12 Bear Market Rules To Live By – Survive & Thrive In The Next Bear Market

Image Source: Pexels

I grew up in the 1970s-1980s when there was not a lot of abundance and wealth in most middle-class families. You were happy if you were in the middle class, but you didn’t have much in terms of wealth. Most people were getting by, but working hard to do it. In most families, both parents worked. When something is broken you fix it, rather than buying a new one. As a child, if you wanted something, you earned money to buy it. Times were good, but people worked hard to keep it that way. There was no "easy" money

Then in 1981, inflation and interest rates peaked. For the next 40 years, they declined until we hit zero or close to it. During this 40-year period of time, enormous wealth was created in the US economy. Asset prices went up on bonds, stocks, real estate, commodities, etc. If you were invested in virtually anything, you made money. Times were good and investing was easy, if you followed some simple rules of thumb.

Bull Market Rules Of Thumb:

- “Invest in what you know” (Peter Lynch).

- Buy and hold.

- Buy the dips.

- Bonds are “Safe” investments.

- Your portfolio should have your age-weighted percentage in bonds.

- Real estate always goes up.

- 60/40 portfolios.

- diversification reduces risk.

I'm sure I missed a few, but these are a few rules of thumb that people have repeated over the past 40 years with some reasonable success… That is until these rules of the thumb become "truth".

"A Half Truth is often a great lie."

Benjamin Franklin

What is not well known is that these mantras or rules of thumb are not the truth, but rather half-truths. Half-truths are dangerous because they sound true, but they are not 100% true. They are true sometimes, but not all the time. However, when we accept them as true 100% of the time, that is when we get ourselves into trouble. The 2008 housing bubble is an example of this. At the time most people made the dangerous assumption that real estate always goes up. So they made investments assuming that they could not lose if real estate always went up. When it turned out real estate can actually go down in price… a lot of people lost money.

Let’s fast forward to today.

For the past 40 years (1981 - 2021) virtually all asset prices went up, in large part because inflation peaked at a high of 14.8%. The Fed funds rate was at 20.6%. The 30-year mortgage rate was 16.63%. The 30-year US Treasury Bonds were at 15%+. Then virtually all rates dropped over the next 40 years. Ultimately ending in 2021 when most rates were at historic lows that most of us have never seen before. Some countries even had negative rates.

Today it is 2022 and inflation has topped 9.1% in July. While it is not the 14.8% we saw in 1981, it is closer to that than the 2020 low of 0.1%. For the first 6 months of 2022, the performance of 30-year Treasury Bonds was -21.54%. The S&P 500 was down -20.80%. The Nasdaq was down -29.76%. Oil was up +48.88%. The paradigm shift has begun and it is obvious most investors were not prepared. Many still are unaware of this paradigm shift

The economic engine that has allowed enormous wealth creation over the past 40 years is now reversing. Declining interest rates have turned into climbing interest rates. High asset prices will turn into lower asset prices. This reversal will lead to wealth destruction. The question is are you going to be a victim or a victor during the next 5-10 years?

12 Bear Market Rules To Live By

How To Protect Yourself And Your Family In The Next Bear Market

The first thing you need to do is to get control of your financial life. This may sound easy, but once again, consider that everything you think you know about finance is going to be different. In many cases, it will be the exact opposite of how you should manage your finances. I’ll give you some insight into what I mean

The prior 40 year bull market had some bull market rules of thumb that helped you succeed and grow your wealth. These rules only apply in a bull market. If you try to use them in a bear market you will end up losing money quite rapidly.

Now that we are entering this new paradigm, there are a new set of rules you should be aware of. These are what I call the Bear Market Rules To Live By. You should plan on incorporating these new rules into your investment philosophy if you want to increase your odds of success.

We want you to survive and thrive in this new paradigm. One of the first steps you can take is awareness. That is what I will give you today. I hope you enjoy these new bear market rules of thumb.

Bear Market Rule # 1: “The winner is the one who loses the least”

This is a tried and true maxim on Wall Street. The US stock market has had many bear markets in the past 100+ years and it will have many more in the future. Bear markets are just as normal as bull markets and just as important (even though you never like them while they are happening).

