Bitcoin is on everyone’s lips.

With gains of over 100 million percent since its creation, it is the best investment instrument of all time.

But what goes up can also go down.

You may be asking yourself: is the current decline just another correction or the start of a longer bear market?

I would like to give you the seasonal answer today, because Bitcoin price’s also have a seasonal pattern.

The seasonality of Bitcoin under the magnifying glass

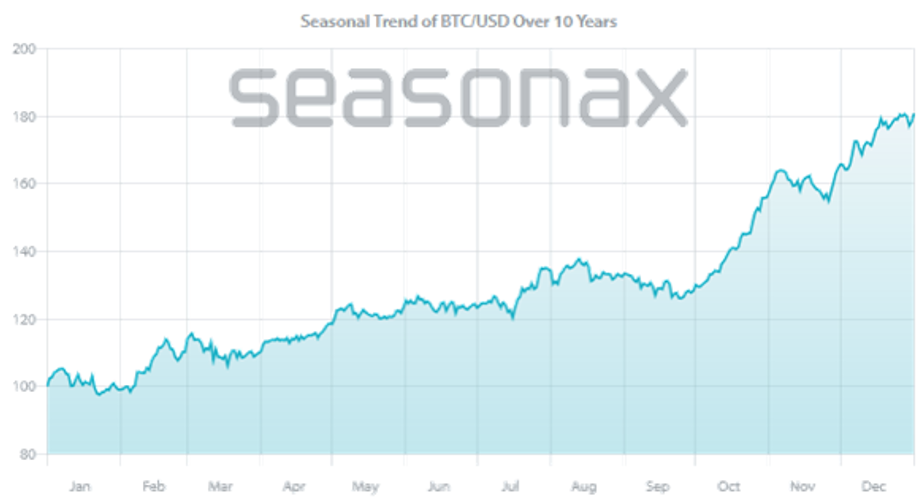

So let’s look at the seasonality of Bitcoin in the following seasonal chart. This shows you the course of Bitcoin price dependent on the season. The horizontal axis represents the time of the year, the vertical axis the value of the seasonal axis. This means that you can see the seasonal course at a glance.

Bitcoin, seasonal course, determined over 10 years

By the end of September, it is only a relatively moderate upward trend. Source: Seasonax

As you can see, Bitcoin usually goes up or sideways. There are hardly any phases of weakness.

This strong increase in the past also makes it difficult to clearly recognise potentially weak phases.

But there is a solution.

Detrending increases seasonal trend visibility

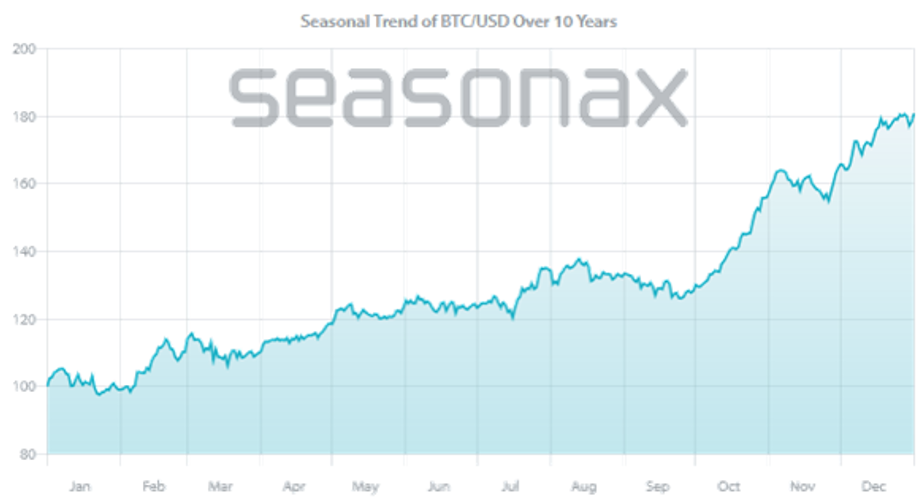

This Seasonax function solution for this is called “Detrending“.

Detrending means that the overarching upward trend is removed. At a glance, you can see very clearly where the relatively weak phases are.

The next chart will show you the detrended seasonal pattern of Bitcoin.

Bitcoin, detrended seasonal pattern examined over the past 10 years

The seasonal phases of weakness are now easy to see. Source: Seasonax.

As you can see, detrending clearly reinforces the seasonal trends visually.

At a glance you can also see the relatively weak seasonal phase much more easily. I have marked it for you with an arrow.

The relative seasonal weakness in Bitcoin begins on February 20th and ends on September 25th.

In this phase, declines in Bitcoin are more likely.

So the current decline can continue for a while – be careful!

More By This Author:

Three Important Markets: How Do They Fare In Post-Election Years? 2025? This Market Performs Well In Odd Years Gold Bull Market: Buy Mines Now?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.