10 Economic Trends That Will Shape The U.S. And Gold Market In 2020

What will 2020 be like? Well, as a leap year, it will be for sure longer than 2019, but the rest is a mystery. However, let's point out a few important trends that will shape the U.S. economy and the gold market this year.

- Inflation should remain subdued.

- The same applies to GDP growth, although global growth could bottom out.

- The Fed will be in a wait-and-see mode, but with a dovish bias.

- The ECB and the BoJ will remain accommodative.

- U.S. dollar should stay strong.

- The U.S. fiscal policy will remain easy.

- Trade wars will be softer with a phase one trade deal signed.

- The uncertainty regarding Brexit should also diminish, as Conservatives won a majority in December parliamentary election.

- Thus, investors could increase their appetite for risky assets.

- Bond yields have room to move higher in 2020.

We will analyze them for you now, as we believe that investors need a clear guide to navigate through choppy waters of our turbulent economy. Without a broader fundamental perspective, it's easy to drown in the sea of conflicting and exaggerated headlines.

First, inflation should remain subdued, as low inflation is not transitory but more of a permanent phenomenon due to global competition, technological progress, and disruptors such as Amazon or Uber.

Second, the U.S. GDP growth is expected to slow down, falling from 2.4 percent in 2019 to 2.1 percent in 2020, according to the IMF, or even below 2 percent, according to other forecasters. However, with eased trade disputes and global growth possibly bottoming out, the U.S. economic growth could surprise on the upside.

Third, given subdued inflation, the Fed is unlikely to hike the federal funds rate in 2020. The latest dot-plot suggests a pause this year, which would imply a more hawkish stance than in 2019 when we witnessed three interest rate cuts. However, the possible economic slowdown or even more serious economic developments could prompt the U.S. central bank to take some dovish actions.

Fourth, both the European Central Bank and the Bank of Japan will remain accommodative. So, even if the Fed pauses this year, it will be more hawkish than other major central banks, which should support the US dollar at the expense of gold. The growth, while anemic, will also be higher in the U.S. than in other G7 countries.

Fifth, as far as the U.S. economy outperforms its major peers, even if it marks the slowdown, the greenback should remain strong, exerting some downward pressure on the yellow metal.

Sixth, the U.S. fiscal policy will stay accommodative. The fiscal deficit is forecasted to increase from $1,092 to $1,101 billion. However, relative to GDP, the fiscal deficit is expected to decrease from 5.2 to 4.8 percent, according to the presidential projections. Abstracting from details, the fiscal stance will remain similar to the last year's.

Seventh, as the U.S. and China have reached a preliminary agreement in their long-running trade dispute, the worries about the full-blown trade war should ease, and confidence could return to the markets.

Eight, the Conservative party secured a large majority in the December UK Parliamentary elections. It means that Brexit will likely occur by the end of January. No matter how one views Brexit, the great uncertainty is now removed and businesses can implement their investment plans once again.

Ninth, as two big geopolitical headwinds receded somewhat, investors' risk appetite could increase, so they will probably allocate more funds into equities, at the expense of gold and other safe-haven assets.

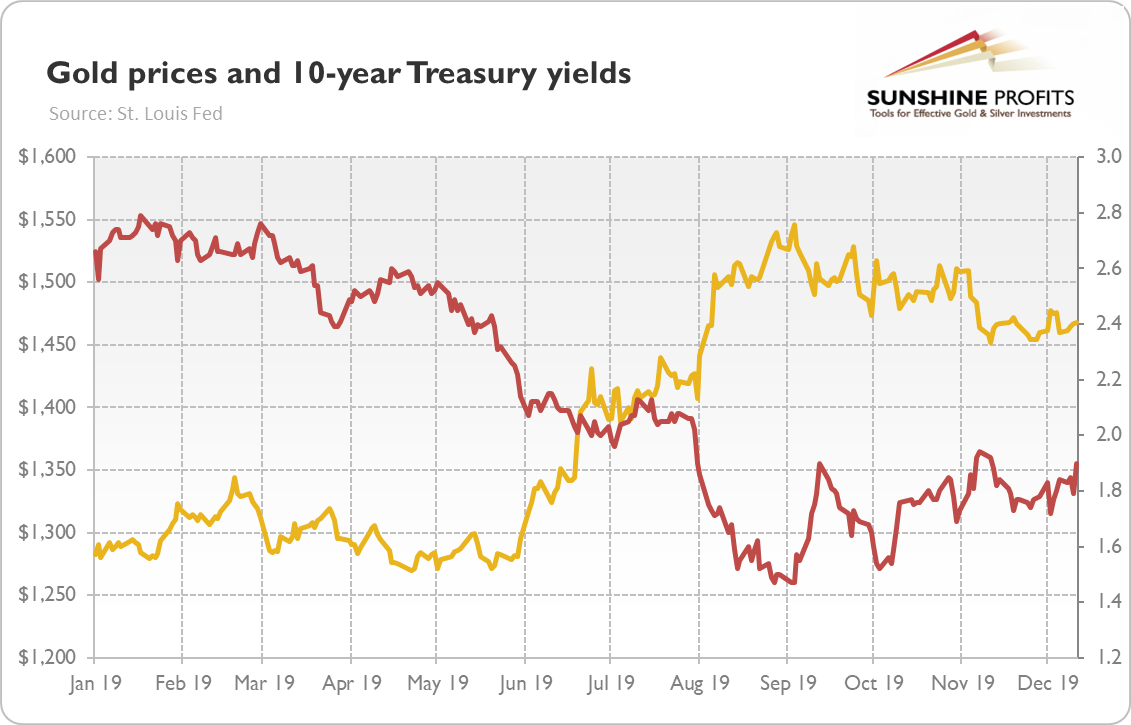

Tenth, indeed, if investors increase their appetite for risky assets, they will shift their funds from the Treasuries into the stock market. Lower demand due to eased recession fears and higher supply due to higher fiscal deficit could drive down the bond prices, increasing their yields. Higher interest rates would be negative for gold prices. As the chart below shows, the price of gold peaked in 2019 when the 10-year Treasury yields bottomed out. So, if the yields increase further, gold should continue its downward trend.

(Click on image to enlarge)

Chart 1: Gold prices (yellow line, left axis, London P.M. Fix, in $) and nominal yields on 10-year US Treasury (red line, right axis, in %) from January to December 2019.

The above trends are, unfortunately, not very supportive of gold prices. The fiscal policy will be similarly easy, while the monetary policy will be more hawkish than in 2019, supporting the U.S. dollar. The geopolitical headwinds have softened, which should support the risky assets and bond yields. So, we could see a strong dollar, higher real interest rates and lower risk aversion - a very bad combination for the price of gold. Hence, from the fundamental point of view, 2020 may be a worse year for gold than 2019. Unless, of course, something really bad happens, such as for example, the next economic crisis arrives.

If you enjoyed the above analysis and would you like to know more about the most important macroeconomic factors influencing the U.S. dollar value and the price of gold, we invite you to read the ...

moreComments

No Thumbs up yet!

No Thumbs up yet!