A bear market allows the economy to reset itself and clean up the mismanaged resources that happen in the bull market. Warren Buffett is famous for saying, “You never know who is swimming naked until the tide goes out.” Bernie Madoff is an example of this. He was able to perpetuate his fraud as long as the bull market continued going up. As soon as it started going down, he was forced to come clean with his fraud. Bear markets expose frauds and business models that do not work.

What makes bear markets so hard to predict is that they operate by different rules than bull markets do. Yet most investors are using “bull market rules” (see below). Another reason is that since there are so few of them, most investors don’t remember how to invest in them. I call this lacking institutional memory.

During the period from 1968-1982, the DJIA traded sideways with a lot of volatility in between. If you were an investor during that time period, you are probably older than 65 years. That is a shrinking segment of the population who remembers this period.

There was a similar period but lesser bear market which occurred from 2000-2013. There are more people who have experienced this latest bear market. However, since 2009, the stock market has been on a historic run-up. This bull market run was so long in duration, that most investors have forgotten what risk is. Most investors still have a sense of being invincible because they think the Federal Reserve will bail them out. Their mistakes are easily forgotten by higher moving markets. Bear markets are not that forgiving.

One of the most common errors I have seen in bear markets is that investors are still trying to “make money”. While I don’t like to compare investing to gambling, I think this example is warranted. If you have ever gone to a casino you know that people have “hot “ streaks and “cold “ streaks. When you are on a hot streak (i.e. bull market) you feel like cannot lose and when you do, your winners overshadow your losers. However, when you are on a “cold streak” you continuously lose money even with the most successful investing systems.

Think of bear market investing as having a cold streak at the casino. When you are on a cold streak, do you try to "make it back” or do you cut your losses and call it a night? The top investors in the world would tell you to call it a night and wait until there are better conditions. Unfortunately, most investors act like gamblers and they try to "make it back”.

I mentioned earlier that this new paradigm will cause you to reassess all of your assumptions. Many will be the opposite of what you have become to “know” as true. Most of your instincts, which have allowed you to build wealth in a bull market, will work against you in a bear market. I’m not suggesting you pull a “George Costanza” by doing the exact opposite of everything you do, but directionally that is closer than you might think.

Here is another example of how hard it is to invest in a bear market. Let's say you have your typical 60/40 portfolio designed for a bull market, when you compare it to a portfolio of 100% in cash. You might think that if stocks and bonds both decline in value that the cash portfolio is the best option because it does not decline in value. However, you are still losing value on your cash. Inflation as of July 2022 is 9.1%. This means your cash is declining 9.1% compared to last year. While you may be losing money on your stocks and bonds, you are also losing value on your cash.

The lesson you should take away from this is that you are going to lose money in most investing scenarios. The winner is the one who loses the least.

Bear Market Rule #2: “Don’t use bull market rules in a bear market”

"In the past 100+ years, the stock market (S&P 500) has gone up approximately 70% of the time and gone down approximately 30% of the time. Most of the time we are in a bull market. In a bull market, you can make money with the buy and hold strategy, if you are holding good assets. That is a bull market rule that increases your odds of success. However, in bear markets, the volatility increases, and uncertainty makes trends harder to establish in the markets. This increase in volatility and lack of clear direction causes people to make bad mistakes. Most of these mistakes are because they are investing using bull market rules. Don’t use Bull market rules in a bear market.

Some of the Bull market rules listed above which many investors hold as truth will work against you in a bear market. Let's look at a few of them.

"Buy and Hold" - This rule works well over very long periods of time, but it can also cause you to lose 40-70% of your investment from time to time and it can also cause you to lose your ability to compound your wealth. If the market goes down 50%, you are almost forced to hold your investments until the market "comes back".

"Buy the dips" - This is a strategy that works really well in a bull market. During a bull market on occasion, the market will drop 5, 10, 15, or 20% and then resume its march higher. So when you are aware of a situation when the market drops 10-20%, it makes sense to increase your exposure to that part of your portfolio. This could fall in the category of rebalancing or you could just use the cash portion of your portfolio to invest at a discount.

