Bitcoin Completes Decline After Lower Low And Strong Push Up

Bitcoin (BTC/USD) made a new lower low as expected in our previous Elliott Wave analysis. The strong bullish bounce could indicate the temporary end of the bearish pullback.

Image Source: Pixabay

This article reviews how the uptrend might take shape in the next upcoming week.

Price Charts and Technical Analysis

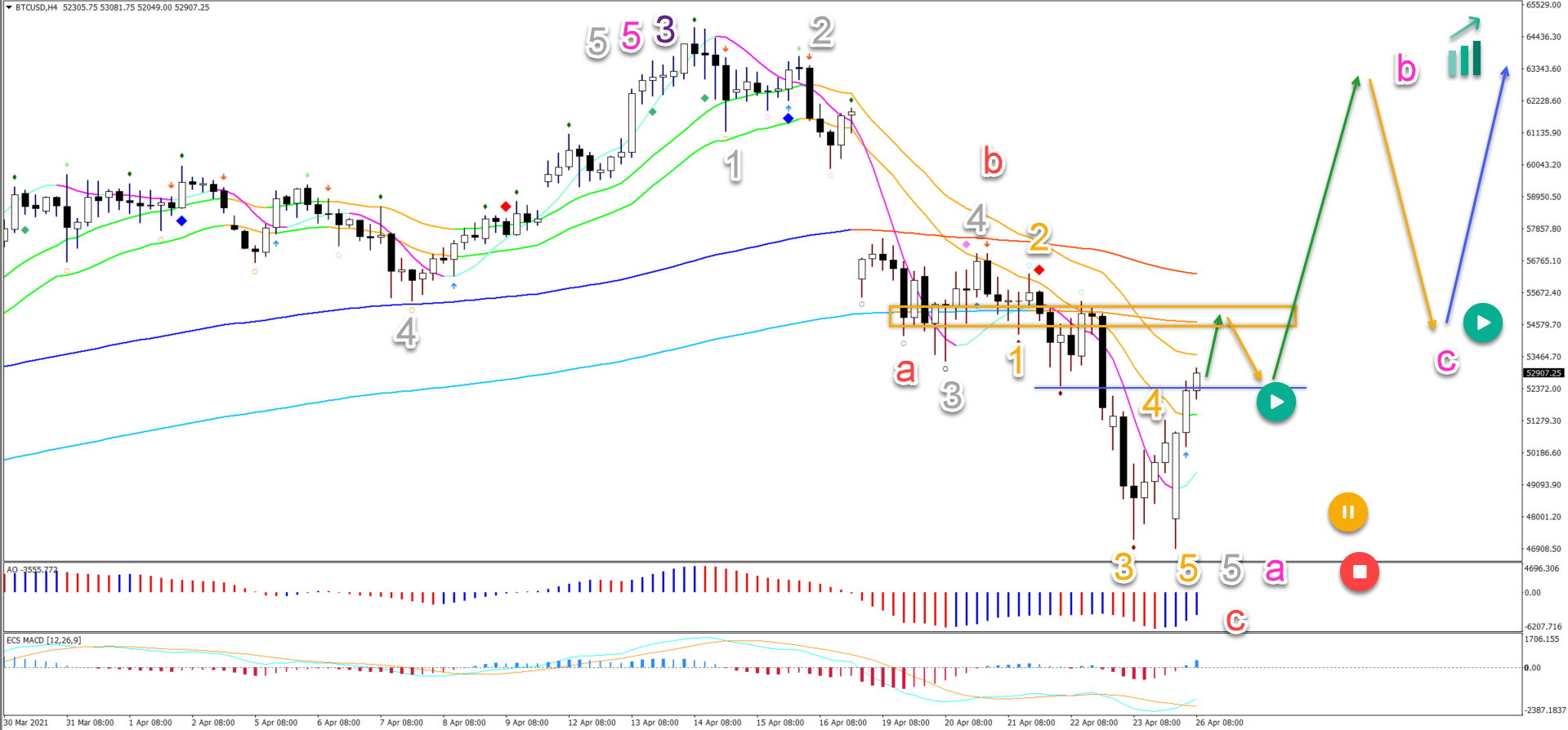

(Click on image to enlarge)

The BTC/USD chart is showing a complete 5 bearish waves down (orange) in wave 5 (grey) of wave A (pink). The alternative is an ABC (red) pattern down:

- A bullish ABC up could indicate a wave B (pink). In that case, another price swing down could be a wave C (pink).

- Considering the strength of the uptrend on the higher time frames, the pullback in wave C could be shallow.

- A 5 wave pattern (rather than an ABC) could indicate a wave 1 and wave 2 rather than B and C. This scenario is also bullish.

