Bitcoin Falls, ETH Tests Support On Fears Of Cascading Crypto Crisis After FTX BK

One of the world’s foremost backers of cryptocurrencies has warned of a ‘cascading crypto crisis.’ This comment came from the CEO of Binance, Changpeng Zhao, who just days earlier was fashioned as the savior of the industry after they came to the rescue of FTX.

But that hopeful news didn’t last for long as after reviewing the books of FTX, Binance walked away. And that itself raises questions, as it’s very much in Binance’s best interest for one of their main competitors to survive for the overall health of the industry. Such as we’d seen with FTX previously, Sam Bankman-Fried was fast to offer bailouts to embattled crypto companies for fear of eroding confidence, to the point of drawing comparisons to JP Morgan from the Great Depression. And at this point it seems that at least some of that attempted heroism is now responsible for his own demise, although details of the scenario are still being uncovered.

This morning brought the resignation of Bankman-Fried and the announcement of Bankruptcy for FTX international. So, the situation is still evolving. And all that we know for sure at this point is that FTX has been trying to raise up to $9.4 Billion USD, which is not a great sign for what might be uncovered upon greater investigation, which will take place now that the company has entered into Bankruptcy proceedings.

CRYPTO CONFIDENCE

Whatever is missing on the FTX balance sheet is something that can and probably will cause further erosion of confidence in cryptocurrencies. To what degree is difficult to gauge as we’re still uncovering the depth of the problem, but when customer funds go missing in an industry that’s already loosely regulated, that’s unlikely to compel investors to take the risk at this point, especially when major cryptocurrencies like Bitcoin and Ethereum are already in down-trending sell-offs.

I’m not one that’s going to say that this will kill crypto. Because forever is a long time. But with investors already facing aggressive inflation and a less-friendly Federal Reserve, the margin for error is that much smaller than it’s been for much of the life of crypto. As I’ve said since much of last year, I’m a long-term bull on crypto. But, at much lower levels.

Also of interest is what this might mean for regulation. Sam Bankman-Fried was often looked at as being a leader in the space in the US. And that’s not turning out very well, so will American regulators look to take a stronger hand with crypto regulation moving forward?

These are questions that are far away from answers and generally speaking, investors abhor uncertainty. So we’ve seen both Bitcoin and Ethereum get hit this week although there’s a deviation between the two that remains somewhat interesting.

