2022 Outlook: The Fed’s Great Balancing Act

With peak liquidity reached, we expect the market will pay closer attention to fundamentals heading into 2022. The market is contextualizing demand-driven inflation, higher energy costs, expectations of when the supply chain will swing from tight to normal, and how the Federal Reserve (Fed) will respond to more sustained inflation pressures. In our view, the broad market needs to emphasize sustainability more, particularly in light of higher energy costs and changing weather patterns. Against this backdrop, markets are likely to be more selective in 2022.

Image Source: Pixabay

Key Takeaways

- We believe 2022 is likely to be the year of the Fed. Updated guidance and sentiments from the Fed about inflation expectations, and the speed and trajectories for tapering and interest rate increases, are likely to dominate sentiment in the equities and fixed income markets.

- Inflation is likely to remain elevated until mid-2022 while supply chains normalize. Currently, we are not concerned about stagflation.

- The Omicron variant of COVID-19 adds a new wrinkle in the fight to control the virus, and it may dominate market sentiment in the near term. The risk associated with Omicron may help dampen the demand-driven portion of inflation while exacerbating supply chain challenges.

- High energy prices challenge the European recovery. We expect more reshoring of strategic components and raw materials critical to the clean and digital transition.

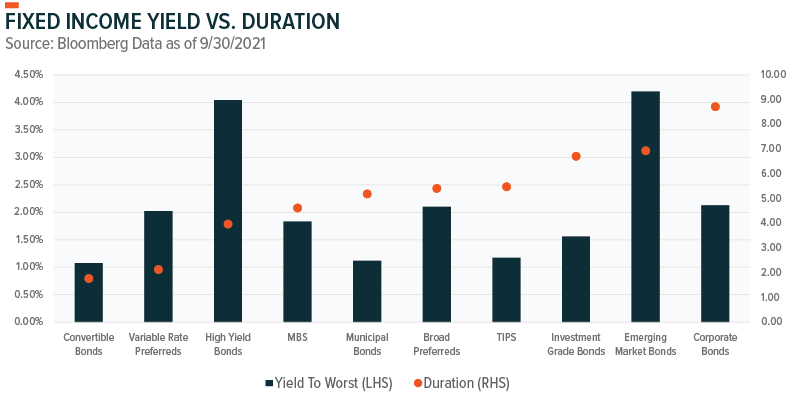

- Income investors should be prepared for higher rates and inflation to persist, a scenario that makes lower-duration assets and real assets more attractive.

- Equity markets will likely be more selective in 2022 with a focus on valuations, fundamentals, and quality.

- We expect margins to remain a focus as investors dissect which segments have pricing power. Given the backdrop of rising yields, we currently favor cyclical sectors with above-average purchasing power.

The Fed: Walking A Tightrope

This is the time of year when we go through the annual exercise of trying to prognosticate about the year ahead. We look at data, analyze patterns, consider various views, and then synthesize these inputs and draw conclusions. The economic and market cues may be similar from year to year, but every year is unique.

Heading into 2022, the two biggest questions on investors’ minds are if global real economic growth will remain strong and when the Fed will move from tapering its asset purchases to raising interest rates. With the median forecast for personal consumption expenditure (PCE) inflation at 2.3% on a 10-year basis, the Fed will likely need to change course soon to maintain the ability to combat inflation credibly.1

But the Fed has a delicate balancing act to perform. Temporary factors are responsible for a substantial portion of the current inflation, and the Fed must look beyond these factors. Moving too early could destroy the economic recovery, yet there are increasingly concerning areas where pricing pressures may be becoming more permanent. And then there are the economic risks associated with the Omicron variant, should it prove to be a major concern.

It’s never easy to strike the right balance and timing for raising interest rates. But after a decade dominated by deflationary concerns, the economy is now at an even more critical juncture. Are recent crisis memories shaping the nature of the Fed’s decisions, or are there underlying economic reasons for the Fed’s more cautious and measured approach?