- An immediate push up (green arrow) is likely to test the resistance zone (orange box).

- A bearish bounce could decline to test the support (blue box) and inverted head and shoulders level.

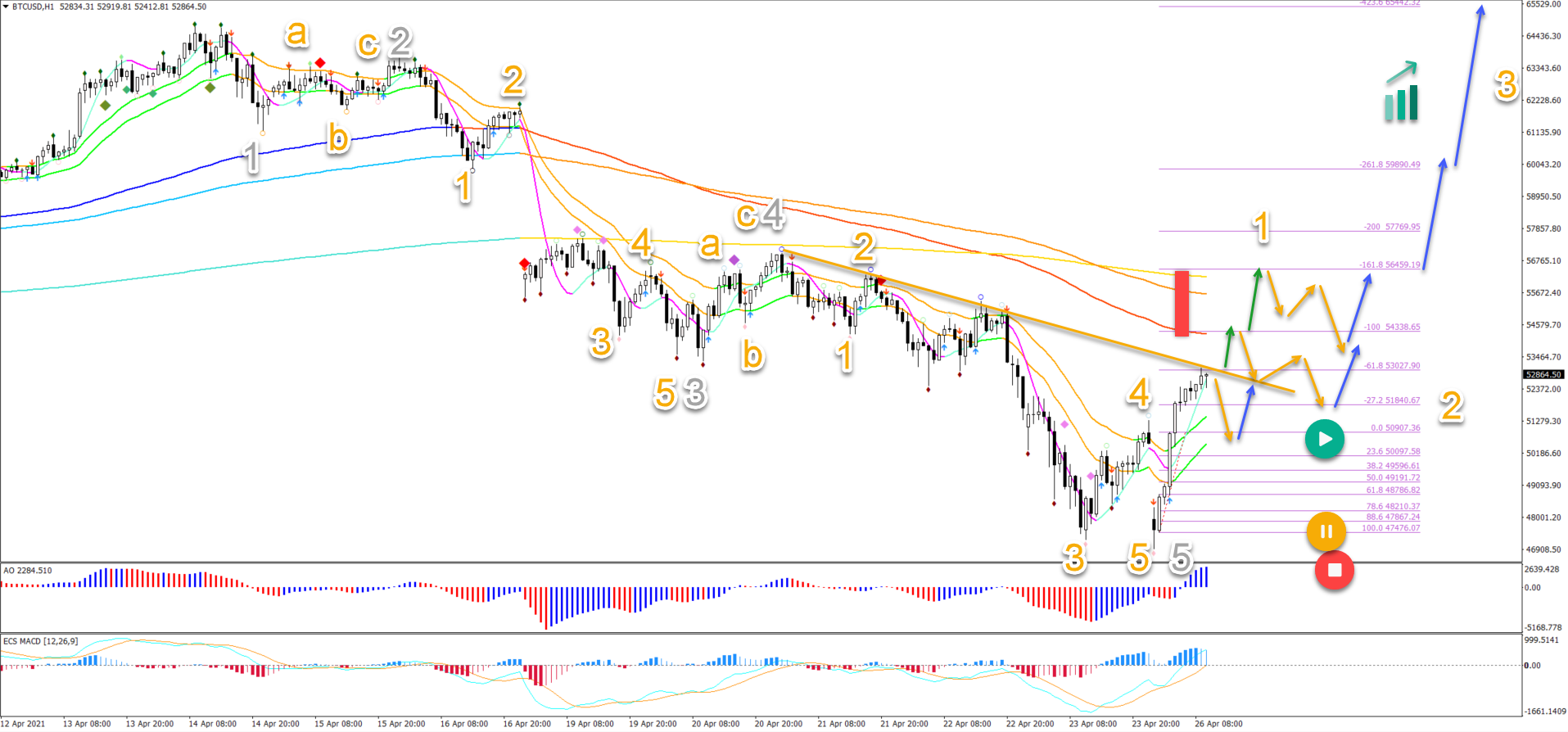

On the 1 hour chart, price action is facing a key resistance trend line (orange) after a strong bullish impulse up. Considering the recent price action, the bulls seems to be back in control:

- The bearish wave 5 seems completed.

- The bullish price action is showing larger bullish candles with closes near the high, indicating bull control.

- Price action managed to break above and away from the 21 ema zone, which changed the angle of the 21 EMAs to up.

- Either a breakout (green arrow) or a bounce up after a pullback (orange and green arrows) is likely.

- The next target is the Fibonacci levels and resistance zone (red box).

- At resistance, price action could make a pullback (orange arrows) but a bullish continuation is expected (blue arrows).

(Click on image to enlarge)

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more