"Bonds are safe" - This is one rule of thumb that many investors are having a hard time accepting. Bonds have been

safe" investments for the past 40 years as they are historically less volatile and pay interest. This equals a way to get lower risk returns for your portfolio. However, in the first 6 months of 2022, 30-year US treasuries (measured by TLT) returned -21.54%. Now I'm not sure what standard each investor uses to judge "safe" but I don't call that safe... especially when retirees are not looking to experience that kind of loss. I think the financial industry needs to do a better job telling investors that bonds are not safe.

"Diversification reduces risk" - This is one of those half-truths that can be dangerous. If you take the rule of thumb and use it as it was intended, then it is generally true. The problem is that most people don't understand the nature of how diversification works. The truth of this rule is that if you compile a portfolio or non- or low- correlation assets, they should lower your volatility and risk over long periods of time. However, most average investors don't understand what non- or low- correlation actually means. Prior to 2000, you could create a portfolio with different asset classes and it would work as intended. However, in the 2020s, this method does not work well. Take the first 6 months of 2022, or 2008, or 2022, no matter what security you are invested in (with a handful of exceptions) you lost a lot of money. That is not how diversification should work. I wrote a few papers on this research as it has become a big problem for institutional money managers.

Bear Market Rule #3: “Don’t confuse brains with a bull market”

Bull markets make everyone look good. A rising tide raises all boats, as the saying goes. When markets go up, it tends to cause all asset prices to rise. Many investors think they are “smart” because their stock went up. When their stock goes down, they blame luck. The same principle holds true for gamblers. The winners think they are smart, and the losers say they are unlucky. I always found this interesting and humorous.

You can be smart and wrong or dumb (i.e. lucky) and right. That is the nature of investing. However, over time, the smart investor will do better. The bear market will hurt all investors the same. Smart or dumb.

Now that you know how bear markets work, you should be prepared no matter your level of investor expertise.

Bear Market Rule #4: “Save your dry powder” or “Live to fight another day”

Most people don’t understand the value of cash. Wall Street has conditioned most investors that inflation devalues cash and holding it is a wasted asset. However, no one who was in cash during the 2008 global financial crisis would tell you they were sad that they were in cash. Ray Dalio has recently said, “Cash is trash”, which is a catchy phrase, but it is also wrong. "Cash is King". Here is why.

In 2008 the stock market dropped over 50%. If you invested $100 into the typical stock, it dropped -50% causing your original investment of $100 to turn into $50. However, if you were in cash, you still had your $100. You could then invest in the same stock and buy 2x the amount of shares. In a way, your cash has increased by 100% in purchasing value. I know that is a weird way to look at it, but it is correct.

Remember... Cash Is King

Bear Market Rule #5: Trends do not last forever

While it may feel like the bear market is relentless and will continue forever. It won’t. There is light at the end of the tunnel… and it's not an oncoming train. Most bear markets are powerful and short-lived compared to bull markets. However, they can drag on as they did in the period from 1968-1982 or 2000-2013.

One of the best things you can do is to adjust your expectations. Most people who have experienced the 12-year bull market from 2009-2021 are expecting it will continue to deliver a 9% return annually. If those are your expectations, then you will be very disappointed in the next bear market. Most likely you will seek out solutions that promise great returns but will end up causing you to lose a lot of money during the bear market.

The bear market winter will cause a lot of pain and damage to portfolios. However, at some point, the markets will thaw and spring will arrive with it the start of a new bull market. The goal is to preserve capital during a bear market so you have dry powder for the next bull market where you can thrive.

Bear Market Rule #6: Bull markets make geniuses out of fools, and bear markets make fools out of geniuses.

There are many smart investors on Wall Street and there are many “lucky” investors. When times are good during a bull market, it is hard to tell the smart investors from the lucky ones. The “luck” tends to be higher when we are in a bull market.

