10-Year US Treasury Yield ‘Fair Value’ Estimate - Thursday, Dec. 12

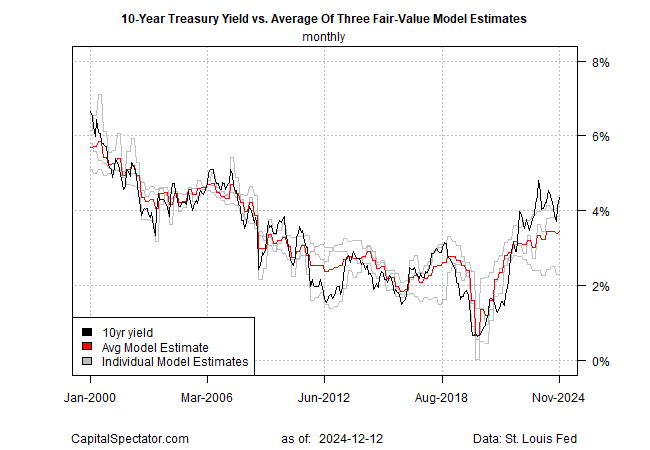

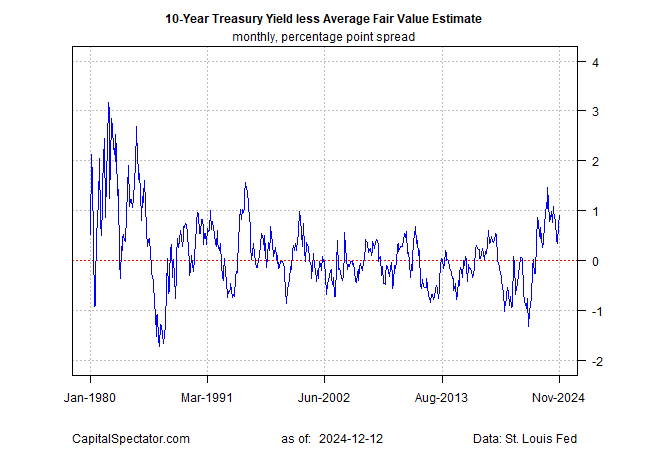

The market premium for the US 10-year Treasury yield continued to rebound in November vs. a “fair value” estimate calculated by CapitalSpectator.com. The increase marks the second straight monthly increase in the premium, which is now at the highest level since May.

The current market premium over the average fair value (based on the average of three models) edged up to 91 basis points last month. The premium increase arrived as the monthly reading of the US 10-year Treasury yield rose last month.

The backup in the market premium over the average fair-value estimate comes at a time of increased speculation about the path ahead for inflation and uncertainty about economic policy changes that the incoming Trump administration may implement in 2025 and beyond.

US consumer inflation picked up in November, rising to a 2.7% year-over-year rate while core CPI held steady at 3.3%. Both measures are well above the Fed’s 2% target, prompting some commentators to note that progress on taming inflation has stalled.

One theory for why the market premium in the 10-year yield is rising again after five months of declines through September: new worries about reflation risk. Some economists say that Trump’s plans to raise tariffs, reduce regulations to juice economic activity and deport millions of immigrant worker would lift inflation. On that basis, the bond market may be reacting by requiring higher yield compensation.

Despite the recent rise in the market’s yield premium, the current level (91 basis points) reflects a middling range relative to recent history, although it’s high compared with decades past.

If reflation is a rising risk, it’s not expected to curtail the Federal Reserve’s plans to continue cutting interest rates at the next policy meeting. Fed funds futures are pricing in a near-certainty that the central bank will cut its target rate by 25 basis points next week (Dec. 18). On the basis, the conditions don’t appear ripe in the near term for a material drop in the market’s yield premium unless incoming inflation data shows a renewed decline and/or economic growth slows.

More By This Author:

Communications Services Leads US Equity Sectors In 2024

Is The Downshift In US Inflation Stalling?

Syria’s Regime Change Reorders Geopolitical Risk For Middle East

Disclosure: None.