Bitcoin Soars Above $11k For First Time Since March 2018, Ether Tops $300

Update (1030ET): Bitcoin just puked some of its overnight gains on a heavy volume spike... But is rebounding rapidly...

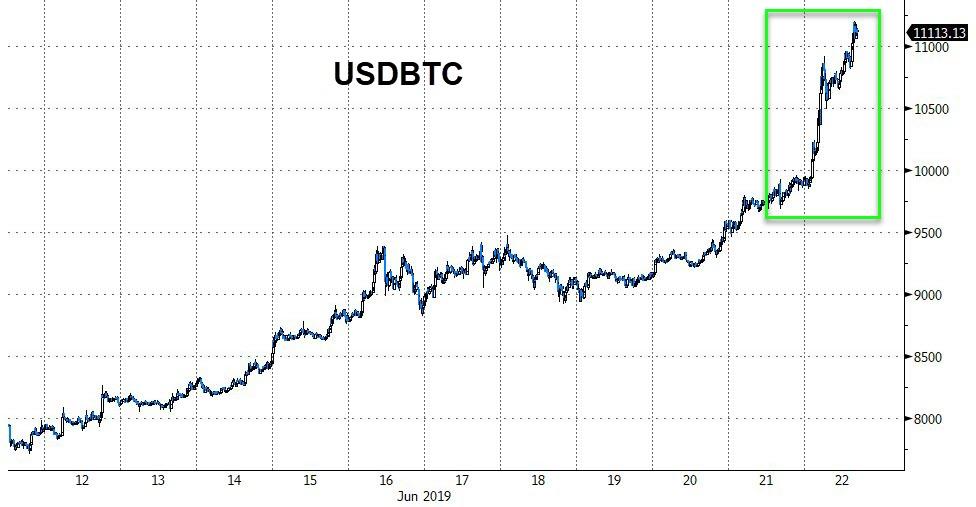

One day after we reported that Bitcoin futures traded above $10,000 as crypto derivatives markets "are gearing up towards another big weekend as bitcoin approaches $10k", not only did the spot price surge above $10,000 but just a few hours later - in a vivid replay of December 2017 - the cryptocurrency promptly took out $11,000 as well.

“The bounce back of Bitcoin has been fairly extraordinary,” said George McDonaugh, chief executive and co-founder of London-based blockchain and cryptocurrency investment firm KR1 Plc.

“Money didn’t leave the asset behind, it just sat on the sidelines waiting to get back in.”

Cryptos are a sea of green this morning after a big overnight session.

Volume spiked as Bitcoin surged past $10k...and accelerated above $11k - the highest since March 2018

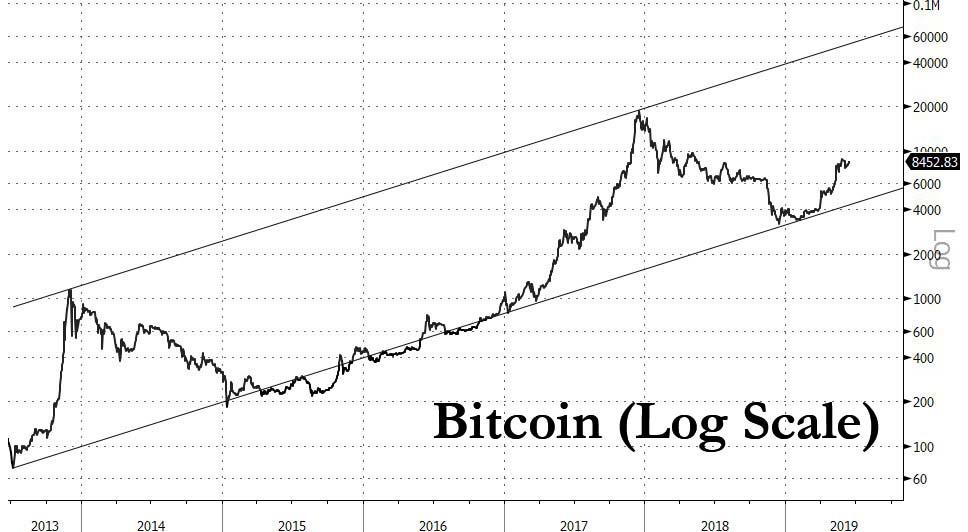

This has pushed the leading cryptocurrency to retrace 50% of its 2017 highs to 2018 lows collapse.

And it's following a very similar trajectory.

Ethereum also spiked above $300...the highest since Aug 2018.

