Blue Skies Ahead For XRP? SEC Finally Drops Case Against Ripple

Image by WorldSpectrum from Pixabay

XRP climbed above $3.25 after the U.S. Securities and Exchange Commission dropped its long-running case against Ripple Labs, ending a crucial chapter in the legal battle. Ripple Labs helped launch XRP and remains heavily connected to the token and the ecosystem.

Following the lawsuit dismissal, XRP jumped 11%, climbing from around $2.90 to a high of over $3.30 before settling near $3.22.

(Click on image to enlarge)

Source: XRP/TradingView

XRP Set for New Rally After Outpacing Solana in Futures

In a case dating back to December 2020, the SEC sued Ripple, alleging the company raised $1.3 billion through unregistered XRP securities sales. In July 2023, Judge Analisa Torres ruled that XRP was not a security when sold to retail investors but qualified as a security in institutional sales. Ripple was fined $125 million in August 2024, and the case was dismissed last week, August 7, 2025.

The dismissal of the U.S. Securities and Exchange Commission’s case against Ripple Labs lifted a major weight from XRP investors. SEC Commissioner Hester Peirce confirmed the agency’s decision to drop its Ripple case appeal, sharing the August 11 announcement from the SEC’s Litigation Releases page.

Last week, the SEC's case against Ripple was finally laid to rest. A welcome development for many reasons, including that minds once occupied with litigation now can concentrate on creating a clear regulatory framework for crypto: https://t.co/xU1VrmSnFM

— Hester Peirce (@HesterPeirce) August 11, 2025

Paul Atkins, the SEC chairman, commented that the agency should now move its focus from litigation to creating clear regulations that support innovation while protecting investors.

Additionally, Ripple Chief Legal Officer, Stuart Alderoty, reacted to Commissioner Peirce and Chair Atkins’ comments: “Thank you for your leadership in moving America towards clear rules of the road for crypto, Chair Atkins.”

It’s worth noting that the press release confirmed the Final Judgment will remain in place, including an injunction barring Ripple from violating the registration provisions of the Securities Act of 1933.