The Fed started tapering in November, reducing its $120 billion worth of monthly bond purchases by $15 billion each month. This pace sets the end date for tapering around June, potentially opening the door to higher policy rates in the second half of 2022. However, recent language from the Fed signals growing concern about inflation and the possibility of tapering at a faster rate than what officials outlined at the beginning of November.2 The December Federal Open Market Committee (FOMC) meeting should provide more clarity on the pace of the taper and if the Fed believes hastening the removal of monetary support is necessary.3 Currently, the market expects 2–3 interest rate increases between June and December 2022.4

The European Central Bank (ECB) admitted that inflation will take longer to normalize than it forecast previously. However, the ECB sees low risk for core inflation overshooting its 2% target amid the slower economic recovery. The ECB is not expected to announce the end of its QE until towards the end of Q1 2022, before beginning to hike interest rates. Conversely, high inflation and wage pressures could force the Bank of England to increase interest rates faster than the ECB.

The ECB’s divergence from other central banks could weigh on the euro, reinforcing inflationary pressures in Europe in the medium term. In addition, we expect energy prices to remain volatile as Europe transitions to a net-zero economy. Persistent energy price inflation could lead to a sharp income squeeze that dampens consumer spending and corporate earnings. The European rates outlook could also be challenged by the latest COVID-19 wave across the region.

The U.S. Economy: Past Peak Liquidity, But Consumers Can Keep It Hot

With monetary policy somewhat more hawkish globally and fiscal support significantly scaled back, there is more onus on the consumer to stimulate the economy. In the U.S., healthy consumer balance sheets remain a liquidity buffer that we expect to bolster consumption well into 2022.

U.S households have accumulated $2.3 trillion in excess savings relative to the pre-pandemic run rate.5 After remaining elevated throughout the pandemic, in September, the household savings rate dropped to pre-pandemic levels of 7.5% of disposable income.6 The reduced savings rate and increased consumption reflected in U.S. retail sales rising 1.7% m/m in October, outpacing expectations for 1.4% m/m. This increase in retail sales was its strongest since March 2021, and it followed a strong jobs report and consumer price inflation (CPI) at 6.2% y/y in October, above the 5.8% that the market expected.7

The retail sales strength in October also speaks to one of the biggest challenges facing the economy: supply chain bottlenecks. The holiday shopping season arrived early as consumers got the message: If you want gifts for the holidays, get them early. This urgency pushed forward demand, potentially boosting October and November retail sales at the expense of December’s.

The flip side of higher retail sales is inflation. Nominal U.S. retail sales increased 1.7% month-over-month (m/m), but when adjusted for inflation, they only increased 0.75%. M2 money supply in the U.S. remains approximately $3.8 trillion higher than the pre-pandemic trend.8 This higher level of liquidity is likely to keep inflation and the Fed in the limelight as the economy and markets navigate supply chain normalization and the shift to higher interest rates.

Inflation: Transitory Signs, More Permanent Possibilities, But Not Stagflation

The worst of the supply chain bottle necks are probably behind us, but moving from peak congestion to a healthy flow will take time. As such, inflation will likely remain elevated until at least mid-2022. During this time, the more persistent areas of inflation are a growing concern. This has driven the Fed to shift their language away from the term “transitory”.

Transitory Portions Potentially Easing

Supply chain bottlenecks weakened economic growth and increased inflation globally. While these bottlenecks are the main catalyst for higher prices, they are also the most transitory portion of this inflation. And it’s possible that the U.S. supply chain crunch may have peaked already.

- Shipping rates decreased substantially during October while remaining subdued in November. The Baltic Dry Bulk Index, a proxy for the cost of moving major raw materials by sea, declined from its October peak of 5,650 to end November at 3,018, near its lowest levels in six months.9

- The logjams at the Ports of Los Angeles and Long Beach are easing. The number of container ships waiting to dock and unload remains high, but the threat of penalties on empty containers left at the ports longer than nine days recently resulted in a 29% decline in idle containers.10 This measure should continue to help alleviate congestion.

- The semiconductor shortage should improve from mid-2022 as supply comes online.11 The shortage affected multiple industries in 2021, everything from automobiles to home appliances. With the growing importance of innovation for economic growth, we expect greater investment in chip design and manufacturing alongside attempts to reshore strategic components of the chip industry. Following the U.S. CHIPS for America Act, which is aimed at enabling the U.S. to compete with Chinese technology, the EU targeted becoming 20% of global semiconductor manufacturing by 2030.

These developments don’t solve the supply challenges in the immediate term, but they are encouraging. The current trajectory is for supply chain bottlenecks to ease in the second half of 2022.12 This scenario could curtail real economic growth in the first half of 2022 while some economic activity may shift into the second half. More disruptions due to actual or perceived concerns related to Omicron are a potential wild card, though.

