Bitcoin Price Levels To Watch Above $116k Ahead Of FOMC

As the FOMC meeting approaches on Sept. 17, 2025, traders are eyeing key resistance levels amid heightened volatility.

Fed Rate Cuts Odds Now 100%

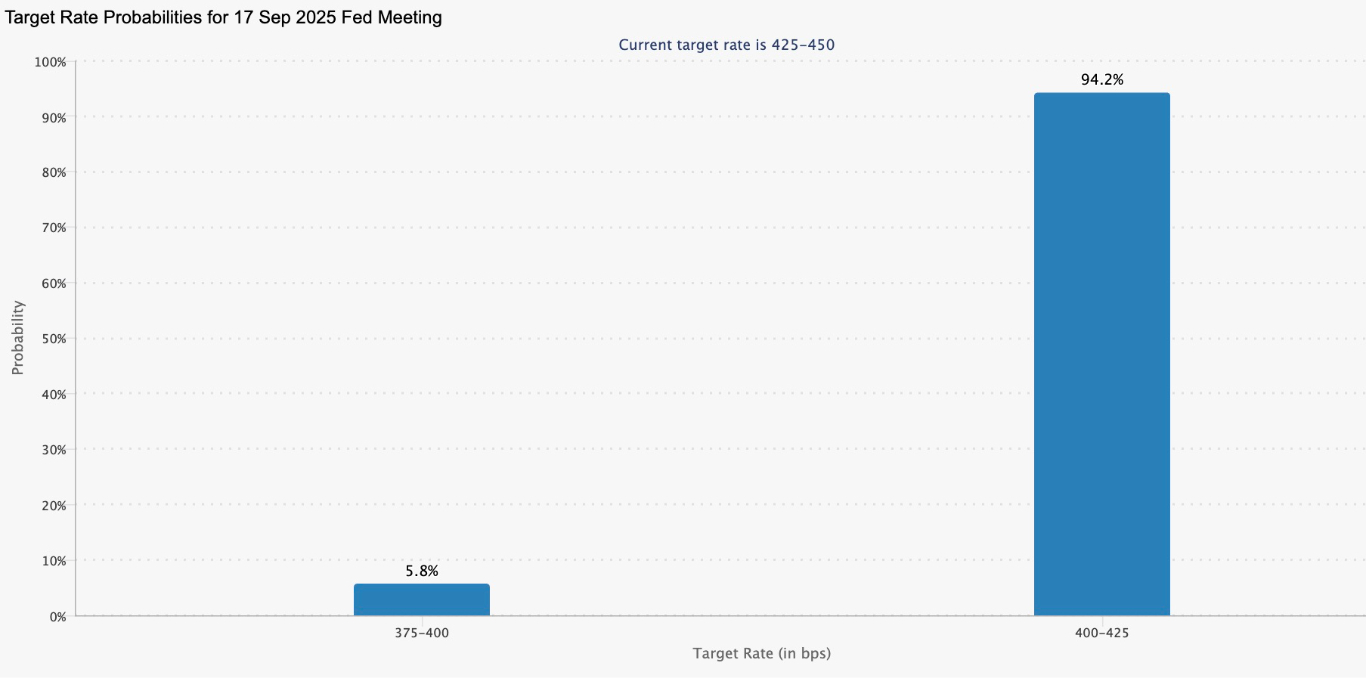

The Federal Open Market Committee (FOMC) is set to convene on Sept. 16-17, with markets pricing in a near-certain 25 basis point rate cut, reflecting a 92% probability based on data from the CME Group’s Fedwatch Tool.

Target rate possibilities for Sept. 17, 2025. Source: CME Group

This expectation stems from softer US jobs reports and cooling Producer Price Index (PPI) figures, which have eased inflation concerns to around 2.9% year-over-year, aligning closer to the Fed's 2% target.

Historically, rate cuts signal easier monetary policy, boosting liquidity and risk appetite, which has often propelled Bitcoin higher as investors seek higher-yield alternatives to low-interest savings.

With interest rate cuts almost guaranteed, market participants are now shifting their focus to the subsequent FOMC minutes and Fed Chair Jerome Powell’s post-meeting speech. These elements will provide crucial insights into the Fed's forward guidance, particularly regarding the speed of future cuts.

While a single 25 bps reduction is priced in, any dovish signals—such as hints of additional cuts in October or December—could ignite a bullish rally for BTC. For instance, J.P. Morgan Research suggests that sustained easing could stimulate borrowing and investment in credit-reliant sectors, indirectly benefiting cryptocurrencies by reducing leverage costs for margin trading and enhancing Bitcoin's appeal as a “store of value” amid shrinking cash yields.

Conversely, if Powell adopts a more cautious tone, emphasizing persistent inflation risks from tariffs or a resilient labor market, it could trigger short-term disappointment and volatility.