BITCOIN

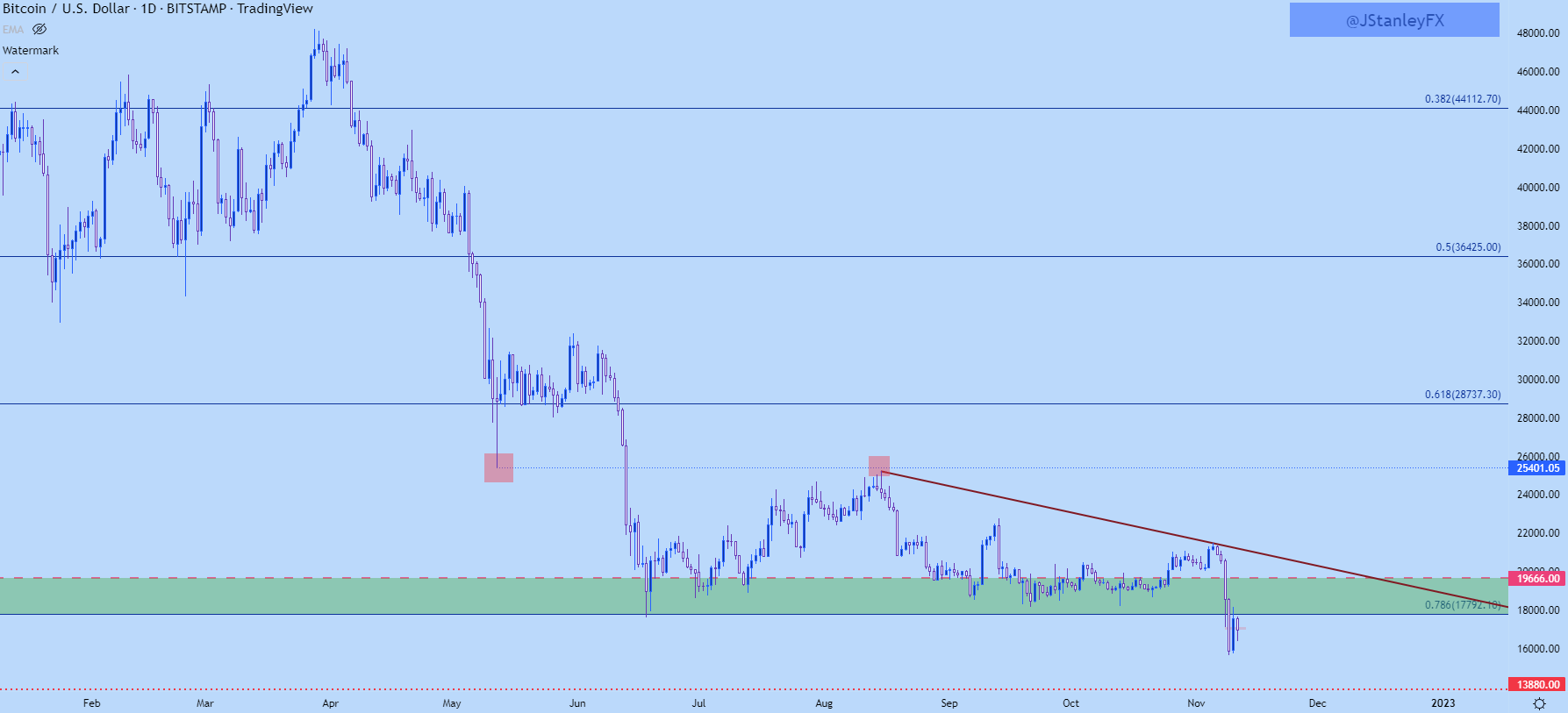

As we saw with previous crypto meltdowns such as what took place with LUNA, Bitcoin was a part of the capitalization plan. So, when assets were quickly sold, so was Bitcoin. Luna blew up in May, and that’s when Bitcoin broke back-below the $28,737 level. And it hasn’t recovered above that since then. And interestingly, the current five-month-high is just underneath the swing from that May sell-off.

Bitcoin Daily Chart

(Click on image to enlarge)

