Bitcoin Recovery Targets New All-Time Highs At $133k As Fed Rate Cut Odds Hit 87%

BTC is up 14% from its local low of $80,500 reached on Nov. 21, shrugging off recent volatility, including expectations of the Bank of Japan increasing interest rates that rattled broader markets last week.

With macroeconomic tailwinds aligning, onchain indicators flashing green, and the technical setup painting a path to new highs, the narrative that the bull market is over is seemingly unfounded.

Improving Macroeconomic Conditions: Tailwinds for Bitcoin

The improving macroeconomic conditions are aligning to propel Bitcoin higher. The US government shutdown ended on Nov. 12, stabilizing markets and boosting risk assets like cryptocurrencies, including Bitcoin.

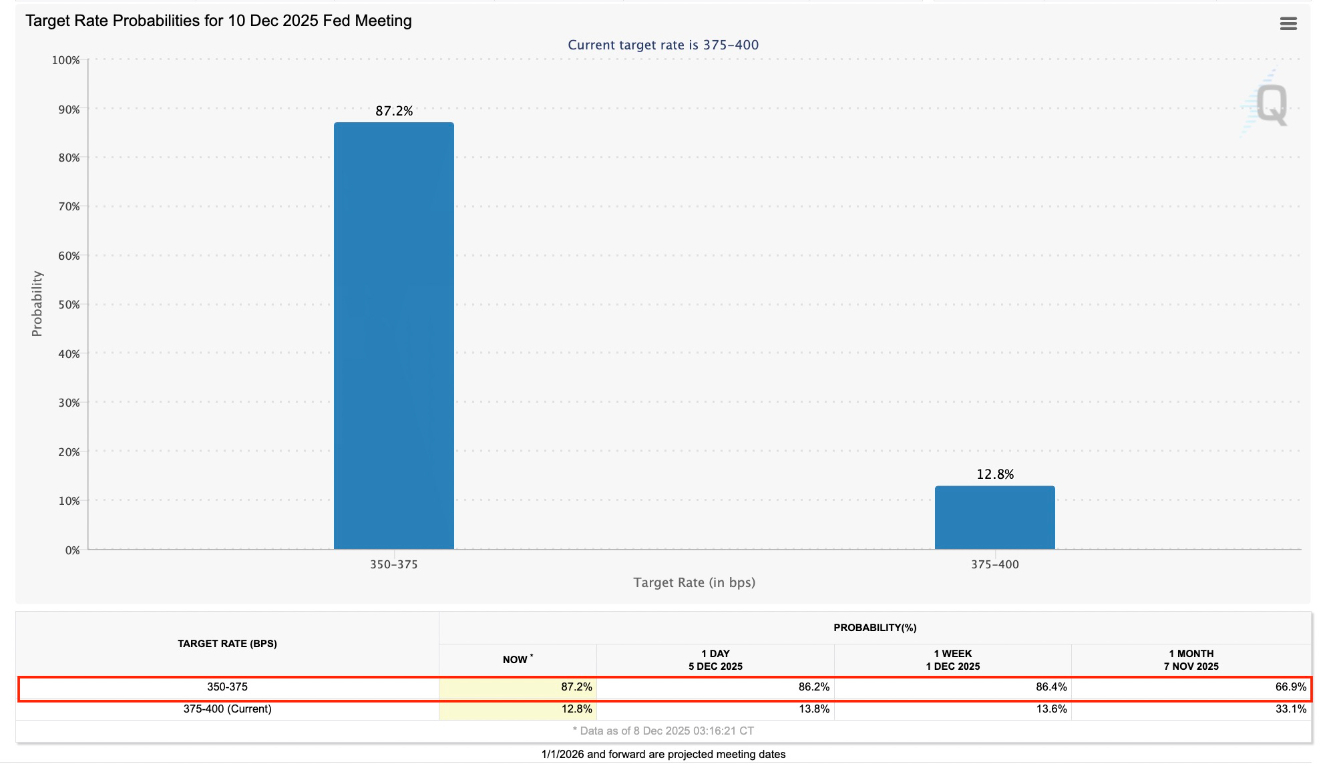

The Dec. 9-10 FOMC meeting carries an 87% chance of a 25-basis-point rate cut, according to the CME Group FedWatch tool, which would lower rates to 3.50%-3.75%. This is higher than last week’s 865 and 67% odds from a month ago.

Target rate possibilities at the October 29 FOMC meeting. Source: CME Group FedWatch tool

Meanwhile, President Trump announced $2,000 stimulus checks could inject approximately $600 billion directly into households, sparking retail spending and speculation. With extra cash, Americans—many already crypto-curious—could pour funds into BTC via apps like Coinbase, amplifying demand.

Historical parallels include the 2020-2021 QE rounds, which saw BTC surge by over 300% amid similar stimuli.

These factors—shutdown resolution, rate cuts, QT wind-down, ETF catalysts, and geopolitical de-escalation—create a liquidity-rich environment. Bitcoin, historically a hedge against fiat debasement, thrives in such conditions, with ETF inflows and corporate adoption amplifying upside potential. The macro stage is set for BTC to climb further, potentially testing new highs by year-end.