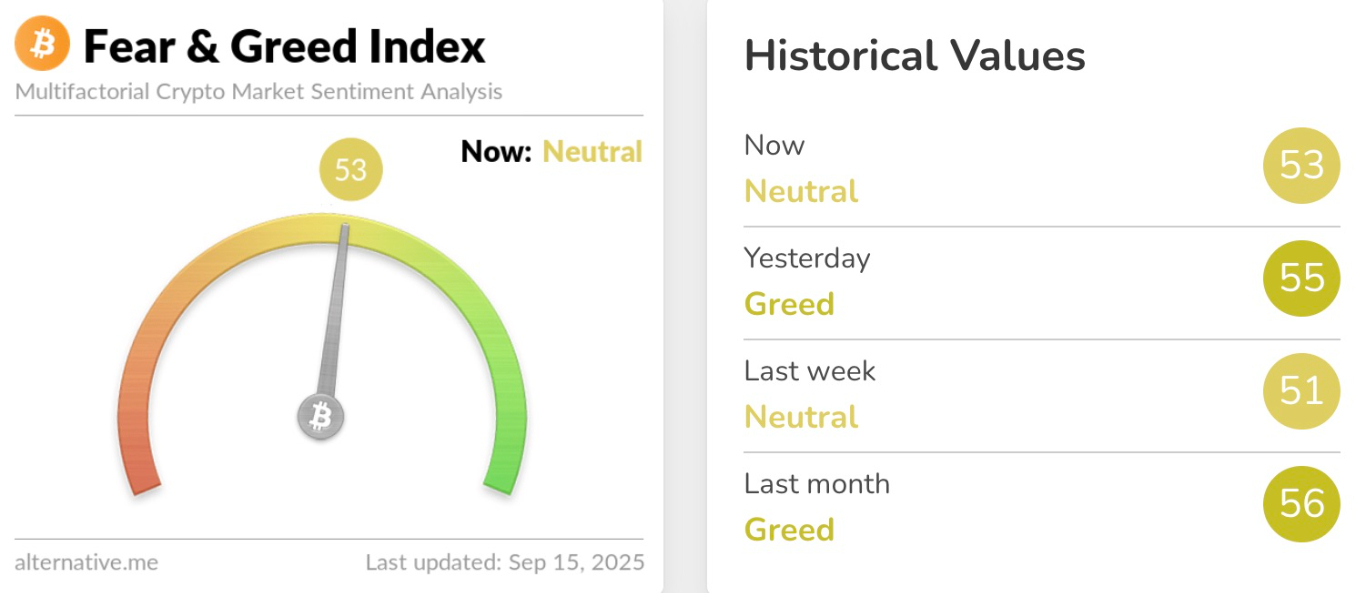

Meanwhile, the Crypto Fear and Greed Index remains in the “neutral” zone, suggesting that investors are taking a more cautious stance and waiting to see what the FOMC minutes and Powell’s speech will say before they make a move.

Crypto Fear and Greed Index. Source: Alterbative.me

High Spot Bitcoin ETF Inflows Suggest Bitcoin Upside

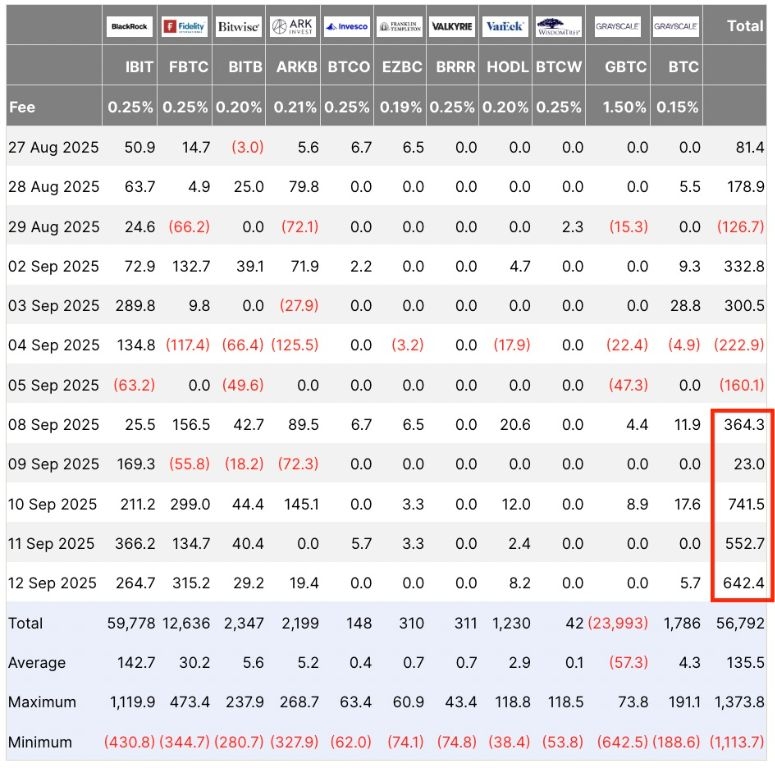

Spot Bitcoin exchange-traded funds (ETFs) in the US demonstrated remarkable strength last week, recording net inflows every single day, totaling $2.3 billion, according to data from Farside Investors. These inflows mark a stark reversal from soft inflows recorded the week prior, signaling renewed institutional confidence amid broader market recovery. Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the charge with $315.2 million in inflows on Friday, followed closely by BlackRock's iShares Bitcoin Trust (IBIT) at $264.7 million, underscoring aggressive accumulation among major players.