In bear markets, smart investors can easily be duped into thinking they can predict the future. One of the investors’ biggest enemies is himself/herself. The battle is a psychological one more than anything else. Even the smartest investors make mistakes. Especially in a bear market when even good investments can go bad for smart investors. Everyone makes mistakes. Own it and move on if you want to be successful in a bear market.

Bear Market Rule #7: Don’t Fight the Fed

This is a rule which applies to both bull markets and bear markets alike, so it bears repeating. There might have been a time when the Federal Reserve was not such a driving factor in market buoyancy. But that time past long ago. You cannot ignore this market driving force… or you do at your peril.

It was take up too much ink to describe why this is the case but just know this. Whether you agree or disagree with the Federal reserve's policies, if you act contrary to their moves, you will lose money. Their pockets are much deeper than yours, so if they want to move a market they can do it. Ask yourself this question, is it better to be right or to make money?

Bear Market Rule #8: Reduce your risk

Most investors don’t understand how to properly manage risk. There has been a long-standing rule on Wall Street that diversification is a good risk management tool. However, it has not worked as a risk management tool since 2008. I say that it is a good volatility management tool, but when it comes to risk management, it is highly flawed. This is in large part because the markets have changed and investors are still using this flawed tool without noticing the change.

There is not enough space to explain risk management in great detail, so if you want to know more about how we do it, please contact us here to learn more.

Here is a simple framework for how to think about risk management, Identify, Mitigate/Transfer, and Accept.

Step #1 - Identity: Identity as many of the risks in your investment as possible. Don’t leave any out no matter how unlikely they are to happen to you.

Step #2 - Mitigate: Mitigate or transfer as many risks as possible. You won’t get them all, but do what you can to reduce many of the risks.

Step #3 - Accept: Once you have completed step 1&2, you will need to accept what is left over and move on. Ultimately you cannot eliminate all risks. There will always be some left. If there aren't then you didn't identify them all. The key here is, are they acceptable risks that you are willing to take? One example is when you invest in US Treasury Bonds, Notes, or Bills, there is a risk of default. The probability of that happening might be close to zero, but it is not zero. You still have to acknowledge that it is possible. Then you can decide if you want to worry about it. All investments have risks. Pick the ones you are comfortable with.

Bear Market Rule #9: Maintain Mental Flexibility

When it comes to investing, there is one constant... Change

Since change is a constant, that means you need to be adaptable and flexible to changes that you don't expect. This requires mental flexibility. This is hard for a lot of people as we human beings don't like change. Yet that is also our greatest strength.

When it comes to investing, most investors get emotionally tied to their positions and don't want to change for reasons that are not logical. There are over 100 cognitive biases that can affect you at any given time. Once you lose your ability to think critically about your investments, you lose all of your ability to make rational decisions about them.

Stanley Druckenmiller defined this mental flexibility as being able to take a position in one direction and when you see you are wrong, being able to immediately invest in the opposite direction with the trade (e.g. buying a stock, then shorting the stock). This is extremely hard for most investors to do.

At a more basic level, this mental flexibility allows you to not get emotionally tied into a position. As Milton Friedman famously said, “when the fact change, I change my mind.” Don’t be afraid to change your mind when the facts change or if you realize you are wrong in your investment. None of us like to admit when we are wrong, but it is an important skill to improve. I will point out that men have a harder time with this than women do.

Bear Market Rule #10: Fundamentals start to improve well after the market price improves.

What typically happens in any bear market is that the bad news causes stocks to drop, then more bad news comes out. It just keeps coming. However, at some point, stocks stop dropping and start climbing. It is weird to experience. Even though the bad news keeps coming, the markets climb. It makes you scratch your head.

Some investors think that this is because at some point the market feels like things cannot get worse. And if they cannot get worse, then they can only get better. Thus the market starts to climb. Then at some point, the fundamentals do get better and they follow the rise in stock prices. They call this “climbing the wall of worry”. People worry all the way up. Until it feels “easier” to invest. This is when all the big gains have passed us by.