Potentially More Permanent Inflation

Higher wages and rising rental costs tend to be more permanent than supply chain-related inflation, for example. In September, single-family rental costs increased 10.2% year-over-year (y/y) on average across the U.S. with certain cities growing 25% y/y.13 And rising rental costs have downstream implications for inflation expectations elsewhere in the economy, including wages.

Labor markets didn’t escape the pandemic-related disruption faced across the economy. Improvement is substantial, but U.S. labor force participation remains stubbornly below its

pre-pandemic levels. The pandemic created higher-than-usual friction in the labor market as it altered priorities and life choices. For example, individuals who took early retirement or changed career paths might not re-enter the labor force in a similar capacity.

With a tighter labor market, continued concerns about COVID-19, and new lifestyle choices, employees are in a reasonably strong position to find well-suited employment. Companies that furloughed a significant number of employees due to the pandemic could struggle to rebuild their workforce more than companies that prioritized employee safety or companies able to work remotely.

These decisions are reshaping the labor market and wages in different industries. Outside of these categories of workers, wage growth is generally more subdued.14 It may take several quarters for these frictions in the labor force to normalize, but current conditions point to more localized wage pressure. And the localized nature of U.S. wage pressure reduces the risk of a wage inflation spiral.

Minimal To No Risk Of Stagflation

Inflation and rising energy prices have a way of conjuring memories of the stagflation of the 1970s. For most of the developed world, there is currently minimal risk of 70s-style stagflation. While the U.S. has the strongest demand pressure, it’s the U.K. that is at the greatest risk of a wage-price spiral. The British economy remains dependent on oil and imports, and shortages in these areas are a concern. However, labor shortages pose a more pressing concern because Brexit could extend their duration, especially for industries that rely on EU labor.15,16

Supply Chains: Companies Rethinking Their Strategies

Financial flexibility has placed certain companies in a stronger position to maintain supplies despite supply chain bottlenecks. Typically, these are larger companies that can afford to charter ships or flights, or companies with greater ability to pivot their production or sourcing. Access to comprehensive supply chain analytics helped companies adapt better to supply chain constraints. Prior to supply bottlenecks, these analytics were primarily the domain of companies striving to understand their impact from an Environment, Social, and Governance (ESG) perspective.17

A shift in perspective on what comprises operational efficiency is evident. Previously, efficiency meant lean global supply chains and just-in-time ordering and production. The recent supply chain bottlenecks illustrate the weaknesses in these systems and encourage companies to think more carefully about the sustainability of their operations longer-term.

Many Western economies and businesses are reassessing their dependencies on supply chains that run through certain regions including Asia. Supply chain disruptions have been a recurring challenge since the 2018 tariffs and the start of the U.S.–China trade dispute. The trade dispute continues to simmer with the U.S. encouraging companies to onshore production and China isolating more. Notably, increased focus on Chinese data privacy may reduce shipping data, potentially reducing supply chain visibility for Western companies. As China is home to six of the world’s 10 busiest container ports, the lack of shipping data could have major implications for supply chains, especially during the holiday shopping season.18

Additional considerations for companies include the growing focus on responsible sourcing and the importance of understanding sourcing’s impact across a company’s supply chain. Pressure for companies to make their supply chains shorter and smarter continues to grow. This type of pressure may have positive implications for the increased use of robotics and artificial intelligence technology.

Higher Energy Prices: Hard to Avoid, Highlight the Need to Go Green

After declining 1% in 2020, electricity demand is expected to rise 5% in 2021 and another 4% in 2022.19 However, the pandemic continues to disrupt the supply side, creating a global energy crisis for major economies including the U.S., Europe, China, and India. Coal inventories are low in India and China, and natural gas reserves are scarce across Europe. As a result, global energy prices moved higher; year-to-date, WTI crude oil, natural gas and coal have increased 40.7%, 263.3% and 146.0%, respectively.20 And higher energy prices are threatening to push global inflation above 5%.21

The sharp increase in the price of electricity is an economic and social crisis. Many European countries implemented temporary measures to protect their citizens from a significant income squeeze that could impede Europe’s economic recovery. European governments are offering subsidies to energy providers and imposing price caps. In Asia, coal shortages threatened the recovery and led governments to ration power supply to factories.