Spot Bitcoin ETF flows table. Source: Farside Investors

These inflows, the highest in two months, directly bolster Bitcoin's upside potential by increasing demand and increasing acquisition by Bitcoin treasury corporations.

By viewing Bitcoin as "digital gold,” these companies hedge against inflation, diversify from fiat, and capitalize on its scarcity post-halving, creating upward pressure amid rising demand. In the first half of 2025, such firms accumulated 244,991 BTC, nearly doubling their ranks to 134 globally, per K33 Research.

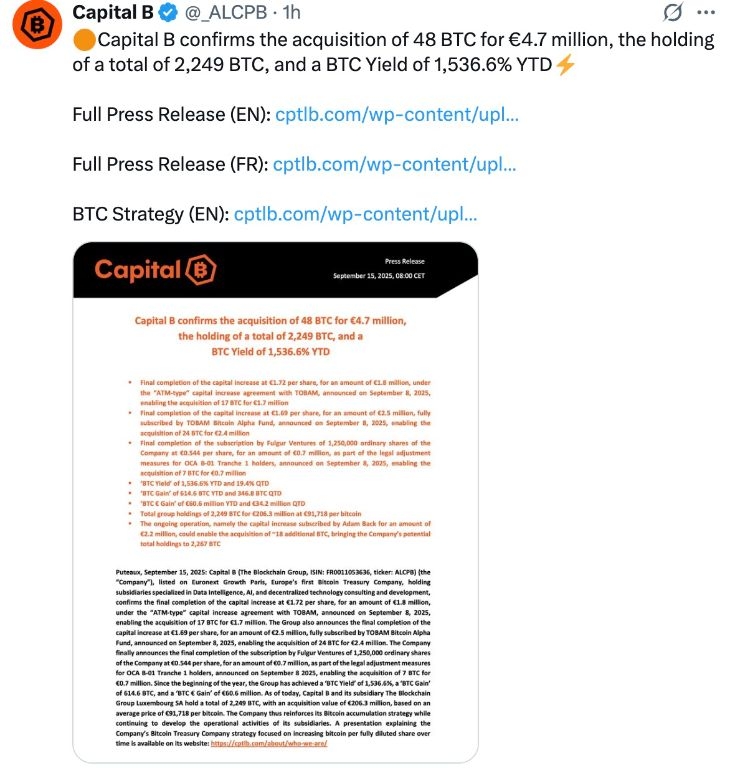

Recent examples include Capital B’s purchase of 48 BTC for €4.7 million ($5.2 million) on Sept. 15, boosting its holdings to 2,249 BTC.

Bitcoin Purchase Source: Capital B

Prenetics adopted a daily buying strategy, amassing 228 BTC by mid-September. Africa Bitcoin Corporation plans to raise $210 million for treasury purchases, while Strategy (formerly MicroStrategy) eyes further buys after adding to its 638,460 BTC stash in July. This momentum, with 152 public firms now holding over 950,000 BTC worth $110 billion, underpins BTC’s potential to surge higher.

Bitcoin Must Hold Above $115K to Secure Further Upside

Analysts agree that Bitcoin must firmly hold above the $115,000 level to secure its bullish trajectory and unlock further gains above $116,000.

“With the #FOMC rate decision looming, I would like to see #Bitcoin hold onto the channel and remain above 115K,” said popular Bitcoin analyst Mark Cullen in an X post on Monday, adding:

“The Key will be if the markets sell the news as a 25bp cut is announced and prices are already baked in.”

This psychological and technical support zone, aligning with the 50-day simple moving average (EMA) at around $114,500, has absorbed recent selling pressure, as shown in the chart below.

(Click on image to enlarge)

BTC/USD daily chart. Source: TradingView

Failure to maintain this floor could trap BTC in a range-bound $110,000–$115,000 consolidation, before another catalyst is needed to send it higher.

On the upside, a key area of interest lies between $117,000 and $120,000, a barrier that bulls must overcome to increase the chances of retesting the all-time highs above $124,500.

The relative strength index (RSI) on the daily time frame sits at 57, indicating neutral momentum, while the MACD at 851.72 signals upward momentum.

Therefore, a drop below $115,000 risks bearish reversal, but current Bitcoin dominance at 57% and September’s +6.79% surge—busting historical "September curse" averages—suggest resilience. As FOMC looms, holding $115,000 will be crucial for bulls eyeing fresh all-time highs for Bitcoin.

More By This Author:

ChainLink Tests $24 Resistance: Is A Breakout On The Horizon?

Will Gold And Silver Continue To Set Record Highs In September?

Silver Forecast: Bounced And Supports Target

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more