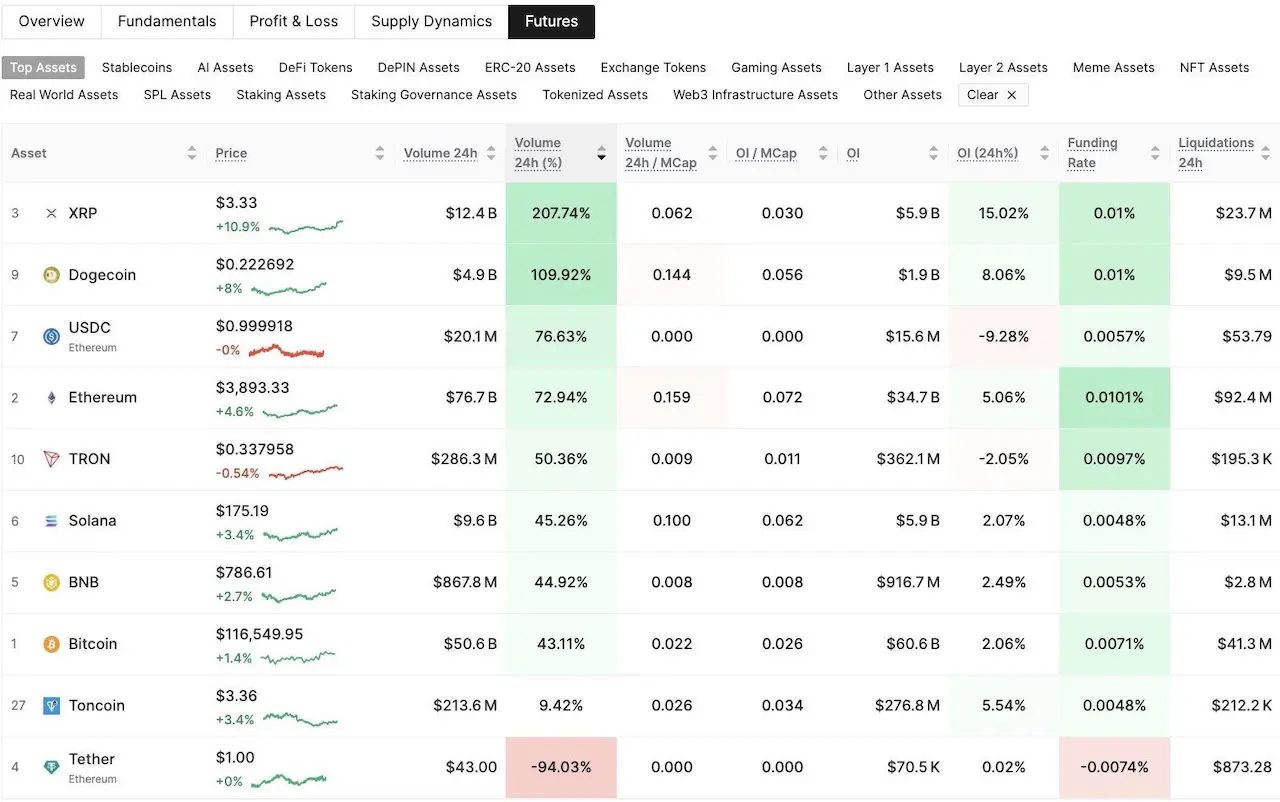

Glassnode on-chain data shows XRP futures activity surged over the weekend, with 24-hour volume rising 208% to $12.4B, overtaking Solana’s $9.6B. Additionally, open interest, which represents the value of unsettled futures contracts, rose 15% to around $5.9 billion.

(Click on image to enlarge)

Source: Glassnode

The legal event has sparked renewed confidence across the market, with institutional participation surging in the wake of the decision.

XRP Price Outlook: Focus on Spot ETFs and Market Trends

XRP has surged over 550% since November, climbing past $3 on Tuesday. Technical analyst Gert van Lagen believes this strong momentum could drive the price toward $34 during the current bull cycle.

(Click on image to enlarge)

Source: TradingView

According to Van Lagen, XRP has broken out of a seven-year double-bottom pattern after surpassing its neckline around $1.80. The coin then retraced to that neckline, which held as support.

$XRP [2W] – Ripple is ready to rip.

— Gert van Lagen (@GertvanLagen) August 11, 2025

The 7-year double bottom has broken out at ❌

The neckline was successfully retested at 🔵

ATH cleared — first target near ~$34, at 2.00 fib. extension of double bottom.

--> Compare with 2014-2017 setup pic.twitter.com/aVk0lxp03O

Notably, the token might retreat from its August 8 peak of $3.3826. Analysts point to the absence of developments toward an XRP spot ETF as a primary drag on sentiment.

In the near future, the price direction could be shaped by several catalysts: updates on an XRP-spot ETF and Ripple’s progress toward a U.S. banking license.

XRP closed Monday, August 11, down 1.74% at $3.1326, extending a losing streak. The decline came after the crypto market snapped a five-day winning streak, slipping 0.91% to bring its total value down to about $3.89 trillion.

While XRP consolidated, Bitcoin reached a record high of $122,190 before reversing. Popular crypto analyst Benjamin Cowen points out that Bitcoin has a history of strong performance in July and August during post-halving years.

He added that, based on past cycles, September could bring a short-term pullback before Bitcoin pushes toward new market cycle highs in Q4.

(Click on image to enlarge)

Source: Benjamin Cowen X

The jump was driven by stronger demand for BTC, showing how the market’s top asset is widening its lead over altcoins.

More By This Author:

Are AI Stocks Outperforming The Market This Year?

The Most Shorted Stocks In The First Half Of 2025

Reddit Stock Nears All-Time High – Can It Keep Rising?

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more