Improved efficiency and greater use of renewables can reduce dependence on fossil fuels. Currently, fossil fuels represent 60% of global energy production.22 A greener future can also promote energy independence for regions that rely on imported fossil fuels. Substantial investment is required over the next few decades, but now more than ever, economic leaders around the world show support for a digital and clean transition. Like fossil fuel energy powered the industrial revolution, cleantech and renewables may power the green revolution.

The strategic importance of energy is such that it drives global economic and geopolitical dynamics. All major economies are racing to establish dominance in the green economy. In 2020, Europe’s green transition achieved an important milestone. For the first time, renewables beat fossil fuel power plants for the most share of electricity produced, 38% to 37%.23 But reducing the fragility of the power grid is also important, as it will facilitate the transition to cleaner energy sources. Currently, most grids struggle with the intermittent nature of clean energy sources.

While transitioning to renewable energy sources, there’s a need for cleaner and more reliable base-load energy that is not coal. Nuclear power can generate electricity at a cost and scale comparable to fossil fuels while producing no greenhouse-gas emissions.24 However, the debate still rages among key stakeholders as to whether nuclear power can be considered clean energy. Nuclear power plants represent 25% of the electricity produced in the EU and have the potential to help the EU meet its pledge to reduce emissions by 55% by 2030 and be carbon neutral by 2050.

Longer-term, battery storage, hydrogen, and several other clean energy technologies may form part of the energy grid solution.

COVID-19: Varied Global Reactions to the Latest Wave

We look forward to the day when we write an outlook without a section dedicated to COVID-19, but with the resurgence of cases and the emergence of the Omicron variant, supply chain improvements could be delayed. In the near term, we identify two key areas to watch: travel restrictions in response to Omicron and Europe’s lockdown reactions.

The travel restrictions could dampen global travel during the holiday season and impact economic growth into 2022. Omicron, first identified in South Africa and deemed a variant of concern by the World Health Organization (WHO), is a challenge for the travel sector. The U.S. has joined the U.K., EU, and several Asian countries with restrictions on travel from southern Africa.

Europe is now in its fifth COVID wave. Austria became the first western European country to reimpose a nationwide lockdown in response to this wave and to make vaccines mandatory.25 Omicron has heightened concerns across the continent. The Netherlands restricted nightlife while Slovakia imposed more stringent restrictions.26 Focus is on Germany and whether they expand restrictions.

However, should hospital resources become stretched again, most European countries’ contingency plans include stricter enforcement of social distancing measures and a strong campaign for vaccines but exclude total lockdowns. As a result, the economic impact of this wave should be less than the previous ones.

As for the U.S., our base case scenario is that lockdowns remain highly unlikely. However, heightened caution can still have an adverse impact on consumption.

- Widespread lockdowns will be harder to manage economically, as supply chains cannot sustain a renewed shift in consumption towards goods.

- Policymakers are likely to be less willing to throw more money at the problem.

- The developed world has more options available to curb the virus’ spread. Whether through vaccines or the forthcoming antiviral pill, there is a growing arsenal of resources to deal with the health risks of COVID without the need for strict lockdowns.

Regardless of the options available in the developed world, China’s zero-tolerance COVID policy has major implications for global supply chains. China’s borders could remain closed through 2022.27

An Investor’s Guide: Cautiously Positioning For Liftoff In The Year Of The Fed

We anticipate that shifting expectations about the pace of interest rate increases and the timing of when the Fed is likely to start scaling back its balance sheet will dominate equity and bond market sentiment.

Thus far in Q4 2021,28 fixed income markets have reacted more than equity markets to the potential for faster interest rate increases. Treasury market liquidity declined at the start of tapering, which increased interest rate volatility to levels not seen since March 2020, as reflected by the MOVE Index.29

Conversely, a stronger-than-expected earnings season helped mute equity market volatility.30 Prior to the emergence of the Omicron variant, stronger than expected earnings kept S&P 500 Index volatility near its post-pandemic lows. As equity markets start to internalize higher yields and become more selective and discerning, we expect volatility to increase. For 2022, we expect average equity market volatility to be higher than the 2021 average.