In contrast with last year, Bloomberg notes that there are now signs of renewed mainstream interest in cryptocurrencies and the underlying blockchain technology, most prominently Facebook's Libra. The social-media giant is working with a broad group of partners from Visa to Uber to develop the system, which has already attracted attention and criticism from politicians raising privacy and security concerns.

image courtesy of CoinTelegraph

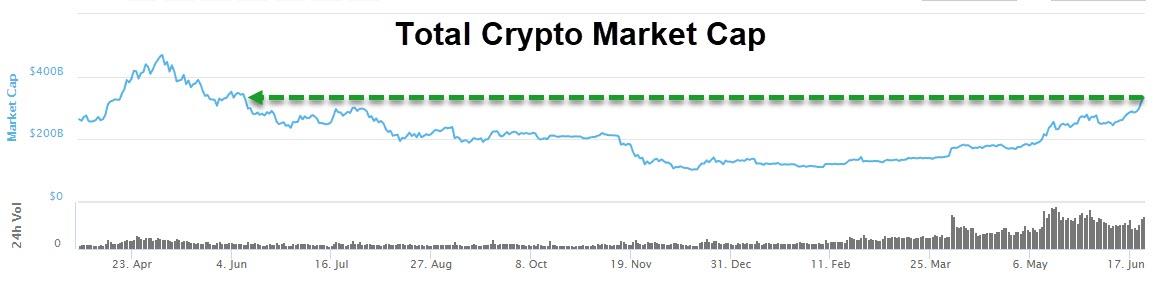

This lifts Crypto's total market cap above $333 billion, the highest since June 2018.

As CryptoSlate.com's Priyeshu Garg notes, while many were quick to dismiss the effect Libra could have on the broader crypto market, it seems that the highly-anticipated digital asset is already making waves throughout the industry. Despite the problems it faces -which include centralization and lack of privacy - Libra was still celebrated by some in the crypto community.

Garry Tan, the managing partner at Initialized Capital, said that Libra’s launch was a “big day” for the crypto industry, as it has the potential to transform the crypto market. Tan pointed out that Facebook has 2.4 billion users, while WhatsApp, the messaging giant owned by Facebook, has over 1.5 billion. Recent studies estimate the number of crypto users worldwide to be roughly 35 million.

That means that a large percentage of those users could get exposure to other cryptocurrencies through Libra, drastically increasing the number of crypto users worldwide.

As we noted last week, the interest "is mostly institutions now."

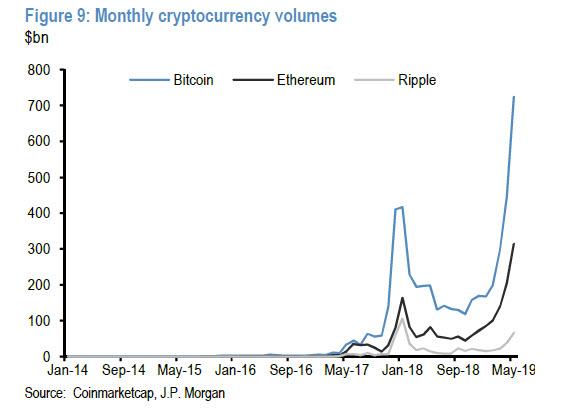

While a substantial part of the increase in volumes in dollar terms reflects an increase in the market value of bitcoin and other crypto currencies, the volumes in bitcoin terms are also significantly above their previous peaks.

According to JPMorgan, in the two years since bitcoin's last major spike in 2017 the "market structure has likely changed considerably... with a greater influence from institutional investors."

This also means that whereas bitcoin's historic surge to its all time high of $20,000 in December 2017 was largely retail driven, and thus extremely fickle as the subsequent crash showed, this time it is largely the result of institutional buying, which is far more stable and far less prone to sudden, painful shifts in sentiment and volatility.

In other words, "this time may be different" for bitcoin in a good way: because with institutions now piling into the crypto space, this is precisely the investor group that bitcoin bulls wanted from the beginning as it creates a far more stable price base for the future. Add to this the potential return of retail buying from east Asian (or even US) retail clients, and it is possible that what we predicted in early April, namely that the third bitcoin bubble is starting ... may soon be confirmed, and that the next bitcoin bubble peak will be somewhere between $60,000 and $100,000.

For now, Bitcoin options imply a 24% probability of Bitcoin being above $15k by September.

And if this feels like euphoria deja vu all over again... we have a long way to go.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more