Chart prepared by James Stanley; Bitcoin on Tradingview

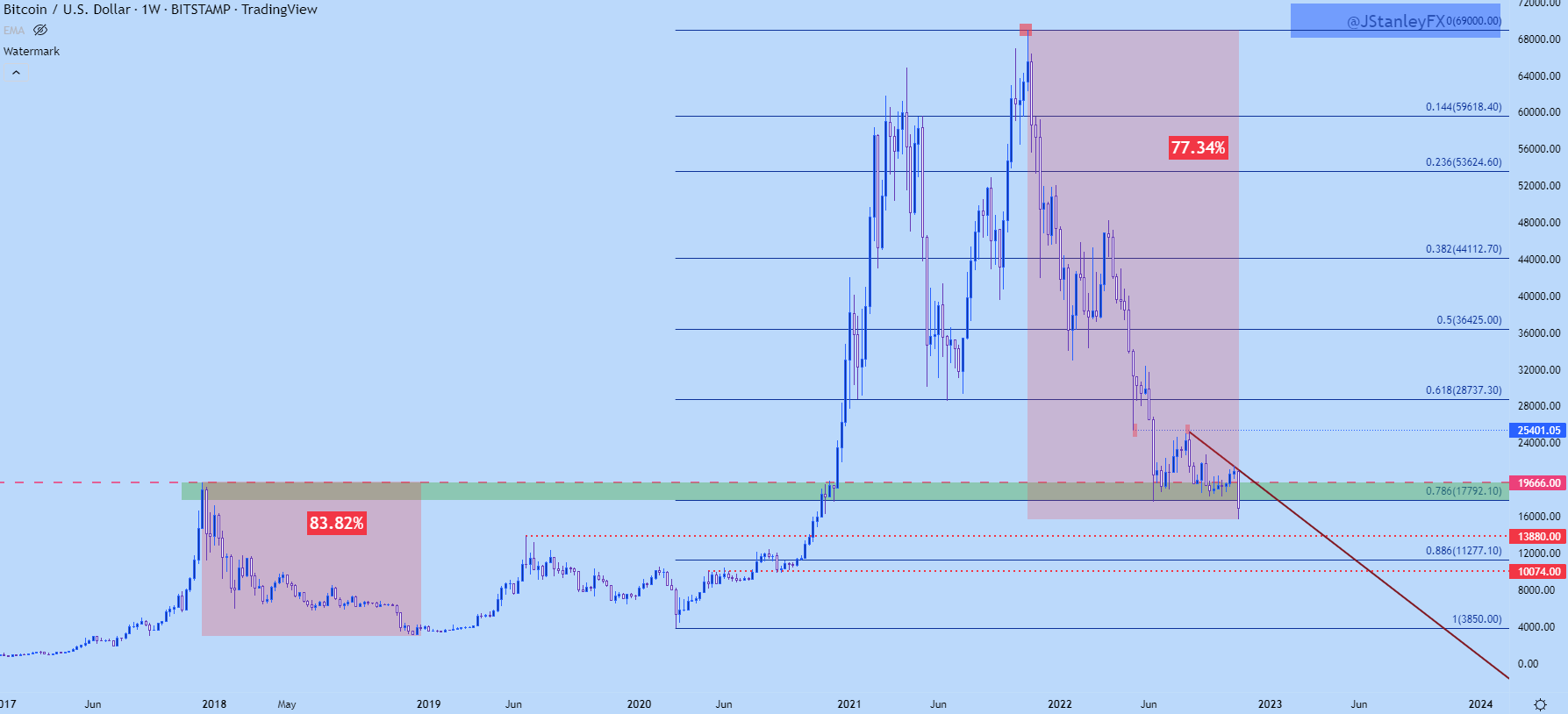

BITCOIN LONGER-TERM

Taking a step back on the Bitcoin chart and we can see where prices have pushed below a major area of support. This spans from the Fibonacci level at 17,792 up to the 2017 swing high at 19,666. That zone came into play back in June and for more than four months, held the lows.

But this week’s break triggers a descending triangle formation, which is bearish and points to the possibility of further losses. As for next supports, there’s not much that’s nearby given how quickly Bitcoin had jumped above 10k back in 2020. That was a big move two years ago, and I had looked into it in May of 2020 after Paul Tudor Jones started to talk about the matter publicly.

A year later, Bitcoin was up to 40k and the run wasn’t over yet, with prices running all the way to the current all-time-high of $69k in November of last year.

Interestingly, this is around the same time that the Nasdaq had topped, driven by the prospect of a shift at the Fed. It was later in the month when Chair Powell’s move to ‘retire’ the word transitory at his re-nomination hearing began to shift the backdrop, which remains in-place today.

Life since the $69 high has been much different and Bitcoin is now down by as much as 77.34% from that swing high last November. This is actually still inside of the 2017/2018 retracement, which tallied 83.82%.

Bitcoin Weekly Price Chart

(Click on image to enlarge)