Opportunities in Equity Income

For income investors, finding meaningful yield is still a challenge especially when factoring in today’s inflation rates. Investors should be prepared for higher rates and inflation to persist. In this scenario, lower duration assets and real assets become more attractive. Preferred stock is one alternative. Its high exposure to the Financials sector may be a buffer in a rising rate environment, as financial institutions like banks tend to benefit from higher lending rates.

Preferreds offer a balance between duration and yield, a tradeoff that most traditional fixed-income investors may find appropriate. Credit spreads widening is a risk for preferreds, but massive credit spread widening seems unlikely given the general reopening momentum and current inflationary trends.

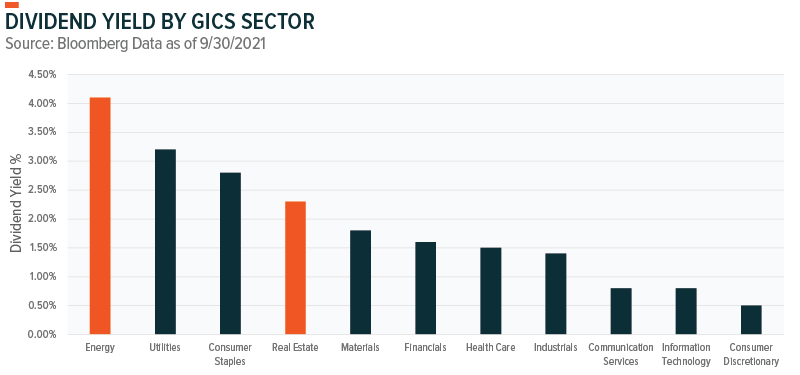

In equities, real assets still look attractive because of inflation-hedging characteristics. Energy and real estate are two areas investors may want to consider because business models in these sectors are often able to pass through inflation costs to customers. An added advantage for income investors is that these sectors typically offer higher-than-market income levels.

Commodities and real assets may be seen as late-cycle plays, but global growth expectations could slow towards the latter stages of 2022. Equity returns could be lower than the levels seen in recent years, but commodities and real assets may be beneficiaries of continuing inflationary pressures.

Focus On Fundamentals And Quality

U.S. equity market valuations are elevated. Given expectations for reduced monetary policy support and an environment with slower real GDP growth, substantial multiple expansion is less likely in 2022. This shifts the focus to company fundamentals. Strong underlying earnings and revenue trends are needed to support valuations.

Q3 2021 earnings season was surprisingly strong with large and small cap U.S. companies generally able to pass along higher prices. But there’s only so much input cost a company can pass down to the consumer before higher costs start hurting their financials. Margin pressure is forecast to impact Q4 2021 earnings with S&P 500 net profit margins expected to contract from 12.9% to 11.8%.31

This estimate is slightly below the September estimate of 11.9%. The decrease can be attributed to Consumer Discretionary and Industrials experiencing a reasonable contraction in their forecast net profit margins. Conversely, margin expansion for the Energy sector is expected to continue throughout Q4 2021.32 Given the supply situation, this scenario could have an even larger impact on small caps. Supply chain mentions on Q3 2021 conference calls increased far more for small caps than larger companies, which could reflect dependence on a smaller number of key suppliers or less flexibility to shift supply chains.33

For the S&P 500 Index, currently there’s a tradeoff between the pricing power of industries and sectors and the relative valuations on each of these market segments. Our November sector views outlines our sector preferences and the positive and negative factors impacting each sector. This monthly report also provides a detailed analysis of the pricing power across different S&P 500 GICS sectors while incorporating valuations into the analysis.

To summarize our analysis, in a rising yield environment, we favor cyclical sectors with above-average purchasing power. Financials, Energy, Industrials and Materials are the most positively correlated sectors with rising real yields. These cyclical sectors benefit the most from improving economic growth and higher yields. Energy, Financials and Materials scored well in our analysis. These sectors are likely to benefit from higher yields and commodity prices while valuations are more moderate.

Higher interest rates and continued economic growth is our base case scenario, but it is important to provide balance between market segments that are sensitive to economic growth and those that can grow despite the economy. Omicron’s full economic and market impact remains unclear. The Energy sector remains the most sensitive to travel bans and any reduction in community mobility or global economic growth expectations.

Conversely, the Information Technology (IT) sector has shown a strong ability to pass on pricing pressure. Also, IT has generally been less impacted by supply chain bottlenecks with industries such as software continuing to benefit from improved scale. However, valuations are typically more elevated.

