Bitcoin Sentiment Still Close To Extreme Greed: More Cooldown Needed For Bottom?

Image Source: Unsplash

Data shows the Bitcoin market sentiment is still quite close to the extreme greed zone, a potential sign that a further price cooldown may be needed before a bottom.

Bitcoin Fear & Greed Index Still Has A High Greed Value

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment among investors in the Bitcoin and wider cryptocurrency markets.

The index uses a numeric scale that runs from zero to hundred for representing this mentality. Its value being greater than 53 means the investors as a whole are showing greed, while it being under 47 implies the presence of fear in the market. Values lying between these cutoffs correspond to a net neutral sentiment.

Now, here is how the current sentiment in the sector looks according to the Bitcoin Fear & Greed Index:

As is visible above, the indicator has a value of 73 at the moment, which suggests the average trader is holding a sentiment of greed. This greed sentiment is also a particularly strong one, so strong in fact that it’s sitting very close to a special region called the extreme greed.

The extreme greed occurs when the index reaches a value of 75 or higher. A similar zone also exists for the fear side, known as the extreme fear, and is situated at 25 or under.

Historically, the extreme sentiments have proven to be important for Bitcoin and other cryptocurrencies, as tops and bottoms have tended to occur while the market has been inside these zones.

The relationship between price and sentiment has generally been an inverse one, meaning extreme greed leads to tops and extreme fear to bottoms. The BTC top earlier in the month occurred when the index was at a value of 87.

(Click on image to enlarge)

With the price decline that has occurred since then, market sentiment has cooled off a bit. The question is: has it cooled enough? While other phases of the market usually require dips into fear or extreme fear for bottoms to take place, bull markets generally don’t see pullbacks that deep.

Often times, a venture into the normal greed zone or the neutral territory is enough for the price to regain steam. That said, the recent sentiment has still been quite close to extreme greed, so it may need a bit more before a real turnaround is reached.

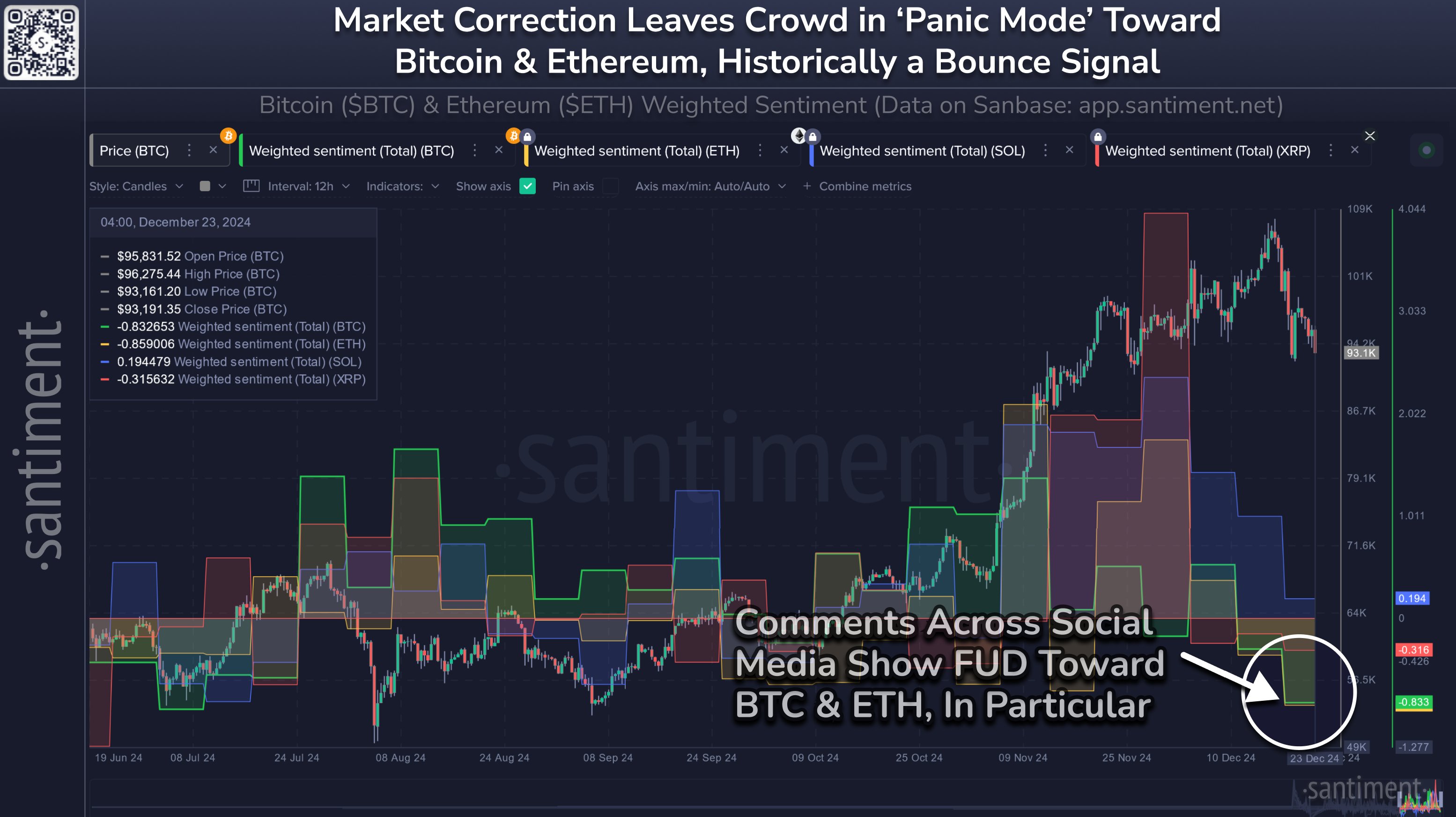

The Fear & Greed Index calculates its value using multiple factors, one of which is social media sentiment. While the overall sentiment has still been positive, it seems social media users have started to show fear, as the analytics firm Santiment has pointed out in an X post.

(Click on image to enlarge)

BTC Price

Bitcoin has shown a sharp 6% rebound during the last 24 hours, a potential indication that the dip into the greed sentiment may have been enough for the rally to restart after all.

(Click on image to enlarge)

More By This Author:

Bitcoin Price Comeback: Can It Regain Ground?

Ethereum Price Attempts A Comeback: Is A Rebound Imminent?

XRP Price Fresh Surge: Bulls Gear Up For Action

Disclaimer: The Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing ...

more