Don’t feel like you need to pick the bottom… no one can do that. So don't try. However, if you find a price that makes sense for the risk you are willing to take, then it might be a good time regardless of the future movements of the price.

Bear Market Rule #11: Nominal price does not equal valuation

This is an error I have seen a lot in the past. In 1970 and 1974 the DJIA hit nominal lows in the price of the index. However, the best time to buy, based on valuation, was in 1982. Even though the index price was 33% higher in 1982, the value was better. It would take more ink than warranted here to explain in detail. The point you should take away from this is that nominal price and value are different and are not to be confused.

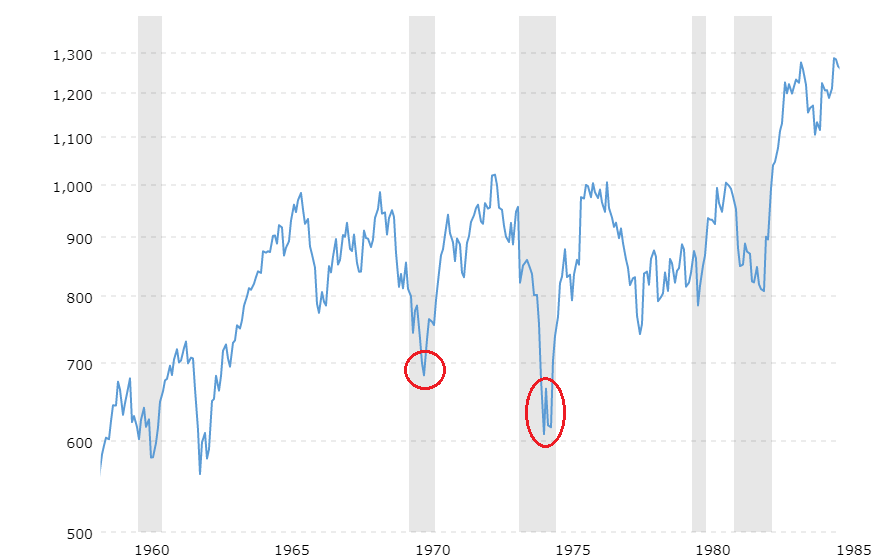

Here is a chart that might show you what I mean. The red circles are the nominal low points in the DJIA. Now you might think this is obviously the best time to buy stocks... you would be wrong. They are not bad times to buy stocks, but they are not the best time...

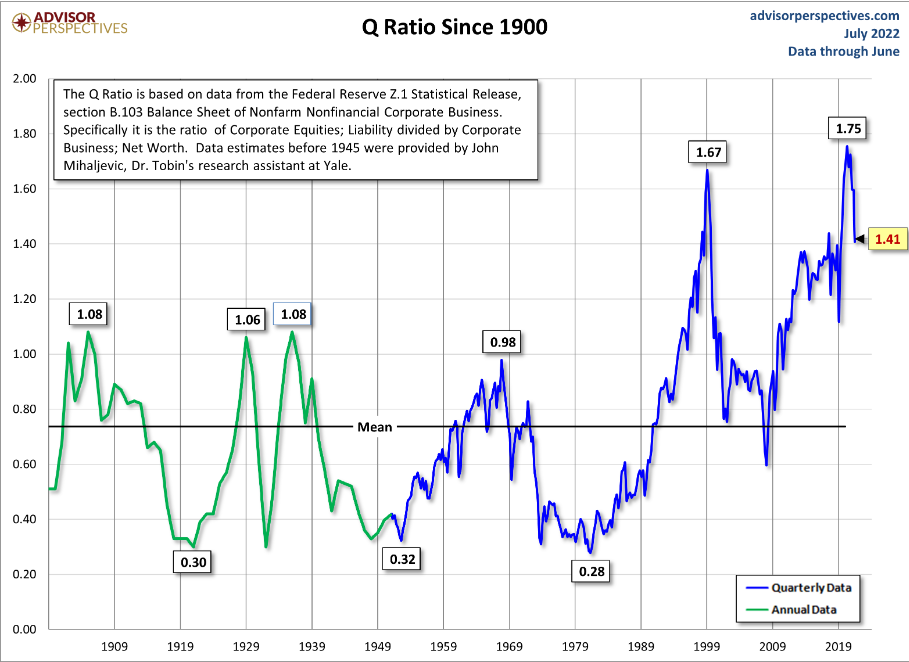

The best time to buy stocks during this period was 1982. See below. The Q ratio shows the lowest valuation point was at a time when nominal prices were higher. 1974 was a close second, but not the lowest.

