Bitcoin Tests Technical Resistance – Softer USD Lifts Sentiment

Image Source: Unsplash

Bitcoin, Ethereum, and Dogecoin are trading higher in today’s session, with the total market capitalization of the industry rising back above $1 Trillion.

In the same way that speculation and crowd psychology fueled the rally that drove Bitcoin to an all-time high of $69,000 in November, rising recession risks, persistently high inflation and aggressive rate hikes have dampened the demand for risk assets, supporting the safe-haven Dollar.

With investors making provision for a potential 100 basis point rate hike at the July FOMC, the ‘crypto winter’ has become more prevalent for major players with Three Arrows Capital, Celsius and Coinbase taking center stage.

Following the bankruptcy of Celsius and crypto hedge fund Three Arrows Capital fears that the largest US crypto exchange Coinbase may be in trouble have intensified after the company announced its plans to suspend its affiliate program.

For those who may recall, just last month, Coinbase CEO Brian Armstrong announced an 18% reduction in its workforce in an effort to cut costs.

Now, after combining its USD and USDC markets, the company has made the decision to suspend its affiliate program that has contributed to the exchange’s success since its introduction in 2019.

BITCOIN TECHNICAL ANALYSIS

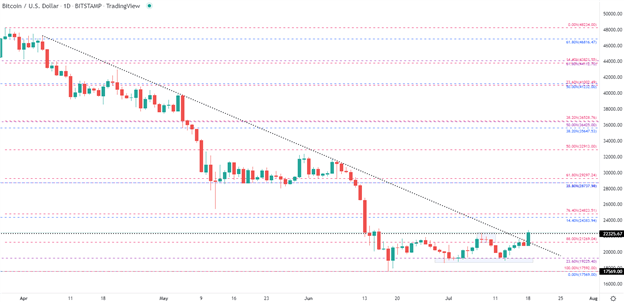

Despite elevated fears that the Crypto giant may not survive the ‘winter’, Bitcoin prices are currently trading around $22,400, a level that was initially rejected earlier this month (08 July). As price action remains supported by the descending trendline (taken from April 2022), a softer USD may allow bulls to drive prices back towards the $23,000 with the next level of resistance holding at $24,383. However, for a resumption of the bear trend, a break of $20,000 and $18,000 brings the December 2020 low into play at $17,569.

Bitcoin (BTC/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

More By This Author:

Gold Price Forecast: Gold Grasps for 1700 Following Five-Week-PlungeS&P 500 Recovery, Goldman Sachs, Bank of America Earnings

Defining Week For The Euro: ECB Lift-Off, CPI And Bond Market Jitters

Disclosure: See the full disclosure for DailyFX here.