10-Year US Treasury Yield ‘Fair Value’ Estimate - Friday, Jan. 12

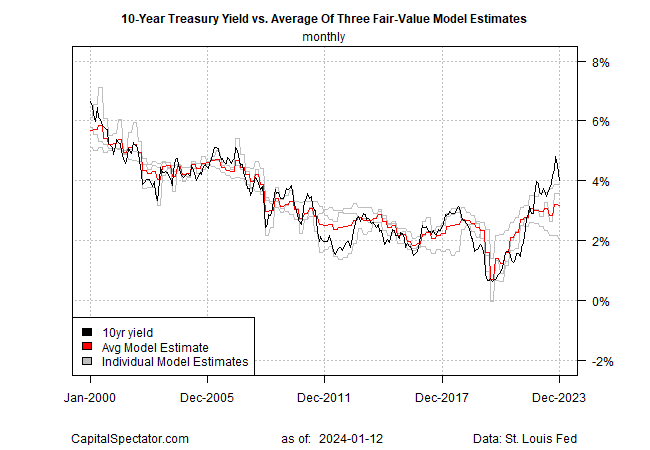

The US 10-year Treasury yield continues to fall, which is narrowing the gap between the higher market rate and a lesser “fair-value” estimate, based on the average of three models run by CapitalSpectator.com.

As recent updates remind us (see this November 2023 review, for instance), the benchmark 10-year rate has traded substantially above the average fair-value estimate for an extended period of time. As expected, the unusually widespread is finally narrowing. Nonetheless, the market rate still trades well above the average fair-value estimate, which implies a bias in favor of further narrowing in the months ahead. The question for how it narrows is one of mechanics: Will the gap fade due to a declining market rate, a rising estimate via the modeling, or both?

For some perspective, let’s start with a chart of recent history for the 10-year yield. At the close of trading on Thursday, Jan. 11, the benchmark rate eased to 3.98%. The downside trend in recent months leaves the 10-year yield more than a full percentage point below its previous 5% peak in October.

The December fair-value estimate for the 10-year rate is 3.16% (red line in the chart below), which is 82 basis points below the current market rate. The wide gap still suggests that the market rate will fall and/or the fair-value estimate (based on monthly data) will rise, or some combination of the two.

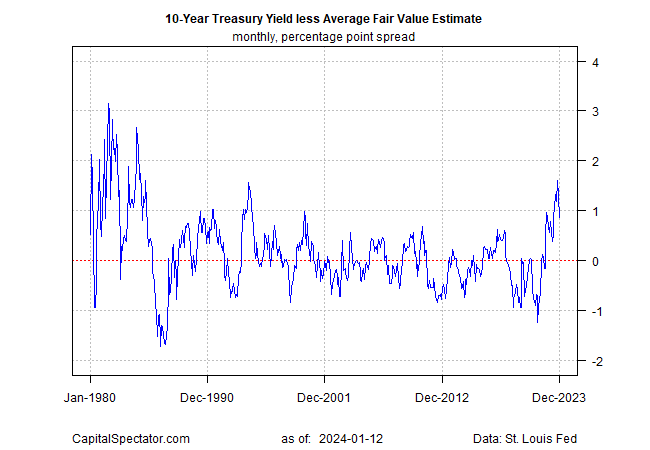

The next chart below shows the spread between the market rate and average model rate. The main takeaway: the gap continues to reverse after spiking to an unusually high level that was driven by a sharp rise in the market yield.

Despite the narrowing gap, the spread remains relatively wide. The tendency for reversion to the mean to prevail, eventually, suggests that this severe condition will continue to normalize in the near term. As The Capital Spectator observed in November, “History suggests such an extreme level doesn’t last long.” Today’s update provides a fresh reason to assume no less.

One caveat to keep in mind: Fair-value modeling isn’t useful for timing market changes in the short term, but it does offer context for marking extremes managing expectations, and, perhaps, developing strategies for longer-run investment decisions. Accordingly, the modeling continues to predict that the wide gap in the market yield vs. the average fair-value estimate has peaked and so more narrowing lies ahead.

More By This Author:

Managing Expectations For December’s Consumer Inflation Report

Still Waiting For A Clear Risk-Off Signal At 2024’s Start

Desperately Seeking Yield: Monday, Jan. 8

Disclosure: None.