Chart prepared by James Stanley; Bitcoin on Tradingview

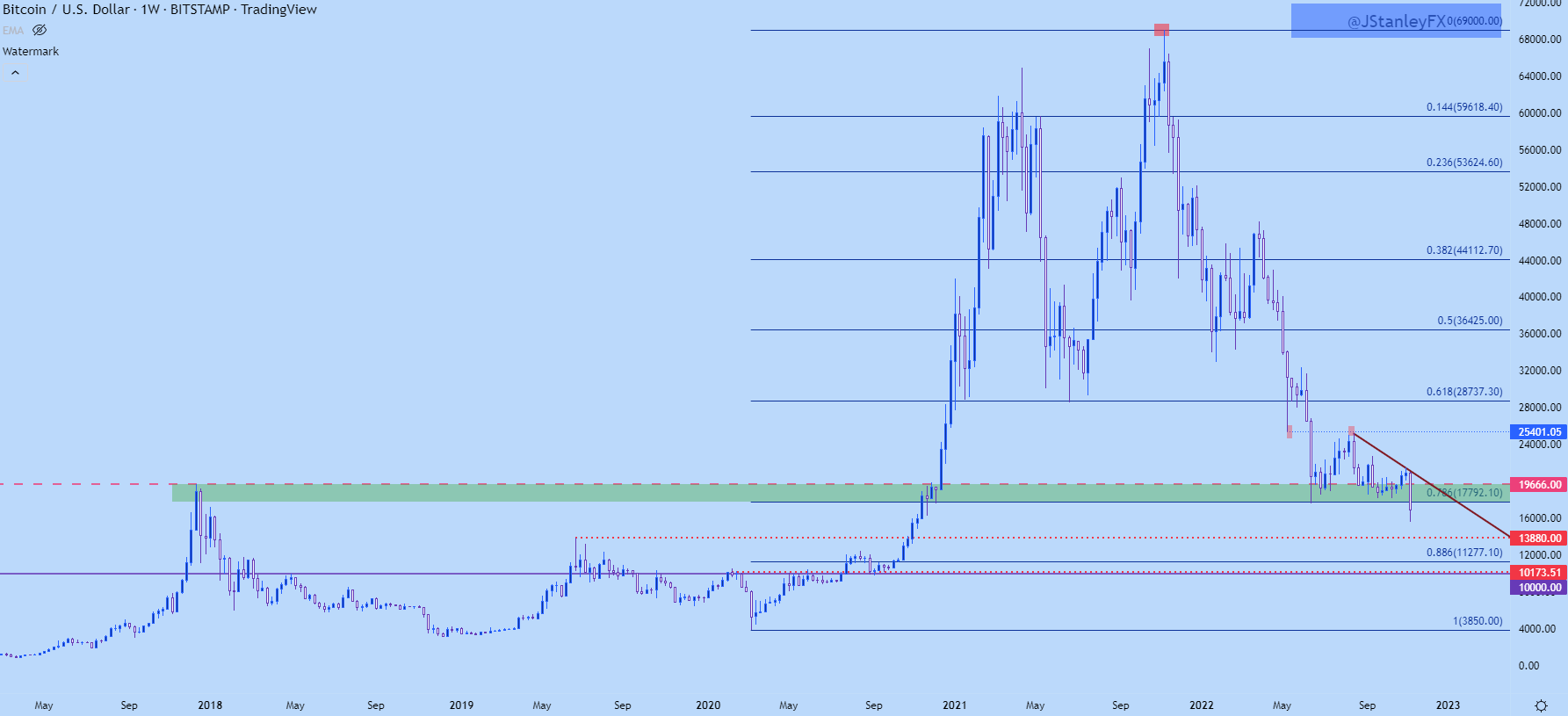

BITCOIN: WHERE’S THE LOW?

The natural question here is where’s the low. I’ll be up front: I have no idea, and I don’t think anyone else does either. We don’t even know the depth of the problem behind FTX at this point and I think the same can be said for pretty much everyone else at this point that hasn’t seen the FTX books. But the signs that we have seen aren’t positive.

The depth of that problem will spell how much confidence erosion may be seen; and that will probably dictate how far Bitcoin might fall.

There are likely many investors that remain bullish on cryptocurrencies long-term, and for something like Bitcoin, this sell-off may be seen as opportunity. But, again, the big question is ‘how much’ and that will probably be dictated by what else is uncovered in the FTX books.

From longer-term charts, there’s not much by nearby supports and that’s largely because of how quickly Bitcoin had jumped in the stimulus-fueled rally two years ago. There’s a swing-high from 2018 at 13,880 and that sticks out; and there’s another spot a bit lower, taken from a resistance-turned-support swing around the 10k psychological level.

If Bitcoin drops below 10k, which is an important psychological level, that’s where longer-term bulls are put into the spotlight and that would be a compelling area to look for support to build.

Bitcoin Weekly Price Chart

(Click on image to enlarge)

Chart prepared by James Stanley; Bitcoin on Tradingview

ETHEREUM

Interestingly, Ethereum hasn’t yet taken-out the June low.

There’s a couple of possible scenarios going on here. Given the rise of Defi since the last crypto sell-off cycle, there may be a building preference for Ethereum for long-term crypto bulls as ETH has numerous applications there.

Or, possibly, this could simply be a case of not as much forced selling being seen in Ethereum.

The ‘why’ is far less clear than the ‘what’ at this point, and Ethereum hasn’t yet tested through the June low. The psychological level at 1k remains key as a series of higher-lows after that test in June held at the big figure before a 20% rally over the next couple of months.

But, again, this situation around crypto is evolving rapidly and there may be collateral damage to show in the days ahead. So, this subtle deduction could still come under fire as the headlines continue to bring the potential for further erosion of confidence.

Ethereum Weekly Price Chart

(Click on image to enlarge)

Chart prepared by James Stanley; Ethereum on Tradingview

More By This Author:

USD Slammed, Gold And EURUSD Jump After CPI

US Dollar Price Action Ahead Of CPI: EUR/USD, GBP/USD, USD/CAD

US Dollar Price Action Setups: EUR/USD, GBP/USD, USD/CAD, USD/JPY

See my full risk disclaimer at dailyfx.com/risk-warning.