Onchain Signals Suggest the Bitcoin Bull Market Continues

Onchain data debunks claims of the onset of a bear market, signaling that Bitcoin has more room for further expansion into new all-time highs.

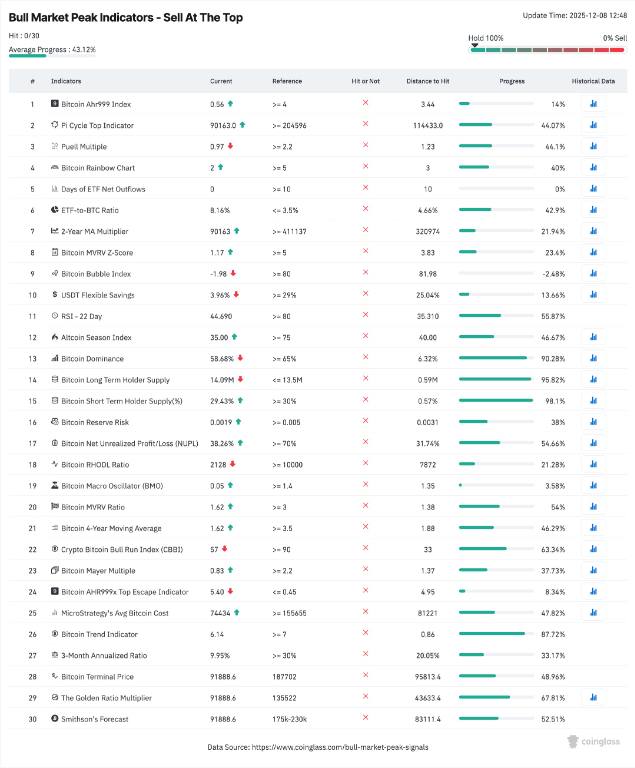

CoinGlass’ curated “bull market peak indicators” selection contains 30 potential selling triggers and aims to catch long-term BTC price tops. Currently, not one of its components is flashing a top signal, with CoinGlass rating BTC a “hold 100%” asset.

For example, the Bitcoin AHR999 Index (currently at 0.56, well below its 4.0 trigger) and the Pi Cycle Top Indicator (90,163 vs. a 204,596 threshold). This dashboard, blending onchain metrics like MVRV Z-Score and RSI, underscores a market with “plenty of room to run,” per analysts tracking historical cycles.

The Crypto Bitcoin Bull Run Index (CBBI) similarly scores the cycle in its expansion phase, with confidence levels far from euphoric peaks seen in 2021. According to these models, the BTC/USD pair will peak within the $175,000 to $230,000 range this cycle.

Bitcoin’s bull market peak indicators. Source: CoinGlass

Meanwhile, the Mayer Multiple, an indicator used for measuring overbought conditions by dividing BTC’s price by its 200-day moving average, firmly points to bullish price continuation. At 0.83 with BTC at $92,000 against an approximately $76,360 average, it suggests that Bitcoin is trading in “undervalued” territory, below the 2.4 level that has preceded every prior top.

The Multiple has broadly cooled this bull cycle, compared to others before it, reaching a maximum level of 1.84 in March 2024. At the time, BTC/USD traded at around $72,000, per data from onchain analytics platform Glassnode.

(Click on image to enlarge)

Bitcoin Mayer Multiple. Source: Glassnode

The price chart above indicates that for BTC/USD to reach the 2.4 mark, it would need to rise to $263,000.

December 2025 emerges as a consensus top target, but with profit-taking just beginning, we’re likely midway, not at the finish line. These tools aren’t infallible, but their unison chorus debunks bear market calls, inviting sidelined capital to join the rally.

Bitcoin’s Fractal Projects $133,000 Price

Zooming out to the macro canvas, Bitcoin's chart presents a textbook bullish setup, with the weekly time frame revealing an April fractal that projects higher targets for Bitcoin.

The chart below shows that Bitcoin fell from its previous all-time high of $102,300 reached on Jan. 11, dropping 32% to a low of $74,500 in April. This formed the bottom that saw Bitcoin rally 67% to new all-time highs of $124,500 reached on Aug. 11.

A similar price action is playing out after the BTC/USD pair dropped 36% from its current all-time highs above $126,000 to $80,500. As BTC price trades 14% above this low, it is expected that the cryptocurrency will sustain its recovery to new all-time highs. If history repeats itself, an over 67% rally in BTC price places new all-time highs at $133,900.

(Click on image to enlarge)

BTC/USD weekly chart. Source: TradingView

However, bulls really need to push Bitcoin above the yearly open above $93,000 and reclaim the 50-week SMA at $102,200 to confirm the structure’s validity.

More By This Author:

BTCUSD Forecast: How High Will Bitcoin Go In ‘Uptober’ After Hitting New All-Time Highs Above $125K?

BTC/USD Forex Signal: Bitcoin Price Rallies As ETF Inflows Rise

United States Second-Quarter GDP Revised Sharply Higher

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more