Bitcoin Shatters $125,000 All-Time High: Will Altcoins Follow Suit?

Image Source: Pexels

Bitcoin (BTC) soared past $125,000 milestone for the first time, marking a new all-time high (ATH) and reinforcing its status as the benchmark for digital assets.

This rally is supported by strong ETF inflows, expansive global liquidity conditions, and a growing investor focus on non-traditional assets amid political and fiscal worries.

Bitcoin almost immediately retracted after hitting a new all-time high, but it’s still up 30% year-to-date, and many analysts believe there is still plenty of road left to run for the biggest digital asset.

(Click on image to enlarge)

Bitcoin’s price on October 7 (Source: TradingView)

While BTC’s performance has outpaced major stock indexes, it still lags behind gold’s near 50% gain.

The concurrent strength of both assets aligns with what JPMorgan analysts describe as the “debasement trade,” a strategy in which investors seek protection from rising debt and weakening currencies.

Institutional demand and shifting holder behavior are also providing critical momentum for Bitcoin’s rally.

- Substantial ETF Inflows: Bitcoin-linked ETFs attracted approximately $3.2 billion in inflows last week alone—their second-largest weekly total since 2024 launch.

- Changing Holder Behavior: According to Fabian Dori, CIO of Sygnut Bank, long-term holders have reduced selling activity, while short-term trader activity has stabilized, indicating a phase of renewed accumulation.

- Political Catalyst: Dori also suggested the recent U.S. government shutdown amplified interest in Bitcoin as a decentralized alternative to traditional stores of value.

However, some analysts question the underlying strength of Bitcoin’s rally.

Market watcher and gold evangelist Peter Schiff on X noted that, despite its nominal record, Bitcoin remains approximately 15% below its peak when priced in gold.

According to Schiff, this undermines Bitcoin’s narrative as a superior store of value, suggesting that its recent gains are more a product of expansive liquidity conditions rather than its true worth.

The Rally Broadens: Signs of Life in the Altcoin Market

The rally is expanding beyond Bitcoin, with capital beginning to rotate into altcoins. Key signals include:

- Early Rotation Signs: Ethereum (ETH) has gained 7.5% against Bitcoin, a classic indicator of shifting investor preference.

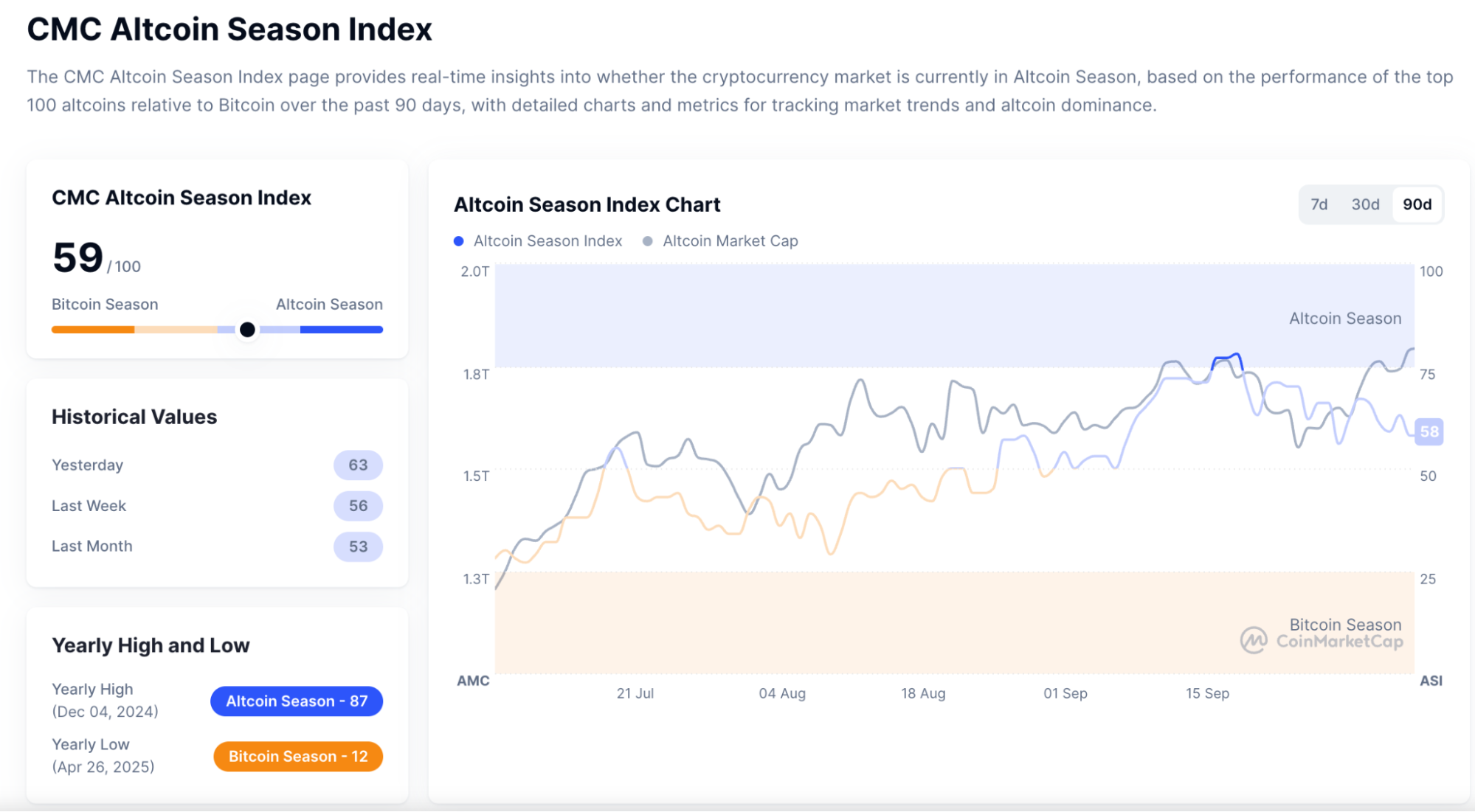

- Market-Wide Metrics: The Altcoin Season Index is rising, though a full “altseason” is not yet confirmed. Bitcoin’s market dominance, holding near 58%, leaves room for further altcoin growth.

- Ample Liquidity Fuel: The total stablecoin market cap has climbed above $300 billion, providing the essential capital for a potential altcoin surge.

(Click on image to enlarge)

Source: CoinMarketCap

So far, altcoins’ momentum is strongly concentrated in utility-driven sectors like Layer-2 networks, AI infrastructure, and real-world asset (RWA) tokenization, indicating a more mature market focused on fundamentals over speculation.

More By This Author:

Tariffs Impact Outlook As McCormick Stock DropsBig Bank Merger: $10.9 Billion Deal Creates Top 10 Bank

Is Apple Stock A Buy After iPhone Rollout? It Depends Who You Ask