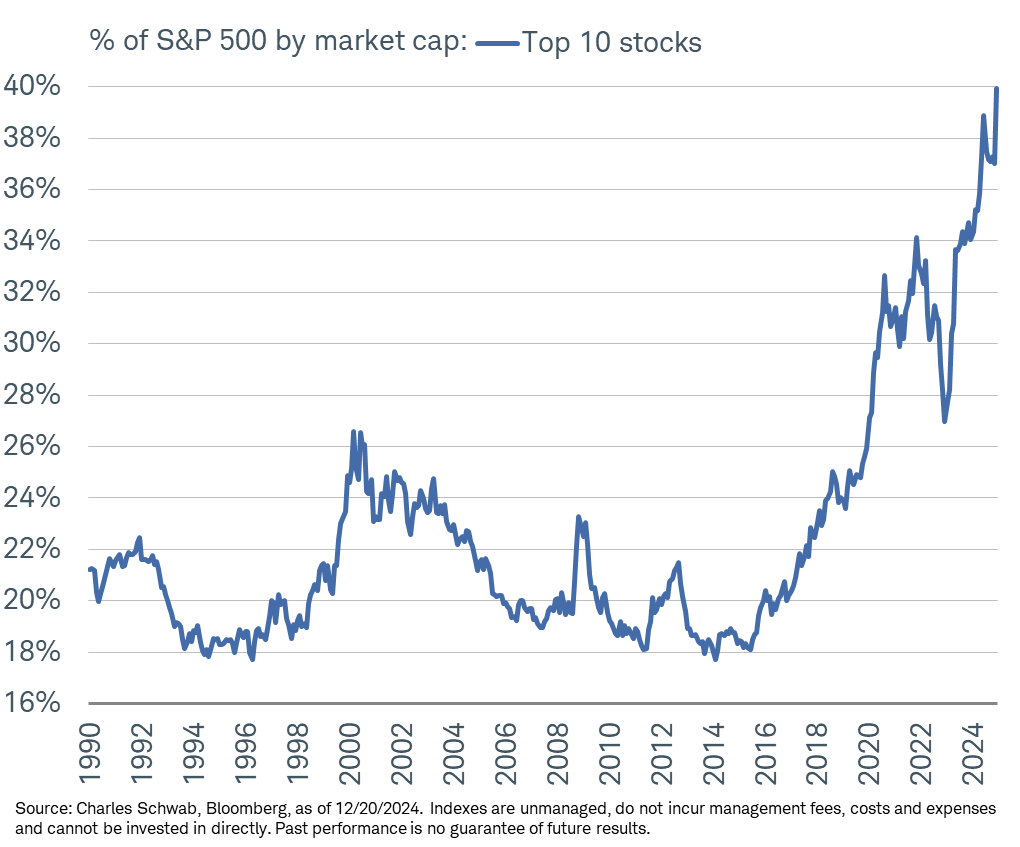

Another historic phenomenon is impacting equity markets: extreme market concentration. Currently, ten stocks account for almost 40% of the total capitalization of the S&P 500, an unprecedented level of concentration.

This imbalance highlights the growing dependence of stock market indices on a few leading companies, amplifying the risks of volatility and instability in the event of a correction in these stocks.

S&P 500 ETFs promise diversification and stability, but the increasing concentration on a small number of stocks increases risk.

In reality, investing in these indices essentially amounts to betting on ten companies, with the other 490 playing a marginal role. This lack of diversification exposes investors to considerable losses in the event of volatility, a particularly risky situation for non-professionals.

Investors are so confident in equities that they are keeping their cash allocation at historically low levels.

A Bank of America survey of fund managers reveals a historically low level of cash allocation, the lowest recorded since at least 2001.

In other words, never before have markets attracted so much interest from retail investors, while at the same time accumulating record levels of leverage and extreme concentration on a few stocks. This configuration makes them particularly vulnerable, as the slightest “pothole” could trigger major turbulence, amplifying volatility and systemic risks.

Against this backdrop of extreme risk, safe-haven assets such as physical gold are set to regain popularity.

The question of the timing of the next rise in the gold price remains uncertain: at what point will a market crash, worsening household fragility or increased pressure on the banking system prompt the authorities to make a decisive pivot in monetary policy to avoid a systemic recession?

More By This Author:

How Will Gold Perform In 2025 (After +30%)?

The Coming Paradigm Shift In Gold

Gold Still At Record Highs, Despite Rising Interest Rates

Disclosure: GoldBroker.com, all rights reserved.