Should concerns about Omicron escalate, it is likely to take the spotlight off the Fed, which could reduce the expected pace of interest rate increases and reduce the focus on valuations.

The Path Forward: More Selective In 2022

The pandemic illustrated that the market can look beyond challenging periods, provided they are not perceived as permanent. This message remains important, considering the current supply chain disruptions and rising energy prices. In our view, most of the disruptions are temporary and will be resolved. However, given the latest COVID-19 wave and Omicron, supply chain normalization may take longer.

Supply chain disruptions will have a substantial impact on companies and their relative competitiveness in this environment. Certain companies have been able to utilize their financial flexibility to ensure supplies, while others are reaping the rewards of greater supply chain analytics.

Overall, we expect the market to be more selective in 2022. In our view, margins, fundamentals, and quality will be key to portfolio positioning in the year ahead.

1 BofA Securities, Even economists believe in inflation, 11/19/2021

2 WSJ, Two Fed officials weigh prospect of speeding bond-buying taper process, 11/19/2021

3 Bloomberg, Fed looks likely to consider faster drawdown in asset purchases, 11/20/2021

4 CME, CME FedWatch Tool, 11/19/2021

5 Bloomberg, $2.7 trillion in crisis savings stay hoarded by wary customers, 10/17/2021

6 BEA, Personal saving rate, 11/19/2021

7 Trading Economics data as of 11/16/2021

8 Bloomberg data as of 11/16/2021

9 Bloomberg data as of 11/30/2021

10 Bloomberg, Container glut eases as Los Angeles Port threatens penalties, 11/16/2021

11 CNBC, The global chip shortage will drag into 2022 – but there are two bright spots, JPMorgan says, 11/19/2021

12 WSJ, When will the supply-chain strains finally ease?, 11/5/2021

13 CNBC, Rent for single-family homes surged 10% in September, boosted by pricey for-sale market and job growth, 11/16/2021

14 UBS, UBS House View, November 2021

15 Economist, The World Ahead 2022 Conference, 11/18/2021

16 Economist, The World Ahead 2022: Double whammy, 11/2021

17 Economist, The World Ahead 2022 Conference, 11/18/2021

18 CNN, China’s disappearing ships: The latest headache for global supply chains, 11/24/2021

19 IEA, Global electricity demand is growing faster than renewables, driving strong increase in generation from fossil fuels, 7/15/2021

20 Bloomberg data as of 12/2/2021. UK natural gas futures. All commodity returns reflected in USD terms.

21 Economist, The World Ahead 2022: Reality check, 11/2021

22 Ember, Global electricity, 11/19/2021

23 Ember, European electricity generation, 11/12/2021

24 Economist, The World Ahead 2022: Reality check, 11/2021

25 Bloomberg, Austria imposes lockdown, Germany may follow as Covid rages, 11/19/2021

26 The Washington Post, ‘We let our guard down’: Frustrated Europe heads into second pandemic winter, 11/26/2021

27 Economist, The World Ahead 2022: Closed, indefinitely, 11/2021

28 Data until 11/19/2021

29 BofA Securities, Global Research Highlights: Fed can’t quit US Treasury market, 11/19/2021

30 Morgan Stanley, Topics in Portfolio Construction: Taper Tantrum or Taper Tiger? Checking the Cross-Asset Implications of Shifting Monetary Policy, 11/16/2021

31 FactSet, Earnings Insight, 11/19/2021

32 FactSet, Earnings Insight, 11/19/2021

33 BofA Securities, Earnings Tracker: Week 4: Corporate America delivers yet again, 11/8/2021

Definitions

Baltic Dry Index: This index is issued by the London-based Baltic Exchange and is reported globally as a proxy for the price of moving major raw materials by sea. The index includes three key shipping sizes across 23 different global shipping routes carrying coal, iron ore, grains, and other commodities.

Personal Consumption Expenditures Index (PCE): Tracks the change in prices of goods and services purchased by consumers in the U.S.

M2 money supply: Includes cash, checking deposits and funds that are easily convertible into cash.

Pricing power: A company’s ability to raise prices without reducing demand in their products.

S&P 500 Total Return Index: The index includes 500 leading U.S. companies and captures approximately 80% coverage of available market capitalization.

Disclaimer: Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from ...

more