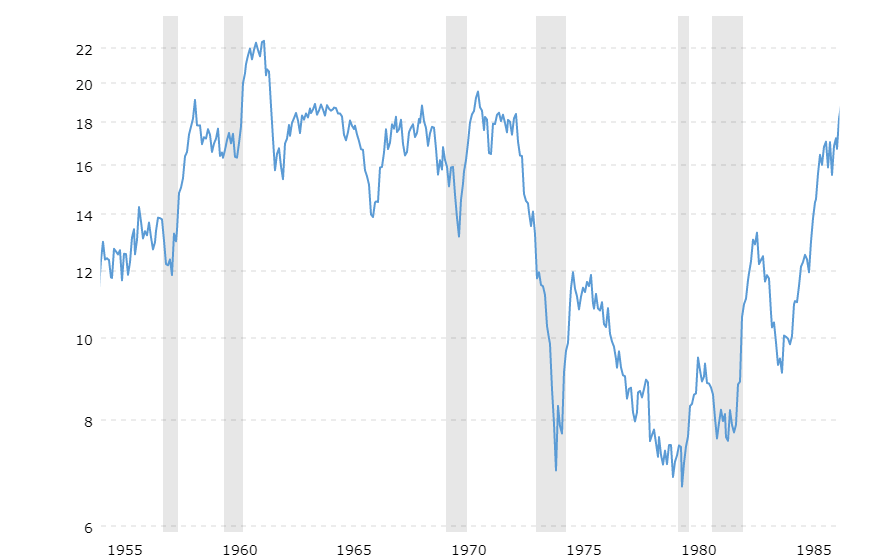

Here is another valuation chart showing the same thing. This one is probably more familiar to you, the PE Ratio. March 1980 was the low point for the PE Ratio on the S&P 500.

The lesson here is, that you cannot pick the bottom of the market. No one can without being extremely lucky. But you don't need to. Close enough is close enough.

Whether you bought it in 1974 or in 1982, it was a good time to buy it. The point is that nominal prices do not equal valuations. Keep that in mind

Bear Market Rule #12: Ratios will readjust lower

This happens during bear markets but if you have not seen it live, it is hard to understand. A normal market has different ratios (e.g. PE, PEG, etc). However, when the market experiences a big selloff, these ratios can get messed up. If you are relying on these for deciding on the right time to buy you will inevitably make mistakes.

Here is an example from 2008. The P/E Ratio is Price/Earnings. You would think that if your price drops, then your PE ratio will be lower (which is more desirable for buying). However, while the price is updated instantly, the earnings are only updated quarterly. This means there is a lag in the earnings number.

So let's say the price drops by 50%. The PE ratio will look good. But when earnings come out, let's say the earnings drop 50%, then the ratio goes back to what it was before because both price and earnings dropped 50%. So now the stock may be expensive even though it nominally dropped 50%.

My point here is to point out that you should not exclusively rely on ratios in a bear market due to the lag. Come up with valuations in advance that you want to follow so when things change you can be more adaptable to changing your buy price.

Wrap up:

Bear markets are hard to navigate. Some of our generation's best investors have a hard time navigating them. I do not expect you to become a top investor just by reading this. My goal here is to help you become better prepared so you can survive this next bear market and thrive and take advantage of the opportunities you will see in the next 5-10 years.

More By This Author:

Alternative Investments (Not Just) For The Wealthy – Investing in Wine with Anthony Zhang

Correlation Does Not Imply Causation

Dividend Growth – Learn How This Simple Secret Can Exponentially Increase Your Returns

This information is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) ...

more