Bitcoin Spikes After ETF Court Ruling

Photo by André François McKenzie on Unsplash

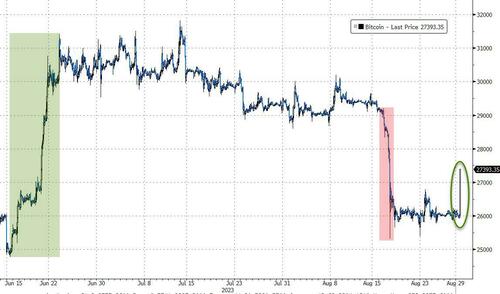

With Bitcoin languishing back at pre-ETF excitement levels - despite hashrates reaching record highs - the news this morning has re-awakened those animal spirits in crypto.

The U.S. Court of Appeals for the DC Circuit issued its opinion in Grayscale v. SEC this morning, ruling that the agency was unreasonable to deny the crypto giant permission to launch a Bitcoin ETF.

The win by Grayscale on Tuesday comes after the firm sued the SEC in June 2022 - when the US securities regulator blocked the crypto-focused asset manager from converting its Bitcoin Trust (GBTC) to an ETF.

The firm had argued that the SEC’s approval of ETFs investing in bitcoin futures contracts, but not proposed products that would hold bitcoin directly, is “arbitrary and capricious.”

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products,” wrote Judge Neomi Rao.

Grayscale CEO Michael Sonnenshein said in a Tuesday tweet that the company’s legal team is “actively reviewing” the court’s decision.

Bitcoin is up from $26,000 to $27,000 on the headline.

(Click on image to enlarge)

Grayscale says converting to an ETF would help it unlock about $5.7 billion in value from the $16.2 billion trust by making it easier to create and redeem shares.

GBTC itself is up around 17% on the news, compressing its discount to NAV even more dramatically...

(Click on image to enlarge)

As Fortune.com reports, the ruling does not mean the SEC has to immediately implement the ruling.

The SEC has 45 days to appeal the decision, which could then go either to the U.S. Supreme Court or a so-called 'en banc' review, a legal procedure used when a team of judges handles a case deemed to be extremely complex.

While it could appeal the decision, it is also facing applications for Bitcoin ETFs from traditional financial firms like BlackRock and Fidelity, which makes it more likely the agency will simply accept the court ruling and approve applications in coming weeks.

Of course, the SEC will likely not take this denial well and, as some industry participants have noted, will now seek another means to stop this ETF leading top more widespread adoption of crypto.

More By This Author:

3M Shares Jump As Litigation Payout On Defective Military Earplugs Viewed Favorably By AnalystsBRICS Expands Footprint In The Global South

UMich Inflation Expectations Jumped In August, Sentiment Slipped

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more